GP profile: CCV

Formed through a spinout from KPCB, CCV claims to distinguish itself through a collaborative culture and a disciplined approach to portfolio construction, valuations, and landing scenarios

Perfect Corp, a software developer that uses artificial intelligence (AI) and augmented reality (AR) to enable consumers to experience beauty brands virtually, was missed by most Chinese VCs because they weren't looking in the right direction. The product development team was in Taiwan, revenue came from New York, Paris, and Tokyo – and the company was a unit to Taipei-listed software developer Cyberlink.

CCV - formerly known as China Creation Ventures - was the exception. The firm's founder, Wei Zhou, who previously served as China head of KPCB, made regular trips to Silicon Valley and Taipei to keep tabs on emerging technology trends. Perfect appeared on his radar in the run-up to the launch of its YouCam makeup app in 2014. The app, which allows users to experiment with different makeup looks, quickly went viral.

At the time, the company was a classic high-cash-burn start-up but still part of Cyberlink. Zhou liked what he saw – technology that captured makeup colour and texture to a level far beyond industry peers – and proposed a spinout, emphasising the differences between Perfect and its parent. He also observed that several units of JD.com, a previous portfolio company, had prospered after going solo.

"More than 80 people followed me from Cyberlink to Perfect. It wasn't a small-scale start-up and we needed to raise capital to continue. It was difficult to persuade investors – most of whom were male – of the fundamental demand for a virtual makeup app. But Wei understood the pain points exactly and fully supported what we were doing," said Alice Chang, founder and CEO of Perfect Corp.

CCV led a USD 25m Series A in 2017 and re-upped in a Series B in 2019 and a USD 50m Series C in 2021. Those rounds were led by Alibaba Group and Goldman Sachs. Perfect now serves 400 beauty brands across 80 markets. It has expanded from makeup into fashion and jewellery and is working on generative AI technology that allows users to change outfits and hairstyles based on a single photo.

The company's success was confirmed last year by a listing on the New York Stock Exchange through a merger with a special purpose acquisition company (SPAC) at an enterprise valuation of USD 1bn.

For CCV, the listing not only delivered liquidity, but it also engendered conviction in two of the firm's main investment themes: supporting businesses established by Chinese founders in overseas markets and backing "new mature start-ups" that come with readymade business models and proven technology.

"The new mature start-up is an important part of our strategy," Zhou said. "When innovative business units go independent, we want to be there as an investor in the Series A round. These companies are more developed than typical Series A plays, which means lower risk and a higher success rate."

CCV raised an opportunity fund of USD 136m last year, and about half the corpus has been earmarked for new mature start-ups. Other portfolio companies that meet both the ex-China founder and mature start-up criteria include Transsnet Financial, an Africa-focused payments and digital bank platform incubated by Chinese mobile phone manufacturer Transsion Holdings.

An independent identity

Over the course of six years, CCV has accumulated USD 1bn in assets under management, closing its second flagship US dollar-denominated fund on USD 319m in late 2020. There have been 84 investments to date and seven exits, three of them by IPO.

The firm is representative of a generation of China VC firms that have gained traction following spinouts from established US-backed platforms. Indeed, its origin story is partly rooted in the mismatch in perceptions between investment committees in the US and investment professionals on the ground.

Zhou's fascination with technology started early and he joined a financial technology start-up, Start Computer Group, out of university. The business listed in Shanghai in 1994 and suddenly, before the age of 30, he was a senior executive of a public company with 6,000 employees. Still feeling pangs of hunger for early-stage innovation, he then co-founded an e-payment business that was later exited via M&A.

Zhou joined KPCB in 2007 as a founding member of the China team after completing an MBA in the US. During this decade-long tenure, he came to realise that China's emerging business models were not necessarily well understood by investors in Silicon Valley.

In 2012, he proposed an investment in Changba, a smart phone app that serves as a portable solo KTV booth, at a USD 5m valuation. KPCB's global investment committee wasn't interested, having failed to appreciate the appeal of KTV in Asia. Worse was to come. The investment committee passed on JD.com's first two rounds and a Series A for Kuaidi Dache, which later became ride-hailing platform Didi Chuxing.

