3Q analysis: Dividing lines

China fundraising stays strong, across US dollar and renminbi, despite regulatory concerns; Australia confounds general slowdown in Asia PE investment; exits demonstrate promise if not results

1) Fundraising: Change in China

The cross-border affiliations that helped build China's venture capital industry are gradually being unpicked. Sequoia Capital's announcement in June of the formal separation of its China and US entities was followed by similar statements from GGV Capital and BlueRun Ventures China in September.

Separation means different things to different firms. For GGV, it involves splitting a single global operation in two, including a global fund. Sequoia must unwind shared global resources across investor relations and reporting, having already changed its name to HongShan. For BlueRun, which had existed separately from US-based BlueRun for several years, there is simply a rebrand to Lanchi Ventures.

A US executive order issued in August prohibiting outbound foreign investment in China that targets sensitive technologies such as semiconductors and microelectronics, quantum computing, and artificial intelligence (AI) is perceived as the trigger for these actions. That is likely the case for GGV.

The firm was one of several named in a Georgetown University report into US investment in Chinese AI companies and it then received a letter from a Congressional select committee asking for further details on its investments. Numerous industry participants have said they believe that striking a balance between likely US disclosure requirements and China's data security laws that preclude disclosure is impossible.

HongShan's situation was perhaps territorial as well as political. Sequoia's China and India entities are now independent, which removes potential disputes as to which team backs the Chinese entrepreneur pursuing a China-related business model in Southeast Asia. HongShan opened a Singapore office earlier this year and is reportedly planning broader geographic expansion.

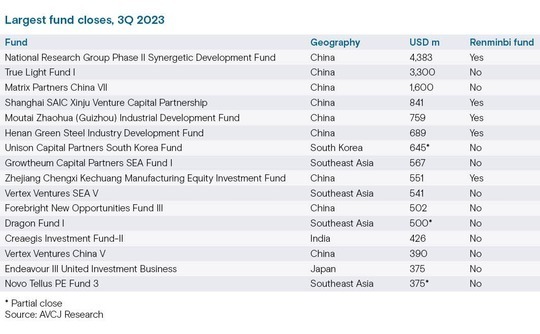

The US and China's conflicting technology agendas are one of several issues hindering commitments to Chinese VC funds by US investors. It remains to be seen how widespread separations become and how that impacts fundraising. The largest VC fund to close in the third quarter was raised by an affiliate of a US firm: Matrix Partners China secured USD 1.6bn for its seventh China fund.

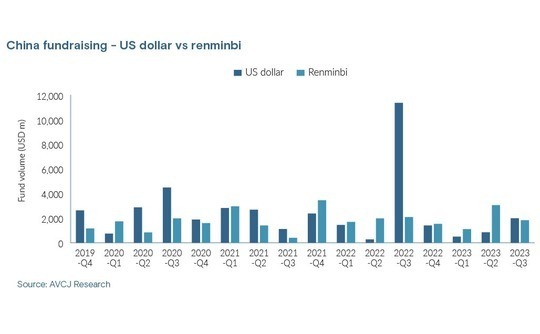

Across all strategies, renminbi fundraising outmatched US dollar by 2:1, once again emphasising how a local currency government guidance fund can move the needle. In this instance, it was the USD 4.3bn National Research Group Phase II Synergetic Development Fund.

China accounted for nine of the 15 largest funds to achieve a partial or final close during the quarter. Five – including four of the top six – are renminbi vehicles. On the US dollar side, Forebright Capital and Vertex Ventures China achieved final closes, alongside Matrix and Temasek Holdings' True Light Fund.

With the executive order contributing to an increasingly stark divide as to which assets are available to US dollar funds versus renminbi funds, an increase in renminbi fundraising is expected as managers look for ways to participate in areas like AI.

2) Investment: Australian uptick

TPG Capital made its first bid for Australia-listed funeral services provider Invocare in early March, walked away one month later after being rebuffed by the board, and then re-engaged in May with an improved offer. The private equity firm entered exclusive due diligence, which was extended several times, and a deal at an enterprise value of AUD 2.2bn (USD 1.4bn) was agreed in August.

Bain Capital's AUD 960m courtship of Estia Health was also a five-month endeavour, while fashion brand Zimmerman was put on the block early in the year and Advent International won out with an approximately USD 1bn unsolicited bid in August. KKR appointed an advisor to sell Australian Venue in September 2022, nearly offloaded it to BGH Capital in February, and eventually exited to PAG in August for AUD 1.4bn.

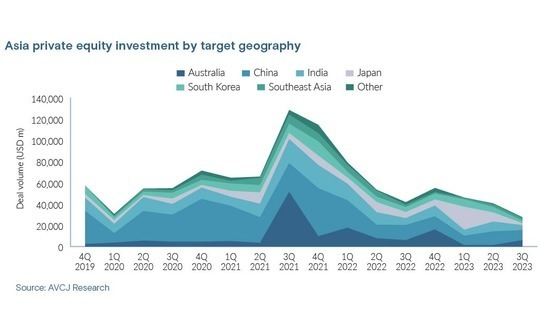

These four deals involving Australian assets feature in the seven largest announced Asia-wide in the third quarter of 2023. They offer snapshots of a local market that appears to be regaining its momentum following a post-pandemic period of inertia as uncertainty around business performance trajectories contributed to valuation volatility – a local market that appears to be at odds with the rest of the region.

