LP interview: New Zealand Superannuation Fund

New Zealand Superannuation Fund believes it has turned its far flung location into an advantage, making decisions away from the mainstream investor community and plotting a differentiated course in alternatives

It takes about 20 hours, including a layover in San Francisco, to complete the 14,000-kilometer trip from Auckland to New York. Journeys like this contributed to the four million kilometers New Zealand Superannuation Fund's (NZ Super) team flew internationally for the year ended June 2016. It is part of the reality of running a global program – every portfolio manager is visited at least once a year, with direct investments requiring more frequent attention – from a single office in a remote location.

However, Fiona Mackenzie, head of external investments and partnerships at NZ Super, believes the upside outweighs the downside. Geographic isolation has forced the sovereign wealth fund to be more outward facing, making all that time spent on the road count by building strong relationships with its partners and peers. Distance also insulates the team from white noise in the investment landscape.

"I used to work in New York and my clients were inundated with meeting offers, it was a constant cacophony of noise and activity. Being on our little island at the bottom of the world gives use a sense of clarity and the ability to focus on what is really important in terms of driving our portfolio," Mackenzie explains. "Another advantage is, because we don't have the sophisticated ecosystem that a lot of our peers have around them, we've had to be more innovative and think about things in different ways."

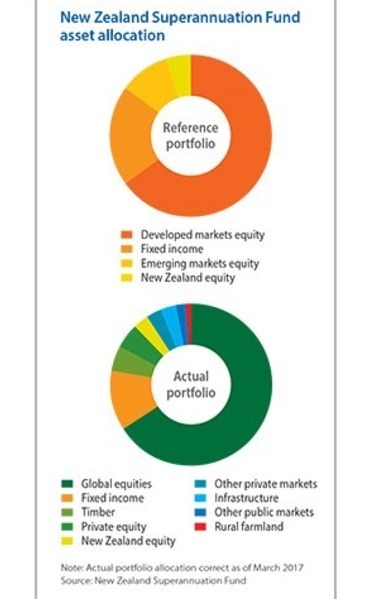

Perhaps the most striking difference between NZ Super and other LPs is its use of a reference portfolio instead of the classic strategic asset allocation model. The reference portfolio, introduced in 2010, sets a base allocation of 80% growth (at present 65% development market equity, 10% emerging markets equity and 5% New Zealand equity) and 20% fixed income. Specific asset classes are considered based on whether they can improve the portfolio by increasing the return or reducing the risk.

While NZ Super has a strategic tilting program that allows it to overweight an asset class at certain times if it sees value, this approach works against exposure to private equity, and third-party funds in particular: they are illiquid, and a 2% management fee and 20% carried interest is expensive compared to other asset classes. As of March 2017, the fund size was NZ$34.1 billion ($23.4 billion), with 5% in private equity, 5% in timber, 3% in infrastructure, and 3% in other private markets.

"Opportunistic flexibility is important to us – when we see dislocations in the market we want to move quickly," says Mackenzie. "Another reason our PE exposure has declined over time is that buyouts are a skill-driven game and it's hard for us to identify skilled managers on a forward-looking basis. You need the top managers to get great returns. Pick an average manager and you're paying 2/20 for what is effectively a market beta return. That doesn't make sense in terms of our portfolio construction."

Areas of emphasis

NZ Super had 33 GP relationships as of June 2016, of which 21 wholly or partially involved unlisted assets. Recent additions include distressed credit and life settlements, both areas in which distance makes it difficult to engage with European and US markets, necessitating the use of external managers. The emphasis is on differentiation. Life settlements – buying portfolios of policies for a discount and taking responsibility for payouts – are attractive because returns are not correlated with public markets.

At present, North America accounts for the largest portion of the fund in terms of geographic economic exposure, with 48%, followed by Europe on 19% and New Zealand on 12%. This strong domestic showing reflects the fact that the reference portfolio is also overweight New Zealand – the country is nowhere near 5% of the MSCI World index. However, this approach is not underpinned by a government policy-like rationale aimed at supporting local markets.

