2Q analysis: Still scrambling

State-supported deals prop up Asia private equity investment; GPs hustle for liquidity in an unforgiving exit landscape; ex-China mid-market players gain some traction in fundraising

1) Investment: Japan's distortion effect

Another quarter, another outlier Japanese deal. JSR Corporation cannot claim the same scale as Toshiba – USD 6.9bn versus USD 15.9bn – but both situations exhibit characteristics that mark them out as unusual rather than replicable. They also had an outsized impact on headline Asia private equity investment in otherwise relatively quiet periods.

In the first three months of 2023, Toshiba accounted for one-third of overall deal volume, narrowing the drop-off from the previous quarter. Without it, buyout activity would have hit a three-year low, according to AVCJ Research. Fast forward to the second three months, JSR contributed 18% of the USD 38.4bn regional total. Without it, buyouts would have reached a seven-year low.

Toshiba's descent from top-rank conglomerate to corporate governance horror show to take-private candidate is well documented. JIC Capital's tender offer for JSR was positioned as an opportunity for a key player in the semiconductor materials space to make long-term strategic investments without the scrutiny of short-term performance that comes with a public market listing.

At the same time, JIC Capital is the PE unit of Japan Investment Corporation (JIC), a JPY 2trn government support programme that replaced Innovation Network Corporation of Japan (INCJ) in 2018. INCJ intervened in various high-profile deals under its government mandate. JIC Capital – which was allocated JPY 400bn to support the realisation of "society 5.0" – appears to be doing the same.

The JSR deal coincides with increasingly aggressive policies on semiconductors from the US and China as geopolitical tensions extend into technology. Earlier this year, encouraged by the US, Japan imposed tighter restrictions on exports of chip manufacturing equipment to China. JSR is a leading global supplier of photoresist, a material considered essential in producing printed circuit boards.

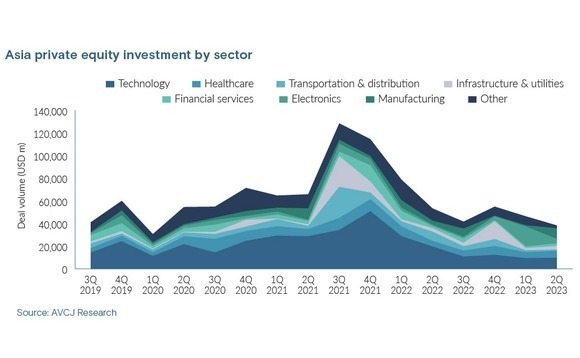

On a regional level, JSR was one of six USD 1bn-plus transactions announced in the second quarter – the same as in the prior three months. Again, China was notable for its poor representation in the top 10, with just two deals; India and South Korea had three and two, respectively. Technology was also weak on a sector basis – one deal, compared to two apiece for manufacturing and electronics.

This taps into an established trend whereby internet-oriented growth investments have lost ground to control deals in more tangible, asset-heavy sectors.

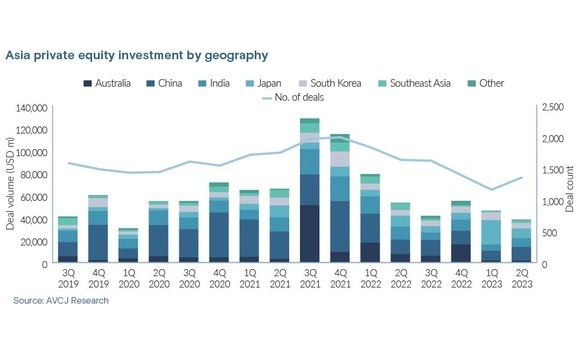

Nevertheless, China was one of three major markets – alongside India and Southeast Asia – to post an uptick in deal volume from the previous three months, rising from USD 8.6bn to USD 12.4bn. This can be attributed to a mini-revival in early and growth-stage minority investment, which also prompted a 50% jump in deal count, ending a downward trend stretching back to late 2021.

The early-stage turnaround could be attributed to several factors, from surging interest in generative artificial intelligence to continued interest in the electric vehicle (EV) supply chain. For growth-stage deals, which are fewer in number, it is possible to pinpoint a key trend.

