STIC-backed Korean game publisher files for US IPO

DoubleDown Interactive, a STIC Investments-backed Korean online game publisher best known for its flagship casino offering, has filed to list in the US.

STIC holds a 32.3% stake in the company. It got involved when DoubleU Games – the Korea-incorporated parent of DoubleDown – acquired a portfolio of casino-related gaming assets from International Game Technology (IGT) in 2017. A STIC special situations fund helped finance the transaction by subscribing to KRW300 billion ($24.3 million) in convertible bonds and bonds with warrants. The fund is expected to exit through the IPO, according to a prospectus.

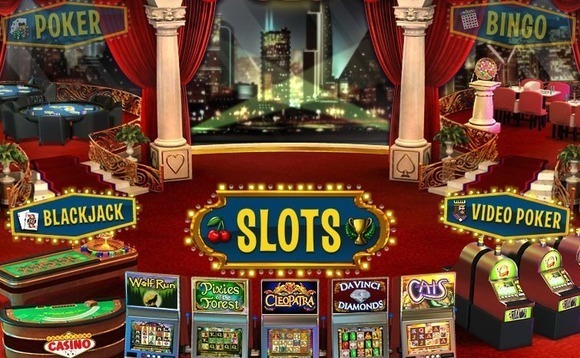

DoubleDown claims to be a leading developer and public of digital games for mobile and web-based platforms. It released "DoubleDown Casino" as a social casino game on Facebook in 2010. As the industry shifted to mobile platforms, the company modified its distribution channels. "Doubledown Casino" subsequently became one of the top 20 grossing mobile games annually in the Apple App Store, a status is has held continually since 2015.

DoubleDown now offers four games: "DoubleDown Casino," "DoubleDown Fort Knox," "DoubleDown Classic," and "Ellen's Road to Riches." Cumulative installations to date exceed 100 million. Last year, an average of 2.8 million people played the company's games every month. The typical user is a player of social casino and casual games. DoubleDown makes most of its money through in-game purchases, with average revenue per daily active user of $0.70 for the three months ended March 2020.

Citing research by Eilers & Kreicik, the company claims the global market for mobile casual games was worth $22.1 billion in 2019, up 22% year-on-year from 2018. The social casino market – which comprises free-to-play online slots, poker, table games, and bingo – is expected to grow 5% over the next four years, reaching $6.8 billion by 2023.

Through licensing arrangements with DoubleU and IGT – creator of well-known slot games such as "Cleopatra," "Wolf Run," and "Megabucks" – DoubleDown has access to more than 2,000 slot titles. It has also developed its own portfolio of over 20 titles.

The company generated $273.6 million in revenue last year, up from $266.9 million in 2018. Approximately 87% of this came from the US. Over the same period, net income rose from $25.1 million to $36.3 million, while adjusted EBITDA increased from $85.1 million to $101.7 million. The size and pricing of DoubleDown's IPO have yet to be decided.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.