The specialists: The impact of Asia's sector-specific funds

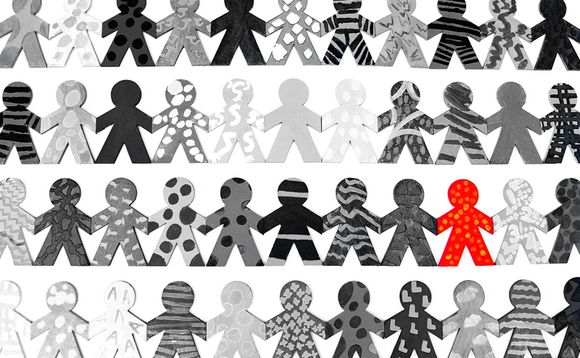

When will Asian private equity funds discard their staunch sector agnosticism and carve out specific areas of investment expertise?

Never let it be said that Chinese private equity firms aren't trying to specialize. Feng Deng, founding managing partner of Northern Light Venture Capital, recalls one local player completing 20 or so deals in the mobile wireless space alone over the last 18 months. "The problem," Deng adds, "is that they also did exactly the same thing in two other areas."

It is generally accepted that the stellar returns available on China's public markets in 2009 and 2010 have created a culture of opportunism. Buoyed by a flood of capital into the sector, the growth capital space has morphed into a giant deal shop, with private equity firms pursuing several times the number of transactions that would be attempted by a Western outfit with comparable resources. The race to deploy funds also takes them across dozens of sectors.

The craze is expected to last no longer than the exit multiples allow, forcing private equity and ambitious venture capital firms alike to reassess their strategies.

"A lot of GPs made their money by having local guys establish relationships with entrepreneurs, taking minority stakes and then going IPO in the bull market," says Andrew Liu, CEO of Unitas Capital. "Those days are long gone. Just being a country-specific fund is not enough unless you have expertise in certain sectors. You can't do every industry; you have to pick a few and then dig deep and add value."

These remarks are, to a certain extent, the party line: Unitas is a regional player that focuses exclusively on the industrial manufacturing and consumer-retail sectors. Yet at the same time Liu widens the issue from China only to emerging Asia as a whole. A shakeout in markets that have seen escalating valuations is not unreasonable. But will the smaller number of players that emerge on the other side attach an importance to sector expertise equal to that now attached to geographies? It poses an interesting twist to the current pan-Asia fund versus single-country fund debate.

Early movers

Sector-specialist funds are already a feature of the venture capital landscape in developed markets, although it could be argued that the Asia franchises of the major US players have adopted the look-at-everything approach of their local peers. There is also a clutch of larger private equity specialists, led by the likes of Silver Lake Partners, Providence Equity Partners and First Reserve Corporation. Their areas of expertise - technology for the first two and energy for the last - have until relatively recently been avoided by the large buyout firms. All three are building out their Asia operations.

Even by trailblazing standards, these firms arrived in the region early. Few industry participants claim to have seen much sector specialization. "All of the private placement memoranda that we do even for country specific funds are multi-strategy," says Andrew Ostrognai, a partner at Debevoise & Plimpton. "You have to stay out of things like weapons manufacturing and aerospace, but pretty much everything else is on the table."

Rather, it is a case of paring away areas - not necessarily sectors - that funds might choose to avoid, such as real estate, infrastructure debt and distressed assets, and then reading through prospectuses that flatter to deceive. Sources note that funds claiming to focus on consumer, financial services and telecom, media and technology are in many cases writing themselves a remit to do almost anything.

"A lot of PE firms tell the market they are specialist but what they are trying to do is put lipstick on whatever they are shipping," says Bob Partridge, managing partner for Greater China transaction advisory services at Ernst & Young.

According to AVCJ Research, 249 sector specific funds in Asia Pacific have raised a total of $23.3 billion since 2006. Over half the funds fell into the technology, media and telecom or cleantech sectors. The largest is Xingzhangcheng Culture Industrial Fund, a renminbi-denominated vehicle with a remit to pursue certain kinds of TMT deals, which closed in March at $760 million. Hanwha Woman's Venture Investment Partnership, a $10 million South Korean fund that only invests in companies founded by females, is arguably the most offbeat.

