Creature comforts: Why PE likes pet care

Private equity investors have long championed the resilient characteristics of pet care globally. The pandemic helped solidify a similar value proposition in Asia

"Nothing is completely recession-proof, but we've certainly seen people protect the food and lifestyles of their pets and trade down their own," said Jay Park, co-founder and managing partner of Prysm Capital, a US-based growth equity investor that recently led a AUD 75m (USD 51.1m) funding round for Australian online pet supplies platform Pet Circle.

"There is a predictability that comes with pets. Not many categories in e-commerce have that combination in terms of spending levels and repeat purchasing levels. It is one of the most attractive areas – there is something almost subscription-like about the unit economics."

Tales of the resilient – if not recession-proof – characteristics of pet care are legion, not least Pet Circle maintaining a AUD 1bn-plus valuation amid generally weak investor appetite for growth-stage technology plays. These are adorned with references to how humanisation and premiumisation have enabled a surge in spending by pet owners that has spread from the US around the world.

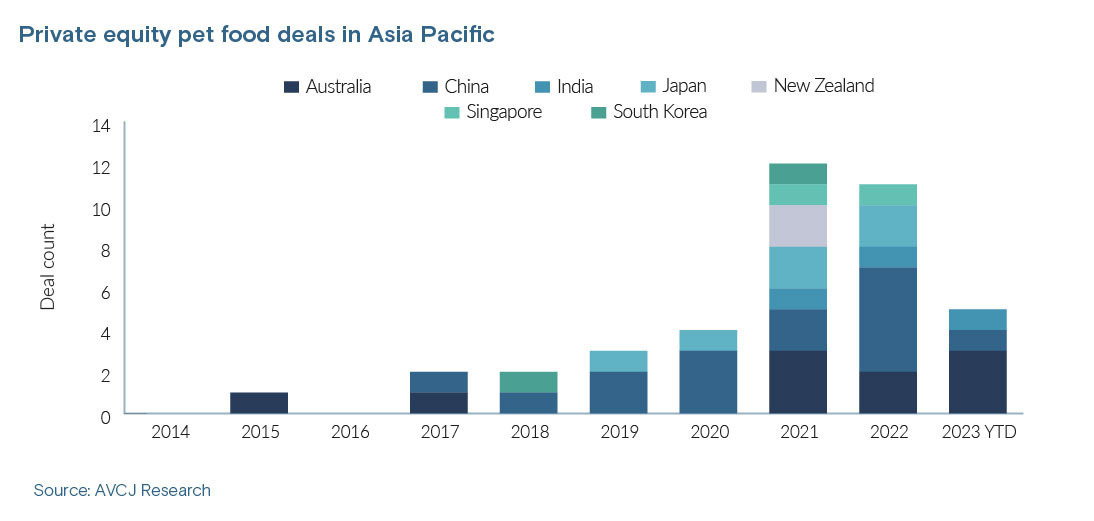

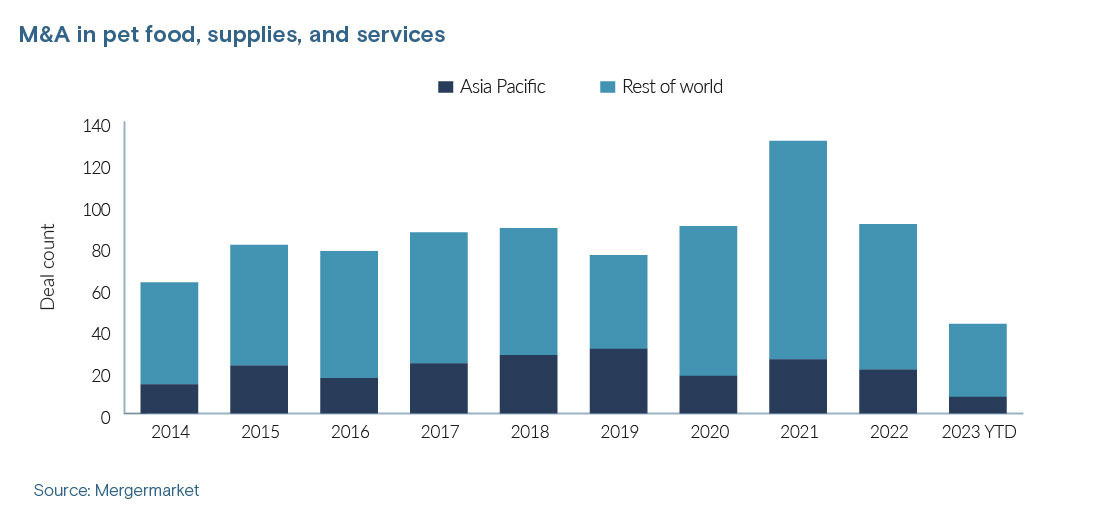

Private equity activity in the pet food space alone appears to confirm this trend. Nearly two dozen deals were announced in Asia in 2021 and 2022, twice as many as in the previous seven years combined. The running total for 2023 is five. From large buyouts of export-oriented Australian and New Zealand brands to expansion capital for Indian upstarts, tapping emerging markets growth is a key theme.

If anything, the industry emerged from the pandemic emboldened. Rising ownership during this period was largely driven by 18–34-year-olds: those reluctant-to-settle-down generation Z and millennial cohorts who sought companionship when social distancing disrupted in-person social networks. Such is the momentum that pet food remains a bright spot in China's bleak economy.

"After the reopening, people were really excited about an economic recovery, but by the end of the first quarter they realised it might not come, and now the tone is more inclined towards recession. Nevertheless, we do see even more attention being paid to the pet food space," said Leo Li, a vice president at Hosen Capital, which targets mid-market buyouts that have a China food angle.

China is unusual in that more than 60% of pet food is sold online, versus 20% in the US and less than 10% in the rest of emerging Asia. Li highlights data from Alibaba Group's Tmall, one of the dominant distribution channels, to demonstrate the power of pet food consumption.

