1Q analysis: Hard times

Only the good prevail as LPs appear wary of China funds; investors continue to seek technology start-up exposure but the check sizes are falling; Korea delivers exits, but other markets fail to shine

1) Fundraising: Volatility breeds uncertainty

"Six months ago, we had 10 LPs looking to come in for the final close and I thought we could get six of them; now it will probably be more like three." So said one Asia-based GP in a remark that captures the difficulties facing many managers currently raising funds. It was already a challenging environment, with LPs looking to cut back GP relationships and concentrate their resources on a select few. Now it appears that nervousness about emerging markets has spread to private equity.

The warning signs were already there. A very ordinary fundraising market in the last three months of 2015 was transformed by Bain Capital and PAG closing their latest multi-billion-dollar pan-regional vehicles, respectively. Nevertheless, AVCJ Research's provisional data indicated it was the weakest quarterly total in over two years. Subsequent revisions made it second-weakest.

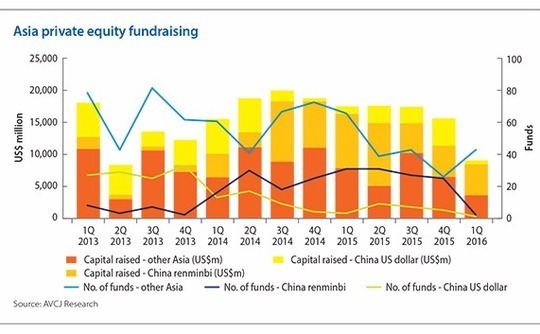

It would take a sizeable late rush of activity to turnaround the first three months of 2016. There is no Bain or PAG this time; only one vehicle came in above $1 billion, and that is a renminbi-denominated fund-of-funds. As such, the quarterly fundraising total stands at $9.01 billion, well short of the $15.7 billion posted for the previous three months and the lowest quarterly total since mid-2013. Fewer than 50 funds achieved final or partial closes, a level not seen since the aftermath of the global financial crisis.

China was inevitably a weak point. For several months there have been anecdotal reports of global GPs struggling to get China deals past their investment committees. Regardless of whether panic over China is warranted - certain segments of the economy still exhibit strong growth and it is unclear how far the malaise in others will spread - LPs also seem to viewing proceedings with a wary eye.

Commitments to China-focused managers came to $5.5 billion in the first quarter, down from $9.2 billion for the previous three months. At present, AVCJ Research has just one record of a close on the US dollar side, with Qiming Venture Partners raising $650 million for its fifth VC fund. Renminbi fundraising came in just over $4.8 billion, roughly in line with the previous two quarters, although Shenzhen Capital Group's Qianhai Fund-of-Funds accounted for more than two thirds of the total.

Nevertheless, there is some cause for optimism. First, the data are preliminary and it is not unusual to see upward revisions. The renminbi space can be particularly unpredictable, although of course this is no gauge of appetite among international institutional investors.

Second, Qiming's fundraise, which was completed within three months, shows there is still ample demand for strong GPs. VC fundraising reached $2.9 billion in the first quarter, down from $5.3 billion in the previous three months, perhaps reflecting nervousness about prospects for some portfolios, given how valuations are moderating in the technology space. But Qiming and Sequoia Capital India, which closed its latest vehicle at $920 million, accounted for the two largest fundraises of the quarter.

Third, in China alone, two final closes have already emerged in April: Everbright ReinFore, which spun out from an offshore asset management arm of China Everbright Group, closed its debut fund at $355 million, comprising a $255 million US dollar tranche and $100 million in renminbi; and GGV Capital raised $1.2 billion for its latest Sino-US vehicle, which targets start-up and growth-stage tech deals.

With several other managers nearing final closes, the second quarter figure may well end up even larger. And with some of the best-performing private equity investments coming during times of economic difficulty - entry valuations might be lower, and there could be more scope for the use of operational skill sets - the vintage, while smaller by number of participants, might turn out to be a strong one.

2) Investment: Selective technology slowdown

Private equity investment in Asia continued its recent downward trend in the first quarter of 2016, coming in at $22.5 billion, more or less on par with the opening three months of the previous year. Between these two periods, frenetic activity propelled the regional investment total to an all-time record high for 2015. The number of deals in the first quarter was the lowest in more than two years.

