Aspects of AsiaPac consumer investing

The Asian consumer, like the pre-crisis US consumer, has become a dependable staple and continues to be of particular interest for Asia Pacific investors looking to make investments.

Consumer plays founded on rising disposable income are a recurring theme for Asia Pacific private equity. But there are many more ways to play this proposition than the plain-vanilla investment in a PRC retail chain or insurance company. AVCJ looks at the case for investing in Asia Pacific consumption and some of the more interesting and counter-intuitive variations on the theme.

Asia's consumers have weathered the GFC and the challenges it presented to export-led economic models in many of their home markets, according to anecdotal and statistical indicators. A recent InsightAsia consumer confidence survey registered very positive sentiment in China and Southeast Asia as 2010 unfolds, with China and Malaysia scoring 125, Vietnam 132, and Singapore 138 against a neutral rating of 100 – albeit also with Indonesia and Thailand slightly negative at 94 and 93 respectively.

However, though the Asian consumer thesis may remain intact, understanding it and its nuances remains a different question. Dr Amlan Roy, Head of Global Demographics and Pensions Research at Credit Suisse in London, emphasizes that, "While I'm bullish on emerging markets, I believe we should treat these countries very differently. India and China are on totally different planets as regards their demographics and per copita spending.He adds, "The biggest component of GDP is total consumption expenditures. And to understand these expenditures by consumers, we have to understand demographics."

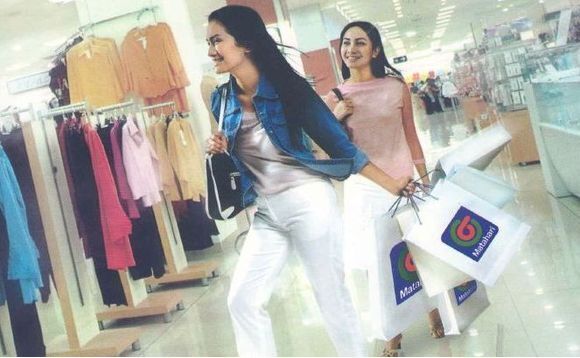

Opening a new consumer market

Consumer market potential led CVC to take a pioneering role in a recently neglected market, and become one of the leading investors in Indonesia for the current investment cycle, with its $773 million majority investment in leading local retail chain, PT Matahari Putra Prima (Matahari).

Sigit Prasetya, Partner with CVC in Indonesia, is clear on the rationale. "Indonesia is the fourth most populous country in the world," he told AVCJ. "It has very young demographics … The middle class has been growing in double digits." Furthermore, Indonesia's market characteristics make consumer plays a very attractive way to capture the overall market growth. "About 65-70% of GDP growth is driven by domestic consumption," Prasetya added.

The attractions of Matahari itself as a business also are considerable. "If you look at competition, it is a lot less intense compared to China. In the retail sector, there may be only three or four major players," Prasetya continued. "Matahari is the number one player by far. It has been around for more than 55 years." This is consistent with CVC's preference for investing in the leading businesses in its target markets.

Against these market and business merits weigh the risks of investing in Indonesia, which have conspired to produce a number of proverbially poor outcomes for a previous generation of international investors. Today there are still has some lingering concerns over domestic stability, security, and the legal framework. "There are many attractions, but very many risks," Roy Kuan, Managing Partner with CVC Asia, told AVCJ. However, he added, "this business still seemed attractive against those risks."

There are hurdles to investment in Indonesia, as well. "There are quite a few industries which are restricted for foreign investment," Kuan noted. "Specialty retail is not open to foreign investment." Chains with large stores of 2000 sq m or more, however, are one of the permitted retail categories. As Prasetya emphasizes, the consumer retail sector, "is a lot more open to foreign investment than, for example, mining." And Kuan believes that CVC's experience through its retail investments elsewhere, in Debenhams in the UK, for example, gives it additional value for its investee and the vendor, Lippo Group, which remains a shareholder in the business.

"If you have a certain business expertise, it gets you through the door," he said.

Even on a risk-adjusted basis, CVC looks set to capture much of Indonesia's consumer momentum through Matahari, but industry players and commentators alike caution against taking too much of a one-size-fits-all approach to the region's retail opportunities. "Consumer and risk preferences for someone coming from rural China or India will be very different to someone coming from Shanghai, Mumbai, Jakarta or Hong Kong," in Dr. Roy's words.

