China biotech player InxMed raises $19m

Ennovation Ventures, a Chinese life sciences and healthcare-focused investor, and China Growth Capital have led a RMB130 million ($19 million) round for local biotech developer InxMed.

InnoMed Capital and Grand Yangtze Capital also participated. It completes an extended Series A round in support of an ongoing clinical trialing program in the US, Australia and China targeting a range of cancers.

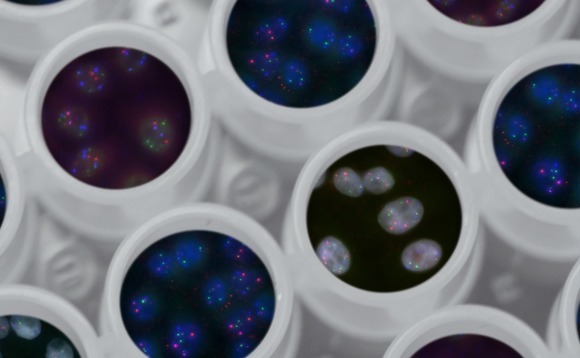

InxMed focuses on combination therapies, which use multiple drugs to treat a single disease. For example, the company teamed up earlier this year with US-based pharma giant Merck in a collaboration whereby each firm contributes a proprietary development asset toward a potential pancreatic cancer treatment.

"Combination therapy is the future for cancer treatment", Wayne Shiong, a partner at China Growth Capital, said in a statement. "We are deeply impressed by InxMed's core team members, who have had exceptional R&D experience in leading multinational pharmaceutical companies such as Merck, Roche, Novartis, GSK, and Johnson & Johnson."

InxMed's lead product is targeting skin cancer, uveal melanoma, a cancer of the eye, gastric cancer, and ovarian cancer. It is also being used in the pancreatic cancer program alongside Merck. InxMed owns the exclusive global rights for the drug. The pipeline also includes two preclinical products targeting liver and colorectal cancers.

Established in 2015, Ennovation claims to manage around RMB1.5 billion across four funds. Drugs make up about half of the portfolio, with medical devices and diagnostics representing 20% and 30%, respectively. Earlier this year, the firm joined a $60 million Series C for drug developer TransThera Biosciences led by SDIC Fund Management.

Enterprise and consumer tech-focused China Growth Capital is a relatively new investor in this space, although it has made at least three health tech investments in the past month, according to AVCJ Research. These include ABM Therapeutics, which focuses on brain cancer, and DK MedTech, which focuses on vascular interventional therapy technologies.

China Growth Capital has also participated in three rounds for gene sequencing developer Singleron Biotechnologies since 2018. These include a $30 million Series A this week.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.