The gathering storm: Preparing portfolio companies for a downturn

As warning signals of a global economic downturn become increasingly convincing, private equity portfolio companies are likely to come under pressure. Investors are advised to prepare carefully

One of the counterintuitive aspects of the private equity industry is the fact that sometimes the most prudent moves are also the most divisive. This was highlighted earlier this month, when Mekong Capital, a minority investor in Vietnam housing developer Nam Long Investment Corp, urged the company to issue VND500 billion ($22.4 million) in convertible bonds to Singapore's Keppel Corporation.

Many shareholders opposed any dilution of their stakes but Mekong was among those lobbying Nam Long to brace for a downturn while the market was still hot. With Vietnam's real estate sector burdened by tight debt-to-equity ratios and reliant on short-term capital from local banks, it wouldn't take much for boom to turn to bust. Mekong saw the Keppel deal as a means of raising capital easily now rather than with difficulty later, fortifying Nam Long's position versus its peers ahead of likely macro challenges.

While the fundamental philosophy behind this maneuver is thoroughly baked into PE investment theses in North America and Europe, it has yet to be fully embraced by emerging Asia. Portfolio companies, notably in China, have been carried along by strong economic tailwinds; reorienting them to withstand opposing forces was not a priority. Now, economies across the region carry a warning sign. Should the malaise set in, some private equity firms - whether control investors or minority players seeking to exert influence - could find their failure to prepare for the worst comes back to haunt them.

"With the market slowdown, principally in China, these private equity houses really need to make sure that their investees are positioned to weather the storm and come out of it with more value created. PE firms don't don't make money investing, they make it on exits," says Bob Partridge, Asia Pacific private equity lead at EY.

Economic pointers

The slowdown in China has been dramatic. Having achieved double-digit GDP growth for much of the 2000s, over the past five years it has fallen from 9.5% to a 25-year low of 6.9% in 2015. Although a shift in focus from quantity to the quality of growth is welcomed, it is uncertain whether the transition can happen smoothly. A recent HSBC report on Asia Pacific economics said that the few recent bounces in China's various economic metrics did not necessarily constitute a recovery in progress. It expects GDP growth of 6.7% in both 2016 and 2017.

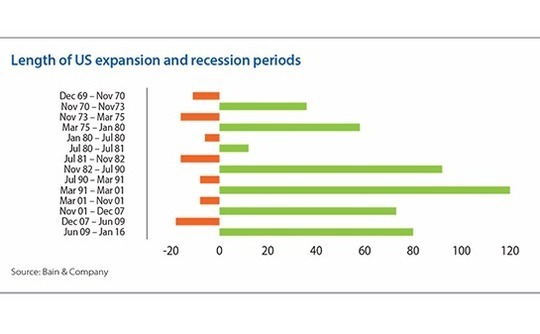

China is also holding back the region as a whole, with Asia GDP growth expected to remain static at 5% in 2016. Exports are weak due to reduced demand from the West, with shipment volumes in the first two months of 2016 representing the worst seen in four years. This shows no signs of abating as the US seemingly close to a turning point in its boom-bust cycle. Considering the country's previous recession hit after 73 months of expansion, the current expansion period of more than 80 months is considered over-ripe for a drop-off.

Export-related businesses are not the only ones that will get hit. Private consumption rates in Asia are also falling, which suggests difficult times for industries driven by discretionary spending, such as luxury goods, travel and entertainment, as well as big-ticket household items. In addition, outsourcing service providers are expected to come under pressure as demand slows and producers move operations in-house to fill their own capacity first.

Operators that fail to adequately prepare for a downturn could find portfolio companies suffer from reduced cash flow and loss of strategic position to better prepared competitors, while key personnel may leave if they believe their compensation is in jeopardy. Exits may also be delayed, depending on leverage levels and asset value impairments.

While recommended precautions are familiar to many investors - indeed, to some extent they represent measures that GPs should already be taking - they emphasize the importance of more nimble, situation-specific planning and engagement methods in the face of disruptive macroeconomic forces. Just as importantly, they point to longer-term change in attitude as portfolio storm-proofing becomes part of the investment process rather than an urgent step as growth-focused agendas begin to falter.

