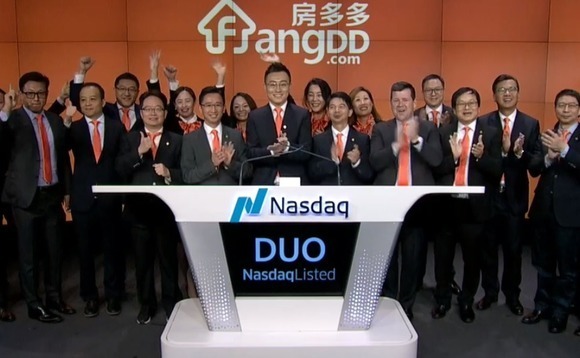

China property marketplace trades flat after $78m IPO

Chinese online real estate marketplace Fangdd Network raised $78 million in its US IPO, having reduced the size of the offering, and traded flat on its first day on NASDAQ.

The company sold six million American Depository Shares (ADS) – having planned to offer seven million – for $13.00 apiece. The pricing represented the bottom end of the indicative range, according to a filing. Fagdd's stock opened at $13.31 and reached as high as $13.55 during morning trading, before falling back to close at $13.00.

No shareholders made partial exits, which means FountainVest Partners, the largest external investor, has been diluted to 7.4%. CDH Investments holds 6.9%, while Vision Knight Capital and Lightspeed China Partners have 5.1% and 3%, respectively. The company is controlled by its three co-founders, led by Yi Duan, who serves as chairman. They hold 33.8% of the equity and 83.7% of the voting power.

Established in 2011, Fangdd initially served as a listing portal for property developers such as China Vanke, China Poly Group, and Greenland Holding, helping them reach out to customers and penetrate lower-tier cities. It offered group buying discounts on new properties, among other promotions. In 2015, a new business line was launched, focusing on direct sales in the secondary market. The aim was to connect buyers and sellers directly, removing the middlemen.

As of June 2019, Fangdd had 131 million properties in its database, covering homes listed for sale or for rent as well as those not currently on the market. Its competitors include Lianjia, Anjuke and US-listed Fang.com.

The business is built around a network of real estate agents that exceeded 911,000 as of the end of last year, which is said to represent a market penetration rate of 45%. Agents open virtual shops in Fangdd's marketplace under unique profiles. Based on actual performance and user ratings, the company helps agents establish credibility and brand value, and match them with the most relevant property listings, buyers, sellers and tenants.

Fangdd generated RMB2.3 billion in revenue in 2018 – up from RMB1.8 billion the previous year – of which RMB2 billion came from base commissions on transactions. Net income rose from RMB600,000 in 2017 to RMB104 million last year. In 2016, the company posted a loss. Revenue and net income for the first six months of 2019 came to RMB1.6 billion and RMB100.3 million.

Fountainvest led a $223 million Series C round for Fangdd in September 2015; this followed an $80 million Series B in 2014 led by Vision Knight and featuring Lightspeed and CDH. CDH - participating through its venture funds, which have since been replaced by a venture-growth strategy - provided RMB50 million ($7 million) in Series A funding in 2013.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.