ESG backlash: Turbulent tailwinds

The strong momentum behind sustainable and responsible investment policies globally has begun to ruffle feathers in the US. Asian private equity should recognise this as a relevant warning

The ongoing backlash against so-called woke capitalism in the US signals a step change in the way private equity is motivated to think about environmental, social, and governance (ESG) investing strategy. And it's of global significance.

The industry's first experience with ESG revolved around meeting compliance regulations and appeasing LP demands. Gradually, ESG achieved wider recognition as part of an operational and due diligence toolkit with financial benefits. Now, it has finally become clear that such work is part of a much broader stakeholder engagement imperative.

Yet in 2023 alone, there have been 165 anti-ESG bills floated in 37 US states. These are mostly boycotts against investment strategies that shun local industries (typically fossil fuels) or proposals to bar state-connected funds from backing investments considered ideological (including managers touting ESG playbooks).

It has not been a legislative success. Only 28 provisions, 17% of the bills proposed, were approved in 14 states. But sentiment around the phenomenon reveals that in the realpolitik of perceptions, ESG is more than just a responsible investing toolkit. Much of the attention has focused on Texas, where a blacklist of 11 global investors deemed to be boycotting fossil fuels was established.

The biggest lightning rod in private equity has been BlackRock, which as a result of the boycott list was sold down by the state's largest pension fund, Teacher Retirement System of Texas (TRS). All in, the politicisation of ESG in the US cost BlackRock USD 4bn in 2022, an admittedly fractional slice of a record USD 400bn year, but according to CEO and chairman Larry Fink, due to "90% misinformation."

Some rudimentary vocabulary tracking by The Conference Board helps chart how, in some ways, the anti-ESG camp is beginning to control the narrative. Fink used the words "ESG," "climate," "sustainability," and "purpose" 32 times in his annual CEO letter in 2020. That number fell to 26 in 2021, 16 in 2022, and only four in 2023.

"I'm not blaming one side or the other, but it has been totally weaponised," Fink told David Rubinstein, co-founder of The Carlyle Group, in an oft-quoted interview at the Aspen Ideas Festival in June. "In my last CEO letter, the phrase ESG was not uttered once, because it's been unfortunately politicised and weaponised."

Fallout for Asia?

The prevailing wisdom is that the anti-ESG eruption is a uniquely American animal and therefore contained. The culture wars around woke capital, red state-blue state divides, and states-versus-federal jurisdictional friction will not play out in Asia. Some high-profile firms will be singled out in a temporary political firestorm, while the rest of the industry gets about its business.

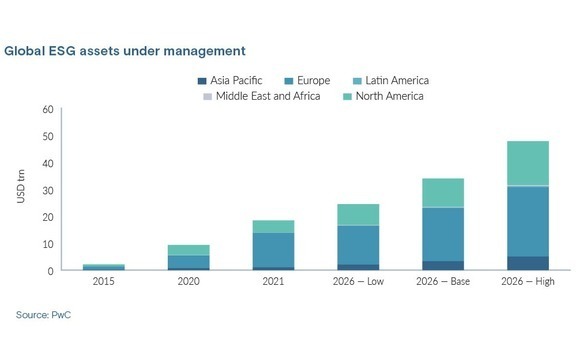

It's easy to support this view in numbers. In parallel to the 83% failure rate of anti-ESG bills in the US, uptake of ESG principles and strategies continues unabated in the US and abroad. Global ESG assets under management have grown from USD 9.4trn in 2020 to USD 18.4trn in 2021 and could reach as high as USD 47.6trn by 2026, according to PwC.

Nevertheless, there is some potential for an anti-ESG contagion effect in the idea that the US episode was in part triggered by macro malaise. To some extent, this has inspired companies to push back on federal ESG standards and reporting proposals in recent months. Investors already committed to ESG will not be swayed in this environment, but those still on the fence will stay there.

Perhaps more pressing is the idea that the macro uncertainty already pinching US money into developing markets could be exacerbated, especially if anti-ESG sentiment hardens at the federal level following next year's presidential election. Could US LPs become more reluctant to take on Asia risk if the ESG policies of funds in the region cause them political headaches back home?

"I don't think that's prominent, but we have heard of some LPs that have found it more challenging lately from a legal perspective," said one pan-Asia manager with several US LPs, mostly in states untouched by anti-ESG legislative action.

"When talking to LPs in a state where ESG legislation is under consideration, it's important to know who is pro and who is anti-ESG and to either highlight or not highlight particular things. We have to cater to these people who are either on the far left or far right and how they're using the term."

It's also feasible that ESG could indeed become a toxic issue in Asia if lessons are not learned from the US.

This was evidenced as recently as last April when the EU approved a law banning foodstuff imports grown on any land deforested after 2020. Malaysia called the law a "deliberate effort to increase costs and erect barriers to the entry of Malaysia's palm oil into the EU" that would adversely impact 450,000 smallholder farmers.

Steven Okun, CEO of Singapore-based APAC Advisors and a former US government official in the Clinton administration, believes this reflects the typically negative correlation between the E and S in ESG. The drive toward net zero emissions, for example, can come at a social cost in terms of lost jobs or higher energy costs. This is the root of the politicisation in the US, albeit amplified by local cultural issues.

"You have to understand the consequences beyond the benefits that come with actions to improve the E, and that's true everywhere. Often, actions taken to limit environmental impact have a corresponding inverse social impact. It's not just in the US," Okun said.

"While the hyper-partisanship in the US drives some of the ESG blowback there, which is not an issue sitting in Asia, focusing on the E and ignoring the S can resort in political blowback anywhere – which is completely understandable."