So far, GPs have reacted to the warning signals with a greater focus on portfolio management rather than seeking out new investments. However, consistently high levels of dry powder in Asia over the past few years mean there is also pressure on GPs to deploy capital. An impending downturn can result in more attractive entry valuations, but it also creates confusion. For instance, a target company's growth projections might be considered overly optimistic in light of increasing economic uncertainty.

Investors are advised to double down on due diligence and explore additional value creation options that could make an investment viable despite the expected industry headwinds. Most importance of all, they need to be able to recognize a dead-end deal.

"Investment committees need to sharpen their focus on downside risk as they think about businesses and be prepared to walk away from deals that they feel are overly exposed," says Vinit Bhatia, a partner at Bain & Company's Hong Kong office. "Nobody wants to walk away from a deal, especially if you've done a lot of work on it, but it's important to have that discipline."

In these circumstances, private equity firms are naturally drawn towards downturn-resistant, countercyclical sectors. These defensive plays typically fall within consumer-focused industries, notably food safety, environmental services, healthcare and education.

For Mekong, the effectiveness of this approach was borne out through the firm's survival of the Vietnam downturn of 2011-12 when inflation peaked at 28% and short-term bank interest rates rose higher than 20%. It contended with this country-level macro event by shifting away from export and manufacturing investments toward Vietnam's reliably robust consumer market.

"That's what led us to only invest in domestic-facing, consumer-driven sectors, which we find to be, overall, relatively stable and well insulated from any macroeconomic cycles," says Chad Ovel, a partner at Mekong. "When it comes to consumer expenditures, there is cyclicality, but we're talking 8% growth or 20% growth - whereas other sectors that we're no longer interested in investing in have major economic cycles."

Practical measures

Any move to diversify a portfolio through counter-cyclicality, however, will need to be explored with regard to what value-add options are plausibly addressable during the investment period. While consumer-focused sectors may generally have stronger fundamental demand to support growth, they remain susceptible to all kinds of other pressures. In these situations, specific industry knowledge can really pay off.

For example, China-focused mid-market buyout firm Lunar Capital claims to have tripled the size of babywear company Yeehoo since acquiring it in 2012. This was achieved by identifying and heading off risks such as a slowing retail market and growing pressure from online competitors.

"We are very focused on opportunities that fit our skill set and approach and we like consumer businesses in fragmented sectors where we can acquire companies that will benefit from our operationally intensive approach," Derek Sulger, a partner at Lunar says. "We are in the process of acquiring a number of snack food companies, which in aggregate will give us a substantial presence in that industry and the opportunity to drive economies of scale, distribution and modernization."

This attention to aligning strategic direction and company-level problem solving will have to be applied to both new acquisitions and existing portfolio investments. But for many Asian companies, the transition from a focus on the low-hanging fruit of rapid revenue growth to a focus on operational discipline is a difficult pivot.

The essential problem facing GPs is that many companies in Asia's emerging market have not experienced economic cycles and therefore do not fully understand the importance of storm-proofing programs. David He, partner and managing director at PAG Asia Capital, says that for the first half of his 10 years in private equity, he rarely had a conversation with a management team about costs.

"A few years back, it was a more difficult discussion with management because people's minds were all about capturing opportunities and how much they should grow," he explains. "Now people realize you need to manage both sides of the business on the revenue side and the costs side in order to have a more sustainable business."

Tactics for achieving cost reduction objectives vary from the establishment of more flexible management compensation structures to the migration of company banking relationships to institutions already affiliated and familiar with the PE firm. A broader cash flow approach, meanwhile, requires increased attention to the deferment of discretionary capital and better management of working capital.

Much of the book balancing effort in bolstering downturn resilience boils down to ensuring that portfolio companies take on as little debt as possible. This is especially critical given the historic tendency of certain Asian jurisdictions to experience dramatic interest rate jumps and the fact that these markets currently have high levels of corporate leverage.

"One of the biggest traps that companies fall into is having too much leverage often unhedged or in the wrong currency," says Nicholas Bloy, a managing partner at Navis Capital Partners, which has a strong focus on Southeast Asia. "It's great for two or three years if things are going well, but it inevitably trips up the company in a downturn. You need to think, maybe it's a bit more expensive, but we need to hedge it appropriately to the currency profile of the business we're buying into."

