MSPEA backs Indian affordable housing financier

Morgan Stanley Private Equity Asia (MSPEA) has invested INR1.9 billion ($26.6 million) in Centrum Housing Finance (CHF), an Indian non-banking financial company (NBFC) that offers loans for affordable housing projects.

Established in 2017, CHF is a unit of the Centrum Group, a diversified financial services conglomerate that earlier focused on merchant banking, foreign exchange, and wealth management services. In recent years, it has launched operations targeting small and medium-sized enterprise (SME) finance, microfinance and housing finance. Outstanding housing loans were nearly four times the size of other loan types in its portfolio last year.

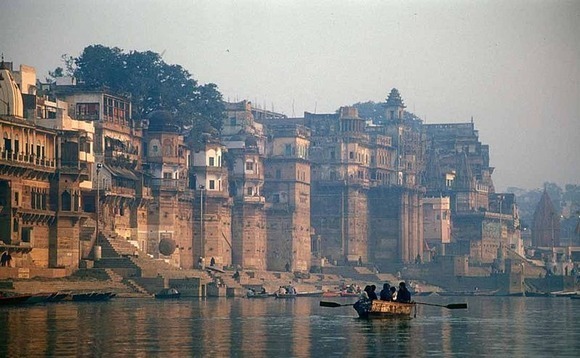

Offering loans between $4,000-85,000, chiefly for individuals seeking to purchase, build or improve homes in smaller cities, the company claims to have disbursed INR5 billion in credit to more than 3,500 customers. It plans to use the fresh capital to expand its operations nationwide. It is one of 82 registered non-banking housing finance providers in the country.

"The affordable housing space in India is underpenetrated and offers tremendous opportunity for growth. We believe that CHF is well-placed in this segment given its strong retail focus, robust underwriting and collection mechanism, and disciplined ALM (asset-liability management)," said Arjun Saigal, co-head of Morgan Stanley Private Equity Asia in India. The GP will take a minority stake of undisclosed size in CHF, according to a filing.

MSPEA has invested in three other NBFCs: South Indian SME finance-focused Five Star Business Finance, vehicle financier Kogta, and Jana Small Finance Bank, which has since obtained a banking license. All three companies have received private equity funding in the past 12 months.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.