Emerging LPs: Fingers in every pie

As more institutional investors dip their toes into private equity for the first time, managers must understand their motivations. Frontier sovereign wealth funds are an enticing wildcard

Asian institutional investors have been historically underweight non-Asia and private equity. That's correcting slowing, but interest in the evolution is buoyed by the idea that even modest percentage-point shifts in portfolio construction can translate into significant absolute volumes. At the same time, new geographies and organizations appear to be coming into play with increasing regularity.

The overriding imperative is to improve returns through diversification into faster-growing markets and higher-performing asset classes, but there are myriad sub-themes.

In some jurisdictions, new regulations are opening doors for certain kinds of institutions. The advent of structured alternatives products combining principal protection, booster notes, and special discounts are expanding the universe of distribution channels.

Liquidity requirements are being reconsidered. The region's newly minted high net worth individuals (HNWIs) are beginning to reinvest back into the asset class that helped them earn their wealth.

Alexandre Schmitz, a Singapore-based placement agent, observes that while European LPs struggle to re-up in their best relationships due to issues such as the denominator effect, their Asian counterparts are poised to increase allocations.

"In Japan, for example, you have huge LPs that are established but new to alternatives, going from zero to 3% in private equity, which means they can put USD 25m-USD 30m in 20 new relationships, each," said Schmitz, who recently rebranded Capstone Partners' Asia business as an independent agent called A2Z Private Capital.

"In countries like Indonesia and India, you will also see the emergence of large pension funds to address evolving demographics. They will reach a certain sophistication and need to allocate to private equity. That might be tiny now, but in 20 years, it will be a significant opportunity for both Asian and Western GPs. It's a trend we cannot miss."

Sovereign investors in frontier markets might need all of 20 years to build the investment and governance infrastructure and develop the talent required to manage sophisticated programmes. However, arguably, they represent the most dramatic emergence of available institutional capital.

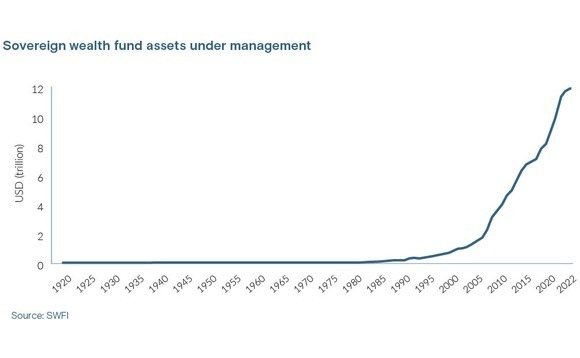

Global sovereign wealth fund (SWF) assets under management (AUM) didn't crack the USD 500m mark until 1970, according to the Sovereign Wealth Fund Institute (SWFI), whose data charts this figure back to the 1850s. Since then, SWF formation has gone into parabolic overdrive, with AUM crossing USD 11.8trn in 2023.

Sovereign investments in private equity jumped from about USD 3.3bn in 2019 to USD 9.3bn in 2020 and have since stabilised north of USD 7bn per annum. The question is how much of this can come to Asia.

Emerging to emerging

SWFI chairman Lakshmi Narayanan, who also represents two family offices, sees an opportunity for Asian managers to access this capital globally, but perhaps especially in terms of Indian GPs tapping like-minded developing economies.

He flagged Japan Investment Corporation as an example of a developed economy sovereign reaching outside national borders for the first time, as well as significant untapped opportunities in Africa and Latin America, especially Mexico and Brazil.

"I've seen people doing roadshows and they're repeatedly hitting the market [Latin America], which tells me they're raising money. If somebody is going four times a year for three years consistently, then something is happening," Narayanan said. "I've also seen a lot of Indian managers going to Canada. Canada, Africa, the Middle East – they understand the Indian ecosystem."

The African opportunity was evidenced last year, when Nigeria Sovereign Investment Authority (NSIA) made its first pan-Asia fund commitment, backing a Hong Kong-based private equity fund-of-funds. That built on some minor Japan exposure that was part of the SWF's developed markets strategy.

Uche Orji, who built NSIA from scratch starting in 2012 and oversaw its Asia investments, understood the region's growth drivers, having previously served as global head of semiconductor research at UBS.

"It has always been a market we wanted exposure to," said Orji, who as of January has moved on to head his own Europe-focused GP Titangate Capital. "I still think regardless of the challenges China is going through now, there's just a skills base and consumption base there that will continue to drive the best returns in Asia."

