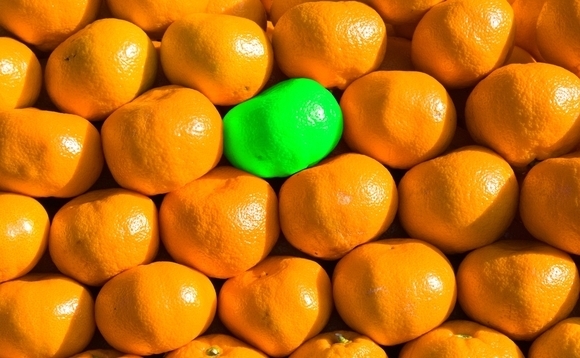

China GP differentiation: Plain vanilla no more

Independent funds have dominated Chinese private equity, but now princeling and affiliate funds have entered the market, offering their own competitive edge. GPs are realizing the merits of differentiation

Nepoch Capital appeared to have that most valuable of commodities in China private equity - a competitive edge. Flying in the face of a challenging fundraising environment that left many of its peers flailing, the newly-founded manager quickly notched up $200 million in LP commitments for its debut fund last year. US endowments were the major takers.

Nepoch's edge lies in one of its founder's progeny. He Jintao is the son of He Guoqiang who stepped down from China's Politburo Standing Committee last autumn. Around this time rumors emerged about another "princeling fund," so called because they have ties to the families of government officials, as He and his colleagues began making the rounds.

"He made it clear that Nepoch would not target investors in Asia, but instead hire a US placement agent to raise capital overseas," says one fund-of-funds LP. This LP was on receiving list for some of the private equity's firm's email marketing. The document proudly declared that Nepoch was "the fifth princeling fund in China."

Princelings must tread a fine line. On the one hand, such funds are perceived in a negative manner by the man in the street; they are a symbol of nepotism and the misuse of power at top levels of government, hot button issues for China's censored-but-not-silenced social media users. It is a delicious irony that He senior's last job was policing corruption in government.

On the other hand, the competitive edge of a princeling fund is almost entirely based on the founder's ability to use his connections, or maybe just the perception that he might have connections, to get things that others cannot - access to deals, special exemptions from regulators, shortcuts to exits.

Clearly nepotism is a selling point among certain LPs, which explains why Nepoch is the fifth incarnation of its type.

Distinguishing factors that make a GP stand out from the crowd are ever more important in a competitive private equity environment. In the light of a challenging exit market that has called pure pre-IPO investment strategies into question, there is no such thing as an automatic re-up.

"All GPs have to be re-evaluated in China," says Sun Dayi, managing director at fund-of-funds Jade Investment. "All funds should be examined in the light of their investment strategy, the capability of the fund managers. Even the same manager of a previous successful fund, has to be re-evaluated, as their new funds could be completely different."

The three ways

The princeling model is one of three distinct strategies prevalent in the China market. There are also "affiliate funds," which are backed by large state-owned institutions, usually investment banks or brokerages that have the ability to guide companies all the way an IPO at a favorable valuation. The third group comprises "independent funds," US dollar-denominated vehicles run by managers offering all kinds of financial, operational and strategic support.

Nothing stays the same in Chinese private equity for long, but which of these strategies has the killer app? "Princeling and affiliate funds have changed the private equity landscape," says one of such manager. "The pioneers were mostly unaffiliated funds but they are no longer the only game in town. Some investors prefer the princeling or affiliate route because of the perceived value-add."

Although Nepoch's deal-making ability has yet to crystallize, the attraction of the princeling model to foreign investors essentially lies in deal sourcing. One particular angle for these funds is taking large domestic companies - such as state-owned enterprises (SOEs) - public in China or overseas, perhaps with a bit of LP co-invest tacked on to the original transaction.

"Princeling funds clearly appeal to investors such as Singapore's Temasek Holdings, Canadian pension funds and other institutional investors," says Jade's Dayi. "Given they want to increase their exposure to direct investments in China, partnering with the relative of a senior leader in can help get some top-down deals and cut through bureaucratic obstruction."

One example of this is Boyu Capital, acknowledged as a key player in the equity tranche of Alibaba Group's $7.6 billion buyback of a stake in itself from Yahoo last September. A source familiar with the transaction previously told AVCJ that the tech firm had been negotiating with China Investment Corp. (CIC) for more than a year, and Boyu advised the sovereign wealth fund from the outset. The other private equity participants came in later.

Boyu is classified as a princeling fund due to the presence of Alvin Jiang, grandson of former President Jiang Zemin. However, the firm can boast additional talent in Mary Ma, formerly of TPG Capital, and ex-Ping An Group executive Louis Cheng. "Boyu's team is well connected. They are raising a second fund this year even though their first fund has yet to deliver much in terms of results," says one fund manager.

