AirTree backs Australia property intelligence platform

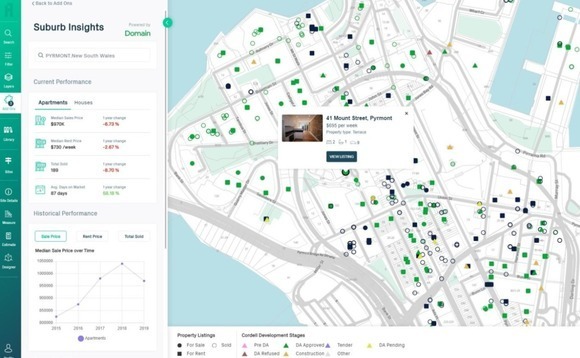

AirTree Ventures has led a A$6 million ($3.9 million) Series A round for Archistar, an Australian online property platform that allows users to click on blocks of land and see what can be built.

The two-year-old company is already working with real estate groups like LJ Hooker, Ray White and Harcourts and engineering and architectural companies including Mirvac, GPT Group, Stockland, CBRE, and Aurecon. Its services are being integrated into the spatial data and modeling programs of three state governments, while property agents want to use the product in digital displays.

In addition to identifying potential land-use options based on local planning and zone rules, the Archistar platform has hundreds of 3D generative designs that factor in height restrictions, exposure to sunlight, and ventilation.

Australia's construction industry is worth A$200 billion a year, with half of that coming from the residential segment. Archistar is targeting the entire value chain from government planners to homeowners. There are also ambitions to expand into the US and UK, and the Series A round will bankroll these efforts.

"Property professionals and governments are rapidly embracing digital tools to enable efficient and informed development. We've seen our revenue triple over the last 12 months," said Ben Coorey, the company's founder and CEO, in a statement. "In an industry that has often relied on instinct, door knocking and back of the envelope calculations, our users can now access planning rules, find off-market opportunities and conduct feasibility studies in a matter of seconds, all from our one platform."

AirTree is currently deploying its third fund, which closed last November at A$275 million, comprising a core fund of A$150 million and a top-up vehicle of A$125 million. The firm targets start-ups at the seed and Series A stages and looks to back them through later rounds. It remains a software investor, but the scope is widening as software solutions enter areas such as education, health, and food.

Within the broader property sector, AirTree also has exposure to Athena Home Loans, a financial technology start-up that helps homeowners refinance their mortgages with better loan terms through the superannuation sector and other non-bank lenders. The company raised A$70 million in Series C funding last October from a group of investors led by AustralianSuper.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.