2015 in review: Capital in abundance

Ample liquidity and a tech boom drive up investment activity; venture takes center stage in a relatively quiet fundraising environment; exits do not disappoint, but fail to match the highs of 2014.

INVESTMENT: SURPASSING $100B

Asia PE deals top $100 billion for the first time in 2015 on the back of big buyouts and internet frenzy

The record for the largest-ever corporate private equity buyout in Asia was broken not once in 2015, but twice. First, KKR, Deutsche Bank and Varde Partners agreed to acquire GE Capital's Australia and New Zealand consumer lending business in March at an enterprise valuation of $6.3 billion. Then six months later, MBK Partners - accompanied by Canada Pension Plan Investment Board, Temasek Holdings and the Public Sector Pension Investment Board - got South Korean retailer Homeplus for $6.4 billion.

These transactions played their part as buyouts for the year to date reached a record $46.4 billion, comfortably beating the $29.3 billion seen in 2014. Indeed, factor in the $7.4 billion privatization of TransGrid, part of the New South Wales electricity network, and the top three private markets deals between them account for over 40% of the buyout total. Little wonder the previous peak of $45.9 billion in 2007 has been surpassed with one third fewer deals.

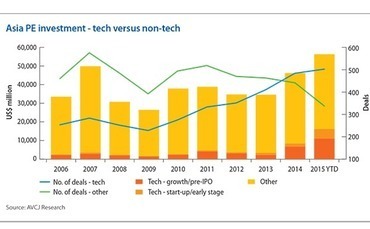

However, another trend has arguably made an even more significant imprint on 2015: roughly six in every 10 deals announced have been early or growth-stage technology plays (and, for various reasons, this definition excludes financial services and healthcare). These investments are responsible for more than one quarter of all private equity capital deployed in Asia. Last year the share was 18%, and that was about twice the 2013 figure.

After PE investors committed $92.5 billion in Asia last year, coming closer to the 2007 total than ever before, the industry has surpassed itself in 2015. As of mid-December, AVCJ Research's records indicate that $112.7 billion has been invested. It represents a hive of activity supported by readily available financing for buyouts and a seemingly insatiable appetite for a slice of the internet economy. Rising interest rates and growing concerns about a tech valuation bubble suggest that a repeat performance in 2016 is unlikely.

Infrastructure deals like TransGrid are an anomaly in the private equity space - privatizations of brownfield assets that are intended to generate long-term yields, not operationally-oriented buyouts positioned to generate outsize returns. However, these mega transactions are likely to become slightly more frequent, with other state governments putting assets on the block.

Australia was one of four major Asian private equity markets to see an upturn in investment in 2015, alongside China, India and South Korea. Eight of the 10 largest deals seen in the country - making up more than 60% of the capital committed - involved infrastructure or resources of some description, although TransGrid is the only full privatization.

There are two factors that connect Asia's three largest deals of the year. First, they demonstrate the willingness of traditional LPs to participate directly in deals that require additional firepower, with one pension plan and two sovereign wealth funds participating alongside two infrastructure managers in the TransGrid transaction. Second, both the GE and Homeplus deals came about because foreign companies divested Asian assets.

Korea has emerged has one of Asia's most active private equity jurisdictions, with overall investment and buyout values rising every year since 2011. While the country's share of the regional buyout market fell, mainly due to the more than three-fold increase in Australia buyout deal flow, the numbers increased in absolute terms, and this was thanks to Homeplus, until this year owned by UK-based Tesco.

The four largest Korea investments completed in the past two years all involved foreign sellers, and it is they rather than local conglomerates driving up the headline number. Domestic divestments are largely restricted to the middle market, the much talked-of financial and strategic pressure having yet to stimulate non-core asset sales by larger players. However, some say it is only a matter of time. Japan is in a similar position, with PE investment falling by more than half to $3.1 billion.

Increased investment in China and India is inextricably linked to technology, particularly growth-stage deals led by mutual funds, private equity, hedge funds and other large-check-size players. Across the region, growth investments in internet-related companies stand at $21.9 billion, up 64% on 2014 and up nearly 400% on 2013. There has also been a sharp jump in early-stage activity - up 203% on last year at $10.3 billion - as VCs pursue start-ups that might become the next multi-billion-dollar unicorns.

