India edtech: Class dismissed

With investment all but evaporated and its champion in a tailspin of bad press, India’s massive online K-12 education space is in an awkward limbo. It’s a welcome correction though

Indian education technology provider Byju's has raised about USD 6bn since its inception in 2011, including USD 1bn in 2022 alone. In the latest round, which closed last October, Qatar Investment Authority joined a roster that featured The Blackstone Group, General Atlantic, and Silver Lake Partners, putting in USD 250m at a valuation of USD 22bn. That was the end of the good news.

BlackRock, which participated in a USD 800m round in March last year at a valuation of USD 16.5bn, revalued the afterschool tutoring company at USD 8.4bn as of last May. Prosus, the largest individual shareholder, slashed its valuation to USD 5.1bn in June.

These moves coincided with a general post-pandemic retraction in start-up risk, compounded by edtech-specific woes around the reopening of schools and children's screen fatigue. Byju's rapid scaling of a video-based – but not live-streamed – offering made it difficult to monitor quality, and accusations of high-pressure marketing practices and reports of unfilled promises multiplied.

The company's growth during the boom period was significantly inorganic, with bolt-on acquisitions of at least 18 smaller operators. This included the almost USD 1bn purchase of Aakash Educational Services in 2021 – likely the largest-ever edtech acquisition – which facilitated a move into India's lucrative test preparation space.

Bjyu's fuelled its expansion ambitions the same year by tapping the covenant-light US debt markets. Earlier this year, investors that contributed to the USD 1.2bn term loan B took legal action in the US, claiming the company had defaulted on payments. Byju's recently shot back, calling the tactics "predatory" and requesting the disqualification of Redwood, one of the lenders.

Last month, representatives of Prosus, Peak XV Partners (formerly Sequoia Capital India), and Chan Zuckerberg Initiative said they would step down from the company's board; Byju's initially denied this. Meanwhile, the company has reportedly laid off more than 3,000 employees in the past year.

"Bad news is coming out of Byju's with depressing regularity. Everyone in the ecosystem is waiting and hoping that there will be an end to it, things will stabilize, and we can heave a sigh of relief," one local edtech investor observed.

Fading forces?

It's worth remembering, however, that Byju's essentially invented the category where it's floundering. Amitabh Jhingan, leader of EY Parthenon's international education practice, doesn't buy into the inferred doom and gloom for Indian edtech. He sees an industry in transition, where the leading player is merely juggling the baggage of a rapidly scaled user base while plotting a new path with different success metrics.

"Byju's has been and will continue to be the dominant provider in this segment. There is no doubt about it. They have too much of a head start and a significant amount of scale for them not to be relevant across both categories [tutoring and test prep]," Jhingan said.

"In terms of new providers, there's probably going to be a greater influx of large offline providers. There's room for innovation, but the start-ups will take longer to grow. They will have to build their brands over time, and that's not easy for the simple reason that building an education brand is not about branding. It's about reputation and outcomes, and that takes time."

EY advised Byju's on the Aakash deal. Deloitte was the company's statutory auditor until last June when it resigned citing delays in receiving financial statements. MSKA & Associates, a local arm of BDO Global, was appointed as a replacement. The latest update is that 2022 earnings will be filed by this September.

Importantly, as India's largest start-up, Byju's was a poster child for more than just edtech. Its ability to exacerbate reduced appetite for tech risk should not be totally discounted. The decline in sentiment can be seen in other industries, where Byju's-like stories are playing out. For example, medicine delivery unicorn Pharmeasy reportedly sought funding last month at a 90% markdown to its prior round.

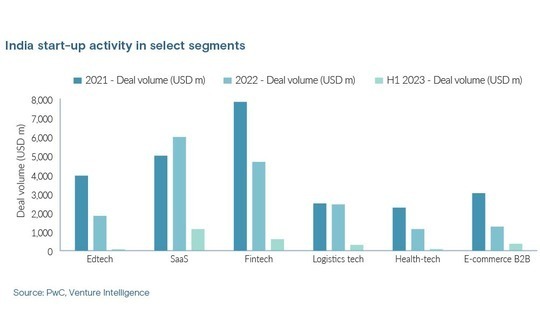

Still, edtech appears to be sinking fastest. Between 2021 and 2022, edtech as a category saw one of the biggest drops in start-up funding, falling 54% to USD 1.8bn, according to data from PwC and local researcher Venture Intelligence. Among the most invested categories, B2B e-commerce was the hardest hit, with investment down 58% to USD 1.3bn.

Byju's biggest competitors have also reflected the disruption in various operational retractions and strategic pivots. Unacademy, a video-focused test prep specialist that raised USD 440m in 2021 at a valuation of USD 3.4m, has cut its team from 6,000 as of April 2022 to fewer than 3,000 currently. This has come with a transition into a mixed online and offline model incorporating a non-test prep offering.

"The market was asking them to do something very different in 2020 and 2021. If you weren't growing and taking those investments, you would have looked out of touch. So, we're looking at it with hindsight bias," said Kunal Bajaj, head of growth and exits at Unacademy backer Blume Ventures.

"[CEO Gaurav Munjal] was one of the first few people to recognize that market conditions had changed, so he made cost-cutting headlines earlier. I genuinely feel he was ahead of the curve. Gaurav is not building a company for next year or the year after that. He's building a generational company, probably the only company he'll ever build."

Vedantu, one of the largest test prep players, started moving into general tutoring services as early as 2020 but post-pandemic has joined the hybrid online-offline bandwagon. Last year, the company acquired Deeksha, the operator of 39 test coaching centres across three states. It is said to have laid off more than 1,000 employees last year and given leadership a 50% pay cut.