Only eight of Tmall's 40-plus categories continued to deliver growth across three periods – 2017-2022, 2020-2022, and the last 12 months – that have seen overall consumption on the platform swing wildly between positive and negative territory. Three involve healthcare; four relate to post-pandemic revenge spending; the eighth is pet food.

"Generally, once GDP per capita hits a certain level, there is a step change in pet ownership. Then, when it hits another level, there is another step change in terms of premiumisation. Most of Asia's developed markets are at step one while its developing markets are mostly not there yet" said Scott Chen, a managing partner at L Catterton Asia. "China reached step one earlier and accelerated towards step two during the COVID-19 pandemic."

Cat ownership - China's cat population has risen from 40m to 65m in the past five years - is regarded as a leading indicator of premiumisation. Cats are more selective in what they eat than dogs, which requires product innovation and engenders brand loyalty. Moreover, cat food is sold in smaller portions than dog food, so a higher price point is necessary to reach parity on a per-kilo basis.

From the world to Asia

L Catterton has made two China pet food investments in the past 18 months, backing Shanghai Enova Pet Products, which claims to be the leading local brand in the premium dog food segment, and then adding freeze-dried cat food specialist Partner Pet. Last month, it entered India by providing growth capital to top local brand Drools Pet Food.

The consumer-focused private equity firm has made over a dozen pet food investments in North America and Europe over the past 20 years. At different points and with different brands, it has broadened the scope of distribution from speciality retailers to supermarkets and made raw pet food more amenable to owners by freeze-drying it and mixing it with kibble.

This has played out in mature markets that have already gone through the main step changes. L Catterton accumulates knowledge gleaned from investments in the US and Europe and applies it to situations in Asia, but local nuance means the transition from dry kibble to wet pet food and on to freeze-dried and chilled won't necessarily be replicated perfectly everywhere.

"Channel and consumer dynamics are different across markets. For example, in the US, people have a lot of freezer space, so five-pound bags work, but this is not the case in certain parts of Europe or China," said Howard Steyn, a US-based partner at L Catterton, who has worked on numerous pet deals

"Our global perspective on the pet food sector is guided by our longstanding experience in the US, where the sector is more mature, with our people on the ground in each country applying those insights with consideration for local nuances."

