China-Taiwan M&A: Strait deals

For the past six years, capital has flowed relatively freely from Taiwan to China while deals going in the opposite direction have faced close regulatory scrutiny. Can wider economic realities redress the balance?

Tsinghua Unigroup has big ambitions: it wants to become the world's third-largest chipmaker. To achieve this goal, the Chinese company - whose state-owned parent is responsible for managing the commercial assets of Tsinghua University - has pledged to spend RMB300 billion ($47 billion) over the next five years.

Weiguo Zhao, chairman of Unigroup, outlined his objectives in a recent interview with Reuters, adding that another US-based acquisition could be on the way. The company's buying spree has so far been wide-ranging. It privatized US-listed Spreadtrum Communication in 2013 and then purchased a majority stake in Hewlett-Packard's China data networking business for $2.3 billion in May. Five months later there was a first foray into the US with the acquisition of a 15% stake in Western Digital (WD) for $3.78 billion.

WD is now said to be negotiating a possible takeover of chipmaker SanDisk Corp, competing for the deal with another chipmaker, Micron Technology. Earlier in the year, Unigroup reportedly offered $23 billion for Micron but the bid was rejected over US national security concerns. And then this month, it spotted a semiconductor target in Taiwan, agreeing to pay $600 million for 25% of Powertech Technology.

Not long after the deal was announced, Taiwan's Ministry of Economic Affairs (MOEA) reminded the two parties that it had yet to receive an investment application. The regulator said it would take Unigroup's global purchases as well as the potential impacts on Taiwan's semiconductor industry into consideration when examining the transaction.

Meanwhile, Unigroup called on the Taiwan government to further open up its semiconductor industry and openly expressed an interest in backing local player MediaTek. For its part, MediaTek said it is willing to join forces with Chinese peers to explore growth opportunities. This series of events highlights the potentially conflicting priorities of business and government - the former increasingly willing to reach out across the Taiwan Strait and the latter wary of the implications of doing so.

"It's a natural evolution of two markets. Over the past three decades, there has been more investment into China from Taiwan. Now the money will flow back into Taiwan," says Dennis Chiang, head of merchant banking in Taishin International Bank. "There will be a lot of interest from Chinese companies in select Taiwan industries that possess advanced technology, such as semiconductors and integrated circuits, and they will be supported by the Chinese government."

Red capital fears

The cross-strait dynamic so far has seen Taiwan, feeling threatened by China, block the so-called "red capital" flowing across its borders. Conversely, China opened the door to Taiwanese investment much earlier, recognizing that entrepreneurs could provide the capital and expertise it lacked.

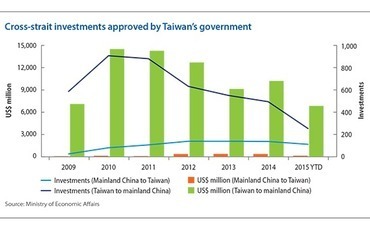

Since Taiwan opened its markets to Chinese capital in 2009, the Investment Commission, an agency under the MOEA, has approved inbound investment just over 700 investments worth a cumulative $1.3 billion. In recent years there has been a big step up in deal value. The total topped $300 million in 2012, 2013 and 2014, and if Unigroup's investment in Powertech goes through, the 2015 figure would be significantly larger.

As for deals in the other direction, the numbers are patchy - the peak years were 2010-2011 - but operate from a much higher base level. There have been nearly six times as many investments and, at $75.3 billion, the amount committed between 2009 and 2015 is approaching 60 times as large. A lot of this activity is likely driven by Taiwan investors engaging in M&A with Taiwan-owned companies in the mainland.

"I haven't seen any relaxation in the rules and regulations regarding mainland Chinese capital investing in Taiwan over the past few years. Every case is still under review by the regulator," says Sonia Sun, a partner KPMG Law Firm.

Taiwan has two different sets of rules for foreign and mainland Chinese investors. The former can invest in any industry apart from a limited number that appear on the so-called "negative list." These typically involve national security and environmental protection.

Chinese investors, meanwhile, can only invest in the industries on a dedicated "positive list," with everything else out of bounds. About 97% of Taiwan's manufacturing sector and 51% of services and infrastructure are currently open to mainland players. There is also a blanked restriction that prevents any Chinese-registered entity holding more than 30% of a Taiwan-listed company. Every investment must be approved by the Investment Commission.

In certain industries - typically those that are most sensitive, such as semiconductors, financial services and telecom - there are caps on foreign ownership. For example, Taiwan's semiconductor industry is the second-largest in the world and there are residual fears that the likes of Unigroup will try and steal it away. Therefore, Chinese investors can have exposure to testing and packaging, but not control; they can also take minority stakes in the integrated circuit segment, but not the design area.

The distinguishing factor is that much of testing and packaging is downstream work and the technology is less sophisticated than for integrated circuits. However, even in these lower risk areas, not every investment is approved, according to Janice Lin, a partner at law firm Tsar & Tsai.

Earlier this month, China chip tester Jiangsu Changjiang Electronics Technology (JCET) bought Stats ChipPac, the world's fourth-largest provider of chip packaging and testing player, from Temasek Holdings for $780 million. It is the largest-ever overseas acquisition by a Chinese semiconductor company.