The impact is most profound in China, led by the $3 billion round for ride-hailing app operator Didi Kuaidi. Growth and early-stage tech investment stands at $14.6 billion and $8.6 billion, respectively, accounting for the bulk of the Asia total. The combined figures also make up close to half of the total private equity investment in China so far in 2015. Last year, the share was 23%, with growth and early-stage technology deals reaching $6.7 billion and $2.3 billion, respectively.

India's numbers are more modest, with growth and early-stage tech deals coming in at $4.8 billion and $866 million this year, jointly covering about one third of overall India PE investment. However, the phenomena are similar - market leaders such as Ola, another ride-hailing app, and e-commerce marketplace Flipkart are able to raise ever larger private rounds in order to cover the subsidies paid to merchants and consumers so they can continue to build market share.

Didi Kuadi's round was completed at a valuation of $15 billion to Ola's $5 billion, but developments in China may yet offer a glimpse of the outlook for India. The question for many investors is how much longer are these companies able to climb the valuation curve while simultaneously burning cash. The answer is not indefinitely, as exemplified by mergers between one-time rivals: Didi Dache and Kuaidi Dache and then online-to-offline (O2O) services providers Meituan and Dianping.

Investors appear to be concentrating their firepower on established players in key verticals such as transportation, food delivery and O2O services, on top of longstanding target e-commerce. Even then, it remains to be seen whether these companies can maintain their position of dominance in a technology sector that is constantly evolving.

Another consideration is the nature and timing of exit. These growth rounds enable early-stage investors to take money off the table, but there is no guarantee these companies will achieve public market valuations that translate into handsome returns for later entrants (and not everyone has downside protection). Chinese smart phone maker Xiaomi remains the leader by some distance in the valuation stakes, having raised $1.1 billion at valuation of $45 billion at the turn of the year.

Much long-term faith is being placed in China's public markets and the willingness of local investors to pay a premium for stock in well-known, consumer-facing companies.

This also explains the jump in China buyouts to a record $8.8 billion in 2015. Announced PE-backed take-private deals involving dating app Momo (which received a bid barely six months after going public in the US) and WuXi PharmaTech (completed in mid-December) make up 70% of the capital commitment. More of these transactions - structured with a view to re-listing domestically - are likely to follow.

FUNDRAISING: VENTURE TO THE MAX

Fundraising fails to keep pace with 2014, but VC firms still see enough demand to raised additional capital

It speaks volumes for the VC fundraising environment in Asia that the fourth-largest vehicle raised in 2015 was an addendum to an earlier fund. GGV Capital closed its fifth Sino-US fund in May 2015 at $620 million, but within 12 months had an additional $457 million to put to work through GGV Capital Select. The top-up fund allowed continued support for portfolio companies that has become so successful - read big and valuable - that they no longer fall within the remit of existing funds, the GP explained.

LPs will see more of GGV in 2016, although probably not for very long. The firm is back in the market looking to raise $1.1 billion simultaneously across three vehicles: a $600 million core venture fund, a $200 million top-up vehicle, and a $300 million early-stage fund. Industry sources say the multi-strategy vehicle is already oversubscribed and a first and final close is expected early in the year.

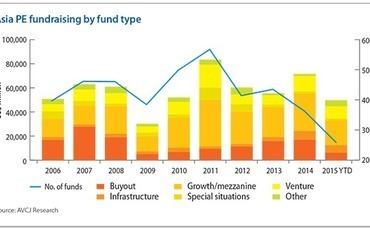

GGV is not alone in accumulating extra tranches of capital with a view to re-upping in portfolio companies that are raising larger rounds as they stay under private ownership longer. Although trailing the 2014 total of $12.7 billion, Asia VC fundraising stands at $10.1 billion for 2015 so far, and is well positioned to become the third-biggest year on record. Conversely, the number of funds reaching partial or final closes is only about 130, the lowest in a decade. This is evidence of the top-fund effect.

Of every dollar raised for VC in Asia this year, about $0.50 is earmarked for deployment in China and $0.20 in India. Singapore is also seeing more activity - fundraising is at its highest in four years - in recognition of its growing status as a technology hub for Southeast Asia, but almost of all of the big rounds are seen in the two larger markets.

