A view from the top

The upcoming 2011 AVCJ Private Equity and Venture Capital Review highlights the growing importance of Asia-Pacific to the global PE community. It also raises the question: Just where is all this money going?

Fundraising rebounds from the GFC

Fundraising throughout Asia Pacific has seen an obvious rebound from the lows of 2009, but AVCJ data notes that 2010 levels were still a shadow of what they were in 2007. According to the research, nearly $32.4 billion were raised in Asia Pacific in 2010 - a more than 40% increase from 2009, which saw $23.1 billion raised. Inversely, $60.1 billion was raised in 2007, exhibiting the potential bandwidth Asian private equity has.

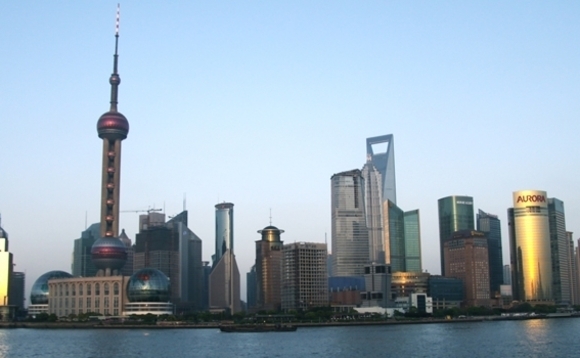

Yet, even when Asian fundraising reaches the height that it had previously experienced, the landscape has undoubtedly shifted these past three years, and will continue to do so. The majority of funds were funneled into China; at $14.5 billion, the region's clear leader.

China's growth story and PE firms' ability to regularly deploy $400-million-plus growth capital into each asset is appealing, and offers opportunity that may not be as abundant in other markets. Special situation, venture and even infrastructure and buyout funds have been readily cropping up in China, but it is the generalist private equity vehicle that is taking over the landscape.

As companies mature to a point where buyout options are viable, the flexibility of such funds have been popular raising agents, especially aided by a liberalizing regulatory system that is allowing more and more foreign dollars to be converted into reminbi for PE investment.

China's opportunities have also long been compared to those of India, but its fundraising landscape is drastically different. With all its emerging-market promise, India only saw $2.4 billion fundraised last year, down 38.5% from 2009. While such a drop may suggest that India has lost popularity, the reality is that funds are still finding it difficult to deploy their capital, which is a problem that has categorized the market in recent years. Investments in India are generally small- to mid-cap commitments, and so effectively funneling cash hundreds of millions out of even a mid-market fund has its difficulty, which will persist until a real push for consolidation occurs. Infrastructure, however, is an avenue that bucked this classification, providing multi-million-dollar investment opportunities.

While funding China and India has its obvious appeal, some markets that have lost their prominence on the fundraising scale. Notably, Korea, Japan and Taiwan have each seen a drop in capital fundraised last year, by 2.4% for Korea and a more drastic 35.5% and 46.2% for Japan and Taiwan, respectively. Longreach Group's recently announced $125 million first close of its Japanese-focused Longreach Capital Partners 2 is an example of this. The Hong Kong-based firm has sought LPs for the vehicle for more than a year, but garnering Asian-allocated dollars has its hurdles. Buyout, VC and distressed/special situation vehicles have largely been the funds to have launched in Korea and Japan in the past year, while investments into Taiwan have been made by regional vehicles.

On the opposite end of the scale, emerging markets in Southeast Asia, and the resurgence of Australasia's economic landscape, have boosted fundraising in specific markets. From 2009 to 2010, funds raised for Australia rocketed nearly 260%, to nearly $2 billion. While this figure doesn't match Australia's 2006-2008 levels, buyout and special situation opportunities have still provided targeted fundraising options. And for a different landscape, Vietnam saw a more than a 1,650% rise in market-focused fundraising activity in that same timeframe, to $161 million. While this sum may be minimal compared to the billion-dollar buyout vehicles available to other markets, the increase highlights the interest in Vietnam as a next-destination investment target.