Preqin, which uses different criteria to AVCJ, offers a slightly modified picture. For 2006 to the present, it has records of 145 vehicles across the business services, cleantech, consumer, energy and utilities, food and agriculture, health care, industrials, IT, materials and telecom and media sectors raising $26.9 billion. By comparison, 484 North American specialist funds have attracted $182.6 billion over the same period, while 192 European vehicles have brought in $39.7 billion.

Agnosticism defended

The principal defense of sector agnosticism is that deal flow in emerging markets is unpredictable and sticking to specific areas could mean opportunities foregone. The reality of the ultra-competitive China growth capital space is that potential investments come at you in a blur and the temptation to grab at whatever passes is often too great.

Even where attempts are made to limit investment scope, the range of companies that come under consideration is dizzying. Derek Sulger, founding partner at Lunar Capital Management, offered AVCJ a snapshot of his firm's deal log for one week in October. It included a gas recovery supply specialist, an oil-drilling tubes manufacturer, an air conditioning retailer, a packaged foods producer, a copper miner and a ball bearing company.

Pan out to the larger-scale transactions typically targeted by Silver Lake and First Reserve and the concern is more that specialization will result in few transactions being executed. There may be plenty of deals in the US across the energy and TMT sectors, but could the same be said about Asia once the venture capital element is removed? Ernst & Young's Partridge advocates carefully managing LPs' expectations, recruiting local teams to source deals, and only doing business with market leaders.

"It must be Chinese companies that want to become global - a local fund offers local knowledge but Silver Lake brings something else," he says. "That usually restricts you to only the top two firms in a sector and then the businesses have to be scalable; it can't be a copycat of something in California."

This does fall broadly in line with Silver Lake and First Reserve's strategies for Asia. Each firm has made only a handful of investments in the region and the sense is that to hurry would be to work against their strengths - i.e. using experience to ameliorate risk.

First Reserve typically makes equity commitments in the $100-500 million range across the energy sector, from sourcing to shipping, eschewing areas where companies and technologies are not proven. In this context, early stage cleantech deals in China are unlikely to be targeted but solar farms in more developed countries have received investment, says Jamie Paton, managing director of the company's Asia operations. Where First Reserve works with corporations, as it frequently does, deals might take over a year to transact.

Similarly, at Silver Lake, a partner is only responsible for 1-2 investments and might be supported by 5-10 other professionals with specific operational or technology expertise. This is far removed from the venture capital model whereby a partner invests in 15-20 companies a year and serves on 10 boards.

Unsurprisingly, both emphasize the significance of deep industry networks that specialization brings, whether the mandate is to source deals proprietarily or identify new CEOs for portfolio companies.

According to Ken Hao, head of Asia at Silver Lake, the firm has relationships with senior management at the vast majority of the world's large-scale technology companies, which creates a natural forum for ideas sharing. Alibaba Group, the Chinese ecommerce giant in which Silver Lake invested $1.6 billion earlier this year alongside Digital Sky Holdings, Yunfeng Capital, Temasek Holdings and others, was a case in point.

"We identified Alibaba a number of years ago and built a relationship with their management team," Hao says. "They have global aspirations and we discussed opportunities with them over the years. It was a natural extension of that discussion when they wanted outside investment."

Paton stresses that First Reserve rarely strays outside its industry network when making investments, which means the firm often uses the same relationship channels to access multiple deals. First Reserve's debut investment in Asia Pacific was a pre-IPO commitment to Australian miner Whitehaven Coal in 2007, which was made through a company called AMCI Capital. Two executives who had spun out of AMCI then introduced the private equity firm to Calibre Global, a mining industry services provider in Western Australia, which became a portfolio company. First Reserve has subsequently entered Mongolia through the AMCI network.

"We generally like to invest alongside talented and experienced management teams and help them grow the businesses for other people to buy," Paton says. "Our investment in KrisEnergy, an oil and gas firm, came about because we knew a very competent management team that built up a successful energy business called Pearl in Singapore. Pearl was acquired by another company and we suggested to the team that they do the same thing again, and invested alongside them."

It is difficult to draw comparisons between the approaches of global specialists and local or regional players that claim certain areas of expertise because the former's value-add cuts across different geographies. First Reserve may not have relationships with a host of Chinese entrepreneurs but it employs people with knowledge of operational efficiency in coal plants, which might be as relevant to Indonesia as China.

