Evergreen funds: The long hold

The notion of patient or permanent capital draws interest from both GPs and LPs, but evergreen funds are rare in the US and even rarer in Asia. This state of affairs is unlikely to change any time soon

At 18 years, Electra Partners Asia's investment in India-based Zensar Technologies can claim to be one of the longest-held in the region to see a successful exit. This happened in October when Apax Partners bought Electra's 23.2% stake for $129 million, a 16x return once dividend payments are included.

The original commitment was made in difficult circumstances. Zensar was a software services subsidiary of a struggling listed computer hardware manufacturer. The parent, RPG Enterprises, used the $9 million it received from the PE firm to pay off the listed entity's debt so the business could be wound up. The software services unit then performed a merger with the remaining shell, which was renamed Zensar.

Governance mechanisms and a management team were put in place so Zensar could operate independently. Over the ensuing years there were also several bolt-on acquisitions as the company rode the wave of growth in India's business process outsourcing industry, expanding headcount from 900 to 8,000. Revenue for 2015 reached INR26.3 billion ($406.4 million).

The length of the investment is a function of the nature of the ultimate shareholder as well as the strength of the business. Electra made the investment through a London-listed investment trust, an open-ended vehicle that promised shareholders annual capital growth of 10-15%. With Zensar consistently expanding at a rate of 12-18%, there was no pressure to exit. Indeed, the sale was largely driven by a shift in Electra's strategy that has resulted in a reduction in exposure to Asia.

"People say they would like to add value and get out after five years, but if you are in a decent business why would you sell?" asks John Levack, managing director at Electra. "Patient capital looks at all of the fees and extraneous heat generated by doing a deal and says, ‘When you find a good business, do what Warren Buffett does, which is back a management team to ride it through some of the cycles.'"

Room to grow

Evergreen fund structures, a private markets near-equivalent of Electra's listed investment trust, perform a similar function. However, they are rare globally and even rarer in Asia. This not only a sign of the industry's relative immaturity in this part of the world, but also a reflection of the fact that extended life or even perpetual structures are not for everyone in private equity - GPs or LPs.

Sutter Hill Ventures is generally acknowledged as the first firm to adopt an evergreen structure in the 1970s and it remains in business to this day. Jordan Silber, a partner at Cooley, estimates there are currently no more than 30 in existence in the US - a tiny fraction of the number of traditional 10-year funds - with his firm having served as formation counsel for half of them.

The Sutter Hill portfolio unsurprisingly exhibits several of the characteristics that make evergreen funds attractive. Its holdings include Pure Storage - for which Sutter Hill provided a Series A round in 2009 and which it then continued to support through an IPO last month - as well as Menlo Security, a two-year-old start-up that received a Series B round from the VC firm in June.

Silber notes that anyone investing in an existing evergreen fund tomorrow would get immediate exposure to a mixture of early, mid, and late-stage companies built up over a very broad period of time. "It is one of the things we have heard from LPs that they view as a positive - they get opportunities to reduce risk by buying into a highly diverse portfolio of assets," he adds.

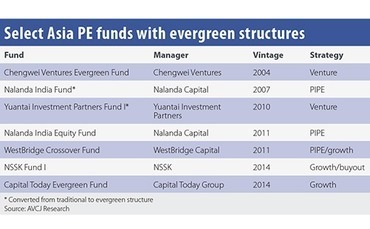

The Sutter Hill portfolio also features an LP interest in Shanghai-based Chengwei Ventures' first fund, raised in 2000. For its follow-on vehicle, Chengwei opted for an evergreen structure; the most recent regulatory filing in 2012 lists a target of $535 million. Yuantai Investment Partners, a spin-out from Chengwei, is another to have raised an evergreen fund.

Other members of the elite club of Asia evergreens include two Indian GPs that have so far wholly or largely focused on long-hold PIPE deals - Nalanda Capital and WestBridge Capital - and NSSK Fund I, which was raised last year by a group led by Jun Tsusaka, former Japan head of TPG Capital. Capital Today Group, a growth-oriented Chinese firm, is expected to join this number: It is said to be nearing a final close of $600 million, plus a 25% additional draw, on its third fund, an evergreen vehicle.

