GP profile: Quona Capital

Financial innovation-focused Quona Capital operates across global developing markets with a compact team and a strict returns-focused impact agenda. Asia dominates the growth narrative

As US-headquartered early-stage impact and financial technology investor Quona Capital enters its 10th year, it is expanding an Asia presence that has historically taken up almost half the business. Even ex-China, the region is seen as the ripest target for impact. Digitalisation is accelerating faster than in the rest of the developing world, ushering in recently unthinkable business models.

Asia and Latin America each typically account for 35%-40% of the portfolio, while Africa is about 20%-25%. Within Asia, India and Indonesia are core, but there is increasing interest in going deeper in Southeast Asia. Several fintech themes that have worked in India are expected to play out in the subregion in the coming years, despite the likelihood it could take the brunt of a global downturn.

The Asia team is currently four-strong with two junior-level hires expected to be finalised in the short term. Quona co-founder Ganesh Rengaswamy, who heads the Asia strategy, has decamped from India to Singapore to lead the effort. He describes an India-ASEAN region where countries and consumers are learning about digital infrastructure from each other as overall disposal incomes rise.

"I have not been to a bank branch since 2010. In India, I have not carried cash since 2018 – zero. I can buy a banana for USD 0.10 using Paytm, PhonePe, or Google Pay. When I do a large-ticket transaction, I just open my mobile banking app and do it," Rengaswamy said.

"Business models are changing and evolving dramatically. We are seeing more geographically integrated models, not just sectorially integrated models, because we talk to a lot of regulators and we realise they're talking to each other, way more than we know. The equivalent of India's UPI [the government's unified payments interface] is being built in multiple countries right now."

Fintech momentum

The momentum comes on the back of Quona closing its third flagship fund last November on USD 332m, beating a target of USD 250m. The milestone was part of a step change that saw the team expand its ranks in order to double down on a high-touch investment strategy in a broadening portfolio.

Globally, the team now numbers about 30, including seven partners, and it oversees a portfolio of about 75 companies and assets under management (AUM) of about USD 750m. Most significantly in Asia, as of the launch of the latest fund, Varun Malhotra, an associate in the founding team, was elevated to partner to co-lead Asia as its constituent opportunity sets appear to gel.

"A lot of the markets that we operate in are heavily export-driven, and we see a lot of opportunities to work with exporters as well as importers across simplifying removing friction across the trade process itself, including the payments piece of it, as well as availing credit in a cross-border way," Malhotra said.

"I think we're going to see a substantial shift in the geopolitical nature of trade going forward, where emerging markets outside of China – think India, Indonesia, and Brazil – are going to play a lot more prominent role in overall global manufacturing and trade."

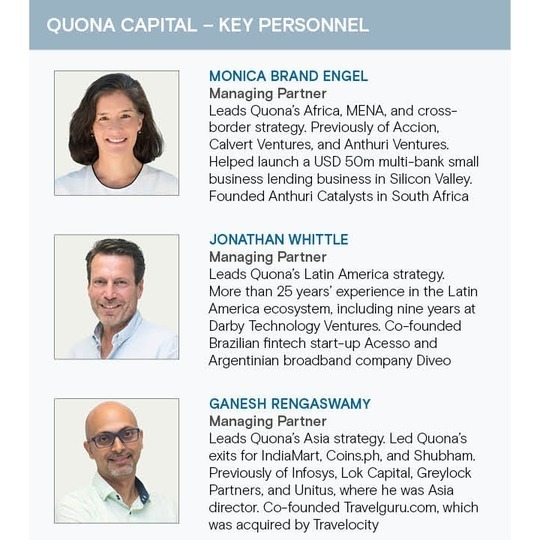

Quona was founded in 2014 by Rengaswamy and fellow US-based managing partners Monica Brand Engel and Jonathan Whittle, all microfinance veterans. Engel began conceptualising the concept as early as 2010 when she worked at Accion, which provided an approximately USD 20m pool of capital for an experimental programme called Frontier Investment Group (FIG).

Rengaswamy and Whittle started consulting with FIG and, alongside Engel, soon hatched Quona as an independent manager, albeit largely bankrolled and incubated by Accion. A debut vehicle, Accion Frontier Inclusion Fund, closed on about USD 141m in 2015.

The naming of subsequent vintages betrays a gradual exit of Accion's involvement. Accion remains an LP in the latest vintage, but it no longer shares in the profits of the managers. Fund II, called Accion Quona Fund closed on USD 203 in 2020. Fund III is called Quona Accion Fund. Fund IV, when it comes, will likely drop the Accion branding altogether.

Early investments centred around "classical" fintech ideas such as digitalised versions of consumer lending, small business lending, wealth management, insurance, and banking products. This has graduated to a focus on so-called embedded fintech models that service specific financial needs in agriculture, mobility, healthcare, and logistics, among other areas.

"At the beginning, we said, microfinance is a single-trick pony and a very straight-line product, whereas the way digitalisation was happening – mobile internet, cloud, data analytics – that was really going to change financial products distribution," Rengaswamy.