Investments up

In spite of the lip service paid to opportunity in emerging markets, particularly in China and India, the upcoming 2011 AVCJ Private Equity and Venture Capital Report paints a picture of an industry that - whilst coming back on the investment front - must use the next 12 months to invest the significant capital overhang it has accumulated.

Data shows that investments across Asia are up nearly 13% year-on-year, to $54 billion. However, capital under management is growing at a steady and somewhat unnerving pace, up 14.5% to nearly $290 billion. The issue of just how much capital is waiting in the wings to be deployed is a serious concern that the private equity community will have to grapple with. At times the need to spend translates into valuations that are too high to make the kind of returns LPs expect to see.

That said, it appears that the dearth of investments seen post-crisis is a thing of the past, with investment committees approving more transactions, and hopefully GPs being more selective about their targets. Deal numbers were down in Japan, New Zealand, Singapore and South Korea.

The seemingly indiscriminant rise and fall of investment numbers in various countries throughout Asia can also be seen as an indication that in particular the larger, global players are truly spreading the wealth, seeking out targets throughout Asia, and not simply focusing on the two hottest emerging markets.

With Chinese and Hong Kong public markets saturated with PRC bank IPOs, investments in the financial services sector made up nearly one-quarter of all investments in the whole of Asia in 2010. Several Australian deals - health and hospital major Healthscope ($2.3 billion) and toll road operator Intoll ($3 billion) - made their mark on the year's top 10 list. Generally, the sector breakdown of deals remained the same, however stage by stage, there appeared to be an increasing focus on growth investments.

Perhaps due to the disapproval by LPs of PIPE investments, their share of the pie dropped from 26.4% to just 12.1% this year. Expansion and growth capital picked up most of that share, growing from 17.6% of all investments made in 2009 to 26.1%.

Overall, the investment environment in Asia remains healthy, with fund managers and onlookers largely bullish on 2011 being a banner year for the industry.

The year of returning money to LPs

Over the past 12 months, the exit market has showed significant recovery. Private equity funds and their portfolio companies were equally pleased with the environment. China's increasing growth numbers were prompted by rising domestic consumption and continuous growth in exports - both a great foundation for investors looking to see returns on investments.

In the full year 2010, AVCJ research shows there were 299 IPOs backed by private equity funds throughout Asia. Unsurprisingly, the top 30 PE-linked listings were nearly all positions occupied by Chinese companies, with two in Mongolia and one in South Korea. The total capital raised through public floats last year reached $85 billion. This is a 2.8 times increase from a year before, when the IPO market was depressed. In 2008, the total amount raised was a mere $15.5 billion across the region. IPO volumes have beat 2007 numbers by capital raised, showing the strength and increased demand for regional floats.

The top IPO last year was the US insurer AIA Group's Hong Kong listing in October, which sold $20.4 million worth of shares. A number of PE groups, including sovereign wealth funds participated. Agricultural Bank of China's debuts in both Hong Kong and on the Shanghai Stock Exchange raised $10.4 billion and $8.79 billion each. Again SWFs were first in line.

Meanwhile, trade sales - including secondary deals among PE players - accounted for 303 exits valued at $31 billion in total. This is nearly back to pre-crisis levels, which reached at its highest $35 billion in 2007.

Interestingly, the holding period for portfolio companies has become shorter, particularly in rapidly growing emerging markets. China assets are one obvious case in point, where the trend seems to be to buy and turn businesses around rather more quickly than in developed countries.

Investments made through funds that were launched in 2003 and 2004 are currently coming ready for exit in more mature markets like Japan and South Korea, which are both (as a result) expected to see more active deal flow this year. China has lured a large number of international funds to its shores, while locally formed RMB funds are ramping up across the country. Even with this proliferation of activity, the large-sized exits are still limited to industries like financial institutions and mining and construction companies. The industry is hoping to see more pure play exits in the coming years as PE becomes more sophisticated in the region.

*The 2011 AVCJ Private Equity and Venture Capital Review is available for pre-order now. To find out more or to order your copy, please contact the AVCJ Subscriptions department at AVCJsubscriptions@incisivemedia.com.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.