Lower middle market fundraising: Early adopters

While Australia’s lower middle market still offers opportunities for conventional GPs, some managers see growing potential in alternate fund models. Skepticism is strong among their peers

In 2010, Yorkway Capital Partners didn't have a fund, a portfolio, or a history in the private equity market. But the firm did have a plan to tackle a group of investors that had so far been reluctant to commit capital to the asset class.

"We saw a trend, particularly in the high net worth and family office part of the market, where they were not really as concerned about the fees," says Paul Batchelor, principal and co-founder at Yorkway. "They'd pay fees for what they thought was good performance, but they were less inclined to actually give any PE house their money for 10 years and wait to get it back."

The firm has built a business around these underserved investors, eschewing the traditional private equity fundraising approach for a deal-by-deal model that allows greater flexibility. Having made co-investments with major PE houses over the past six years, Yorkway is now preparing to make its own majority investments, still on a deal-by-deal basis.

It is one of several GPs that have filled a niche following unconventional investment models in the country's lower middle market. While many industry players view these firms as special cases, and unlikely to represent a significant part of the market going forward, there is also widespread recognition that they can play an important role in the industry.

Moving market

The emergence of this strategy is not necessarily a function of choice. For several years, a number of larger superannuation funds have been moving away from lower middle market managers due to constraints imposed by their own growing asset bases. On one hand, they have a bigger minimum check size; on the other, they are usually not allowed to comprise too much of an individual fund. This has created a fundraising squeeze for smaller managers, so they have begun to target different sub-sets of domestic LPs.

Industry players point to a similar trend among GPs as well. Several private equity firms established themselves in the lower middle market and went on to raise larger funds. Naturally, they now write bigger checks and are interested in larger companies.

Nevertheless, participants still consider the lower middle market to be a good bet. GPs note that while some domestic investors have left the lower middle market space, others show no signs of departing. In addition, increasing interest from international LPs in Australia offers local fund managers another source of funding - one that they may prefer to superannuation funds due to more relaxed expectations regarding fees and returns.

"It comes down to a situation where if the GPs can raise that capital offshore they will," says an investment manager at one Australian LP. "If you can raise dumb money from overseas that doesn't ask questions and expects a lower return for a higher fee why not do it? That is exactly what they have done at the big end of the spectrum."

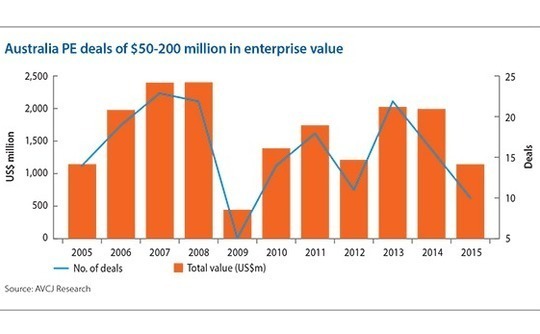

From an investment perspective, activity in Australia's lower middle market has fluctuated in recent years. AVCJ Research data show both the number of deals between $50 million and $200 million, and the total value of those deals, follow a pattern of peaks and troughs: 10 deals worth $1.1 billion in 2015 represents the lowest point for both measures since 2009. However, in 2013 investors completed 22 deals for a total of $2 billion, the highest point for both since 2008.

Despite this fluctuation, industry players say the lower middle market continues to provide plenty of opportunities for investments and exits. Traditionally, deal flow has focused on small businesses, whose founders are looking to exit. With its wealth of small and medium-sized enterprises, Australia represents a particularly attractive market and some GPs have generated strong returns.

The issue, then, is not with the availability of deals, but the availability of investors with the capital to take on those deals. Even GPs that are active in the space say things have gotten tighter in some regards. For example, one manager has noted a decrease in the availability of co-investment capital, and a growing reluctance on the part of LPs to pay fees and interest on this capital.

"It's an increasingly focused and concentrated market," says Yorkway's Batchelor. "The crème de la crème can still find the money, but some highly-rated long-term managers with good performance over many years are not finding it that simple, even from the international players, for reasons like the fees that are being charged."

With shrinking amounts of capital concentrated in ever-smaller numbers of funds, some industry participants have looked to unconventional fund models as a means of entry. Deal-by-deal fundraising is one such approach; though not all participants consider it a viable long-term option, its proponents feel that it offers hidden benefits.

Fundamental to the deal-by-deal model as practiced by Yorkway is the belief that there is a pool of capital that is willing to get involved in private equity but has not been presented with the right opportunity. In this case, that means the high net worth individuals and family offices with which Yorkway's founders had built contacts in their years in leadership roles at financial institutions.

So far the firm has looked for opportunities to invest its clients' money alongside established private equity funds. Last year, for example, it set up an investment in quantity surveying company BMT Tax Depreciation, buying a 70% stake in the company at a valuation of A$65 million ($50.3 million) alongside CHAMP Ventures, which took the larger portion of their purchase.