Revising the model

In addition to offline offerings, edtech investors and companies are navigating the doldrums by exploring emerging categories such as study abroad placements, education finance, and online degrees. Course-specific apps are in vogue, especially maths and languages. Extra-curricular activities have proven less sustainable; the latest casualty is FrontRow, a hobby-learning app that shuttered last month.

As with the broader start-up space, unit economics are back under the microscope but with a twist. Anup Jain, a managing partner at Orios Venture Partners, observes that education is possibly the only industry where payment is received before companies even start to deliver the service, and consumers don't question that paradigm.

He notes that in the current environment, edtech companies will be valued at roughly 8x to 10x of sales and only seriously considered where unit economics are positive. Orios invested in Vedantu in February last year, topping up a roughly USD 100m Series E that valued the company at USD 1bn.

"Word of mouth is a very big factor in reducing the consumer acquisition cost. Marketing costs can fall much faster than in other businesses, which is fundamentally the biggest reason you would raise capital again and again until you become profitable," Jain said.

"Therefore, investments in this sector are now going to be driven by strong unit economics. I can't think of a single school or university in India that is not generating a profit and is unable to fund itself after a few years of operation. It takes that long to know the mettle of the faculty and the pedagogy."

The more fundamental shift for investors has been toward skills and employment-focused edtech rather than pure K-12 offerings. Ultimately, this is because outcomes are more immediately provable. Skills training is a boot camp experience, not a childhood journey.

Test prep, although within the K-12 category, benefits significantly from this effect but is also subject to challenges related to a dependence on star teachers. Students seek out test prep services based on the reputation of individual professors, who can start or join rival businesses.

For example, Adda247, a Google-backed test prep start-up, stands accused of poaching talent from Physics Wallah, the category's rising star. Physics Wallah closed a USD 100m Series A last year at a valuation of USD 1.1bn. As recently as March, it was in talks over a USD 250m raise at a USD 3.3bn valuation.

"There has been very little tech in edtech in the K-12 space. You can see it in companies like Byju's – it's all been a sales-driven phenomenon. We strongly believe in product-led growth and brand-led growth as opposed to having armies of salespeople adopting high-pressure tactics to meet quotas," said Surya Mantha, a managing partner at Unitus Ventures.

"Entrepreneurs got lazy and said let's focus on the top line as opposed to the efficacy of the product and measuring learning outcomes. You really should not think of education as a consumer internet business with a customer acquisition cost and so on. It's a brand business and a word-of-mouth business."

Unitus is among those gravitating toward the skills and training end of the spectrum, where edtech meshes with other favoured themes such as employment-tech and fintech. However, its standout investment in the category is K-12 tutoring platform Cuemath, which has raised about USD 100m since 2020 and expanded into more than 80 countries.

Mantha claims Cuemath was quick to understand that demonstrating outcomes would be the key to K-12 success as the edtech investment bonanza ended. Part of the plan for achieving this involves leveraging generative artificial intelligence to personalise student experiences.

As a returns-focused impact investor, Unitus is a curiously atypical actor in this category. Despite manifest virtues around social uplift, global impact investors have largely prioritised financial inclusion over edtech. Indeed, Byju's and Vedantu are arguably the only major start-ups in the space to have attracted impact funding, Chan Zuckerberg and ABC World Asia, respectively.

It's a point worth noting as the spectre of over-commercialisation looms over the digitalisation of essential public services in the developing world.

Reputational risk

Indian edtech is not widely seen as vulnerable to the kind of regulatory crackdown experienced in China in recent years, where investment was brought to a standstill as the industry was restructured to be entirely non-profit. But that doesn't preclude investors from thinking about reputational damage.

Marketing that encourages families to take out burdensome loans to pay edtech companies is not widespread in India. Likewise, the pricing of K-12 products, even in the competitive test prep sub-segment, is not overly aggressive. Yet in the wake of an episode of runaway investment and customer targeting, these variables are reminders of edtech's susceptibility to becoming a parental guilt-driven debt trap.

Anil Ahuja, a 20-year private equity veteran with the likes of 3i Group, set up Singapore-based 88tuition in 2018 to remove pricing from the equation. 88tuition is for-profit, but barely so. Margins are slim by design. If a student cannot afford the service, the price can be lowered or eliminated.

Ahuja brought the idea to India last year – branded locally as 88guru – and plans to crash the price of tuition in the country by 95%. The company's lead investor, Aarin Capital, was Byju's first investor in 2013. Aarin exited Byju's shortly before backing 88tuition in 2021.

Gamification and animation are not on offer; instead, kids get a front-facing camera and front-facing teacher next to a writable blackboard, digitally superimposed meteorologist-style. The old-school approach is part of 88tuition's bid to crack the outcomes measurement dilemma of K-12.

"That's the proven method for learning outcome. This is not about gimmickry. Anything that you handwrite forms in the brain and is remembered," Ahuja told AVCJ last year. "If you actually make a child write it in their own handwriting in their own book, they remember it better. If it just shows up, it's forgotten easily."

This approach bears contemplation as India's edtech unicorns reimagine their growth models and a new crop of start-ups slowly emerges in the white spaces between them. Once brand credibility is cemented, prices can be increased, and investors must recognise that they may be funding price-led growth.

Price risk becomes all the more important in the outlook that online learning will eventually become a primary medium of education in India rather than just an afterschool supplement. India's masses of remote populations and language challenges almost ensure such a scenario eventually. And opinion is almost unanimous that private providers, not government infrastructure, will lead the charge.

"No unit economics should have high upfront sales costs loaded in the economic model. One shouldn't have to sell that hard," Orios' Jain added. "The use of technology is to give access to millions at low cost, and that's where you get your millions. India has no dearth of students."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.