Stats ChipPac is based in Singapore and has manufacturing sites in South Korea, China and Taiwan. The Taiwan subsidiary - in which the parent held a 52% stake - couldn't be part of the sale due to Chinese ownership restrictions. It was spun out instead.

There are also circumstances in which sensitivities over ownership trigger public discontent. Last weekend, Taiwan saw the first large-scale demonstration in its history as more than 3,000 employees of packager and tester Siliconware Precious Industries (SPIL) protested against what they see as an attempted hostile takeover by chipmaker Advanced Semiconductor Engineering (ASE). SPIL asked the government to re-examine the deal due to suspicions that ASE was using mainland Chinese capital to finance it.

"Whether it is Chinese investors coming to Taiwan, or vice versa, there are rules stating which sectors they can invest in and how much they can own. But sometimes it is difficult to predict because the regulators consider things on a case-by-case basis," says Jack Huang, a partner at Jones Day and chairman of the Taiwan Mergers & Acquisitions and Private Equity Council (MAPE).

This was also an issue in 2009 when Taiwan relaxed restrictions on its technology companies investing in the mainland. United Microelectronics Corp. (UMC) planned to take full ownership of a Chinese chip maker He Jian, but Taiwanese regulators refused to approve it.

Fears of "red capital" show no sign of abating, especially in the wake of the brouhaha that surrounded the still-to-be-ratified Cross-Strait Service Trade Agreement (CSSTA). Indeed, Unigroup's Zhao announced that his company would suspend plans to invest in Taiwan technology companies due to regulatory obstacles. Unigroup will rather focus on the US market.

"Unigroup has done it very properly. It isn't seeking to take over a Taiwan company, but acquire 25% through a mutual agreement. It also agreed to appoint only one person to the board," says Huang. "But Unigroup is so high-profile in its acquisitions. Sometimes a strong arm may work, pushing the Taiwan government to change mind. But equally it might not work. Then the investor has to bear the consequences."

PE firms have also been accused of acting as proxies for red capital. When MBK Partners announced this year it would sell cable TV provider China Network Systems (CNS) to Morgan Stanley Private Equity Asia (MSPEA) and Far EasTone Telecommunications, a Taiwanese legislator observed in parliament that sovereign wealth fund China Investment Corporation bought a stake in Morgan Stanley during the global financial crisis. He questioned whether China therefore had influence over MSPEA.

An earlier attempted sale of CNS to Want Want China Holdings was unable to proceed in part due to concerns about its founder's supposed pro-Beijing sympathies.

These situations often reflect a general discomfort with private equity involvement in certain sectors. In financial services, for example, regulators are highly selective as to what types of investors can participate. They don't welcome the private equity because they are afraid that the ultimate investors in these funds are hard to verify and could be backed by Chinese players, according to Tsar & Tsai's Lin.

"There are regulations but they give the authorities a fairly large degree of power to make their own interpretations. Even if you are perfectly legitimate it doesn't mean you will be able to invest - the MOEA reserves the right to have the final say," says C.Y Huang, president of FCC Partners and founding chairman of MAPE.

Economic realities

The political balance is further complicated by lobbying from Taiwanese corporations. MediaTek is not alone in suggesting that it would be in its long-term interests to work with Chinese investors, as opposed to keeping them out. There is a growing body of opinion that the government should open up industries or risk being marginalized and losing competitiveness.

"Ten years ago the foreign private equity came to Taiwan to make investments. It's the time for them to exit. China-based private equity firms could form a new wave of investors, alongside strategic players," says Taishin's Chiang. "That's going to be the trend. The private sector will keep pushing and the government will become more open-minded. It's a slow process."

Industry participants agree that there will be more M&A activity driven by Chinese investors among listed small and medium-sized enterprises in Taiwan. Companies with market capitalizations below $500 million from less sensitive industries such as food and beverage transportation, manufacturing, entertainment and lifestyle are expected to be the initial targets.

Another subset of companies, particularly those in the technology space, are keen to go private with a view to re-listing in mainland China. A group that is trading at less than a 10x price-to-earnings (P/E) multiple on the Taiwan bourse might be able to achieve twice or even five times that valuation in the mainland market.Private equity investors could play a role in this and perhaps even Chinese players as well, if they use offshore vehicles to work around the 30% ownership cap in the public markets.

Against this backdrop, the presidents of China and Taiwan, Xi Jinping and Ma Ying-Jeou, recently met in Singapore. Their public handshake represented the first formal interaction between the leaders of the two territories in 66 years, and fuelled speculation of a closer cross-strait bond.

However, the political reality is that Ma's Kuomintang will likely be replaced at next year's election by the more hard-line Democratic Progressive Party. The prospects for Chinese M&A in Taiwan under the new administration are unclear, and until then regulators will play it safe, carefully selecting investments that avoid controversy.

"I think people in the government have different priorities," says Paul Yang, chairman of CBID Capital. "They aren't necessarily going to make decisions based on what makes sense economically; it's more about what is popular. So I am not too optimistic about the market. But the cross-strait relationship is such a big part of the Taiwan economy now. Having strong ties with China and the US is a must for Taiwan."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.