China secondaries: Willing sellers?

Few, if any, LPs are so desperate to divest China exposure that they will sell fund positions at any price. The main sticking point for secondary transactions is a disconnect on valuations

AirPower Technologies casts a long shadow over PAG's secondary transaction. The private equity firm is working on a tender offer whereby secondary investors would take out positions in its first three funds – should the LPs holding them be willing to sell – and make a stapled commitment to Fund IV in the process. AirPower accounts for much of the USD 10bn in net asset value (NAV) feasibly up for grabs.

This acknowledged star asset, which cuts across Funds II and III, was formed through the merger of two Chinese companies acquired in 2017 and 2018: Yingde Gases and Baosteel Gases. It is also on the fast track to an exit. An agreement to sell the business to Hangzhou State-owned Capital Investment & Operation, at an unspecified valuation, was announced in May.

For incoming secondary investors, the prospect of a near-term distribution strengthens the underwriting case. One industry participant describes the ideal scenario as an exit happening post-pricing and pre-closing: the investor can treat it like a deferral and recycle the proceeds from the distribution into the deal, thereby improving the return.

Selling investors, meanwhile, face a dilemma. They are giving up the distribution in return for divesting their entire interest in the fund, typically at a discount to NAV. Calculating the value attributed to the rest of the portfolio is one concern. Sellers must also factor in the risk of regulators thwarting an AirPower sale or seller backing out, as well as the extent of their desire to sever ties with the fund, manager, or geography.

Secondary players interested in anchoring the transaction submitted first-round bids earlier in the summer. Fairview Capital, PAG's advisor, notified those moving forward to the next round in early July with a view to finalising the lineup in August, according to three sources familiar with the situation. The process is still underway. Fairview didn't respond to a request for comment.

One LP with exposure to multiple PAG funds noted that the initial guidance on pricing represented too steep a discount to justify selling through the tender. A secondary investor, explaining why his firm declined to pursue the deal, said that respect for PAG as a manager was outweighed by "scepticism as to whether there would be enough buyers" and the uncertainty around AirPower.

The Carlyle Group's attempt at a similar deal involving a USD 18.5bn US buyout fund underscores the challenges of tender offers. The firm hoped to generate sales volume of up to USD 2bn, but reportedly ended up with about USD 500m in March. Even if secondary investors agreed to a generous USD 1 of staple for every USD 2 of secondary, the commitment to Carlyle's new fund would be meagre.

"With tender offers, you don't know what you are going to get in sales volume until the process closes, and when the size of the staple is contingent on how many people sell, the sponsor doesn't really know what the upside will look like," said Damian Jacobs, a partner at law firm Kirkland & Ellis. "There might be conditionality around minimum sales before the buyers are obliged to go ahead and trade."

Pressure points

PAG is one of Asia's largest private equity firms with more than USD 50bn in assets under management (AUM) and a footprint that encompasses the entire region. Yet over two-thirds of the portfolio earmarked for the secondary transaction, including the crown jewel asset, is in China.

Doubts over seller interest reflect a broader reality about China secondaries. Even though a combination of geopolitical tensions, targeted regulatory upheavals, a weak economy, and uncertainty over exit timelines has made LPs wary of new fund commitments, that doesn't mean they are willing to offload their existing exposure at fire sale prices.

"It has been suggested that there might be some pressure to sell interests in portfolios in China," said Martin Yung, a Hong Kong-based principal at HabourVest Partners. "When global portfolios come up that have Asian exposure, there are invariably some China-focused funds, but pricing tends to not be attractive for sellers."

This sentient is echoed by Zhan Yang, a principal and general manager of Coller Capital's Beijing office, who notes that the opportunities he sees typically involve relatively mature funds of five to seven years old. This suggests the rationale for selling is "managing liquidity rather than just trying to get out." A truly desperate seller would be willing to offload 18-month-old funds that haven't been fully called.

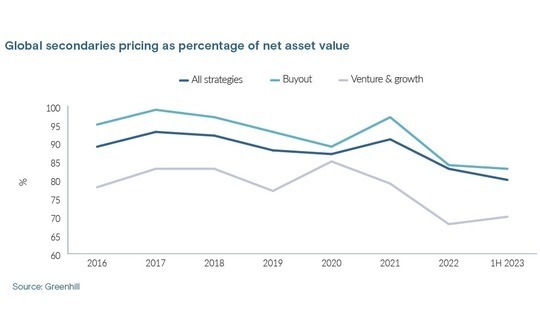

Global secondaries transaction volume came to USD 44bn in the first half of 2023, down from USD 58bn 12 months earlier, according to Greenhill. Pricing held reasonably steady, but it remains at a 10-year low with the average portfolio across all strategies transacting at 80% of NAV. Buyout portfolios went for 83% in the first half, while venture and growth was at 70%, up slightly on the 2022 figure.

Greenhill observed that activity was primarily driven by LP portfolio management intended to free up investment capacity. Many investors held back, waiting to see how the market would shake out following the release of fourth-quarter valuations. However, a narrowing of the price gap – driven by redounding public markets, not meaningful movement on the private side – is expected to stimulate more activity.

