CDH, SDIC lead $62m Series C for Virogin Biotech

Virogin Biotech, a drug developer based in China and Canada, has received $62 million in Series C funding led by CDH Invesmtents and a subsidiary of State Development and Investment Corporation (SDIC).

Other investors include Korea Investment Partners (KIP), Panlin Capital, Linden Asset Management, and the Canada Alumni Association of Peking University's Guanghua School of Management.

According to AVCJ Research, Virogin received $7 million in Series A funding from GP Capital in 2016 and a $5 million Series A extension led by Sangel Capital the following year. In 2018, Sinopharm Capital committed approximately $10 million in Series B funding.

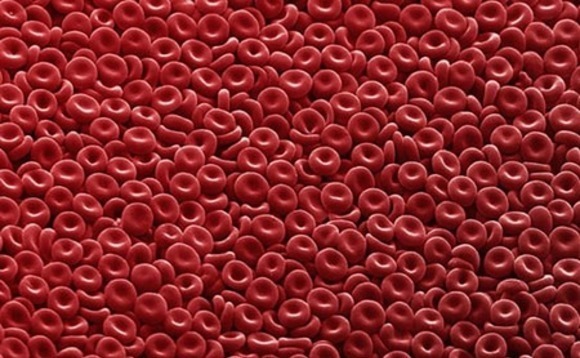

Founded in 2015, Virogin specializes in oncolytic virotherapy, which involves the replication and modification of viruses to destroy cancer cells. The company employs 50 staff and has R&D facilities in Vancouver and Shanghai. Its lead asset, VG161, has entered phase-one clinical trials in Australia. Trials are due to begin in China later this year.

Chris Huang, co-founder and CEO of Virogin, said in a statement that combination therapies will be the future direction of cancer immunotherapy. Oncolytic virotherapy could feature prominently because it works well in combination with other treatments.

Dan Liu, an executive director at CDH VGC added: "Demand for drugs that treat cold tumors [cancer cells that are almost invisible to the immune system] is urgent and we see great potential in oncolytic virotherapy as a cure. We reviewed global players in this area and identified Virogin."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.