All that glistens

Gold has had a good GFC, enjoying fresh luster as a reserve investment of last resort as the value of other assets has been decimated. Gold in some Asia Pacific markets has an extra value, often to local cultural practices and in some countries the immaturity of the financial markets. This has fueled some investments that have tapped this phenomenon in interesting and unique ways.

In India, Sequoia Capital recently scored a major exit success with the sale of its 11% stake in Manappuram General Finance and Leasing, a non-bank financial company specializing in loans based on gold.

"We invested around $14 million in Manappuram at the end of 2007 from our growth equity fund, to help scale them into a market leader in gold loans," KP Balaraj, Managing Director with Sequoia Capital in Bangalore, told AVCJ. "We took the decision to exit via the public markets recently and sold our position for $70 million, realizing a little north of 5x in two and a half years."

Although active in a number of financial services areas, including insurance and forex, Manappuram's strength was the use of the gold traditionally held by many Indian families, as collateral for loans.

As Balaraj explained, "gold is a favored form of investment in India and is the second largest asset class of savings after cash for most Indian households. India has the largest gold market in the world. Most families pledge gold jewelry as collateral."

Paradoxically, Sequoia's investment in Manappuram succeeded at least in part by targeting a section of the Indian public far removed from the fast-rising and increasingly influential Indian middle class. "Their core business is focused on customers who are typically lower income, and based in smaller cities and rural India, with no regular access to banks, and who see Manappuram as a source of short-term funding and bridge loans," Balaraj continued. "Most of these customers have historically been very dependent on informal money-lending channels."

The results speak for themselves. "Our view is this investment probably rates as among the best private equity investments and exits in India in the last few years," Balaraj concluded.

Hanoi-headquartered investor Mekong Capital also saw a gold-related success in March last year with the listing of its investee Phu Nhuan Jewelry (PNJ) on the Ho Chi Minh Stock Exchange. Listing in the depths of the financial crisis, PNJ saw its shares rise 20% on its first trading day, and up by 38% soon after.

As Dr. Thomas Lanyi, director of investments for Mekong, which invested in PNJ in December 2007, pointed out to AVCJ at the time, "buying jewelry in Vietnam is a means of storing value. Many people buy gold and jewelry when they feel that the economy is troubled. So in effect, the company is benefitting from the rise in gold, and the retail stores are passing that higher price on immediately, while consumers are buying it as an investment."

PNJ won on several counts: as a proxy for rising gold prices; Vietnam's first listed jewelry company; a consumer/retail story; and a company with both a committed, forward-looking management team and a sound business base as an industry leader, with 90 retail outlets and 3,000 wholesalers.

"There's an active market for lending and borrowing in gold," Chris Freund, Managing Director at Mekong, confirmed to AVCJ recently. But his firm is also concentrating on education to tap Vietnam's consumer growth, with its $6 million commitment to Vietnam Australia International School. In Vietnam, he observes, "the upper and middle class is growing much faster than the GDP," and the international schools they favor have "probably the strongest brands in Vietnam."

… is not gold?

Some GPs observe, though that the popularity of the Asian consumer sector with investors has come close to killing the goose that lays the golden eggs. Specifically, valuations on consumer assets, especially in certain hot markets like China, have been bid up by competition between would-be investors, to the point that any upside from anticipated growth is already factored in to the entry price of the asset.

Gordon Shaw, Managing Director at the Shanghai office of Baring Private Equity Asia, cites the example of his firm's deal flow from China at the height of the pre-GFC investment boom, in 2007. "A full 29% of the deals that came through were in this sector, and we did zero." Baring, he said, could not accept the prices being asked for the assets. "Discipline on entry valuation is very important," he told AVCJ. "The prices that were being paid were 20-25x p/e." Consumer deals on these terms, he feels, could not be justified to LPs on a returns basis, no matter how attractive the sector.

Post-crisis, pricing discipline has to some extent returned to the market. "The market comparables have come down significantly," Shaw remarked. "Come 2009, we were able to close two transactions in that area." And for astute regional investors, he continued, there are now opportunities among exactly the deals that were made in the pre-crisis period, that are now running into problems. Baring's two most recent Chinese consumer deals, he noted, "were actually secondaries; we were buying from motivated sellers."

