Weekly digest - May 25 2022

|

PORTFOLIO

INVESTCORP AND VIZ BRANZ

War, climate change, and COVID-19 are twisting the outlook for Investcorp-owned instant food supplier Viz Branz. But an implacable China growth story has underpinned an aggressive expansion agenda. War, climate change, and COVID-19 are twisting the outlook for Investcorp-owned instant food supplier Viz Branz. But an implacable China growth story has underpinned an aggressive expansion agenda.FUND FOCUS

XVC STRESSES ITS IDIOSYNCRASIES

The China VC firm cuts against the grain, eschewing investment committee meetings and embracing consumer deals while others shun them. It works from a fundraising perspective. The China VC firm cuts against the grain, eschewing investment committee meetings and embracing consumer deals while others shun them. It works from a fundraising perspective.DEAL FOCUS

INDIA'S FASHINZA IN VOGUE WITH VC

The appeal of the boutique brand ensures that fashion will always be a fragmented space. As e-commerce splinters the industry even further, India's Fashinza aims to tie it all together. The appeal of the boutique brand ensures that fashion will always be a fragmented space. As e-commerce splinters the industry even further, India's Fashinza aims to tie it all together.FUND FOCUS

BLUERUN DEFIES CHINA FUNDRAISING WOES

Having secured USD 819m, across US dollar and renminbi vehicles, the early-stage investor wants to prove that China can deliver globally competitive technology. Having secured USD 819m, across US dollar and renminbi vehicles, the early-stage investor wants to prove that China can deliver globally competitive technology.DEAL FOCUS

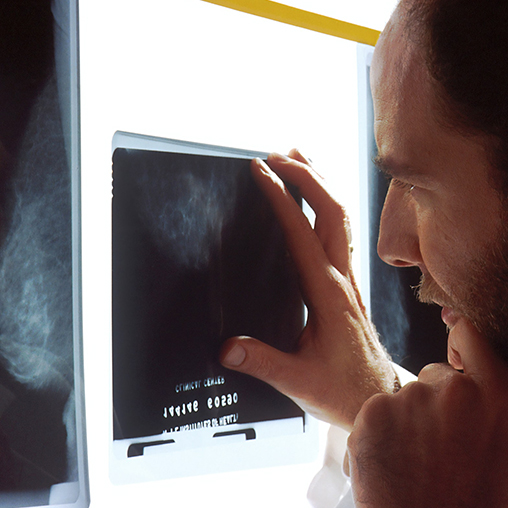

ICG FINDS ALIGNMENT WITH DOCTOR-SHAREHOLDERS

Intermediate Capital Group believes its flexible approach to deal structuring – and a willingness to share upside – helped win over doctors who are employees and part-owners of Canopy Healthcare. Intermediate Capital Group believes its flexible approach to deal structuring – and a willingness to share upside – helped win over doctors who are employees and part-owners of Canopy Healthcare. |

|

By the Numbers

AVCJ RESEARCH

RETAIL ROLLOUT

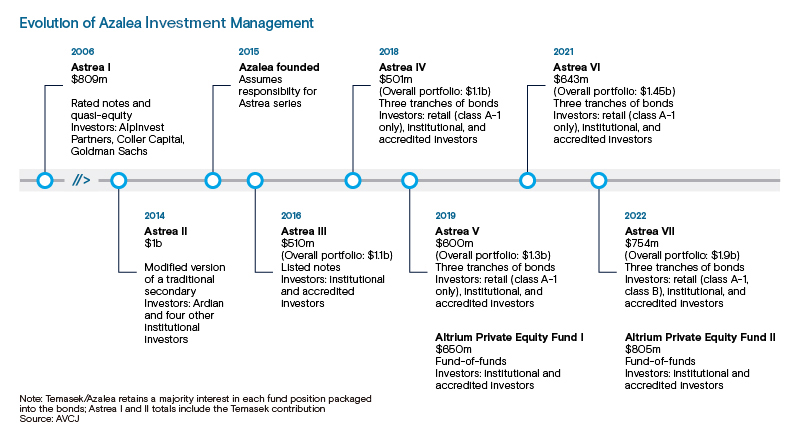

The Astrea series, initiated by Temasek Holdings and now run by Azalea Investment Management, is a story of incremental progress. What started out as unorthodox secondary transactions backed by orthodox secondary investors has evolved into an exercise in widening access to private equity – unique in its consistency and its commercial-educational remit.

A significant breakthrough came with Astrea IV in 2018 . A three-tranche bond structure was introduced, with retail investors permitted to subscribe to the least risky class A-1 tranche. The others went to institutional and accredited investor. Individuals could subscribe to tiny portions of the bond offering and get exposure to a mature portfolio of funds. Azalea served as curator and majority shareholder in each LP position. Now in its seventh iteration, the Astrea series has taken another step forwards, opening the class A-1 and class B tranches to retail investors. Class B sits lower in the capital structure. Azalea said it was a response to investor demand. This begs the question of what comes next and how quickly – direct exposure to equity rather than through bonds supported by private equity cashflows? Azalea, which is building out a product suite much like any other asset manager, already offers this through its fund-of-funds series. However, at present, only institutional and accredited investors can apply.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.