"Changba was the moment when I first realised that China's local innovation, and the potential scale of such innovation, might be incomprehensible to mainstream Silicon Valley investors," said Zhou.

On spinning out to form CCV, he deliberately adopted a straightforward decision-making process and a democratised management infrastructure. The firm champions deep dives and group hunting. Once a thesis is identified, 4-5 people – or half the investment team – conduct detailed sector analysis for up to six weeks. The individual who originates the thesis leads the investment, usually supported by a partner.

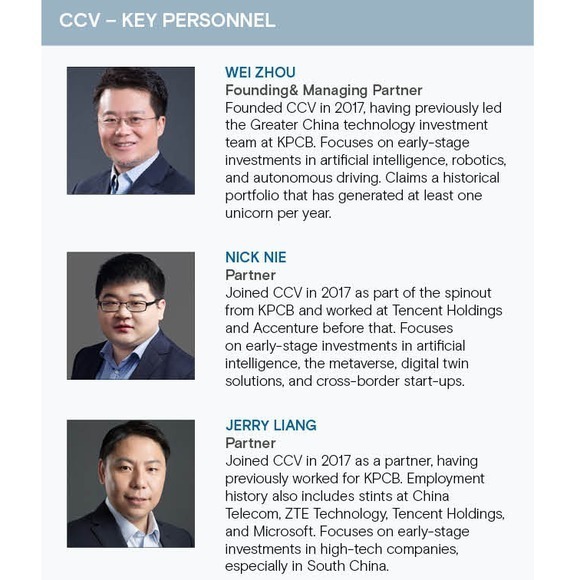

Zhou brought KPCB's entire technology, media, and telecom (TMT) team to CCV, including Nick Nie, who was barely 30 at the time. Nie was immediately given the opportunity to an investment in Wankaonline, a provider of Android-based content distribution services aimed at marketers. In late 2018, just 18 months after CCV came in, the company went public in Hong Kong.

Nie was promoted to partner a year later and assumed the mentor role. He supported a young analyst who, six months into their career at CCV, was tasked with leading an investment in the cloud gaming space. The selected target, MetaApp, received a Series A round led by CCV. The company is now valued around the USD 1bn mark and CCV is the largest external shareholder.

"We are a highly cooperative team, and we put aside personal interests to focus on group hunting. However, it's important to recognize and quantify each team member's contribution to the investment process. We discuss and agree on the effort levels and accomplishments of individuals and this ultimately determines the allocation of carried interest," Nie explained.

"Typically, the group leader receives a much larger carried interest share than the partner who is supporting them."

Elevating younger professionals to leadership roles is one way of keeping the team fresh and preventing the development of entrenched viewpoints. In this way, pairing a young project leader with an experienced partner is a risk mitigation measure.

For Zhou, group hunting doesn't end at target identification: he wants to see a signed term sheet as soon as possible. Nie recalls staying up to 4 a.m. in the offices of company CEOs trying to get all the paperwork done. When CCV led the MetaApp Series A, the company wasn't officially open to new funding. Zhou persuaded the founder to call in all the angel investors and got a deal signed on the same day.

"We seldom follow the conventional views of the market, and we only back one company per segment. If we miss out on something, we basically give up that segment," said Zhou. "We have a mild and cooperative culture, but I think a healthy dose of wolfishness is good, especially as China's venture capital industry is undergoing rapid changes that could knock out most players. Only the best survive."

Clarity on criteria

When CCV settles on a target, it wants to be a meaningful investor. The firm insists on stakes of at least 10% plus board representation. Valuation can also be a dealbreaker. Adhering to a disciplined approach effectively forced the firm to decline opportunities in red-hot areas like autonomous driving.

CCV responded by focusing on less competitive segments – so-called lower-speed fixed route or semi-fixed-route autonomous driving – where it discovered CowaRobot. The venture capital firm led a funding round in 2018 and re-upped in a USD 250m Series C in 2019. CowaRobot currently enjoys a valuation of approximately USD 1.5bn, up 25x from when CCV first invested.