A scan down the list of funds raised offers a clear picture of how the industry is thinking. At the top sits Shunwei Capital Partners third US dollar-denominated fund with a corpus of $1 billion, split equally between a core vehicle and an opportunity fund that will not only make follow-on investments in existing portfolio companies but also back new companies seeking expansion rounds.

Morningside Venture Capital repeated its trick from 2014, raising a core fund, a special opportunity or top-up fund, and an entrepreneurs fund for friends and family, although the quantum of capital was larger - $660 million this time. Sequoia Capital raised its third China growth fund, having operated separated venture and growth strategies for several years now, while India's Nexus Venture Partners got $450 million for a core fund plus a top-up vehicle.

Banyan Capital closed its second China fund at $362 million and then three months later raised $100 million for follow-on investments in Fund I portfolio companies. The explanation, like many others, was that the technology investment opportunity is so great they found themselves deploying capital at a faster pace than expected. Perhaps once the cycle swings there will be less cause for these addendums.

Venture was not alone in seeing a retraction in fundraising activity from 2014. Every major fund type that AVCJ Research tracks - buyout, infrastructure, growth, special situations and venture - is down year-on-year. With $49.7 billion in commitments, Asia private equity fundraising is lower at this point in 2015 than for any full-year since 2009. It is unlikely to stay that way but matching the 2014 total of $71.6 billion is not going to happen. The number of funds receiving commits is also small by historical standards.

Concerns about emerging markets economies - particularly that of China - undoubtedly play a role. There is considerable anecdotal evidence that LPs are shying away from Asia in favor of the currently flourishing North American market. There are, however, other factors to consider.

First, fundraising statistics do not capture all of the dry powder available for deployment in the region or offer a clear impression of the willingness to put it to work. LPs of means are increasingly following bespoke playbooks, setting up separate accounts and allocating more capital for co-investments and perhaps solo direct deals as well.

Second, fundraising fluctuates depending on which GPs are in the market. For example, there was little action for Asia buyout funds in 2009 and 2010 but in each of the four years after that the total increased as the global firms returned with their first regional funds raised since the global financial crisis. The series of closes ended in 2014, with $16.9 billion going into buyout vehicles, and in the less populated market of 2015 it has dropped to $6.2 billion.

Of the largest funds to reach a final close in 2015, much of the $3.98 billion entering Baring Private Equity Asia's sixth pan-regional fund is classified as 2014 because that is when the GP announced a substantial first close. This leaves RRJ Capital, which raised $4.5 billion for its third fund and then drop all the way down to Pacific Equity Partners on $1.5 billion.

However, the buyout statistics could be stimulated early in 2016 with Bain Capital and PAG Asia understood to be in the final stages of raising their latest regional vehicles, each of which could around the $3 billion mark.

The middle market was the usual combination of a minority of managers that raised rapidly on the back of strong track records and compelling investment stories, and those that struggle. Ascendent Capital Partners with its China investment-plus-advice strategy, Asia energy and infrastructure player Equis Funds Group, and Anchor Equity Partners, set up by a team of Goldman Sachs alumni in Korea, are arguably examples of having the right approach at the right time, if speed of fundraise is considered.

Meanwhile, the one major Asian jurisdiction to see a year-on-year upturn in fundraising was India, where the likes of Everstone Capital and India Value Fund Advisors achieved final closes at relatively short order.

EXITS: TOUGH ACT TO FOLLOW

After a record 2014, PE exits have been more muted this year, as GPs think more creatively in China

The acquisition of China Mobile Games & Entertainment Group (CMGE) and DianDian Interactive for a combined RMB13.5 billion ($2.1 billion), announced in early December, should deliver liquidity to a string of local private equity investors.

It is also a microcosm of the broader dynamics of China's PE exit environment.

CMGE was listed on NASDAQ until August, when private equity units of Orient Securities, Changjiang Securities, and Beijing HT Capital Investment completed a take-private. The initial plan may have been a re-listing domestically - through an IPO or a reverse merger - but it never happened. DianDian, meanwhile, spun out from foreign PE-backed FunPlus in 2014 and was supposed to be acquired by a Shanghai conglomerate. This failed to get regulatory approval so the PE arm of a local textiles manufacturer took a stake instead.