Other secondary deals, Shaw believes, now are available: "It really has to do with the cycle. We're just coming out of the cycle: people have not had divestments for some time." And there may well be the opportunity to increase the value of the asset by correcting some missteps in the original primary deal. Shaw takes the example of in Hsu Fu Chi International, a Singapore-listed Chinese confectionary company that Baring invested $135 million in for a minority stake in October 2009. "In the case of Hsi Fu Chi, we took advantage of the relatively lower p/e multiples found in Singapore," he told AVCJ. "We were able to buy in at a relatively low valuation." Shaw, now a board member at Hsu Fu Chi, now has the opportunity to help realize the company's full value by addressing past defiencies in HR and strategic planning.

However, he cautioned, the Asian consumer sector remains fully priced, and still requires discipline, or an edge in deal sourcing, to invest in profitably. "For these highly-favored sectors, we really have to look for special situations to get the entry valuations," Shaw said. "In an open auction, it's going to be highly valued. Everybody is gung ho."

Consumer investments in hard times

As Sequoia's Manappuram deal illustrates, tapping lower-income sections of the community can often pay off when investing in Asia. The more developed markets of this region may be less favored as consumer-related investment destinations, especially when some, such as Japan, are going through long-term secular economic and demographic decline. However, the problems of such markets can create opportunities for investors.

In March this year, EQT invested in Hong Kong's Japan Home Centre group, a retail chain specializing in discount houseware products. With 200 directly-owned outlets in Hong Kong, the company had already proven its capability to expand overseas, franchising some 80 stores in the Philippines, Malaysia, Australia and the Middle East.

"In the more mature markets like Hong Kong, it provides a solid base," Fredrik Atting, Senior Partner at EQT Partners in Hong Kong, told AVCJ. "It is a recession-proof stable base business. At the same time, in many of the more emerging economies in Asia, this format also works well. As the consumer is getting more affluent, in a country like the Philippines, they can then trade up into value-for-money high quality products, which Japan Home provides."

EQT saw the discount retail sector as a growth area with considerable opportunity for expansion both within Hong Kong and overseas. "Japan Home Centre liked the experience that EQT has in retail investments, both in Europe and in Asia," Atting added. "They saw the expertise and the support we could give them."

Japanese buyout investor Marunouchi Capital pursued a similar theme in September 2009 with its $220 million pre-IPO investment in Joyful Company Co., which operates the Joyful Honda discount brand in urban eastern Japan. Once again, the private equity investor saw the potential for growth in the business, as budget-constrained Japanese consumers go for cheaper goods. "Joyful Honda's business generates good sales," a Marunouchi Capital director remarked to AVCJ.

Ducking the China consumer?

Kuala Lumpur-headquartered Navis Capital, a firm usually associated more with Southeast Asian, Indian and Australian consumer-focused investments than Greater China, found a novel way to play the China consumer proposition – via Bangkok and the UK. In April, it injected $50 million into its existing Thai investee Bangkok Ranch Co. Ltd. as part of the latter's c.$100 million, 100% acquisition of Lincolnshire-based duck business Cherry Valley Farms, Ltd.

"The really exciting aspect of the deal is the genetics business," Tim McKinlay, Director of the Portfolio Management and Monitoring group at Navis, told AVCJ. "This is the business of developing the ‘Super Ducks' which are at the top of the Value Chain of all modern integrated processors for ducks."

With the Cherry Valley acquisition, Bangkok Ranch became the dominant supplier of duck genetics and new breeds worldwide, including to the China market. "The business is exciting because over many years Cherry Valley has established a dominant position with the very large Chinese producers," McKinlay continued. "China is by far the world's biggest market for duck – probably 70-80% of the total – and as food safety and cost-efficiency have become relatively more important, commercial processors have taken over production."

"Cherry Valley has retained control of the top-rung of the chain [the ‘elite' stock] and therefore physical control of the IP," he concluded. With Cherry Valley's dominant market position in the supply of this genetic material, "growth will come from the continued industrialization of the market … as consumers continue to demand increased levels of food safety."

So consumer stories will continue to fuel investment across the region for the foreseeable future – but they will also reward those most capable of understanding and tapping the unique aspects of the Asian consumer market in the globalized economy.

"My bottom line is that I would follow the family structure changes in all the richest cities in emerging markets," maintains Dr. Roy. "Private equity in emerging markets should be focused on the changing household structure, and seek to exploit that through growth in sectors such real estate, pharmaceuticals and financials."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.