Portfolio: Shaw Kwei & Partners and Beyonics

When Shaw Kwei & Partners bought Singapore-based electronic manufacturing services player Beyonics, it was in debt and making no money. A strategic repositioning has returned the business to profitability

Shaw Kwei & Partners' connection to Beyonics Technology dates back to the 1990s when it invested in contract manufacturer Flextronics International. Former employees of Flextronics populated the management team, so there was an immediate familiarity.

Beyonics was founded in 1981 as Uraco Precision Engineering and listed on the Singapore Exchange 14 years later. With the introduction of new management in 2000, the electronic manufacturing services (EMS) provider took a different guise - the manufacturing agreement with Seagate Technology was signed - and ultimately a different name.

But life as a listed company proved challenging. When the market was collapsed during global financial crisis, a large chunk of second- to third-tier Asian stocks - companies with market capitalizations below $500 million - were neglected by investors. Shares in Beyonics were trading at a seven or eight year low with an enterprise valuation of about $80 million.

And despite being the 16th largest EMS company in the world, with approximately S$1.2 billion ($945 million) in annual turnover, profits were drying up. In the 2011 financial year, Beyonics swung to an S$17.5 million loss on sales of S$1.33 billion, compared to net income of S$6.9 million a year earlier. Furthermore, the companies was struggling under the weight of $18 million in debt.

For Shaw Kwei, it was an opportunity to make an acquisition at an attractive valuation. In 2012, the Asia-focused GP paid $115 million for the business, which represented a 35% premium to the trading valuation at the time. Beyonics was then de-listed from the Singapore Exchange.

"The business was drifting down and was very sleepy. In this world, if you aren't moving forward, you're going backwards. It's really not possible to stay still, so we saw the opportunity to change things. It has been fun and we're seeing the result now," says Kyle Shaw, founder and managing director of Shaw Kwei, who is also a chairman of Beyonics.

One step back

When the private equity firm completed the acquisition, more than 70% of Beyonics' revenue came from manufacturing hard-disk drivers, with much smaller operations in supplying contracted consumer telephones, medical devices and auto parts to original equipment manufacturers (OEMs).

Drawing on its over 20 years of experience in the EMS industry, Shaw Kwei decided that the company had a little chance of becoming a strong competitor. EMS is by necessity a high-volume business because margins are so low - and the landscape was markedly different from before the global financial crisis when demand was much stronger.

"Their strategy was in the wrong place at the wrong time," Shaw explains. "When the global market contracted in 2008-2009, the biggest challenge for all manufacturers in Asia was that demand for products dropped. There was way too much capacity. If you were competing in an undifferentiated space and making something simple, then you would face tremendous competition."

As such, Shaw Kwei took one step back to evaluate the whole business strategy in order to take two steps forward in the future. It brought in Bain & Company to conduct thorough research on Beyonics' existing customer base, underlying market size, and product range. The conclusion was that business lines accounting for 30% of the revenue base actually had the potential to grow. These areas - such as printed circuit boards (PCB), plastic injection parts, aluminum die-casting and machining, and metal stamped components - required high skillsets. Management had neglected them.

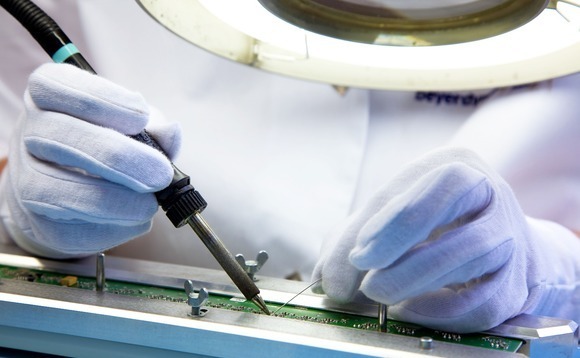

Instead of positioning Beyonics as an EMS company offering a variety of manufacturing services, including design, assembly, and testing, Shaw Kwei decided to re-focus as a precision manufacturer, pursuing lower volumes but higher margins. Beyonics already supplied precision products to several global leading players in the automotive, industrial and medical spaces, and the GP wanted to dive deeper into this group of customers.

Compared to consumer electronic products, the PE firm sees the automotive parts in terms of a much longer lifespan. This has implications for product quality and reliability. There are similar considerations in the medical equipment space. For example, a tool used in spine surgery, for which Beyonics manufacturers the metal tip and internal plastics and PCB, must perform to a consistently high level. During an operation, the surgeon relies on the tool to generate a lot of information about the patient.

To avoid distraction, Shaw Kwei wanted to cut off the existing low-value EMS manufacturing division, which contributed the remaining 70% of revenue. However, most of this revenue was closely tied to global hard-disk giant Seagate, a customer of more than 30 years' standing.

US-listed Seagate outsourced its hard-disk manufacturing, specifically making aluminum base plates and machining, to Beyonics in 2001. It soon expanded to provide PCB assembly (PCBA) services, packaging it as a box with all the parts inside. The contractor sold each hard-disk driver for about $1.54, generating up to $5 million every month.

Given the plans to restructure the business, privatization was always the best option. There would have been considerable panic among public market investors had Beyonics announced its intention to sell a division responsible for 70% of revenue. Moreover, Shaw Kwei understood that selling hard-disk drivers was a declining market, a fact underlined by the zero profit contribution, which also consumed a lot of working capital. This strengthened the case for terminating the arrangement to supply components to Seagate.

