Private equity insights from Japan

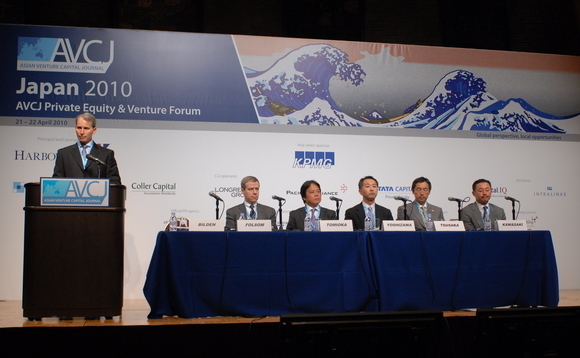

At the eleventh annual AVCJ Private Equity & Venture Forum Japan in Tokyo, GPs and LPs gathered to give their views on the current state of the Japanese private equity market post the global financial crisis, and the consequences for both the local industry and attitudes – and allocation preferences – among Japan’s large LP base.

For the consensus was that the Japan market has been particularly impacted by the recent global economic changes. As Philip Bilden, Managing Director at HarbourVest Partners Asia, stated, "normally, private equity is not a discussion about macroeconomics," but he added that, "in Asia Pacific, we cannot separate the macroeconomics from the practice of private equity … we must look at some of the macro considerations in considering private equity in Japan."

Japan investing alongside Asia

In Bilden's view, many fundamentals of actual deals have "become a function of what global investors consider are attractive places to invest," with direct consequences for Japan. But the differential plays between Japan and Asian markets could in themselves be turned to GPs' advantage.

Richard Folsom, Representative Partner of Advantage Partners, saw hard hits on his firm's Japanese portfolio companies, especially in the financial services space. Deal flow was scarce in the year, he noted, but not for want of capital or deals: rather, the largest single factor, he felt, was bid/ask spreads and seller expectations. But Folsom saw opportunities for private equity to prove its value to Japanese investees even during the crisis by "helping them make entrees into China and other [markets in Asia]," or moving their cost bases offshore.

As a representative of a very regionally-focused firm Jun Tsusaka, Managing Director at TPG Capital, agreed that portfolio company support was a constant throughout 2009, but so was the effort to assimilate the sweeping market changes. "How do we assess the new world?" he asked. For Japanese companies and their GPs, this meant asking: "Are we positioned in a competitive fashion to compete in the new world economy?" – whether by finding new products, international expansion, or other growth avenues.

"Some of our Chinese companies didn't see a dip at all," Tsusaka pointed out. "They're living in a high-class problem." But many other Asian investees, as well as Japanese ones, did see hard times and consequent cost-trimming. TPG's operational group, Tsusaka noted, "spent time equally" throughout Asia and the world, without supporting Japan disproportionately. "It's not much different from what the world has seen," agreed Masamichi Yoshizawa Representative Director & Partner at The Longreach Group.

Traditionally, Japanese companies have seen private equity and VC players as a "Hagetaka" (vultures) that are opportunistic above all else. However, Japanese GPs are recently reporting that local groups are coming to accept them as positive business partners. They also remain conservative and very cautious when making any new, business decisions or implementing basic changes, but private equity practitioners said at the conference that if they approach potential investees the right way and explain their plans to bring about fundamental changes to existing operations in the context of Japanese business culture, business owners will soften their resistance and start to listen, and even seek to understand.

LPs to the fore

Concurrently, many Japanese and international LPs are like are evidently looking at emerging markets such as China and India in preference to Japan, as possible destinations to secure high returns from their investments. However, as one local LP said at the conference, "We hope to see further [positive developments] in investments in China and India, but it is too early to determine if we will allocate further capital, as those investments do not have any track record." Other LPs also said that they will keep investing in local markets while they allocate part of their capital to China and India.

And the Japanese market itself can deliver attractive returns, despite its foibles. "We have been making investments into the Japanese private equity market for more than15 years, observed Soichi (Sam), Takata, Deputy Head of Private Equity at Tokio Marine Asset Management. "It has its own uniqueness. The way of investment is different, the way to operate the private equity market is different … the market is not really growing, for good reasons, but some of those factors [have] deep roots in Japanese culture." However, he still cited annual returns of some 20% from the Japanese market. "If you do it right, you can do it." But simply introducing non-Japanese practices, he added, would not work. "You have to adjust."

Before April 2009, foreign investors faced problems in making capital allocations to Japan due to the taxation system, but this has now been modified to alleviate the tax burden. And there is a strong institutional push to attract more outside investors. "To revitalize the Japanese market, we do need foreign risk capital," as another LP said.

Not that Japan itself is short of institutional investment capital. Japan's private equity market was once quoted as worth around JPY1.2 trillion ($12.8 billion). If government pension funds allocated even 1% of capital from their current zero exposure to private equity, that could add another JPY1.5 trillion ($16 billion) to the size. Japan should not rely only on foreign capital injections, but the Japanese government should also help promote Japan's domestic private equity and VC landscape. This may need some major changes in Japanese institutional attitudes, but as Bilden said, these are, "very extraordinary times.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.