Portfolio: Unison Capital and Gong Cha

Bubble tea chain Gong Cha’s Korean franchise started out with an entrepreneurial approach that suited its needs. Now Unison Capital is transforming management style and building a regional lifestyle brand

Yeo-Jin Kim, founder of the Gong Cha franchise in South Korea, was looking for a change. The entrepreneur and her husband had brought the Taiwanese bubble tea chain to Korea in 2012, and within two years they had grown the brand to 255 shops nationwide.

It was by any measure a success story, and the couple believed that there was potential for much more - but they also recognized that they were not the ones to take the company where it needed to go. They began looking for a partner that could put Gong Cha on the path to further growth, and in Unison Capital they found a collaborator that understood their desire and was eager to take the reins.

"I give quite a bit of credit to the owners," says T.J. Kono, a partner at Unison. "They really had the foresight that, as soon as it started to get too big for them, then they wanted a little bit more professional management, they wanted a little bit more structured governance and so forth."

In the nearly 18 months since it paid KRW34 billion ($31 million) for a 70% stake, Unison has sought to justify the owners' faith in it through overhauling the company's management and building a robust corporate structure. As its initiatives come online and the new leadership team takes over, the private equity firm hopes to help Gong Cha take its place as a quintessential Asian brand.

The Gong Cha purchase didn't fall into Unison's hands unbidden; it was the result of an active search by both parties. While Kim and her husband wanted an experienced company builder, Unison was looking for an opportunity to participate in Korea's domestic consumption story. With the economy projected to slow down soon, investments tied to domestic demand were seen as offering more reliable growth.

"It's rather a consensus that the market itself is somewhat fragile. Korea is definitely going into a lower growth phase, just like any other developed market," says Kono. "Where we can see more stable opportunity, something that we feel much better about controlling our destiny, I think that tends to be a more domestic-oriented business."

Target selection

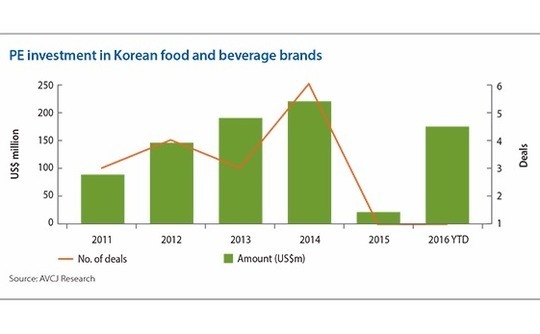

Unison was not alone in looking to Korea's food and beverage sector; an increasing number of GPs have made similar investments in recent years. In 2014, when Unison made its investment, the market peaked following a steady rise in such investments since 2011, with six deals announced worth a total of $219 million. The following year saw a decline, with one deal and $22 million invested, and so far 2016 has seen just one as well - though that deal, the KRW210 billion purchase of South Korea's Burger King Franchise by Affinity Equity Partners, was nearly as large as the total for 2013.

Amid this investor focus on food and beverage opportunities, Gong Cha would have been attractive to any fund. But Kim and her husband quickly came to see Unison as their best bet. Though briefly courting a rival firm, they and the financial advisor assisting with the search soon turned their attentions to Unison.

The firm appealed to the owners in part due to its resources and experience in relevant areas. Unison had been involved with Japanese sushi restaurant Akindo Sushiro, first as a minority investor and then as a full owner, from 2007 until its exit to Permira in 2012 at a valuation of $1 billion. The deal generated a multiple of 8x. In addition, the PE firm was enthusiastic for the future of Gong Cha, sharing its plan to expand the company's reach not only in Korea but in Japan as well. Its lineage in that country gave this goal credibility.

For its part, Unison saw Gong Cha as a company with unique strengths. The brand was internationally known, with over 1,000 locations - now 1,200 - in 10 countries, including Australia, the US and Canada. But the influence of the owner couple meant that the business was run with a hands-on, entrepreneurial style uncommon among multinational chains. In the early stages, Gong Cha could move quickly and take initiatives that would be difficult for a larger organization. This allowed the company to grow quickly.

Another factor that made Gong Cha unique in Unison's eyes was the willingness of the owners to turn over control. The couple realized that, while their previous entrepreneurial approach was crucial to getting the company this far, continued growth would mean revamping the internal structure and implementing a more stable organization.

"In the retail business, they start with a specific product or service and they grow. And oftentimes the growth itself, in this case opening new stores, is the utmost priority," says Kono. "The business itself doesn't really have time or resources to operate it in a more quantitative way, and also to find some consistency in it." The old and new owners agreed that the company would have to change its way of operating if it wanted to be a sustained presence in the market rather than a fad.

Growth initiatives

Unison sees this cultural overhaul as its principal job at Gong Cha. Rather than taking charge of day-to-day matters, the firm put in place a management team to handle regular affairs, including a new CEO, CFO, chief development officer and chief marketing officer. A larger team allows for a more structured decision-making process, unlike the quicker but less considered process required for a smaller, more entrepreneurial business.