Big ambitions

According to one source familiar with Capital Today, the founder, Kathy Xu, is "a big believer in the laws of compounding." This translates into a desire for longer holding periods and no longer being at the whim of LPs, trying to manage the timing of exits to suit their liquidity needs.

Capital Today remains a shareholder in JD.com, having participated in the online retailer's Series A round in 2007, seen the business go public, and taken more than $100 million off the table through an IPO and subsequent share placement last year. The firm is sitting on a partially realized return of more than 100x, but is said to have come under pressure from certain LPs as early as 2011 to sell some or all of its stake as the valuations of private rounds grew in size.

More is expected from JD.com and from other portfolio companies such as Yi Feng, a brick-and-mortar pharmacy chain now listed on the A-share market, so Capital Today wants to stay involved.

Chengwei is said to have made a similar pitch when raising its evergreen fund, saying it wanted to build the Exxon Mobil and Procter & Gamble of China, one LP who looked at the fund notes. Among its current investments is Youku Tudou. Chengwei was Youku's first backer in 2005 and remained a shareholder as the online video platform went public in the US and then merged with domestic rival Tudou. Alibaba Group recently agreed a buyout at a valuation of $4.2 billion.

The primary challenge of an evergreen fund is creating a structure with which investors are comfortable. Phil Culhane, of counsel at Simpson Thacher, has designed several structures for GPs in Asia but it has proved impossible to date to sell LPs on novel approaches in a region they already view as high risk.

On one occasion, the structure and terms allowed investors - after an initial lock up - to annually elect to exit or rollover their positions. Exits would be facilitated through a mechanism that mimicked the traditional PE approach: a return within a proposed range of five or seven years, with a calculation that factored in hurdle rates and carried interest, as well as when the capital was to be returned to the LP. Although the structure addressed concerns over liquidity and fair valuations, and drew intellectual interest as permanent capital vehicle that could offer liquidity, the fund did not get traction.

"Even if you have great alignment and the right set of professionals, many LPs aren't always ready for such a big change," Culhane explains. "They say, ‘Okay, I have a certain amount to spend in Asia every year, do I want to be breaking my head over a fund structure I don't understand or do I want to look at industry standard models and make industry standard comments? It's high risk to be a first mover LP on a new structure in Asia.'"

The structure that has worked for Cooley is a 28-year fund divided into seven four-year activity periods. If an LP commits $10 million at inception, at the end of year four it can choose either to re-up, which means putting in another $10 million, liquidate its position or in some cases place it in a run-off account to be wound down over time. An LP that re-ups every time would therefore end up investing $70 million.

The amount of back office work that must go into keeping track of different positions is substantially greater than for a traditional PE fund. In order to facilitate exits, at the end of each four-year period all of the assets in the portfolio must be marked to market, with even unrealized gains and losses allocated out to the capital accounts of participants. This means that, should new investors enter, they are buying a pro rata portion of the existing portfolio at fair market value.

"All of these funds have the relief valve of a mechanism whereby the LP can get out, but they aren't really designed for people to exit," says Cooley's Silber. "You might go so far as to say they are set up to incentivize LPs to stay in for the long term because only by doing that do you get all the compounding benefits. The historical incidence of LPs exiting these funds has been near zero percent."

Nalanda, which converted its 2007 vintage traditional fund to an evergreen (although the GP is no longer investing out of it) and then raised a separate evergreen fund in 2011, has a somewhat different approach: an LP makes the full commitment up front and has the option to exit every five years. However, the stability in the investor pool is just the same, with a source familiar with Nalanda saying that 95% of the firm's LP base remained unchanged since 2007.

Foundation's friend

The reason for this consistency is both a negative and a positive of the evergreen approach: the range of LPs that like it is very limited, but those select few tend to like it a lot. The vast majority of Nalanda's investor base is in the US and dominated by endowments and foundations. Chengwei is also popular among the US endowments.

A number of endowments are known for approaching managers they like and suggesting an evergreen structure for the next fund. The motivation is in part access - an LP has the right to re-up at every juncture, no matter how much the GP might want to replace it - but more about longevity. These groups represent long-term, proprietary capital; they are able to be patient or even permanent.

By contrast, a fund-of-funds, which is bound by its own fixed-term lifecycle and must return capital to investors, is generally not a good fit for an evergreen structure. Public pension funds may also shy away from such an approach - if not because of unpredictability in their future exposure to alternatives as part of a broader basket of investment, then due to a residual discomfort with structures that depart from the norm. (It is, however, worth noting that open-ended funds are commonplace in infrastructure.)

