LP interview: CalSTRS

Keen to reduce investment costs, California State Teachers’ Retirement System is changing the way it works with managers. Co-investment, joint ventures and stakes in GPs are priorities for private markets

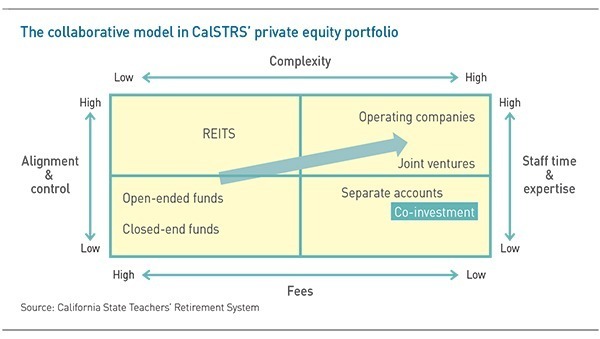

California State Teachers' Retirement System (CalSTRS) coined the term "collaborative model" about three years ago to describe efforts to bring more of its assets under internal management. However, the process began in 1987 with fixed income and since spread from public markets into private. The more complex and costly the strategy, the more nuanced the collaboration. It is not just a matter of building internal capabilities, but also working with – and even investing in – third-party managers.

"We picked the word collaborative intentionally to be very broad. That meant we could do lots of different things with different people," says Chris Ailman, CIO of CalSTRS. "In private equity and infrastructure, everything is in a limited partnership format and we know those are very expensive with no control. There are other business formats we can use – direct ownership, syndicates, co-investment – where we can own things in a more effective way."

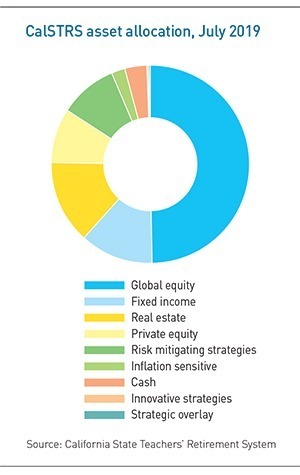

The US pension plan had $241.3 billion in assets as of July, including $21.8 billion in private equity, $32.3 billion in real estate, and $22.5 billion in risk mitigating strategies, which are intended to offer protection against equity market downturns and feature some PE. Private equity is the top-performing asset class on a three, five and 10-year basis, while real estate ranks second or third over each of these periods. This is net of fees, but access comes at a relatively high price.

In 2017, CalSTRS incurred $1.1 billion in portfolio costs – chiefly management fees that went to external managers – and paid out $727 million in carried interest. Private markets strategies accounted for 81% of the portfolio costs even though about three-quarters of the portfolio was deployed in the public markets. Moreover, while 44% of assets across all classes were managed internally, they were responsible for just 3% of the costs.

CalSTRS found it had made significant savings compared to its peers by bringing management of public assets in-house – 85% of fixed income and 60% public equities are now handled internally – and pursuing co-investment and joint ventures in the private sphere. Over the past two years, more thought has gone into what resources are required to support further growth of the collaborative model.

"When we started coining the term, people said CalSTRS has started to invest directly, but this began more than 30 years ago," says Scott Chan, the pension plan's deputy CIO. "The biggest issue with executing a direct model is the execution itself. Our experience gives us a huge advantage because we are moving incrementally, which minimizes the risk. If one day you woke up and said, ‘I'm going to start building a firm with 1,200 employees,' do you think you would be successful?"

Evolution, not revolution

The 1,200 figure is not pulled out of the air. In May, CalSTRS acquired a majority interest in Fairfield Residential, a US-based property developer and manager, from Brookfield Asset Management. The pension plan started investing in Fairfield's funds in 1997 and bought a minority stake in the business eight years later. Assuming control is intended to create better alignment and reduce costs across the real estate portfolio. It is also a shortcut route to achieving deeper direct investment and management capabilities through Fairfield's staff of 1,200.

"With private markets, we can't take assets in-house because it would cost a lot to do that," Chan adds. "We have 180 employees in our entire investment division. Would we ever hire 1,200? Do we have that capability? No. But by buying a majority position in that organization we are leveraging their pipeline, they are managing some of our assets, and we are sharing in the profits. Whatever we are paying for relative to the assets we are managing, we are getting a rebate in the form of profits."

The Fairfield deal did not represent unchartered territory for CalSTRS. The pension plan owns three real estate operating companies – it first acquired an interest in one 12 years ago – and has stakes in at least five property investment managers. There is also a partnership, now in its second iteration, with Dutch pension fund APG that focuses on North American energy infrastructure.

"If it's captive capital, we can have a say on operations and how they do things," Ailman says of the infrastructure partnership, which was established in 2015. "Even when you team up with a peer, though, it brings challenges. The business is run out of New York, but they interact with Amsterdam a lot and get approvals. It has been a good learning process."

The mantra is evolution, not revolution, and it applies to private equity co-investment as well. CalSTRS has participated in more than 90 direct deals alongside portfolio managers since 1996, with $3.4 billion deployed, $3.4 billion realized, and $1.5 billion in residual value. It amounts to just over 10% of the PE program and the goal is to at least double that over the next several years. Annual deployments have been in the $300-500 million range over the past five years, but the 2019 total will be $1 billion.