The various private equity investors will get $1.25 billion between them should the China Securities Regulatory Commission (CSRC) greenlight the sale to Zhejiang Century Huatong Group. The new buyer has little or no existing interest in mobile gaming. Rather, the Shenzhen-listed company sees the acquisition as a means of pivoting away from low-growth automotive plastic parts manufacturing to the high-growth internet industry.

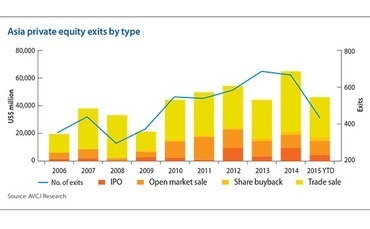

A total of 91 China private equity exits have been announced so far in 2015, generating proceeds of $10.2 billion. The last time full-year figures came in lower than these it was 2009. The weakness is largely due to a substantial drop off in shares sales at IPO or on the open market: 31 transactions and proceeds of $3.4 billion compared to $7.3 billion across 80 transactions in 2014.

In the absence of reliable public markets - the CSRC reintroduced the ban on new share offerings, which previously lasted most of 2013, for a few months in the middle of 2015 in response to a collapse in stock prices - private equity investors have turned to trade sales. At 51 deals and $5.5 billion in proceeds, they account for more than half of all exit activity. Trade sales have picked up over the last three years, but this is the first time they have made up more than half of all China exits.

Four deals are responsible for about half of the cumulative trade sale value: the two gaming transactions, plus Shanghai Jin Jiang International acquisition of budget hotel operator 7 Days Inn and Shenzhen Energy's purchase of China Hydroelectric. All of them are profitable and three were previously been privatized offshore; other companies in similar situations - notably Focus Media and Giant Interactive - have opted to re-list domestically through reverse mergers, but trade sales tend to be quicker and easier.

Furthermore, these trade sales have all been made to mainland-listed companies. Half of the 51 trade sales announced in 2015 share this characteristic - a remarkable total given that until 2014 these buyers were responsible for a small minority of sales. Like Century Huatong, many see M&A as a short cut to align themselves with the modern economy.

China exits account for only about one fifth of the regional total, but the country has a wide-ranging impact, whether as a buyer of PE-owned assets (Vogo Investment and Archer Capital's exits of Tong Yang Life Insurance and Healthe Care Australia to Chinese strategic players are among the largest trade sales of 2015) or a factor weighing on investor sentiment in public markets.

The opening months of 2015 saw a host of IPOs, block trades and sell downs as investors rushed to capitalize on buyout public market valuations. Open market exits by GPs across Asia stand at a respectable $10.2 billion for the year so far - better than 2014, though lower than each of the four years before that - but they tailed off sharply in the middle of the year as shockwaves from the ruptures in China's markets were felt elsewhere.

Similarly, exits via IPO were down as were the gross proceeds of private-equity backed offerings. China was a key factor here with IPO proceeds down by nearly 50% on 2014 - there was no bumper deal along the lines of Alibaba Group - but most major markets saw a slowdown in activity. The one bright spot is India, where there have been more PE-backed offerings than in the previous three years combined, although that is working from a relatively low base.

In all, IPOs have raised $38.3 billion, down from $70.1 billion in 2014, while exits stand at $46.2 billion, compared to $64.9 billion the previous year. The exits total is not bad by historical standards, but replicating the success of 2014 was always going to be tough - it was a record year for Asia that also saw the region's largest-ever IPO and largest-ever trade sale.

In addition to the Alibaba-shaped hole in the IPO numbers, there was nothing on the same scale as Oriental Brewery. As such, trade sales for 2015 stand at $28.9 billion, above the 10-year average but well short of the $43.7 billion posted in 2014.

The largest deal is still pending regulatory approval, but it would be a boost for the industry if it goes through. Morgan Stanley Private Equity Asia and Far EasTone Telecommunications agreed to buy China Network Systems from MBK Partners in July at an enterprise valuation of $2.3 billion, potentially bringing an end to a protracted sale process in a challenging market that saw two earlier bids flounder.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.