Portfolio: Gaja Capital and India's Educational Initiatives

Educational Initiatives was not part of India’s pandemic-driven ed-tech explosion. The PE-owned company emerged from the chaos having reaffirmed its sustainable, school-facing business model

The Indian government's imposition of pandemic-related lockdown measures in March 2020 led to the closure of the country's approximately 1.5m schools and the suspension of in-person classes for the best part of two years. Educational Initiatives (EI), a technology-enabled assessment and adaptive learning company, responded by making its software platform free to access for three months.

It was a bold move. EI recognised that schools were hurting, especially in the private sector, with parents failing to make payments because household incomes were strained. But schools were also EI's primary source of revenue. The desire to be a good partner involved tapping its own balance sheet to cover operating costs – and no one really knew how long COVID-19 would last.

"We weren't betting on COVID finishing quickly, only on schools getting their act together and delivering online learning," counters Gopal Jain, a managing partner at Gaja Capital, which bought a majority stake in EI in 2018.

"Schools were completely unprepared, but we assumed that once they moved from offline to online, they would come back and start paying us. And nearly all of them did. The problems EI addresses are fundamental in nature. Online or offline, schools need assessments and personalised learning."

Still, the prolonged period without in-person classes – for a company that entwines its products with the school curriculum and designs them to complement the classroom experience – presented challenges. Pranav Kothari, EI's CEO, recalls curtailing new hires and downsizing office space.

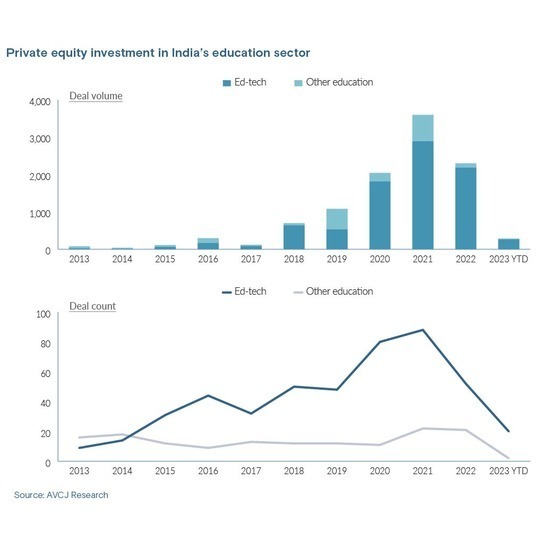

Meanwhile, consumer-facing education technology was on a roll. Reliance Jio triggered the surge several years earlier by bringing affordable 4G services to the mass market. The pandemic took it to another level. Homebound Indians turned to digital consumption in their droves, enabling a cluster of afterschool tuition platforms to position themselves as the default solution for continuity of learning.

Private equity was only too willing to ride the wave. Investment in India's education sector surpassed USD 1bn for the first time in 2019, according to AVCJ Research. Over the next three years, nearly USD 8bn was put to work, with ed-tech accounting for more than four-fifths. Byju's raised USD 1bn in 2022 alone, hitting a valuation of USD 22bn. Unacademy and Vedantu also achieved unicorn status.

EI rode out the storm, retaining key talent and managing to maintain investment in technology. The company doubled the size of its field sales team once schools reopened and it is seeing compound annual revenue growth of 40%. Jain describes EI as "arguably the only profitable, high-growth ed-tech company in India today." Kothari credits Gaja for its support during a difficult period.

"When the ed-tech boom was happening, it was tough," he said. "We flirted with B2C, but TAC [traffic acquisition cost] was 3x ARPU [average revenue per user], so it didn't make sense. We conserved capital, rather than throw it at Google and Facebook ads, and we doubled down on what we knew best: improving the product and selling more internationally. It was all about riding out the bottom in 2021."

Virtuous circle

Gaja, for its part, has always avoided business models underpinned by cheap capital. The mid-market GP typically invests once the early-stage risk has dissipated and unit economics are relatively strong – EI, for example, has a 90% gross profit margin. Customer acquisition costs are a key consideration.

"If you are willing to spend insane amounts of money on marketing, you can literally sell a refrigerator to an Eskimo," Jain explained. "Aggressive marketing in education is a strict no-no for us."