Differentiation is already visible within Asia. Fresh pet food is the fastest-growing segment in the US, having risen from negligible five years ago to 10% of the market today, while Europe is in the process of figuring out how to produce and distribute it economically and at scale. Emerging Asia's cold chain is years behind, but Australia has some breakout fresh pet food brands.

Lyka Pet Food was founded in 2017 as a direct-to-consumer (D2C) offering that uses lightly cooked fresh ingredients. Anna Podolsky, one of the founders, was motivated by the improvement in her dog's health after switching from kibble – produced through high-temperature extrusion – to home-cooked food. The company controls its supply chain from R&D through manufacturing.

"There is a difference between D2C brands that are wrappers on commodity products like kibble and D2C brands that have strong product differentiation. They had a vision of a better way to feed pets, supported by a lot of science around diet and the holistic health of pets," said Jessy Wu, a principal at Afterwork Ventures, which recently re-upped in a AUD 55m Series B for Lyka.

More than 20m meals have been served to date and Lyka is currently building a third factory that will triple capacity. From the outset, product quality and customer experience – portion sizes are customised based on pet needs – were emphasised, and marketing was driven by word-of-mouth.

When asked about making cold chain work, Podolsky conceded that geography is an advantage. Australia's population is concentrated in a handful of metropolitan areas and "quite clustered" whereas the US is more dispersed.

Brand awareness

Most private equity investments in Australia and New Zealand-based pet food businesses have been a couple of steps down within the premium segment: chilled, freeze-dried, air-dried, sometimes single-protein diets (SPD) aimed at pets with food sensitivities. Several have scaled under the stewardship of local GPs and then been exited to larger managers.

Hosen was part of a consortium that acquired Real Pet Food (RPF) from Quadrant Private Equity in 2017, while KKR picked up Natural Pet Food Group (NPFG) from Pioneer Capital in 2021. Both companies have a global yet Asia-centric presence. And China was part of the agenda: the country's share of RPF's business has risen from zero to over 10%; it accounts for 35% of NPFG's revenue.

These companies control brands that are part of an exclusively foreign group that dominates China's super premium pet food segment. They sit alongside Ziwi – a New Zealand brand acquired by FountainVest Partners in 2021 – and names from the portfolios of multinationals like Mars and Nestle.

PE ownership typically sees master-distributor relationships replaced by local teams that coordinate distribution. Hosen assisted RPF on this and NPFG has done the same. Ziwi's operating structure is unclear, but two sources familiar with the situation said that FountainVest acquired the asset through a joint venture fund with Mars. FountainVest didn't respond to a request for comment.

Though fast-growing, these super-premium brands make up a single-digit percentage of China's overall pet food market. Hosen's Li stressed the challenges of scaling sophisticated products (this wasn't connected to the recent equity injection into RPF; rising costs of raw material and financing in Australia were to blame) but also questioned the ability of local brands to move up the value chain.

"Local players have tried to ‘premiumise' their portfolios, though without much success. It goes back to their origination. Most are OEMs [original equipment manufacturers] for overseas brands," said Li. "They learn the manufacturing and the idea of building a brand happened relatively recently."

Gambol, which received growth equity from KKR in 2016 and filed for an A-share IPO earlier this year, is making this journey. The company's OEM-branded revenue split has shifted from 70-30 to 30-70, elevating it from seventh to first in the local mass-market brand rankings.

"We visited a lot of pet food companies and recognised some product innovation was required. Gambol's OEM business was pet treats and our research found that if you combined these with kibble – creating kibble-plus, or meat and kibble – it would create a highly commercial product," said Jason Wang, a director in KKR's China private equity team.

He added that the capital infusion allowed Gambol to be patient, absorbing a couple of years of break-even performance on the branded business before wider market acceptance supported profitability. The company also pushed into e-commerce, converting consumer data into insights that underpinned 10-15 new product launches each year aimed at different consumer segments.

Gambol is now edging into the premium segment through a sub-brand. L Catterton's two China portfolio companies are already there, after the private equity firm decided that backing emerging local players was preferable to bringing in brands from overseas. Import substitution was a factor.