One secondaries advisor noted that China funds are increasingly included in these global portfolio sales to get feedback on pricing because there aren't enough recent trades in the market to form an opinion. This doesn't necessarily lead to a favourable outcome.

"If your motivation is liquidity, then selling China doesn't get you enough money. You're better going for infrastructure, credit, or blue-chip buyout," said the advisor. "People are worried about taking a hit on their P&L [profit and loss] statement this year because they aren't getting many distributions. There is no upside to voluntarily taking a 50%-plus hit on part of your portfolio. You would look stupid internally."

The Carlyle secondary that failed to generate much interest was priced at 81% NAV. For the PAG transaction, after the first round of bidding, Fund I was priced at 50% and Funds II and III at 71%-74%, two of the sources familiar said.

The only comparable tender offer-plus-staple in Asia was done by TPG Capital in 2018 for two funds with a combined corpus of around USD 7bn. The deal was worth USD 1bn, with USD 1 of primary capital committed for every USD 2 of secondary sold. PAG may aim for a similar ratio but given current market conditions, 1:3 might represent a best-case scenario, according to another industry advisor.

PAG's portfolio has some element of geographic diversification and is buyout-centric. Most pure China funds tend to be crammed with minority positions in early to growth-stage technology companies. Prices offered by prospective buyers reflect this. Several advisors said that, when discussing potential secondaries with GPs, they emphasize that selling LPs should be comfortable taking a 40% discount.

"A lot of China portfolios are growth and venture-focused, and they continue to hold companies at their last-round valuations, which might have been set up to two years ago. This means the marks on the books do not necessarily reflect the reality," said HarbourVest's Yung.

"At the same time, a lot of secondary investors have global investment mandates and are applying a global lens to find the most attractive risk-adjusted opportunities across the globe."

On the quiet

Nevertheless, removed from the portfolio sales that characterise the top end of the market, there are sellers that are both willing and perhaps flexible on price.

Vincent Ng, a partner at placement agent Atlantic Pacific Capital, has been asked to advise on sales of individual interests in China funds, mainly by family offices and corporates. Balance sheet and cash flow issues tend to be the key motivating factors, not geopolitics.

"They want liquidity, will accept some kind of discount, but they aren't desperate. They might take cost plus some carrying value for the interest, like cost plus 10%," he said. "However, in situations where there is a severe need for cash or there has been a change in strategic direction, it becomes a question of ‘What is the biggest discount I can take?'"

Kirkland's Jacobs recalls a Hong Kong family office selling off China fund interests during COVID-19, but that was simply a function of the high level of China exposure portfolio-wide. Most of the time, liquidity-driven sales involve mixtures of random interests, perhaps two brand-name funds and an assortment of lesser-known funds because the family office is jettisoning relationships it no longer regards as core.

"When people sell single positions in China funds, there is usually a specific reason for getting out and deals tend to trade at a significant discount," Jacobs said. "And I hear they are struggling to find buyers."

One option is to ask the GP to find a buyer by reaching out to its existing LP base and wider network. Several China managers are said to have offered to acquire fund interests from LPs personally – as a demonstration of their belief in the portfolio, although often at cost – or sought to match-make buyers with potential sellers as a sweetener for coming into a new fund.

Steve Byrom, co-founder of institutional advisory firm Potentum Partners, has received proposals from multiple Chinese GPs looking to sell fund positions. They include some highly successful managers willing to accept steep discounts, and the sellers come from across the institutional investor spectrum.

"LPs are selling very quietly, they are not going through advisors, sometimes because they don't want to draw attention to the geopolitical angle," Byrom said. "For some, it is geopolitics. For others, it was triggered by perceived stroke-of-pen risk around online education and restrictions placed on technology companies. And then there's been very little liquidity in the market."

Buyers are acutely aware of the same issues. Policy risks, for example, are hard to predict or quantify. Investors flag the recent crackdown on corruption in healthcare procurement that has seen hospitals and pharmaceutical companies targeted and the way in which regulators favour certain sectors for IPOs almost regardless of company quality.

Coller exercises caution when looking at portfolios with exposure to certain industry verticals. Yang points to biotech, which saw a flurry of deal activity at elevated valuations in 2020 and 2021 as investors looked to take advantage of stock exchange provisions allowing IPOs by pre-revenue companies.

"The music stopped in the first half of 2021 and valuations dropped significantly for new investments. However, existing investments were still marked at last-round valuations," he said. "There's no revenue or performance data, so it's difficult for auditors to call for markdowns, but this gives LPs a false sense of value."

This doesn't mean deals can't get done. The discount to NAV that secondaries investors expect to pay is an output, not a starting point. It is arrived at by assessing each asset in a portfolio and how it is likely to perform from now through liquidation, aggregating the results, and dividing by the target return.

The secondaries investor cited earlier said that he solves for a higher target return in China compared to a few years ago, which implies a bigger discount across the board. But pricing is specific to a situation and to an individual investor's perspective on companies, industries, and risks over a certain timeframe. For the time being, sellers do not appear to view the world in the same way.

"If we think the price is good enough to compensate for the potential risk, we wouldn't hesitate to go in," added Zhang. "The challenge is sellers being uncomfortable with the discount rate and refusing to transact."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.