Capital management exercises also free up cash for portfolio companies that can be used to pursue new markets, bring in external management help or make the complementary bolt-ons which can be necessary to continue adding value as a downturn runs its course.

The inevitable sticking point for most GPs, however, is that the balance sheet improvements needed to realize these value-add moves depend on better portfolio engagement. Firms tend to suffer in actually realizing it as a course of action due to a lack of clear, practical inroads. In fact, Bain's research indicates that although 80% of GPs boast a robust value creation plan, only 14% believe they are successfully executing it.

Control is the key differentiator, but larger groups such as Navis and PAG can also rely on dedicated operations teams or contracted consultancies. Smaller players, which have fewer resources and are often minority investors, must be more inventive in their engagement strategies.

Mekong achieves its cost objectives in part by insisting on the introduction of an independent, non-executive director in portfolio companies. This person is an elder veteran in the targeted sector, hand-picked to help professionalize a company's founding management - and without the direct ties to PE that many entrepreneurs find intimidating.

"We will not make an investment unless we've already identified a person like that and the company has invited them to join the board," Mekong's Ovel says. "They're far more effective at convincing the leadership teams of companies we're investing in than we are, and we make it clear they're not reporting to any one shareholder. If the company perceives that person as an extension of Mekong, they may be resistant to the ideas."

Effective engagement

This sensitivity to the psychology of entrepreneurs and their relationship with investors is essential to successful portfolio company engagement. PE firms must tread a fine line, ensuring that any operational interventions in businesses often dominated by the founder-CEO are as transparent as possible.

Effective approaches in this area include sharing third-party analysis with management and other shareholders to demonstrate how consulting efforts are generating results in the best interest of the company, not just the PE firm. Although storm-proofing agendas will largely focus on cutting costs, an initial focus on improving top-line performance is often a better way of defusing the usual suspicions about outside help.

An immediate demonstration of practical cash generation without cutting staff will build an initial trust that may be needed later if an economic downturn means more dramatic intervention is required. The importance of tactfulness stems from the fact that the self-reliant identities of many start-up founders are inextricable from the operational style of their broader management teams.

"It's difficult to impose something on an entrepreneur - it has to be sold to them," says Oliver Stratton, co-head of Asian operations for Alvarez & Marsal, which helps PE firms drive operational and financial performance improvement in portfolio companies. "You're far better off if the CEO or the founder feels that they're in control of things."

Trust is also essential in getting access to accurate financial information, particularly when economic headwinds begin to affect company performance and perhaps inspire a more defensive posture in management. The danger is that less sophisticated teams will respond to intense commercial pressure by resorting to questionable business practices and short-term thinking. This might involve stuffing sales channels to artificially inflate revenue or bribing suppliers to disguise costs.

EY's Partridge sees this issue as a particularly acute in China. "So many mid-market companies just really haven't invested in the back office," he says. "If you haven't made the investment to make sure you know what's going on in the company quickly, it's hard to make those 90-degree turns quickly when there's suddenly a wall coming up in front of you."

Practical solutions in these instances will focus on putting systems in place before external pressures become too problematic. Effective contingency plans include predetermined indicators for cost cutting moves such as shutting down a production line and establishing financial indicators for a return to normal operations. Also, an increasing number of minority investors insist on formally negotiating decision rights around capital expenditure and key management changes.

If the crux of company-level storm-proofing program is to have place at the decision-making table when the storm hits, that seat has to be reserved as early as possible. Likewise, first-movers in fund-level efforts will benefit from an ability to target companies in the best defensive sectors ahead of competition. But while the strategic processes involved in this dual approach may be familiar to Asian investors and entrepreneurs, the adoption of long-term readiness as an indispensable business virtue requires some developing.

"The need for storm-proofing applies to all companies, not just minority-controlled companies," Bain's Bhatia adds. "Downside testing and value creation planning, they're not part of day-to-day activities yet. We are seeing an increased focus on them but there's a long way to go for most GPs in that regard."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.