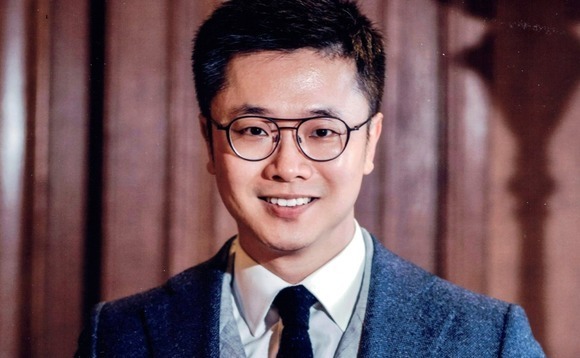

Q&A: Northwestern University's Tianhao Wu

Tianhao Wu, a managing director in the investment team at Northwestern University’s endowment, on adding new GP relationships, addressing China risk, and pursuing geographic diversification in Asia

Q: What role does private equity play in Northwestern's overall investment programme?

A: Over half the portfolio is in private markets [the overall endowment has approximately USD 15bn, of which 23% is in venture capital, 15% in private equity, and 15% in real assets], and it has contributed to healthy returns. Now, though, we expect venture distributions to be slow for a period. We are constantly monitoring contribution pace and distributions, and running stress test scenarios, to make sure we have enough liquidity to cover university spending. Our programme is mainly the US and Asia, and Asia is mostly China and India. About 9% of the entire endowment – split half-half between public and private – is invested in China. It has fallen from 14% two years ago, largely because there were strong distributions in 2020 and 2021, but since then, the markets have repriced a lot, especially on the public side for tech companies. Our target hasn't changed; NAV has shrunk.

Q: What are the current priorities in portfolio management?

A: We have close to 110 active relationships – 60% of them in the private markets space – and we want to consolidate them, focusing on high-conviction managers and supplementing them with talented emerging managers. This will happen step by step. We are open to secondaries; we sold some of our private equity assets last year, raising a few hundred million dollars. However, pricing was very strong last year, and conditions have changed since then.

Q: How did you address the surge in re-ups last year and early this year?

A: It was crazy. We've never seen fundraising at that pace before. There were a lot of re-up decisions and because I joined recently [Wu followed Amy Falls, his CIO at Rockefeller University, to Northwestern last year], every re-up decision was a re-underwriting decision. This created a lot of work, but it was a good exercise – it helps to go deeper and do some thorough work – and we decided against re-upping with several GPs. The worst thing you can do is overcommit during a bull market because when things go down, you don't want to be overallocated. We were glad to have done the secondary sales when we did; it meant we had more dry powder. In the past six months, we've maintained a higher level of cash or short-duration fixed income than our target.

Q: Are you establishing new GP relationships?

A: Capital is scarcer now, and fundraising timelines have been extended. This gives us more time to conduct due diligence. The bar is higher for new relationships – there are liquidity constraints, the cost of capital has risen, and the risk-free rate has increased significantly, so our risk premium has gone up. However, we are still open to adding new relationships.

Q: Including in China?

A: It's harder. We want to maintain or increase our exposure to Asia because the region contributes 40% of global GDP, it is growing faster than the rest of the world, and it has strength in entrepreneurism and innovation. But we need more diversification by geography. We have six GPs in China, and we could re-up in those, but adding a seventh in the near term would be difficult. We must be mindful of the regulation situation. There are proposals in the US about restricting the role of US capital in certain sectors in China, including technology. For example, there is talk of a reverse CFIUS [Committee on Foreign Investment in the United States] process whereby US outbound investments would be screened. We need to figure out whether institutions like us are responsible for compliance and reporting or whether that falls to the GP. It's possible that a Chinese fund with US institutional investors would have to go through an additional regulatory process for some deals. If a highly restrictive regime is introduced, I could see GPs doing separate vehicles for US and non-US LPs.

Q: How are you navigating hard tech, given the surge in funding for this area?

A: There has been a shift from consumer internet to hard-tech and software-as-a-service (SaaS). It's debatable whether SaaS will continue to be attractive. Part of the thesis was that comparable companies in the US were trading at 30x price-to-sales, but now valuations have collapsed. Within deep-tech, there are a lot of nuances. Robotics for factories and logistics are fine, and then some areas of semiconductors are too sensitive while others are not. Generally, we find that GPs tend to be more on the application side, targeting areas like automation where development is in line with what the government wants to achieve.

Q: Are you concerned that US dollar-denominated funds might become less popular as more founders seek renminbi funding?

A: Historically, US dollar funds have been more valuable to GPs – they are larger, have a longer lifespan, and are viewed as more prestigious. And we've found that US dollar funds generally outperform renminbi funds operated by the same manager. It is a concern that, going forward, we might not be a preferred LP because company founders want renminbi instead. We are looking into using the QFLP [qualified foreign limited partner] scheme, but even then, you are still classified as a foreign entity for certain deals.

Q: To what extent are China managers turning their attention to markets like Southeast Asia?

A: We are seeing that a lot. As an LP, we support innovation and investing in areas with entrepreneurism and talent. There are lots of situations where Chinese business models have been taken into other markets, and we see Chinese entrepreneurs going to Singapore, Indonesia, and Vietnam to start companies, often with an engineering team in China and a local team for execution. The question is whether there are enough opportunities. We don't see many GPs pushing beyond their fund remit, but that may change. I think a 20% allocation to a market like Southeast Asia would be fine, but if it's above 50%, we would have questions. We like to give GPs flexibility, but we don't them to abandon their original mandates.

Q: What is attractive outside China?

A: Our India exposure is about half the size of our China exposure, mainly venture capital. In the last couple of years, India has done very well, helped in part by money that was earmarked for India being rerouted to China and by booming public markets. We don't have anything in Southeast Asia, but we are interested. We have discussed internally whether we need a dedicated Southeast Asian GP, or we are fine backing regional and global managers investing in Southeast Asia. We have one VC relationship in Korea, which is doing very well, and we are interested in Japan and Australia, where buyouts have done well.

Q: How do you go about adding a geography?

A: We look at the size of the market and the opportunity set, and whether it reflects structural or temporary change. We don't want to jump in, see the tide turn, and get trapped. Assessment is harder than before because we are living in a world of greater deglobalisation, more government intervention, and heavier industrial policies.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.