Qiming joins Series B for Chinese AI diagnosis player

Shukun, a Chinese start-up that develops artificial intelligence (AI) technology used in the medical imaging diagnosis, has raised RMB200 million in the third tranche of Series B round.

The transaction was jointly led by Qiming Venture Partners, Shenzhen-listed Thunder Software Tech, Everest Venture Capital, and SPD Silicon Valley Bank.

It comes two months after Shukun secured RMB200 million in an extended Series B round led by BOC International and CCB International, featuring existing investors China Creation Ventures (CCV) and Huagai Capital re-upped. CCV led the first tranche of the Series B - also worth RMB200 million - in February 2019.

This followed a Series A round led by Hua Gai Capital and Morningside Venture Capital in 2018. Marathon Venture Partners provided RMB22 million in angel funding a year earlier.

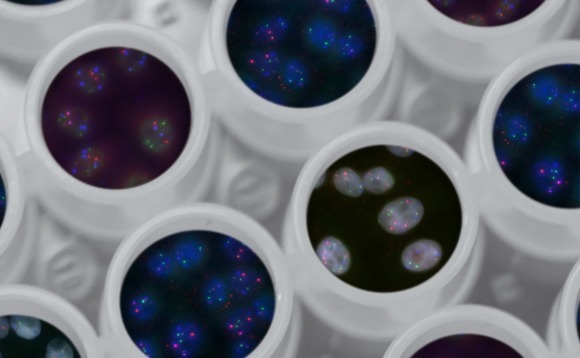

Founded in 2017, Shukun launched its core product - a three-dimensional heart disease diagnosis solution - in December 2018. It has collaborations with 29 of China's top 30 hospitals specializing in cardiovascular diseases. Overall, more than 300 hospitals nationwide use Shukun's "digital heart" products.

The company responded to the coronavirus outbreak by expanding its diagnosis capabilities to include the brain and lungs, Lei Zhang, Shukun's chief marketing officer told AVCJ. "We developed a diagnosis solution for COVID-19 in just 10 days, that's because of our technology accumulation over the years and our strong execution capability," said Zhang.

Shukun launched in July the world's first "digital brain" product which has been clinically verified in more than 100 hospitals across in China. It has a similar product targeting lung cancer. "With one single CT scan, we provide screening results for heart and lungs," said Zhang.

The proceeds of the latest round will go towards advancing comprehensive coverage in the AI medical imaging market and accelerating product development and commercialization.

For a traditional heart-disease imaging examination and diagnosis, doctors need at least 30-60 minutes to complete the scan-diagnosis-initial report-report review process. Patients must then wait 1-3 days for the results. Shukun provides an end-to-end solution that enables some hospitals to offer same-day service.

"One CT session creates some 400 images. We can use them to reconstruct a three-dimensional ‘virtual heart' and give a pre-diagnosis," Zhang told AVCJ in a previous interview. "It normally takes 30-40 minutes for a doctor to review and analyze all the images. With AI, this process can be cut to four minutes."

However, there remains a stark difference between theory and practice. A host of legal issues surround the use of AI in this way – all of which come back to the point that doctors hold medical licenses, not technology solutions.

"If a patient is misdiagnosed, the ultimate responsibility for that lies with the doctors; they can be sued for medical malpractice but not the AI," said Michael Keyoung, head of North America at healthcare investor C-Bridge Capital. "That's why a physician still goes back and reviews the images and make a proper diagnosis, rather than just reading the AI-generated report."

Some industry participants question whether AI represents a workable solution in this area. Ajay Royyuru, a vice president of health care and life sciences research at IBM, insisted that no matter how effective AI solutions prove to be, they will not displace the expert practitioner.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.