Only three deals surpassed USD 1bn, down from six in each of the prior to quarters. China was once again poorly represented in the ranking of largest investments. It accounted for two of the top 10, much like the second quarter, but the number of Chinese entries slumped by half to just six.

Even though India struggled – deal flow fell from USD 9.2bn in the second quarter to USD 4.7bn in the third, its lowest three-month total in five years – there is reason for optimism. Reliance Retail is back in fundraising mode, securing USD 996m from Qatar Investment Authority (QIA) and USD 250m from KKR.

The company, which operates India's largest brick-and-mortar retail network and represents one pillar of an ambitious new commerce strategy pursued by Reliance Industries, previously raised USD 6.4bn from eight global investors in 2020. It appears to be gearing up for another mega round. A USD 597m commitment from Abu Dhabi Investment Authority fell just the wrong side of the quarterly cut-off.

3) Exits: More of the same

Trustar Capital spent nine years reorganising and recalibrating Moritex, so that the Japan-based manufacturer of machine vision lenses could tap into rising demand for semiconductor checking equipment. A 20x return was its reward. However, the identity of the buyer is worth noting. Moritex was sold to NASDAQ-listed Cognex Corporation for USD 275m.

International strategic buyers facilitated few trade sales in Asia during COVID-19 because travel restrictions hampered due diligence. Post-pandemic, activity has yet to fully rebound. It is therefore encouraging to see two deals involving US-based buyers – Moritex and Australia's Honan Insurance, which TA Associates offloaded to Marsh & McLennan – among the top 15 exits in the third quarter.

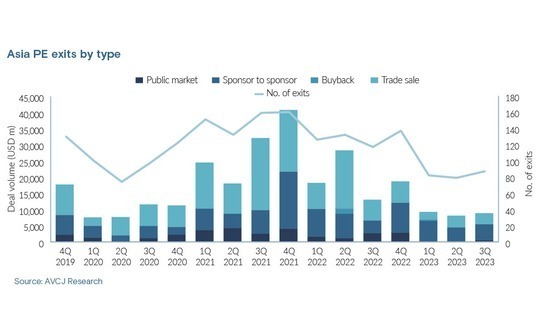

Otherwise, private equity exits for July-September represented more of the same. Announced transactions amounted to USD 8.9bn, a small increase on the second quarter, and sponsor-to-sponsor deals accounted for the bulk of capital put to work.

In addition to Zimmerman and Australian Venture in Australia, which enabled exits by Style Capital and KKR, TA Associates and The Longreach Group secured substantial paydays when BPEA EQT and Boyu Capital came in for Indira IVF Hospital and medical device manufacturer Quasar, respectively.

Second, KKR secured a debut Asian exit from its global impact fund with a 3.3x return when Ontario Teachers' Pension Plan (OTPP) took full ownership of carbon projects operator GreenCollar at a valuation of nearly AUD 800m (USD 509m). The company's workforce is also in line for a windfall having been the first Asia-based participants in KKR's employee ownership and engagement initiative.

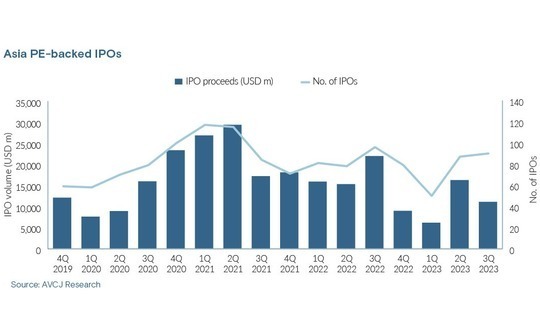

Proceeds from private equity-backed IPOs for the quarter came to USD 11.1bn, down from USD 16.3bn. It remains a mainland China-dominated story, but there were signs that the trickle of filings in Hong Kong are turning into offerings, albeit relatively small ones. Automotive after-sales service platform Tuhu and AI specialist 4Paradigm were among those that made it onto the Hong Kong bourse.

There could be more to come, however, with Cainiao Smart Logistics Group – Alibaba Group's logistics unit – confirming plans for what is likely to be a bumper Hong Kong IPO. Freshippo, operator of the Hemma technology-enabled grocery store chain is also expected to go public as part of Alibaba's broader operational restructuring, although it is unclear where.

Finally, Hong Kong saw the first successful merger by a special purpose acquisition company (SPAC) launched in territory. Aquila Acquisition Corp, which is sponsored by CMB International Asset Management, combined with Zhaogang, a private equity-backed Chinese B2B steel-trading platform, at a valuation of approximately HKD 10bn (USD 1.27bn).

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.