"The 2018 round was first we raised from the VC market. At that time, we were still exploring various paths including robotaxis, logistics, shuttle minibus and sanitation vehicles," said Tao He, the start-up's founder and CEO, "CCV played a crucial part in convincing us to focus on sanitation due to its faster commercial landing. This decision was pivotal in shaping our future growth."

A 2019 service agreement with Zoomlion Heavy Industry Science & Technology, China's leading producer of sanitation vehicles, gave CowaRobot much-needed traction. Similar deals with other groups have since enabled it to branch into sanitation services for roads and sidewalks, industrial park logistics, and robotaxis – the segment CCV initially avoided due to valuation concerns. The company received orders exceeding CNY 500m (USD 69m) in 2022.

CCV's emphasis on solid commercial landing scenarios also led it to Shukun, an AI medical imaging start-up. In 2017, when the GP closed its debut fund on USD 177m, investor sentiment on AI-enabled diagnosis had begun to cool. The first generation of start-ups had commanded premium valuations yet relatively few were generating meaningful revenue through distribution to China's hospitals.

Shukun was founded by a husband-and-wife team who previously held senior positions in IBM's AI imaging research business. However, as a late entrant to the market, the company wasn't even among CCV's top-five prospects when initial contact was made.

"I disagree with the theory that a company's development is limited by its weakest link. Rather, I believe development is determined by a company's strengths. Shukun is a prime example. Its focus on complex cardiovascular diseases and strong commercial landing capability set it apart from peers," said Zhou.

The company now supplies more than 2,000 public hospitals and 1,000 medical checkup centres. It has also established collaborative relationships with some US hospitals and is applying for local regulatory approval. Now valued at approximately CNY 10bn, up from around CNY 600m when CCV entered, Shukun is preparing for a Star Market IPO.

Chun'e Ma, Shukun's founder and CEO, observed that only five of the 100-plus start-ups that emerged during the pre-2017 AI diagnosis frenzy are still operational. "CCV is unusual in that it didn't rush to invest before forming clear views about the problems in healthcare and how AI could solve them. Zhou is more driven by fundamental investment logic than most VCs we have met," she observed.

CCV's strategy of backing only one start-up per segment was also valued by Shukun's founders. They turned down capital from several large investors that had also backed several competitors.

Addressing uncertainty

According to Zhou, it is easier to make calculated assessments of targets when markets are in troughs than at peaks. The challenge for many China-focused VC investors is that, unlike him, they cannot draw on the experience of working through different cycles. This has become a pressing concern for the industry with the onset of a capital winter last year.

VC investment in China peaked at USD 41.3bn in 2021 before correcting to USD 29.7bn last year, while less than USD 8bn was put to work in the first half of 2023. Even longstanding industry participants observe that fundraising is tough, with many of the US institutional players that have traditionally supported China VC backing off amid concerns about geopolitics and investment risk.

"The venture capital industry is not as widespread as many people assume," Zhou said, noting that sustainability has never been guaranteed. "There are only three regions where VCs have been active for more than two decades: China, the US, and Israel. The rest have basically died out. Japan and South Korea are primarily focused on corporate VC and it's hard to find pure VCs in Europe."

He prefers not to dwell on the anxiety consuming others and concentrate on the positives in China. The country has accumulated a lot of experience and knowledge over the past three decades, building strong positions across three key areas of technology: AI that defines human-machine interaction, autonomous driving, and the end-to-end value chain in robotics.

Zhou draws comparisons between China today and Japan in the 1970s when numerous enterprises went global on the back of the evolution in high-end manufacturing. World-leading Japanese companies were created in automobiles, ships, and rail. He expects China to replicate this effort in areas like intelligence devices and platforms.

"The industry value chain determines everything. If a country leads in most of the nodes of a certain value chain, the emergence of giant enterprises is inevitable – as we saw with Alibaba Group and JD.com. China has the most nodes in robotic manufacturing, it is on par with the US in AI, and it has a leading position in autonomous driving," he said.

"Combined, these technologies can pave the way for intelligent robots that link generative AI capabilities to the real world. China's era is coming soon."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.