Australia services: Roll-up rapport

As Australia rebalances its economy in the wake of the commodities downturn, services are coming to the fore. Private equity investors continue to see consolidation opportunities

The acquisition of DB Dental earlier in February took National Dental Care's (NDC) footprint to more than 60 practices with around 200 dentists. Three years ago the business, started by Crescent Capital Partners, did not exist.

The objective is to bring consolidation, standardization of services and economies of scale to an industry that is estimated to be worth A$8.7 billion ($6.3 billion) a year but remains highly fragmented. According to Pacific Smiles Group, one of the larger listed players, there were more than 13,000 dental practices nationwide in 2014. Bupa was the largest individual provider with a market share of less than 5%.

DB Dental is a fairly typical target for NDC - formed 30 years ago by dental practitioners who remain active in the business. For NDC, the acquisition represents an opportunity to enter Western Australia, adding 17 practices that fill a gap in the company's geographic footprint. For the founders of DB Dental, it means capital and expertise to further expand the business.

"There has been a big shift in the last 20 years," says Tim Martin, a partner at Crescent. "Many practitioners don't want the headache of running small businesses and that leads to consolidation. If you do it properly it means better standards of care because practitioners focus on patients rather than worrying about the business side. You can also invest in technology and systems to make businesses run more efficiently."

This corporatization opportunity doesn't just apply to dentistry. It has driven investments by Crescent in audiology and skin cancer care, while other GPs are pursuing similar strategies in healthcare and also in education. The services sector has traditionally accounted for the bulk of middle market private equity investment in Australia. However, recent activity is taking place against the backdrop of structural change and a broader economic rebalancing, which means the impact could be even more meaningful.

Rebalancing act

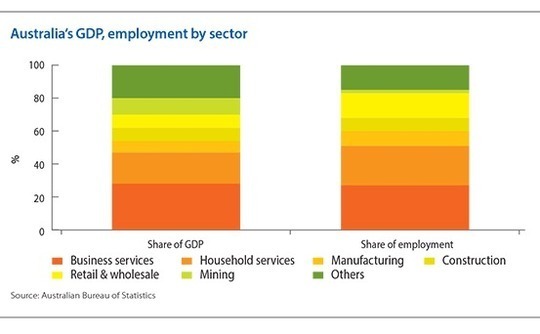

When the commodities boom peaked in 2011-2012, mining - chiefly investment in capacity - accounted for over half of the 3.5% expansion in GDP. The sector still accounts for more than half of total exports, despite the cycle turning as demand from Asia slows down, but it is only responsible for 10% of the overall economy. The boom saw that figure double over the course of a decade, but now the trajectory is flat. As a pure growth driver, it has been supplanted by services.

Providing 70% of Australia's GDP, the services sector has a strong domestic bedrock. However, Paul Bloxham, chief economist for Australia and New Zealand at HSBC, sees a significant shift in export-driven services. Three years ago, the balance of services imports and exports was a half percentage point drag on GDP growth; now it is responsible for one percentage point of the country's 2.5% GDP growth.

The weakening of the Australian dollar is crucial to this. Not only are more Australians now choosing to holiday at home rather than abroad, but there has also been an influx of visitors from overseas - tourists and students.

"Unlike most developed economies, Australia's major trading partners are developing economies in Asia," Bloxham says. "We started off exporting commodities because that's what these economies needed to build housing and infrastructure. Now we are starting to provide more of what they will need next, which is services and high-quality food products."

Healthcare, education, agribusiness, business services - these are routinely cited by Australian GPs as being of interest. The ability to remain strong in the face of economic adversity is a key consideration. "In volatile times there is a strong interest in defensive areas, and healthcare and premium food would be counted as such," says Marcus Darville, a managing partner at Quadrant Private Equity. "Not everything we do is defensive, but it's a large proportion."

A cancer care clinic chain, a data center business, and premium food services - one company aimed a humans and another at pets - are among Quadrant's most recent investments. Pacific Equity Partners' two most recent investments comprise an education business and a specialist health foods producer. Meanwhile, Archer Capital's portfolio includes a consumer and commercial credit bureau, an aged care business, and a tertiary education provider.

Currency depreciation was a factor in the latter investment: according to Australian Education International, overseas student enrolments surpassed 630,000 in 2009 when the Australian dollar was around $1.50; they dropped to 515,000 in 2012 when the currency slipped below $1.00, and then rebounded last year, with the Australian dollar back around $1.40.

New Zealand has seen similar exchange rate-linked peaks and troughs. In late 2015, Archer combined five New Zealand institutions to form Aspire2 Group with a view to creating the country's largest provider of vocational education services to international students.

However, there are also ambitions to become a significant player in the domestic training market, and these are tied to structural change in the sector rather than currency movements. In addition to its international students, Aspire2 serves 7,000 clients through a state-funded youth services program. When the investment was made, approximately one third of the company's revenue came from government sources.

As such, Peter Wiggs, CEO of Archer Capital, places the education opportunity in the context of governments that have under-invested in the sector and are unable to redress the balance, in part due to the fiscal challenges they face. Rather, they want the private sector to step in and lead the build-out. A similar dynamic is at work in Australian healthcare, notably aged care, where changing demographics are driving demand for services and private sector providers are expected to ramp up supply.

"While education and healthcare are defensive sectors, solving that under-supply is going to play out over 15-20 years," Wiggs adds.

Risk factors

While Crescent's consolidation agenda with NDC is predicated on generational change and founder-operators no longer wanting to go it alone, for others it is the passivity - or withdrawal - of state providers that could see previously niche private sector players build meaningful scale. However, a roll-up strategy is not always the best way to go.

Australia's childcare sector is fragmented, with companies managing 25 facilities or more accounting for just 1% of the for-profit segment, but consolidation efforts have delivered mixed results. G8 Education has achieved scale, reaching nearly 500 centers through a combination of organic growth and M&A. Yet the specter of ABC Learning, which expanded aggressively before collapsing under the weight of its debt in 2008, still looms large over the industry.

A successful roll-up must amount to more than the sum of its individual parts - in terms of the customer value proposition as well as the customer numbers. "Bigger is generally better but it is not always the case," says Crescent's Martin. "If the aim is to buy cheap and sell at a much higher multiple but not do anything to improve the business, it might be a short-term way of creating a quick flip to a seller but no value is being created. You are playing with numbers, not creating something sustainable."

Consolidation can also be challenging to execute on a practical level. In cases where the founders of an acquired company agree to stay on in a management capacity, they need to be incentivized to keep operating at the same level. A group that makes a string of purchases without putting in place the systems to run them risks seeing a drop in performance that is too widespread to be offset quickly.

Indeed, Archer made one large bolt-on acquisition following its acquisition of Lend Lease's Australia aged care business but is now focusing on the development or existing facilities and the construction of new ones. Wiggs explains that the industry has already seen a degree of consolidation and the assets still available command such high prices that an acquisition would not be accretive.

Striking a balance between the valuation one is willing to pay for an attractive consolidation opportunity and the challenges involved in making it work therefore lies at the heart of these investment decisions. Partners Group, for example, was willing to take on Guardian Early Learning - becoming the third PE owner in three years of the fast-growing childcare business - because it thought it could bring its industry experience and cross-border coverage to bear.

Cyrus Driver, head of Asia PE at Partners Group, suggests this could be one of several deals in the services sector. "A lot of analysts initially expected the impact of depressed commodity prices on the Australian economy to be much more severe, but the growth of services has diversified the economy more effectively than those of other commodity exporters," he says. "We see the services sector in Australia it as a resilient space to invest and operate in."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.