3W leads $43m Series E for China's CANbridge

Hong Kong’s 3W Fund Management has led a $43 million Series E round for CANbridge Pharmaceuticals, a Beijing-based drug developer that focuses cancer and rare diseases.

Casdin Capital, Summer Capital, SPDBI, and Yaly Capital also came in as new investors. They were joined by existing backers Hudson Bay Capital, RA Capital, Lyfe Capital, and local biotech counterpart Tigermed.

It follows a $98 million Series D in February led by General Atlantic and WuXi AppTec, a leading contract research organization in China. That round also featured RA, Hudson, Tigermed, and YuanMing Prudence Fund. General Atlantic and Wuxi AppTech had the right to each invest an additional $10 million should CANbridge satisfy certain conditions. It is not clear whether this has happened.

Previous investors in the company include Qiming Venture Partners, Biossom Investment Management, and TF Capital.

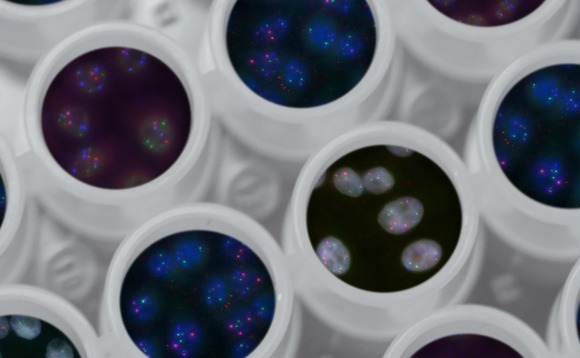

CANbridge recently received marketing approval in China for its first rare disease candidate, Hunterase, which targets Hunter syndrome, an aggressive genetic disorder that typically kills sufferers as children or young adults. Meanwhile, Nerlynx, a breast cancer treatment with regulatory approvals in the US and Europe, has been cleared for commercialization in Taiwan.

Hunterase and Nerlynx are two of three products currently being marketed outside of mainland China, along with Caphosol, a mouth rinse used to treat oral inflammation and ulcers. The pipeline otherwise includes five products at the preclinical stage targeting various rare diseases, one cancer drug at the phase one trialling stage, and one cancer drug in phase three trials.

CANbridge leverages a number of partnerships, including a rare disease treatment development program with WuXi Biologics, a sister company of WuXi AppTec, and two collaborative agreements with the Horae Gene Therapy Center at the UMass Medical School for rare disease gene therapy research. CANbridge teamed up with Korea's GC Pharma for the rollout of Hunterase.

"As a leading pharmaceutical company in the rare disease sector, we believe CANbridge is well-positioned for commercialization of innovative drugs, and applaud its successful execution in drug development," Cathy Chen, a managing director at 3W, said in a statement. "We are impressed by management's extensive experience and past track record and are truly excited to share in the next chapter of CANbridge's success."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.