"We decided that over time, financial services would not be transactional – they would be very contextual, happening in the context of commerce in different verticals. And that's what happened. It's about being able to deliver end-to-end lifecycle goals in any sector. We look at financial innovation as the oil that greases the economic engine. It's applicable to various sectors and can catalyse them."

Collegial culture

Shallen Baweja, Quona's India-based portfolio manager, estimates that the firm has grown almost 4x in terms of investments and AUM since he joined as an analyst in May 2019. During this period, he has gone on to wear several hats, which he describes as a signal of a team-oriented culture.

These roles span investment and operations functions, with Baweja leading LP reporting as well as portfolio monitoring and engagement, contributing to follow-on investment due diligence and transactions, as well as some exit activity.

In his previous job at Goldman Sachs, Baweja worked on the NASDAQ listing for Singapore's Sea, Southeast Asia's first major consumer tech IPO in the US in 2017. In 2020, he contributed to Quona's standout exit, a 35x oversubscribed IPO for B2B marketplace IndiaMart. As such, he has shared in some minor economics at Quona despite not being formerly a part of the deal team.

Rengaswamy observes that the firm endeavours to distribute carried interest across the team. A small reserve is held for extraordinary performance, although deal-by-deal incentives are generally not considered a good fit for Quona's DNA. The team is geographically dispersed and prone to multi-tasking, which demands intense cooperation.

"I think I'm probably the only person at Quona who has context of how each business is performing because I lead investor reporting for the global portfolio. I have that kind of vantage point," Baweja said. "The room to grow within my role has always been supported. That's something that continues to push me and make me contribute to the quality."

To this point, Baweja has also taken on duties around ensuring impact measurement across the portfolio is aligned with industry-leading financial inclusion and social impact standards. Part of the internal policy here is to only consider companies based on their active user base, rather than their total historical number of users, which could exaggerate impact.

Quona – which counts eight development finance institutions as LPs – was an early signatory, member, and advisor of most leading global sustainable investment organisations, including Bluemark, GIIN, 60 Decibels, and the Impact Management Project. But these partnerships do not feature in its marketing materials, which frame impact as merely a gating factor of a returns-focused strategy.

"If you look at India, Nigeria, Philippines, Mexico, Brazil, Indonesia – 60%-80% of the population is underserved and lower-income. That's not impact – that's the real market. Our goal over time is to remove the impact tag from this and bridge Impact Street to Wall Street," Rengaswamy said.

"Look at IndiaMart, which had the most impact for SMEs [small to medium-sized enterprises] of any business outside of China and was the best digital IPO in India in 15 years. We want to create more such examples so that more capital and more talent comes into this space to solve tough problems and remove the stigma that people working in impact should not do well financially."

Communication, integration

The combination of active portfolio involvement, a stringent impact gating policy, and the limited availability of talent with global-local credentials has put Quona in something of a squeeze as it has scaled. Internally, this has perhaps translated most noticeably into an intense team communication schedule.

For each regional team – Asia, Latin America, and Africa – there is a twice-weekly catch-up. There is also a global team meeting every Monday and a weekly call for the seven partners, plus multiple separate calls per week for the managing partners.

Moreover, there is a standing slot twice a week for anyone to book that gives potential investee founders a chance to pitch to deal team members. And then the investment committee has a standing 1.5-hour block every Thursday to discuss pipeline activity.

"That's the way we organise ourselves to make sure that there is efficiency and nimbleness for folks who are working with founders to really be active," Malhotra. "It's super important to ensure that coordination, alignment, and information sharing happens in real-time so that when a decision needs to be made, people are not playing catch up."

Some technology has been introduced to facilitate these goings-on. Information and contact sharing, especially in terms of relationship mining, has been prioritised in the in-house database. Portfolio analytics have become more meaningful with the scaling of funds in recent years, including in terms of benchmarking costs and performance metrics across geographies. But the initiative has its limits.

"When five years later, a partnership that you turned down becomes a success, it's important to have conversations about what set of factors we considered and what led us to make our decision. Would we make that same decision again? That's a conversation you have to have and not something that you can automate," Malhotra said.

Cross-border team communication could become all the more crucial as Quona's expectations of a more integrated Southeast Asia opportunity set come into focus. Rengaswamy observes that there is currently too much capital concentrated in a few countries in the region and that the paradigm needs to be rethought, perhaps especially in Indonesia.

Quona's standout case study in this theme to date is Bangkok-based insurance start-up Sunday, which has raised about USD 70m to date and is the only operator of its kind licensed in both Thailand and Indonesia. It has planned to expand into Malaysia and Vietnam over the next two years.

The traction is all the more notable given the relative difficulty of expanding an insurance model in this way, even versus other nuanced and regulated fintech categories such as credit. Insurance underwriting requires exceptional historical knowledge in target geographies, generally faces more stringent regulatory hurdles, and is subject to more variables around culturally influenced health risks, education levels, and capital adequacy needs.

"We do think we're going to see more interesting regional plays, and regional doesn't mean they have to be across five countries. Maybe just two. Maybe an Indonesia-plus play," Rengaswamy said.

"The more digital we get, the more silos are being broken. India-only and Indonesia-only – those walls are coming down as we speak. We're going to see more entrepreneurs building across markets, and not necessarily by raising tons of capital. They're going to do it efficiently.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.