"We couldn't just leave Seagate overnight without a supplier. We wanted to do it in an orderly fashion, because we didn't want to let any customers down. So we said: ‘Either you pay us more, or if you don't want to do that, then we need to exit the relationship.' We basically had a one-year exit period, which was almost like a divorce," says Shaw.

After Seagate agreed to discontinue the partnership, the PE firm wanted to bring in a new CEO to direct the transformation. As a matter of course, the incumbent, Chan-Peng Goh, handed over all his business records on departure. It turned out that Goh had abused his position and broken the law, having received bribes for sending components of Seagate's hard-disk drives to a Korean competitor. Attempts were made to revolve the case quietly but Goh refused, prompting a legal action.

"I had never expected that. Having pulled together all the previous CEO's files and information, we found he had signed contracts for a bribe, which seemed a bit odd to me. I didn't know how people reach agreement on a bribe, but I assumed that they didn't really sign a contract," says Shaw. "By that point we had already bought the company. When you buy a company you think you can control the future, and that might be doable. But you also inherit the past."

The situation led Shaw Kwei to two conclusions. First, that Goh likely wasn't dedicated to developing the healthy part of the business, preferring to focus on taking advantage of the customer networks. Second, that Beyonics suffered from poor corporate governance, with the board failing to have strict oversight of the CEO's behavior. Both issues could be addressed.

The PE firm introduced an enterprise resource planning (ERP) system - in order to integrate all facets of business operations, including planning, development, sales and marketing - and brought in accounting firm Deloitte to improve the accuracy of financial reporting and operational efficiency.

Integrated solutions

Shaw Kwei's other priority was consolidating and upgrading the existing manufacturing facilities. Previously, Beyonics had 12 different manufacturing locations spread across Indonesia, Singapore, Malaysia, Thailand and China. Each facility was small scale and it usually took 45-50 minutes to travel between locations within the same city.

Efforts are being made to shift to a network of concentrated facilities that offer multiple services and product solutions. For example, it recently moved into a new 320,000 square-feet integrated plant in Johor, Malaysia, which effectively does the job of five facilities in Malaysia and one in Indonesia. There are now only five locations in total - two in Malaysia, one in China and two in Singapore.

This will drop to four in 2017 with the merger of the two Singapore plants. Each large facility looks like a campus comprising several buildings that provide one-stop solutions ranging from plastic equipment making to aluminum die-casting. It means that customers - mainly automobile, medical and industrial industry players - have more choice. Integrated facilities also make it easier to expand and introduce technology upgrades.

"If you want to deal with automotive and medical companies, you need something that actually looks clean and sophisticated. You need something that says quality and precision. The decision was very simple. We needed to move into better, more presentable and more efficient facilities, in locations where we can hire people not for low-cost but for their brain power," says Shaw.

The GP opened the China facility in Changshu, a country under the jurisdiction of Suzhou, which has a strong reputation for manufacturing auto parts. The facilities in Singapore have also been well received and are perceived as being high quality, a key factor for automotive and healthcare industry clients.

Having written off substantial revenues by discontinuing the Seagate relationship, Beyonics has built up a portfolio of around 50 customers, including some Fortune 500 companies, across a diverse range of industries.

The combined size of the company's three core markets is estimated to be hundreds of billions of dollars globally. The automotive supplies market alone was worth EUR620 billion ($605 billion) in 2015, up from EUR515 billion in 2010, according to Statista, an independent data provider. Meanwhile, Transparency Market Research put the value of the global medical device outsourcing market at $21.1 billion in 2012 and expects it to reach $40.8 billion in 2018.

"One challenge for the business is that it is a long sales process, which can take one or two years," says Steve Manning, chief marketing officer at Beyonics. "We need our own employees to ensure we maintain focus on dealing with this long-term process, including customer identification, price quotation and qualification. For the medical and automotive players in particular, it takes even longer for them to approve the factory and qualification of process and parts."

That said, once partnerships are forged, they remain in place for up to 10 years. The company now generates about $300 million in annual revenue. Automotive parts and industrial component manufacturing each account for 40% of the total, with medical devices on 20%. Most of Beyonics' products are sold to Asian buyers, although they will end up in devices that might be exported overseas or used domestically.

Growth phrase

The company quickly paid down its debt and now carries no financial burden. Before Shaw Kwei bought Beyonics, operating margins were 1%, which explains why the business was operating at a net loss. Three years on, margins are up to 10% and with an increasing focus on higher-margin products they could reach as high as 15%.

"We have executed the transformation strategy as we mapped it out three years ago. That part is almost finished and we have some small follow-ups. The next challenge I'm looking at is growing the business, taking what we have done and focusing on getting more out of it in terms of expanding into new customers and products. That hasn't been the primary focus for the last three years," Shaw says.

Four months ago, Warren Buffet's Berkshire Hathaway agreed to buy US-based Precision Castparts, an equipment manufacturer for the aerospace and energy industries, in a deal that valued the business at $37 billion, including debt. Shaw Kwei envisages Beyonics becoming an Asian version of Precision Castparts by expanding its product lines, with several bolt-on acquisitions under consideration that would strengthen the company's presence in Southeast Asia and China.

One way or another, a trade sale appears to be the logical exit route, which would compete Beyonics' transformation from a relic of another era to an attractive niche player at the cutting edge of manufacturing.

"For operational value, you really need to look at the business as a complete system, including the factories, equipment and the people in place. There are also ERP and financial systems. When you start making changes to one thing, inevitably you have to make changes to other things as well," says Shaw. "It is just not possible to do a little bit, or to do half of it. You either all-in, or don't do it."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.