"We think New Zealand on the listed side remains relatively inefficient: it's not particularly liquid, a reasonably high percentage of retail investors versus institutional investors. Our research suggests it is still relatively achievable for a median manager to outperform the benchmark," says Mackenzie. "That's why when you look at our portfolio it's an exception to the passive approach. We have active managers and internal teams for listed equities, several mandates for private equity at the smaller end which augments our in-house direct team which focuses on larger investments like Kiwibank."

She estimates that NZ Super accounted for about 25% of the NZ$1 billion raised by New Zealand-based GPs in the last 12 months. It contributed up to NZ$90 million to Direct Capital's fifth buyout and growth fund, which closed at NZ$375 million, the third time it has backed the manager; re-upped in Pioneer Capital with an investment of up to NZ$120 million in the firm's third growth fund, which closed at NZ$260 million; and committed up to NZ$50 million to Movac's fourth fund, an earlier stage expansion capital vehicle that is targeting up to NZ$100 million.

The in-house view on New Zealand private equity is that early-stage investment has become more robust in the last 10 years, but the expansion capital – where the higher end of the venture capital space meets mid-market buyouts, with check sizes of NZ$5-20 million – is relatively inefficient. Many companies are looking to expand internationally and PE can provide the capital and expertise to make this happen.

NZ Super recognized that allocations would have to be made to several local managers because committing NZ$200 million to a single fund would distort the market, but great care was taken in ensuring these three firms do not end up chasing the same deals. The solution was to negotiate "swim lanes" or investment criteria based on their views of where each manager could generate the best returns.

"We think expansion capital in New Zealand is very attractive – it is an opportunity that doesn't necessarily exist in the same form in other markets in the world. But while other markets are so big the risk of managers competing with each other is very modest, in New Zealand it is very high," Mackenzie explains. "Each manager's swim lane is slightly different and they overlap as little as possible, but we also don't want to overly constrain them. That is the challenge."

Doubling down

For the private equity program as a whole, fund commitments of below $100 million are the exception, not the rule. Five years ago, NZ Super had about 50 manager relationships and an average check size of $40 million. The number of GPs has been cut by one third but the fund is putting more capital to work with each manager. For example, when it awarded an energy mandate to KKR in 2014, it allocated $75 million to an energy fund and a further $175 million, on a flexible basis, for natural gas investments.

In this respect, NZ Super is behaving much like its sovereign wealth fund peers. But the comparisons do not end there. The fund has also moved more capabilities in house in recent years and become an increasingly active direct investor. A team of seven is responsible for external manager relationships, while five people focus on direct investments outside of New Zealand and infrastructure globally, and eight more cover domestic direct investments as well as forestry and agriculture globally.

The fund is obliged to work with a co-investor on direct deals because it is not allowed to control operating companies. However, when making commitments overseas, it is more likely to work with other sovereign wealth funds or family offices rather than taking a piece of the downstream syndicated tranche of deals led by private equity firms. "That's not consistent with our approach of getting as direct as possible," says Mackenzie. "We have to understand the drivers of an investment opportunity."

Despite concentrating its resources out of a single office, easing the reliance on third-party managers has been accompanied by a culling of third-party advisors as well. NZ Super previously used Franklin Templeton for real estate, Hamilton Lane for private equity, Albourne for hedge funds and Aksia for operational due diligence. Now it relies only on Aksia occasionally and on Cambridge Associates as a database provider.

The advisor-heavy approach is deemed more suitable for an asset allocation model than for a reference portfolio. However, it also reflects NZ Super's desire for fewer and deeper relationships. "We believe we get a better monitoring outcome if we have direct relationships with managers," says Mackenzie. "If you have an advisor in the mix, it means another layer of incentive alignment to work through. We've ended up with a slightly bigger team with fewer managers and almost no advisors because we felt our efforts were best spent on getting close to managers."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.