Quarter-on-quarter declines were across the board - buyouts, growth, PIPE, early stage - but attention is inevitably drawn to the VC space, where the proportional decline was largest. Having deployed $5.3 billion in deals during the final quarter of 2015, investors committed $2.9 billion in the first three months of 2016.

While it is easy to surmise that the euphoria of much of last year is ebbing away, the statistics tell a more nuanced story. The number of early-stage deals did not drop off between these two periods; indeed, the first quarter of 2016 will likely exceed the final quarter of 2015 in terms of deal volume as news of additional transactions inevitably emerges. The average size of the early-stage deal in Asia is therefore declining.

Growth and pre-IPO investment also saw a relatively substantial decline in the first quarter, falling from $11.6 billion to $7.4 billion. Isolate the computer-related, electronics and IT sectors, which capture much of the later-stage fundraising activity by start-ups, and the origins of the broader growth capital drop-off become clear. Investment reached $3.1 billion in the first quarter, compared to $7 billion-plus in each of the three previous quarters.

Late-stage rounds for internet-related companies still make up six of the 25 largest private markets investments announced in Asia in the first quarter. And those rounds are taking place at princely valuations: China-based JD.com's finance subsidiary raised $1 billion at a $7.2 billion valuation, while Southeast Asia mobile internet and gaming platform Garena raised $170 million at $3.75 billion.

Rather, the squeeze is coming further down the food chain. Start-ups that are established leaders in their segments or newcomers with substantial strategic backing are perceived as less risky and can therefore raise large sums. There has been a gradual decline in the size of these mega deals - to a certain extent it depends on who is in the market - but just as noticeable is the slowdown in mid to large-size rounds.

Four internet-related Investments of $500-999 million in the third quarter of 2015 were worth a collective $3.1 billion. This fell to two deals and $1 billion in the fourth quarter, and zero in the first three months of 2016. In the $100-499 million range, the transactions in the first quarter of 2016 came to 17 with $2.1 billion invested. This compares to 18 deals for $3.4 billion and 21 deals for $4.4 billion in the preceding two quarters.

The implication is that investors are becoming increasingly wary of start-ups that might become category leaders, and of operating in categories in which the growth trajectory is unclear.

3) Exits: Consolation in Korea

South Korea has a reputation as a prolific buyout market by Asian standards, yet one in which private equity investors have at times struggled to find exits. When they get there, the returns can be impressive, as Affinity Equity Partners demonstrated in January when it agreed to sell its stake in music streaming provider Loen Entertainment to Kakao Corporation. The GP is set for a 6x multiple and a 96% IRR on an investment made in mid-2013.

Korea was responsible for six of the 25 largest Asia private equity exits in the first quarter of 2016, with other significant deals involving Hyundai Securities, HK Mutual Savings Bank and the local Burger King franchise. The $3.1 billion in proceeds - the largest quarterly total since Affinity and KKR agreed their bumper sale from Oriental Brewery in 2014 - accounted for more than 30% of the regional total.

Given its relative size, Korea is seldom the largest source of exit activity in the region, but other markets did not live up to their reputations. India was an honorable exception, posting its fifth straight quarter of exit values over $2 billion, helped by KKR's agreed sale of Alliance Tire Group to Japan's Yokohama Rubber for $1.1 billion and Advent International selling CARE Hospitals to The Abraaj Group for over $250 million.

Overall exits for the quarter reached $9.8 billion from just under 90 announced transactions, the lowest total since the same period in 2015. Trade sales suffered the sharpest change, from $9.7 billion in the previous three months to $5.5 billion in the opening quarter of 2016. The number of trade sales didn't fall substantially, but there were only two exits worth above $1 billion to move the needle.

Secondaries also declined, but still accounted for five of the 15 largest exits and 20% of overall regional proceeds. Korea was also a contributor here: MBK Partners sold HK Mutual Savings Bank to VIG Partners, J.C. Flowers and KT Capital, and then VIG exited Burger King to Affinity.

Private equity-backed IPOs understandably suffered due to market volatility. A total of 29 offerings generated $1.1 billion between them, down from 75 offerings and $10.2 billion in the previous quarter. It is the smallest total since the first three months of 2013.

China was responsible for most of the offerings, but once again India suggested its public markets turnaround, though slow, is no fluke. There were four PE-backed offerings in the quarter, continuing a trend that began in the first half of 2015. Sequoia Capital, Gaja Capital Partners, ICICI Venture, Quadria Capital and Sabre Capital, among others, secured partial exits.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.