This philosophy has shaped one of Indian private equity's deepest track records in education. Since 2007, Gaja has backed the likes of test preparation specialist CL Educate, youth sports platform SportzVillange, and preschool education provider EuroKids International. The latter was sold to KKR for a 5x return in 2020 following a strategic repositioning and several bolt-on acquisitions.

The basic thesis for the sector hinges on the commercial potential of India's K-12 population, which was the world's largest at 265m as of 2022, according to the Ministry of Education. Market researcher IMARC Group projects that the K-12 segment will be worth USD 87.3bn by 2028, up from USD 43.5bn in 2022. Over the same period, the broader online education industry will rise from USD 6.4bn to USD 14.1bn.

From there, the classic pain points Gaja seeks to address through its investments are access and effectiveness. In this context, the importance of assessment and personalised learning is clear: parents want to know whether children are making progress and what might be done to fully realise potential.

EuroKids played a role in the EI sourcing process, and not only as evidence of Gaja's buyout bone fides. It was one of several portfolio companies that used Asset and Mindspark, EI's flagship software products for assessment and personalised learning, respectively. "We like to discover companies as a customer first," Jain observed. "We often find that one investment leads to another."

Convincing the founders to sell took about three years. There were three of them, Indian Institute of Management graduates who ran a school together for several years in the late 1990s and went into business together in 2001. Gaja paid about USD 25m to take out two of the founders and a string of angel investors. The third, Sridhar Rajagopalan, remained; he currently serves as chief learning officer.

The essence of the private equity firm's pitch was: You are an accomplished data science company, but you need to invest in the product; and your business has largely grown through word-of-mouth, you need to build a sales engine. Kothari, who had joined six years earlier after a stint at BCG and an MBA at Harvard University, recognised the merits of Gaja's proposal.

"The founders were high-quality individuals, but they were conservative, and EI was run in a bootstrapped way. The company was consistently profitable; the downside was slow growth. Unless they knew something would be profitable, the founders wouldn't invest talent and sales and marketing," he said. "Bringing in an external investor de-risked them and allowed the company to invest."

Origin story

More than anything else, EI was born of frustration at what the founders regarded as a K-12 education system compromised through learning by rote. Facts, figures, and procedures would be memorised, but whenever a pupil was asked a question designed to check conceptual clarity, they came up short.

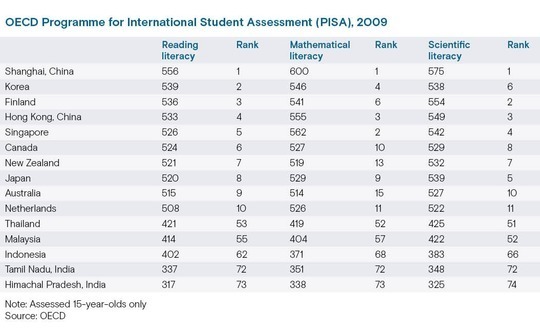

It is most apparent in the secondary school exit examinations that determine whether a student can continue the path to university. Kothari observed that the likes of Hong Kong, Singapore, Finland, and Japan have effective checks for understanding in their exams. India, however, does not.

"India's exam has questions such as ‘Who were the parents of Mussolini?' This is useless information, but the question setter thought it would be a tough one and could defend themselves by saying it's in the textbook," he explained. "Another one is ‘What is the weight of the pituitary gland? The more important question to ask would be, ‘What is the function of the gland?'"

Authoritative comparative evidence is thin on the ground. Every three years, the Organisation for Economic Cooperation & Development's (OECD) Programme for International Student Assessment (PISA) samples 15-year-olds to assess their ability to use reading, maths, and science knowledge to address real-life challenges. Questions focus on understanding rather than recollection of facts.

Tamil Nadu and Himachal Pradesh – two Indian states that are not necessarily reflective of the broader population – took part in 2009. They finished in the bottom three out of 74 participants, alongside Kyrgyzstan. "Memorisation without understanding is not a good 21st-century skill," Kothari added.

Mindspark came next in 2007, developed in response to research that found an alarming number of misconceptions in student knowledge. The idea is students can learn more efficiently if they receive instantaneous feedback on performance that is customised to rectify common mistakes.

Asset is relatively light touch; a school might use it several times a year for each subject. Mindspark and Cares – a full suite of assessment, reporting, and evaluation materials introduced in 2011 – are built into the school day. Students use Mindspark 70 minutes per week on average. Kothari's best-case scenario is 180 minutes per week: two 60-minute classroom sessions plus regular 20-minute refreshers at home.