"One of my observations – especially in emerging markets and Asia is no exception – is that first funds, rightly timed, tend to do extremely well. In the second and third funds, the returns start to normalise, and so it's almost a bizarre psychology in private equity," Orji said.

"It takes a lot of effort to convince people on your board to take first-time risk on a new manager. Naturally, some people don't do it at all, but we did within certain risk limits, the argument being, it's one way to earn really outsized returns."

The globalisation of frontier sovereigns with empathy for developing Asia appears to be a discrete theme, at least anecdotally. As recently as June, Qazaqstan Investment Corporation (QIC), a historically infrastructure-minded investor, doubled down on its Southeast Asian start-up exposure with support for the latest fund from healthcare-focused TVM Capital, which is targeting USD 200m.

QIC, previously known as Kazyna Capital Management (KCM), was established in 2007 to develop PE infrastructure in Kazakhstan and promote the national economy by attracting foreign investment and expertise in priority sectors. It claims KZT 230bn (USD 513m) in assets, including a wholly-owned GP called BV Management. QIC has also described itself as a private equity fund-of-funds,

Last year, QIC made a USD 10m LP commitment to the second fund from Singapore's Quest Ventures, a diversified technology investor. However, the core Asia Pacific exposure remains CITIC Kazyna, a fund focused on China's Belt & Road infrastructure initiative set up in 2010 in partnership with CITIC Group.

"Due to economic and political reasons, the Asian market looks more and more compelling. China's economic recovery after the COVID epidemic appears to be very impressive. Kazakhstan and China's cooperation goes way back in decades," said QIC CEO Ainur Kuatova.

She added that QIC "will sign agreements with several organizations working in the fields of healthcare and power generation" at the third Belt & Road Forum for International Cooperation in Beijing in October. Southeast Asia is viewed as a neighbouring opportunity set, fuelled by similar themes around industrialisation, export-led growth, foreign direct investment, and a rising middle class.

"Asia Pacific region demonstrates long-term growth potential, with many factors, such as the favourable demographics and constantly evolving economic landscape which makes the region favourable to invest for growth potential and technology transfer," Kuatova said.

Building best practices

Strategic alignment is a key consideration when approaching investors in this vein. Opportunity sharing and synergies are crucial areas in terms of establishing comfort. For GPs, offering co-invest opportunities via side letters is viable as an initial approach.

The starting point is understanding that emerging sovereigns often want to borrow against assets, which pushes them towards public equities where value is clearly visible. Secondaries can play this role in private markets because there's no j-curve and there is enough liquidity around certain positions to facilitate borrowing. They might use fund-of-funds and gatekeepers to do this.

Meanwhile, they continue to multiply. In July, the Philippines launched the Maharlika Investment Fund (MIF), which is expected to have initial firepower of around USD 1bn. Senior management is likely to be appointed within the year.

There is significant risk in such undertakings, however. The Philippines, unlike resource-rich Nigeria, will rely on multinational counterparties such as development finance institutions to build up MIF's coffers. Governance will be their primary concern.

The most dramatic warning on this front is possibly Malaysia's 1MDB fund, which was launched in 2009 as a means of attracting foreign direct investment and went on to lose an estimated USD 10bn via various channels. Opaque processes and political leadership were key problems; Najib Razak, the former prime minister, was arrested earlier this month on charges of embezzling billions of dollars.

"MIF has promised a lot of things to a lot of people that simply are not going to be possible. They're going to have to make some decisions, and that goes back to what the board looks like and what will be its objectives," said Bob Herrera-Lim, a political risk analyst at business and investment consultant Teneo.

"What they are selling is that they will have the beneficial, stabilizing effect of a Temasek or a GIC, but that's difficult to accomplish. If you're an external party coming in, you cannot assume, ‘This is a sovereign institution, so they will do the right thing.' There are a lot of vulnerabilities in terms of corruption, short-term thinking, mismanagement, and the quality of management."

Herrera-Lim noted that there is additional risk in the possibility of emerging sovereigns competing against the private sector, targeting the same industries and sectors but with lower costs and less shareholder oversight. He sees the Indonesia Investment Authority (INA), launched in 2021, as still shrouded in unknowns but relatively better designed and conceptualised, at least initially, than MIF.