"We are likely to do more complex co-investments, taking larger stakes, and getting involved early, before the deal has closed so we can be a partner to the GP and ensure they have funding," says Margot Wirth, director of private equity at CalSTRS. "We used to have the authority to go up to $125 million per co-investment, but now we can go to $250 million. Still, prices are high, and we must be careful – it is quality over quantity."

In assessing where the collaborative model could be better resourced, CalSTRS identified legal, technology, financial services and communications capabilities, travel, and human resources as key areas. The last of these represents the most pressing consideration, given the skills and experience required to engage successfully in direct investment.

According to a January presentation, there were 23 people in the PE team, including 18 investment selection specialists and five operations executives. Of these, only five were spending 30-50% of their time on direct deals. Around one-third of the team had little or no co-investment exposure. In order to at least double co-investment run rate capacity over the coming two to five years, Wirth estimated she would need an additional 15 full-time staff, 10 for investment selection and five for operations. This would see direct investment headcount increase to 17.

The presentation noted that additional costs incurred by hiring people with the requisite skills and experience "would be miniscule compared to the likely rewards" in the form of higher investment returns and reduced costs. It also suggested that these executives might not be based in Sacramento; they would be better equipped to source opportunities in a major financial center. The Bay Area was mooted as the obvious choice.

"We now have people who are dedicated solely to co-investment and more people will be added periodically," Wirth explains. "We have people who have worked for GPs. We might like someone from a middle market lending company, someone who has been a consultant, maybe a banker or valuation expert. The salary structure in and of itself would attract a quality person to some degree. We are looking into how we can attract and retain more senior people."

Beyond discounts

The overall CalSTRS private equity portfolio comprises positions in approximately 350 funds across more than 100 GP relationships, although some of these are no longer considered core. The pension plan invests in about 25 funds a year with an average check size of $200 million. In 2018, it put $7 billion to work in funds and co-investments. Recent fund commitments have been as low at $50 million and as high as $750 million. Fund-of-funds or separate accounts are used for niche strategies.

The geographic split is 70% North America, 20% Europe, and 10% Asia. Within Asia, since 2014 CalSTRS has backed funds managed by the likes of Affinity Equity Partners, Bain Capital, The Carlyle Group, CVC Capital Partners, FountainVest Partners, GGV Capital, KKR, Lilly Asia Ventures, MBK Partners, PAG Asia Capital, RRJ Capital, SSG Capital Partners, and Vivo Capital.

Increasing fund sizes are an issue in every market and can result in additional questions asked during due diligence if there's a suspicion that a GP is leaving its comfort zone. Ailman believes managers will keep pushing the envelope as long as there are LPs out there willing to fund them – and the big checks aren't necessarily coming from North America.

"Being number two in the US, our board thinks we are so powerful. I keep emphasizing that the pools of long-term capital outside the US are enormous," he says. "If Japan's GPIF [Government Pension Investment Fund] invests 5% in private markets, that would swamp our portfolio. We're barely in the top 25 of those rankings of the largest funds in the world. We are an established name that commands respect, which is good, but we aren't that fresh money."

Nevertheless, CalSTRS is still large enough to leverage its sizeable commitments and longstanding ties with managers to secure discounts on fees, close working relationships, and separate accounts for co-investment. What the pension plan has yet to do is follow some of its peers in pursuing lower cost structures through strategic relationships that cover multiple asset classes and lock up capital for extended periods of time.

While such arrangements have been discussed, the fact that the investment directors responsible for private equity, infrastructure and real estate like to do business with different GPs is a deterrent. The preferred approach is select the partner first, then try and negotiate a fee discount. Indeed, the objective of more closely aligning interests between CalSTRS and its portfolio managers – which partly underpins the collaborative model initiative – lends itself to deeper relationships. Volume discounts would be one of several items on the agenda.

"One of the best things we wrote into a partnership was the right to look at every deal and have the opportunity to invest alongside the manager," says Chan. "We can be smarter in terms of organizing our partnerships and leveraging them. For example, what about putting some of our people into a PE firm's office for a period to learn more about the asset class? It's not going to be top-down only where management signs a blockbuster deal and none of the experts within the asset classes necessarily likes what is going on. We will be more holistic in structuring these partnerships."

Ultimately, all LPs must find their optimal position on an investment spectrum that has outsourcing at one end and insourcing at the other, with co-investment, separate accounts and joint ventures sprinkled in between. What CalSTRS wants is a model that allows a greater degree of flexibility in how private market opportunities can be addressed while acknowledging the limitations of government ownership.

"GPs are so frustrated about having to raise capital, but none of us want to give them permanent capital. We've all been looking for a better alignment tool," Ailman says. "The Canadians are doing a great job of being direct investors. It wouldn't be the right business model for CalSTRS, as a division of a state government, to roll out its own direct investment program. There are ways we can pair up with the Canadians or other people, and we are trying to figure out if we can do that."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.