One of management's main goals is to build brand awareness for the company. Despite its fast growth over the past four years, Gong Cha is still a very recent arrival to South Korea, and it has yet to achieve much penetration outside the Seoul metropolitan area.

One way to drive awareness is through changes to the menu, reflecting the leadership's desire to move the company's brand away from the traditional milk teas and bubble tea that it is most associated with. Instead, Gong Cha has set out to attract customers through more innovative menu planning, giving Korean consumers more options for brand entry.

For one season the company introduced strawberry menus - sets of items themed around the strawberry flavor, including a newly created strawberry-green tea mix. The move may not seem like much, but it was part of a wider effort to change public perceptions of the company; management feels the previous owners would not have had the luxury to make such experiments in the middle of a constant push for more growth.

The company has also invested in updating the interior design of its stores to emphasize its positioning as a lifestyle brand. This is meant to help Gong Cha compete with Korea's increasingly popular coffee chains, such as Hollys and Caffe Bene, which have taken similar market positions for themselves.

"Management comes to Unison and presents our ideas, and then Unison, after rounds of discussion, gives the go sign on that high level strategy," says Eui-Yeol Kim, the CEO of Gong Cha, who was hired by Unison. "It's not a form where the management presents at a board of directors meeting once a month or so with a final idea; it's more of a fluid discussion to find out what is the best strategy."

This strategy includes supporting Gong Cha's plans for both domestic and overseas growth. In South Korea, capital is being provided to enable the company to expand outside of its core market in Seoul. The growth strategy involves opening a select number of flagship stores in target markets and pursuing franchise arrangements for other locations, and it has paid off: in the 18 months since the acquisition Gong Cha has gone from 255 stores in South Korea to 370, nearly a third of the global brand's worldwide reach.

This has been reflected in the company's financial results too, with revenue growing by 11% in 2015 with an EBITDA margin of 17.5%. This actually means that Gong Cha outperformed the trendy coffee chains, which had EBITDA margins of 10-15%, Kim notes. Management expects financial performance to improve even more now that the initial period of hiring and investment has been completed.

As for bringing Gong Cha into the Japanese market, the master franchising rights for the country were acquired after Unison's purchase. Here in Unison's home territory, its professional network proved as crucial as its financial resources. The GP helped Gong Cha to find a partner that would manage daily operations in Japan.

"Japan is a much larger tea market than Korea, and the tea culture is much more developed as well," says Kim. "The first store's performance also happens to be better than the performance of the first Gong Cha store in Korea. So because of this, the company is quite excited about the Japan opportunity."

The plan is to have five more flagship stores in Japan by the end of the year, at which point Gong Cha will begin reaching out to potential franchisors. Following the Korea model, the company is likely to achieve most of its growth in Japan through the franchising model, rather than through directly operated stores.

The mother ship

In addition to entering new markets, Unison has helped Gong Cha to build closer ties with the parent company in Taiwan, owner of the Gong Cha global brand. The Korean company had previously found it difficult to communicate with the parent due to language limitations of the staff; with Unison's larger talent pool, this barrier proved easy to overcome.

For Unison, the Taiwan initiative is about more than a good line of communication. The firm sees the relationship with the Gong Cha headquarters as a crucial asset to enable closer collaboration with additional global Gong Cha franchises. Ultimately Unison believes this collaboration could help to build a strong regional lifestyle brand, with a local appeal to rival brands from outside the region.

"Oftentimes in Asia these franchises that go over multiple countries tend to be more western-oriented," says Kono. "This is a very Asian brand and Asian product that's popular in this area. We look forward to growing not only in Korea and Japan, but also exchanging information, strategy, branding, and all sorts of things with other markets, and we want to be a part of that growth overall."

However, this goal is still in the future; Unison's primary current objective is to improve the company's internal structure. That Gong Cha has continued to expand and remain profitable is a positive sign, but the PE firm is concerned more with the company's ability to reach the next phase of growth.

This stage, in Kono's eyes, will require more than just a focus on opening more stores and reaching more markets. It needs a creative and innovative approach: Gong Cha will need to introduce new product lines and new store formats, and might, like other food and beverage outlets, look to introduce new brand concepts beyond the core business to capture different groups of customers.

Gong Cha has not reached that level yet, especially the Japan franchise, which Kono assesses as several levels behind the Korean branch. When it does get there, Unison will face the same question that confronted Yeo-Jin Kim and her husband in 2014: whether it is the right backer to help the company continue in the new phase of growth. The answer will depend on what kind of challenges it faces at that time. If Unison concludes that the company needs support that it cannot give, it will need to find a new partner.

"In order for this company to continue to grow it will have to diversify its business model to a certain degree. Would we be the best owner or shareholder for something like that? Maybe, maybe not," says Kono. "Our cost of capital when it comes to our investment is a little different from strategic. What we consider risky, or our risk appetite, may be a little different. That kind of new diversification business model may require a different type of platform as well."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.