What remains uncertain is whether a global yet industry-focused approach features sufficient on-the-ground abilities to access the kind of Indonesian mining deals that have in the past worked out so well for local players. First Reserve's response would be that its vertical knowledge is deep enough to identify suitable transactions, but this must stand the test of time in Asia.

What LPs want

From an LP perspective, investors in global specialist funds seek exposure to an asset class, not geographical area, so Asia is not a clear-cut priority. Industry participants note that LPs looking at Asia exposure alone still view the markets as very competitive and are therefore wary of tying up capital in a sector-focused fund.

Nevertheless, past experience suggests that the market will evolve. LPs initially saw Asia as too small to generate much deal flow and they responded by making capital commitments to global emerging markets and then pan-Asia vehicles. Once investors become more familiar with the region, country-specific funds gained traction. According to AVCJ Research, in 2007, country funds attracted $37 billion in capital to regional funds' $24.7 billion. So far in 2011, four times more capital has been raised by country-specific vehicles than regional vehicles.

As strategies become more granular, sector-specialization could theoretically be the next step. "We have seen strong interest in country funds," says Debevoise & Plimpton's Ostrognai. "I wouldn't be surprised if the next part of the evolution saw some country funds focusing on certain kinds of deals."

No one expects this evolution, if it follows as described, to be anything but incremental. Ernst & Young's Partridge recalls recent conversations with Chinese GPs in which specialization was singled out as a trend to watch in a few years time. Just as US funds have sought to diversify in order to boost their appeal to investors, their Chinese counterparts must alter their approach to secure funds in an increasingly competitive environment.

"International funds are competing with an increasing number of renminbi funds so they need to differentiate themselves," Partridge says. "This theme is resonating throughout the funds but I can't point to any that are very successful yet - they are mostly still opportunistic."

Sidebar: Sector funds - talent distribution

The specialist skills that sector-focused funds can offer go well beyond operational expertise. Whatever a firm's core competency, there are plenty of finance-oriented professionals watching an industry just as intently as the operations guys seek to bring about change on the factory floor.

Bob Partridge, managing partner for Greater China transaction advisory services at Ernst & Young, argues that private equity firms' traditional focus on earnings multiples is merely a starting point and can't be uniformly applied to all industries. In a user-driven

technology company, for example, data sets such as average revenue per user play a significant role. In financial services, EBITDA is often considered of secondary importance to the likes of embedded value and net income margins.

Such concepts are familiar to professionals with experience in these fields, but the significance attached to them has a wider impact on investment strategy. Ken Hao, managing director and head of Asia at Silver Lake, notes that his firm's appreciation of a typical technology company's growth trajectory often results in using less debt in the acquisition structure so that there is capital available for development purposes.

"Our bias has always been to set up structures that enable more investment in R&D and technology," he says. "We enable a company to take more risk and grow a little faster as opposed to using low-cost borrowed money. Other investors might use debt to reduce the equity check but over half our investments involve little or no leverage."

Andrew Liu, CEO of Unitas Capital, also endorses the role played by finance-oriented professionals who develop sector expertise. Unitas claims to be the first Asia-only firm to employ a dedicated operations-focused executive and it has since recruited many more. But the ability to turnaround a manufacturing facility by replacing line managers, altering resource allocations and implementing new IT and oversight systems doesn't necessarily translate into a talent for knowing when to exit.

"We have financial guys who have spent the last 7-8 years doing nothing but industrial manufacturing deals. The more experienced they become in executing transactions, the better they are picking the right points in the cycle to buy and sell," Liu tells AVCJ. "The operations guys get their hands dirty but they seldom talk to the research guys or look at what other competitors in the industry are doing."

The need to rebalance human resources to reflect the changing focus of private equity firms is not lost on professional services providers. On a global level, before the financial crisis, transaction skills were pushed to the fore and sector-specific knowledge was considered a secondary competence. Now, though, the Big Four accounting firms in particular are under pressure to differentiate in order to showcase their strengths to fund managers - much as fund managers are trying to appeal to LPs. The trend may be less prevalent in Asia, where the ability to execute deals in different local markets is highly prized, but it is expected to build over time.

"We have to invest more in our people," says Ernst & Young's Bob Partridge. "If they are going to be a healthcare specialist and they aren't working on healthcare deals we don't throw them back into industrial products deals. They need to continue to learn about the industry even when things are slow for them."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.