Engagement issues

GPs bringing concepts such as net zero to their portfolio companies and therefore the broader stakeholder groups around those businesses must acknowledge the E-S trade-off and commit to being part of the solution. At the LP level, it cannot just be about divestment of certain industries or carbon offsets. Investors in both cases will need to engage actively with governments to minimize backlash.

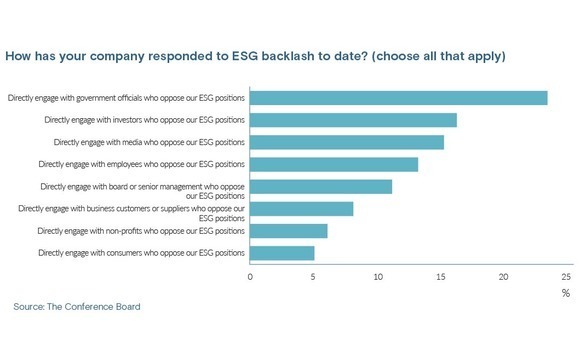

There's not a lot of evidence that this is happening. In a survey on topics related to the ESG backlash in the US, The Conference Board found that only 23% of companies responded to government officials that objected to their ESG positions. This figure was as low as 5% when everyday consumers objected to companies' ESG positions.

Financial institutions in the country are already recognised as having the strictest ESG requirements in the region. Has social pressure related to the country's recent climate-related shocks influenced the way they talk about ESG?

"Not really. Australia is often a place of extremes, but sadly, the impact of climate change is global. It's a wake-up call for everyone, not just Australia," said Stephen Whatmore, head of private equity at Queensland Investment Corporation (QIC), a sovereign wealth fund.

"We're finding that the increasing focus on ESG frameworks and sustainability in Europe is really pushing the PE market along. We see that as a strong secular theme."

Anti-ESG sentiment in the US could also disseminate overseas if it reduces pressure on global corporates to set an example. While the focus of the backlash has been on corporate activity within the US, most of the environmental and social problems being targeted by investor ESG policies are in those companies' overseas supply chains.

The idea is that a softening of ESG rhetoric – even if policies remain in place – can stymie uptake of best practices over time. Following BlackRock's lead, many investors and companies now prefer terms such as "responsible investment," "sustainability," or variations on "downside protection with value-add," and there's nothing wrong with that. However, it is feared that refined language will lead to reduced urgency.

Marti Flacks, director of the human rights initiative at the Center for Strategic & International Studies (CSIS) in Washington, sees shifting rhetoric as a danger to the continued improvement in managing social indicators, which already suffer from challenges around measurement and data reliability.

"If investors take the gas off efforts to address human rights risks in supply chains, you are going to see negative effects all around the world. It's going to undermine efforts that have really been strengthened in recent years to combat a lot of human rights abuse, whether its forced labour, child labour, health and safety at work, displacement of communities, or attacks on human rights activists," Flacks said.

"When the leaders on these issues are suddenly quieter about that, it puts less pressure on other companies in that sector to follow suit and keep up with competitors. It slows down the momentum we've seen for companies tackling these issues."

Crafting a narrative

For many investors, the supply chain hygiene point speaks most directly to the Asia-specific case for ESG, especially in developing markets. Southeast Asia-focused Navis Capital Partners, for example, has made this core to its playbook: clean up Asian businesses with an ESG lens to the point where they are attractive to global buyers.

As anti-ESG rumblings have amplified in the US, Navis has expanded its ESG team from five to six and a seventh is currently being sourced. This has coincided with a ramp-up in regional compliance regulation. In Singapore, ESG disclosures are now mandatory for non-listed companies. In Malaysia, a strict new ESG framework has made, for example, unlicensed palm oil facilities punishable by two years in prison.

"In the past few years, customers of our portfolio companies are demanding sustainability, and they're willing to pay for it. That includes the consumers on the streets and business customers at the B2B level. So, you have to serve sustainable products and reduce your carbon footprint," said Navis COO Michael Octoman.

It's worth noting that at least two of Navis' last three flagship funds have been backed by Employees Retirement System of Texas (ERS), which is in theory required to divest BlackRock among 10 other global managers. Navis is well under the radar of such power plays, however, and even if the firm approaches ERS at the time of its next fundraise, there would be no need to address ESG with any special sensitivity.

"I don't think the narrative would be any different," Octoman said. "We wouldn't calibrate or put a clutch on it because it's very good business practice for us in Southeast Asia in exiting businesses and making sure our LPs can sleep at night that their brand will not get tarnished."

The comments are a good example of the COO perspective: ESG is about material factors that impact financial performance. Still, there is often an instinct among investors and companies to talk about these benefits in conjunction with the broader, non-financial wins for the environment and society. That instinct may have to be put on pause for now.

In an environment where engaging sceptics is more common – or at least more delicate – it has sometimes become necessary to eliminate all reference to positive non-company outcomes. Any talk of incidental benefits to the environment or society could be construed as red flags by stakeholders wary of moral posturing and political agendas in investment.

Most investors mention both – financial performance improvements and broader non-company benefits. In some cases, this may no longer be tactical.

If the plan is to get rid of single-use plastics, show only that it saves costs, increases customer satisfaction, and gets ahead of coming regulation. If the inclusion policy is to get more women on boards, just demonstrate that it leads to better decision-making because it facilitates a fuller understanding of the customer base.

"If you don't want to say ‘ESG' anymore, don't say it. But you still need to know your material factors and understand how they impact financial performance and say this is the only reason you have this policy," Okun said.

"Keep the basis for ESG financial, and not as a means to drive a political agenda, and you'll be able to have a better conversation with stakeholders sceptical about ESG about what you're doing."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.