"There are four major pet food exporters to China: the US, Canada, New Zealand, and Australia. Between 2021 and 2022, only New Zealand wasn't impacted by an import ban," said L Catterton's Chen. "Pet parents don't like changing a pet's diet. If a product from an impacted country isn't available, the next one they buy will be a Chinese brand because there's no import risk; and they will not switch back to the foreign brand if the local one is satisfactory."

In addition to product quality, L Catterton prioritised companies with an established offline presence and the ability to go online, reasoning that supply chain management is a larger barrier to entry than digital marketing. Partner Pet was stronger online, but the private equity firm liked the product fit and knew it could broker an arrangement with Enova around production and distribution.

Beyond premium

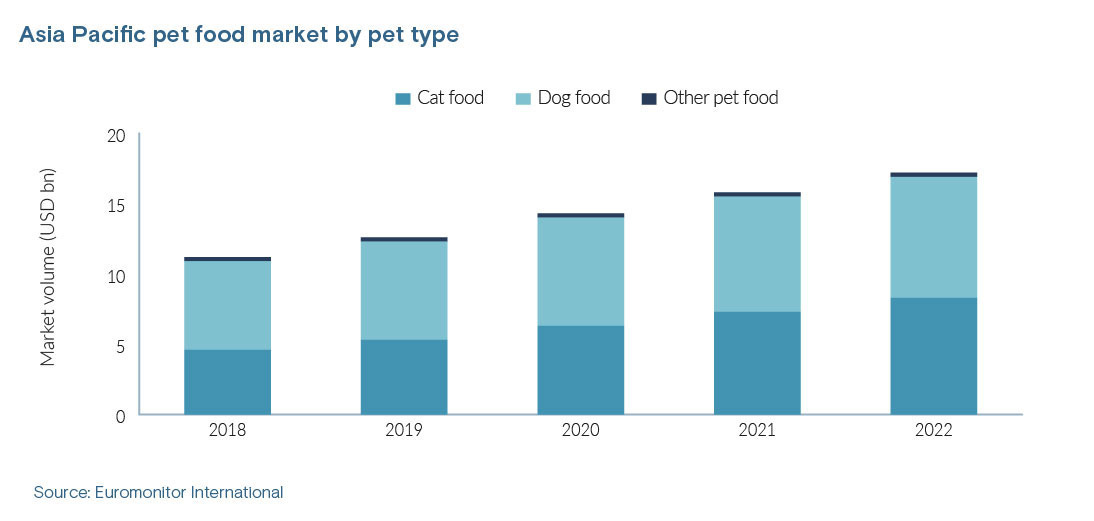

China's pet food market was worth USD 7bn in 2022, accounting for 40% of the Asian total, according to Euromonitor International. India trailed on USD 500m, but it is growing rapidly at around 20% a year. The country is seen as being 10 years behind China: pet penetration is less than 10%, and four in five pets are fed carbohydrate-centric home-cooked meals.

The market dynamics are also vastly different. In China, the top 10 brands make up 30% of the market. In India, Mars and Drools together represent 70%. L Catterton expects premiumisation to take hold in India, but in Drools, it backed a dominant value-for-money player that has managed to scale efficiently and establish strong distribution channels through vets and breeders.

Mars is a ubiquitous presence in Asia, having entered the region very early – "They introduced the first commercial packaged pet food in most of those countries," observed Hosen's Li. More M&A is anticipated in the region, following a global pattern of consolidation, but outside of China, relatively few brands in emerging Asia are looking to challenge international players in the upper tiers.

Livia Chan, head of Malaysia and Vietnam at Creador, estimates up to 70% of the overall Malaysian market is populated by brands under Mars, Nestle, and Thai conglomerate CP Group. The private equity firm recently acquired a 40% interest in Pet World, which distinguishes itself from the OEM-centric local competition through integrated manufacturing and SPD products.

"Pet World is the second largest in standard formulations, after Mars. They have little penetration in the economy and premium segments – and premium is very hard to penetrate," said Chan, adding that growing the existing portfolio across Southeast Asia is as much of a priority as category expansion.

"The company has just launched a premium product with higher meat content and more protein variety. Based on the strong track record in standard formulations, we see premium as a white space for them. It will take time, but they need to take the fight to the giants."