In private schools, the product sells for USD 50 per student per year, which amounts to less than 2% of the typical school budget. Pricing is as low as USD 5 per student in state-run schools, with the private sector making up the difference. EI has partnerships with charitable foundations and local companies that are required to channel a portion of annual profit into corporate social responsibility programmes.

Within India, state-run schools make up three-quarters of the user base and contribute 50% of EI's revenue. The company has separate sales and content teams for private and state-run schools – reflecting the contrasting practical needs as well as the differing economics.

"In a private school, a teacher starts with additional fractions on Monday, activates the module on Mindspark and off they go. On Tuesday, the teacher establishes that the class needs to focus on the subtraction of fractions. That happens on Wednesday and on Thursday, they do Mindspark again," said Kothari.

"If you walk in unannounced to a public [state-run] school, there is a one in four chance you find a teacher in the classroom. Our product goes into autopilot mode, taking the child along a structured learning path. A grade-seven child might do grade-four maths because that's what they need to do."

Broader scope

Gaja's initial steps included the augmentation of EI's management team and upgrades to internal systems and processes. Beyond that, it emphasised product development and international expansion.

"Thanks to the digital revolution, customers expect a very different UI and UX, so we had to become omnichannel. We are now available in every subject and every grade and across 11 languages. And we have a sales presence in 70 cities," said Jain.

"When we invested, international revenue was basically zero and the company was looking at an India TAM [total addressable market]. Now, 20% of EI's revenue comes from outside of India and we are looking at a global TAM. We want to be a best-in-class product serving a global user base."

More than 1m students use Asset every year and around one-fifth of them are based in the Middle East. Mindspark gets 500,000 logins every day from users spread across five countries. The Middle East is the key expansion market, but EI also has a growing presence in South Africa and is eyeing other markets in the African continent. A handful of schools in Singapore and Japan make up the numbers.

EI's products have undergone multiple independent evaluations by consultancies such as IDinsight and Gray Matters which found an improvement in learning outcomes. However, development doesn't stop there, with the company looking to build on its previous experiences with machine learning to explore generative artificial intelligence (AI) as popularised by ChatGPT.

"GPT-4 is a LLM [large language model], so we have incorporated it into our main English product. There are guardrails, which means it is prompt-engineered and doesn't hallucinate. It allows children to build their own story and get quick feedback on the writing," said Kothari.

"When it comes to maths and science, GPT-4 does hallucinate. If you ask what is five plus seven, GPT-4 looks at text containing five and seven and identifies the probabilistic work that comes next. There is no computing. A calculator can do that, GPT-4 cannot."

This willingness to continue engaging with technology underpins much of EI's growth trajectory – which Gaja hopes will see the international share of revenue hit 40% as the company establishes itself as a top 10 player globally by revenue as well as by number of users. Jain noted that he typically holds assets for 6-7 years and is in no hurry to exit this one.

New paradigm

Yet EI's relationship with technology is not straightforward. The company's penetration rate is only about 2%, despite more than two decades of history and a lack of meaningful like-for-like competitors. According to Kothari, schools remain infatuated with smart boards, audiovisual classrooms, and playgrounds – anything they can show off to parents who don't deliberate over pedagogy.

His post-pandemic business trips have been informative. Schools went from rejecting the role of technology in education to being forced to accept ugly comprises during lockdowns – Zoom calls in which teachers would lecture, students would resolutely keep their cameras switched off – to a kneejerk revulsion of all-things-technology and a call for paper-based solutions.

It is a temporary phenomenon. There is an abiding sense of "not why tech, but which tech" as schools accept that students will eke out screen time regardless, so perhaps it is better that they provide the content. EI hopes this will create more traction for its classroom-friendly products that straddle physical and virtual worlds. For Jain, it is a reminder of how COVID-19 has plotted a new industry trajectory.

"COVID left behind a greater realisation of learning loss. If you are an educator, a parent, or a student, the first thing you need is assessment at a very granular level – what you know well, where you are missing out," he said. "In this way, technology is an education enabler. It improves access and effectiveness but cannot become an end in itself. Every student deserves a coach; EI aims to be that coach."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.