According to Lorna Chen, a partner at Shearman & Sterling, some LPs also struggle to decide how evergreen funds should be addressed internally. "The risk profile doesn't fit the hedge fund team's requirements because there is such a big illiquid pocket, but if you go to the PE team then the redemption part doesn't fit its profile."

Asked about evergreen funds, Nicole Musicco, managing director and head of Asia Pacific at Ontario Teachers' Pension Plan (OTPP), observes that they are an innovative and interesting structure for long-term investors, but she hasn't seen many of them. "Maybe that kind of desire is being met through managed accounts that some of the larger LPs are taking on. If you can do it in a captive way with one or two like-minded LPs, then it could work but it's still hard to figure out a structure," she says.

Andy Hayes, private equity investment officer at Oregon State Treasury, tends to avoid evergreen funds. He wants managers to display the full PE skill set - buy a company, make it better, and then sell it. Hayes adds that a GP is only likely to get traction on a differentiated structure of this kind if it has very strong relationships with LPs and an impressive track record. Indeed, the Cooley clients that have successfully raised evergreen funds were all between vintages three and five.

Capital Today has, in short, earned the right to be creative. At least four of the investments from the GP's 2005 debut fund have individually returned the entire fund, including JD.com, Yi Feng, Rongqing Group and Youku Tudou, while Fund II is said to be tracking well. If Capital Today wanted to raise a traditional vehicle, the consensus view is that it would happen swiftly and smoothly.

Given the track records of many PE firms in Asia are still works in progress - in large part due to challenges faced by minority investors that want to take portfolio companies public - an evergreen structure represents a leap of faith. An LP must be confident that, even on achieving an IPO, a manager can then secure a timely exit. The danger is that a manager falls in love with his investments and never wants to let go.

"If you look at people who are successful in private equity, in general those who sell too early and take money off the table faster probably do better over the long term. Firms that hold on to stock over long periods of time - whether public or private - and think they are going to create more value certainly could run into trouble," says Doug Coulter, a partner at LGT Capital Partners.

Another significant obstacle for evergreen funds in Asia is team depth and volatility. While these vehicles may run nearly three times as long as traditional funds, they tend to come with similar key person clauses. This means the leaders must commit to staying around for the full 28-year cycle. In reality, the likes of Sutter Hill have managed succession planning in the standard way - every eight years a couple of people might step back and others are promoted from within - and LPs haven't felt the need to trigger to the key person clause.

The problem in markets like China and India is that most firms have been around for no more than a decade and one or two founders remain dominant figures in the hierarchy. Were they to depart, there is no guarantee the franchise would survive. If an LP is uncertain how many out of a core group of partners in their 40s will still be with the firm 10 years down the line, then it will be wary of making a commitment that could last more than twice as long.

While the exit mechanism is a comfort, expecting to use it undermines the rationale for backing the fund in the first place: that a particular team has the skills to consistently outperform its peers by holding companies for longer.

An infrequent occurrence

Should Capital Today make an evergreen structure work effectively, others will certainly want to follow suit - not least because they crave being freed up from fundraising every few years. However, even though industry participants say they are seeing movements away from traditional structures, this is more towards deal-by-deal strategies rather than longer duration blind pools.

"As a manager raising a fund, you have to decide which battle you are going to fight - explaining the structure to investors or laying out your credibility or strategy to investors," one GP observes. "People would rather fight the second battle than get into an evergreen structure."

Cooley's Silber adds that it will be more difficult to raise these funds in Asia than the US. First, most of the investors familiar with this structure are based in the US and so their approach to Asia is likely to be more conservative. Second, Asian LPs don't know the structure, which means a concerted educational effort is required to get them comfortable with it. Regardless of geography, the law firm asks its clients to think carefully about whether they really want to proceed with an evergreen structure.

"We at Cooley believe they provide some very positive commercial attributes to investors once deals get done, but these funds are very hard to raise and you risk losing a lot of LPs along the way," he says. "Some won't be able to proceed with you because of their nature, such as fund-of-funds, and others may be fine with the idea of patient capital but at the end of the day it is too complicated for them."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.