INA was announced last year as part of a package of reforms intended to attract foreign investors to Indonesia. It raised USD 10bn in initial external funding from an array of investors, including Caisse de dépôt et placement du Québec (CDPQ) and the US International Development Finance Corporation. The government is expected to provide up to USD 6bn in seed capital.

Herrara-Lim observed that INA has more clearly defined investment goals and leadership than MIF. For example, it immediately engaged Stefanus Hadiwidjaja, who spent eight years leading deals for regional private equity firm Creador, as CEO. Hadiwidjaja said his background in PE has been invaluable in terms of deal structuring, understanding sectors, and portfolio operations.

"Undertaking thorough due diligence is pivotal, and knowing where to deep dive across various areas, from financial and commercial to legal and ESG, is crucial," Hadiwidjaja explained.

"Strategic thinking, in our view, is the ability to assure optimal risk-adjusted returns for an investment, whilst concurrently seeking the right smart capital to partner with us. Moreover, finding the appropriate investment model and structure that will enable value creation and support the development of a sector, extending beyond the asset we invested in, is vital to our approach."

INA aims to make robust anchor investments in traditional sectors while proactively exploring and integrating into future-oriented categories. Its activity in infrastructure offers a case in point, gradually carrying the firm closer to private equity and venture capital.

To date, this includes establishing a data centre platform with sector specialist GDS and forming an electric vehicle fund with Chinese battery giant CATL. More traditional fund commitments have yet to materialise but are roundly seen as inevitable.

"It is crucial to note that all these investments maintain inherent characteristics typical of infrastructure: stable cashflow, long-dated contracts in certain assets, minimal correlation to other asset classes, and high barriers to entry," Hadiwidjaja added.

"We navigate through investments in both hard infrastructure and digital, new-tech infrastructure. Our investment lens also expands beyond the infrastructure asset class, venturing into private equity, debt asset classes, real estate, and more."

Know your target

It is important to note, however, that government-linked investors – including state-owned pension funds – remain relatively minor players in the broader theme of emerging LPs.

The bulk of capital flows are coming from family offices and wealth management platforms investing on behalf of HNWIs. As with the sovereigns, there will be some element of advice or intermediation, especially when targeting markets that are distant or not readily accessible. Separately managed accounts (SMAs) and semi-liquid structures feature prominently.

Established allocators will be essential go-betweens as more new entrants come into the asset class. There appears to be a general understanding that picking the right partners comes down to resources and data about counterparties, which requires guidance. This includes technical support with executing secondary transactions, which many LPs describe as surprisingly difficult.

"In this tougher fundraising environment, managers are reaching out to institutions and private clients but sometimes they may not be ready yet to invest with the manager," said Audrey The, a Singapore-based managing director at Cambridge Associates.

"If a client of ours is not ready for a particular manager, we would still encourage that GP to continue meeting with us, so we can get to know them and understand how their portfolio companies evolve over time. That's what we do – monitoring and diligencing managers over time to help our clients build tailored, diversified portfolios, by including established and emerging managers."

In some instances, emerging LPs such as endowments have come to Cambridge looking to build more direct relationships with managers. This is an indicator that such matchmaking has a significant strategic component – in addition to financial objectives – and that there is a desire to have control over that strategy.

Strategy can be imposed externally. Regulatory and public pressure to improve environmental, social, and governance (ESG) credentials, including involvement in impact agendas, can drive emerging LPs to private markets.

This can be especially relevant for insurance companies with immediate ESG-related risks. There is also a sense that no one wants to be left behind in an era of rapidly developing technology – a theme that appears particularly resonant in frontier markets.

"Hong Kong, Singapore, Bangkok, Kuala Lumpur, Tokyo, Melbourne – everybody is trying to make a Silicon Valley at home, and they're using private markets to do it," said Juan Delgado-Moreira, Hamilton Lane's Hong Kong-based co-CEO designate.

"Many national insurers, pensions, and government funds want to invest in establishing their local Silicon Valley, and investors can look to tap into this agenda."

Delgado-Moreira expects an explosion in the number of evergreen funds in the near term and estimates up to 20% of his firm's clients are newcomers to private equity.

"Despite macro headwinds and issues around deglobalization, Asia-based financial institutions are very long on private markets because they're still building to fundamental long-term targets, and they're taking full advantage of the newer structures in alternatives," he added.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.