A deep bench at Boyu is likely to be of comfort to LPs. The fundamental flaw of the princeling model is that it is a one-trick pony: Any firm that relies on an individual's connections for a competitive edge is subject to personnel risk. And princelings have been known to move for what are appear to be political reasons.

In 2011, Winston Wen, son of former Premier Wen Jiabao who was then still in office, departed New Horizon Capital for a job at an SOE, within a year the firm closing its third fund at $750 million, well above its initial target and more than seven times the sum raised for its first vehicle. The LPs included Temasek and California Public Employees' Retirement System (CalPERS). Last year, Lefei Liu, who set up CITIC Private Equity in 2008, gave up the role of chairman ahead of his father's elevation to the Politburo Standing Committee. He remains CEO.

One global fund-of-funds LP tells AVCJ that he won't back any princeling funds because there is too much baggage in the form of political and reputational risk that has nothing to do with the market or portfolio companies. "How would you explain to your board members why you invested when the GP is at the center of a corruption scandal?" the LP asks. "I won't support that model because their image is negative."

Brothers in arms

This particular LP claims to have more of an appetite for affiliate funds. Rather than placing their hopes in one individual, such vehicles have an entire financial institution behind them.

In China, there are currently more than 60 affiliate funds in operation, backed by the state-owned brokerages firms like China International Capital Corp. (CICC) and CITIC Securities, and banks such as Industrial and Commercial Bank of China, Bank of China and China Development Bank. Still more are affiliated to local governments.

According to AVCJ Research, government affiliates raised $4.5 billion last year, up from $2.6 billion in 2011, while brokerage and bank affiliates saw capital contributions fall to $2.1 billion from $7.6 billion the previous year. This is largely a factor of which big beasts happen to be in the market, but there are nuances in terms of what government and brokerage affiliates have to offer.

"Government-related funds tend to see a lot more small- and medium-sized enterprise (SME) investment opportunities in their deal-sourcing, which can be different from the independent or specialist funds," says Vincent Ng, a partner at a placement agent Atlantic Pacific Capital. "There could be a lot of interesting opportunities coming out of government-related funds."

A brokerage affiliate's pitch is inevitably tied to an IPO. This is a big hit with entrepreneurs who have grown accustomed to asking what public market exit multiple they can get before the investment has even been made. These funds can rely on banking and investment banking teams to contribute to private equity efforts. However, the brokerage affiliates are still new - a decade ago independent GP CDH Investments spun out from CICC because the government wouldn't allow brokerages to operate private equity arms and it is only relatively recently that the ban was lifted - and unproven.

For some LPs, there are potential conflict of interest concerns. A brokerage affiliate is essentially a small part of a much larger business and it might be treated as such.

"The results of those funds do not really make any big difference to the year-end bonus of the top executives, so whenever there is an internal conflict they will be pushed aside internally," says one independent fund manager. "For those institutions, sales and trading activities are the priority because they are the most important sources of revenue. Private equity carried interest is far away and not in their short-term budget."

There is an added caveat: Once a brokerage's private equity affiliate reaches a certain investment threshold in a portfolio company - said to be 7% - the underwriting team is prohibited from taking a major role in any future capital markets activities.

Whither the independents?

As for the independent funds, 10 years ago they were the only players in China's private equity landscape. They still dominate the market by virtue of their sheer number - affiliate funds accounted for only 29.4% of fundraising last year, while the princeling share is tiny - but there is greater competition. For many, the solution is to move out of the mainstream.

"To be independent, we differentiate by focusing on the low mid-market segment. It is labor intensive strategy with a lot of Series A rounds, small deal sizes and a low conversion rate. It also takes longer to get to market and there is a greater reliance on secondary exits," says Vincent Chan, CEO in Spring Capital. "At the same time, China's SME deal market is huge and a lot of entrepreneurs don't want to be involved in the sensitive political areas. They can call up a managing partner like me any time."

Specialization is another means of differentiation, with most activity in the healthcare and cleantech spaces. LPs have yet to fully pass judgment on this approach but several observe that sector-agnostic funds are hiring healthcare-focused professionals and outperforming the specialist competition.

Doug Coulter, a Hong Kong-based partner at LGT Capital Partners takes the view that a single-sector strategy is not necessarily the best approach at this stage of the private equity industry's development in China. Yet there are no perfect business models.

"There are a lot of funds and the market is getting more crowded," says Coulter. "Many of the princeling funds were not there 5-6 years ago. The fact that they can raise money easily does not mean that they can invest wisely, manage the target companies and exit the right way and at the right time. Generating good returns is very difficult."

At the same time, implementing models based on their success in Western markets is equally fruitless. Stage and sector strategies have taken 30 years to mature in North America so can't necessarily be transplanted to China. All GPs can do is tailor an approach to conditions on the ground and execute consistently.

And in the end, track records will out. "Strong local GPs tend to have teams that have global experience as well as local connectivity and know-how," says Sally Shan, managing director at HarbourVest Partners. "The ability to generate liquidity for LPs is an increasingly important measure of capability."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.