"Deals are too small for institutional capital in that segment, but it's sort of accessing a different pool of capital into private equity investing," says Gareth Banks, a director at CHAMP Ventures. "It's not a bad thing; it's giving these high net worth individuals access to come into some of these smaller sized but growing businesses."

Unique qualities

Industry players identify several factors that make an unconventional fund structure attractive. For one, the model offers managers flexibility in investing. As they are not limited by their fund size, they can theoretically commit as much or as often as they want, provided they can locate the capital.

On the side of the LPs, high net worth individuals - such as the retired business founders who form many of Yorkway's clients - and family offices might gravitate toward a fund with an unconventional structure, rather than a traditional blind pool, because of its more accommodating risk and fee structure. Since investors can choose what they invest in, they are not exposed to risk from every deal as in a conventional 10-year fund, they can see returns much sooner than with a conventional fund, and they do not have to pay fees on un-invested capital either.

"Because the average life of what we invest in is 4-6 years and you only pay fees during that life, the fees are much lower over the life of an investment than they are in a traditional PE fund," says Batchelor.

In addition, the model does not have to exclude conventional private equity LPs. Catalyst Direct Capital Management (CDCM), launched by Catalyst Investment Management founder Trent Peterson, set up a 2015 buyout alongside Canada's OPTrust in Melbourne's SkyBus, valued between A$50-100 million. The firm pitched itself as a direct investment by LPs in target companies, with Peterson arranging the deals and managing the assets.

However, CDCM's experience also points up some of the reasons why GPs on the whole are skeptical about working deal-by-deal. A common view in the industry is that this approach is a transitional stage in the life of a GP, rather than a model that can serve as the foundation for a long-term strategy. By this reading, operating on a deal-by-deal basis is either a stepping stone to raising a conventional fund or what one manager calls "a second best option for firms that can't raise another fund."

Peterson himself acknowledges the challenges of the approach. CDCM had the advantage of the Catalyst pedigree when it started, but it still must go through the fundraising cycle every time it wants to do a deal, and it must complete all of its pre-investment homework before it can raise any capital.

"It is very difficult to do and clearly a sub-optimal model. More often than not, it arises from necessity, not as a preference," says Peterson. "The guys that do succeed might charge 2/20 or sometimes higher. Investors can get their heads around that, but it has to be a materially completed deal; due diligence is done, terms have been negotiated, agreed and documented. So it's ‘cherry pick' participation for the investors, with little risk on deal completion."

Despite the difficulty of the deal-by-deal approach, its proponents do feel that, if managed well, it can serve as a successful strategy. Yorkway points to its five years of operational history as a sign that an experienced and practical manager can make the model work.

Both practitioners of the model and more conventional GPs acknowledge that it can also play a unique role in the private equity community. For instance, those with a non-traditional approach act as originators of deals, something Yorkway has done several times.

In addition to the BMT investment and the purchase of Ansett Aviation Training, also with CHAMP Ventures, the firm has done several deals with Quadrant Private Equity, including the 2010 buyout of media monitoring service iSentia and the purchase last year of oncology service provider Icon Cancer Care, a deal that Yorkway holds up as an example of its ability to match the right investor with the right opportunity.

"The most important thing with that investment was that we saw the opportunity to consolidate the market and to grow quite aggressively through acquisitions and investment in businesses in the same space, or in adjacencies strategically. And that's something that Quadrant's very good at," says Batchelor.

Niche operators

Yorkway's confidence in its strategy is reflected by the fact that it plans to continue to follow its deal-by-deal model when it begins making investments on its own. The firm is currently working on several potential deals and plans to complete three or four this year, seeking stakes of 50-70% at check sizes from $10-$50 million.

While disagreement persists on the proper place of a deal-by-deal approach in a firm's tool kit, players concur that the strategy is not likely to become a major part of the industry. The dominant view is still that the traditional fundraising approach is most likely to be successful.

For one thing, raising a fund only needs to be done once, rather than every time a GP wants to make a commitment. Having its own source of capital also means that the GP can readily cover broken deal costs and fees, rather than having to eat those costs itself.

"It is now very difficult to raise a fund as a cold start-up. How do you do it if you don't have a track record?" says Tim Martin, a partner at Crescent Capital Partners. "It's a long hard road. You need to get 3-4 deals successfully done and exited - so if you start deal by deal it's potentially an 8-9 year road before you can raise your first fund. You might do it faster if you have some pedigree from elsewhere."

Some players feel that the deal-by-deal model will slowly become more popular as market players become more aware of the remaining untapped capital pools. However, most agree that the most likely result is that the model will retain its current role.

"That good PE operator with a strong personal track record and network might not be initially backable on their own for a A$200-300 million fund, but if the alignment's right, the investors will certainly back someone to do deal-by-deal," says CHAMP Ventures' Banks. "You would then imagine that after a few of those deals, they can progress that investor support to being able to raise their own fund of commitments. It's a model that has occurred overseas.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.