For some investors in these markets, the humanisation and premiumisation phenomena are best addressed through online platforms rather than brands. DSG Consumer Partners has participated in three early-stage rounds for Supertails, an India-based marketplace that is beginning to scale its pet products offering. There is one in-house brand, but 90% of the business is third-party.

"We wanted to back a digital-first platform along the lines of Chewy with the best customer service, merchandising, and product discovery," said Hariharan Premkumar, a managing director and head of India at DSG. "It is still a nascent industry in India – customer acquisition is the biggest challenge right now, not supply chains – but it has all the long-term tailwinds you can think of."

Chewy is a reference point for pet care investors globally. The US-based company gained traction at a time when Amazon wasn't focused on pets, was acquired by BC Partners-owned PetSmart for USD 3.35bn in 2017, and went public two years after that. The Prysm team backed Chewy in 2016 while working at BlackRock, and it sees some of the same qualities in Pet Circle.

"Inflection is driven by the right team and the right company executing to a degree that is a step function better in consumer experience to what is out there. The step function change in 2016-2017 was Chewy-driven, not market-driven. We see an opportunity in other markets for a similar effect if you have the right combination," said Matt Roberts, co-founder and partner at Prysm.

Craig Blair, a co-founder and partner at AirTree Ventures – Pet Circle's first investor – talks about the company in a similar way. Australia was lagging the US on e-commerce penetration and premiumisation, which meant that high-end brands unwilling to sell through grocery stores lacked a distribution channel. "The market was poised to take off, but the infrastructure wasn't there," he said.

Chewy capitalised on its early success by branching out from pet supplies into pet pharmacy and pet insurance services. Pet Circle and Supertails are doing the same. It is described as traditional e-commerce logic: build a strong market position underpinned by loyal customers, then target adjacencies that don't necessarily work on their own but can be huge margin drivers for a platform.

Strength in services

This isn't possible in every geography. Andrew Joo, CEO of Korea-based brand agglomeration business Wholesum Brands, has acquired three small pet e-commerce players but he doubts standalone specialist platforms have a hope against the might of Coupang and SSG.com. Generalists also hold sway in China through Tmall, JD.com, and ByteDance-owned Douyin.

Nevertheless, there are examples of vertical expansion within China's pet services space. Petkit, a manufacturer of smart devices for pets such as water and food dispensers, launched an offline grooming business with 1,500 outlets, most of them franchised.

"The logic was compelling – smart devices give pets a higher quality of life and give owners more hassle-free time," said Bonnie Wang, a partner at Qiming Venture Partners, an investor in the company. "And then with offline services, like bathing and grooming, demand is often inelastic, particularly for owners with large dogs that require frequent grooming."

Petkit was forced to downsize following the pandemic, but it remains profitable, largely thanks to the devices business that generates about 50% of revenue from overseas. J.P. Gan, a founding partner at Ince Capital Partners, another Petkit investor, is hopeful that the business will eventually rebound, enabling China to fulfil its potential in areas like grooming and pet hospitals.

While pet food is the dominant category in pet care, this sentiment underscores the scope for pet services. There is already evidence of consolidation in the US and several investors point to similar opportunities in Japan and Korea, where they still see huge fragmentation in veterinary services, and pet beauty and grooming.

The China opportunity was placed in context earlier this year when Hillhouse Capital-backed New Ruipeng Pet Group, the country's largest operator of pet hospitals, filed for a US IPO. The prospectus included projections that pet spending in China will hit CNY 537.6bn (USD 75bn) by 2026, nearly twice the 2021 level. Pet services will grow 150% over the same period, reaching CNY 135.6bn.

KKR entered the pet healthcare space last year with an investment in Ruichen Pet Hospital Group. The company has fewer hospitals than Ruipeng – less than 200 versus nearly 2,000 – but its establishments are larger and focused on more complex procedures.

"We saw significant room for growth and demand for veterinary services in China, which lagged even more than pet food. While pet food consumption is one-quarter of US levels, pet services is one-tenth of US levels," said KKR's Wang. "The first generation of pets is now ageing, so there is more demand for health services like surgery."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.