Shein, a fast-fashion e-commerce platform popular outside of China, led the way with a USD 2bn round – at a reported valuation of USD 66bn, down from USD 100bn a year ago – from General Atlantic, Mubadala Investment, and Sequoia Capital China. Ten more growth deals surpassed USD 200m in size and in eight cases state-owned or government investors provided most of the capital.

For example, Beijing Eswin Technology Group, a semiconductor products and services supplier, raised a CNY 3bn (USD 420m) Series D round led by Beijing Financial Street Operation Center. Other participants included China Integrated Circuit Industry Investment Fund and investors linked to Shanghai International Group and Beijing government-controlled E-Town Capital.

Independent investors are not necessarily being excluded from these deals in sensitive industries like semiconductors – indeed, they might be consciously stepping back due to discomfort with valuations or a more conservative pace of deployment. But the balance of power appears to have turned.

2) Exits: China IPOs up, other exits down

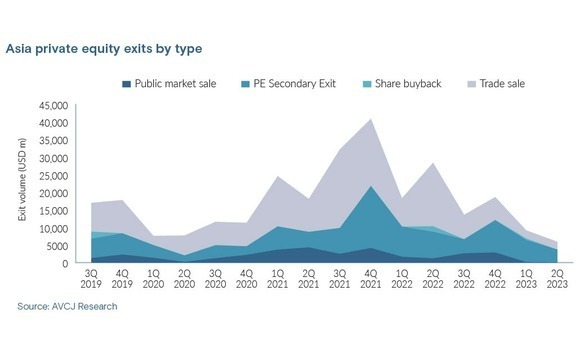

Four private equity-backed companies completed IPOs of USD 1bn or more on mainland China bourses in 2022. In the second quarter of 2023 alone, there were two, while a further two companies raised USD 975m. This underpinned a strong rebound in the proceeds of PE-backed offerings across Asia, which reached USD 17.2bn, up from USD 6.2bn in the first three months.

China was also responsible for the uptick in listings from 50 to 87. Outside of the mainland, less than USD 500m was raised from about two dozen offerings.

China's two largest, coming in at around USD 1.6bn, were both semiconductor foundries with assorted pre-IPO investors. The third-placed entry, CSI Solar, is arguably more interesting. It is the product of a 2020 carve-out of several China-based assets from NASDAQ-listed Canadian Solar. CDH Investments and Oriza Holdings were the main external backers, taking a 20% stake in CSI Solar.

Three of the four largest exits were sponsor-to-sponsor deals, led by India's National Investment & Infrastructure Fund (NIIF) and TPG Capital selling their stakes in Manipal Health Enterprises to Temasek Holdings for around USD 1.9bn (though TPG also committed new capital from a later fund).

This was followed by IMM Investment selling a 30% interest in Korean industrial gas supplier AirFirst to BlackRock for USD 860m and The Blackstone Group offloading India's IBS Software Services to Apax Partners for USD 450m.

Sitting in between these two is Glenwood Private Equity's exit of Korea-based PI Advanced Materials to Arkema of France for USD 764m. It might have been a sponsor-to-sponsor deal as well, but an earlier agreement to sell to BPEA EQT lapsed after regulatory approvals were not secured in time.

Amidst the top 25 exits there are plenty of instances that could be interpreted as investors tidying up portfolios and making distributions wherever they can. IMM's partial exit from AirFirst might fall into this category; so too the assortment of India-based transactions where new capital came in and existing backers made full or partial realisations.

Two exits involved the constituent parts of Japan's Hitachi Kokusai Electric, one of the breakthrough corporate carve-outs from 2017. Following a successful USD 2.9bn tender offer, the business was split in two with KKR taking 100% of the thin-film division and 60% of the video and communication division. The remaining 40% was shared equally by Hitachi and Japan Industrial Partners (JIP).

An earlier attempt by KKR to sell the thin-film division to Applied Materials for USD 3.5bn was thwarted by regulatory intransigence. In June, the private equity firm made a partial exit to Qatar Investment Authority for an undisclosed sum. This followed JIP selling its entire interest in the video and communication unit to electronics giant Nisshinbo Holdings for USD 136m.

3) Fundraising: China flatters to deceive

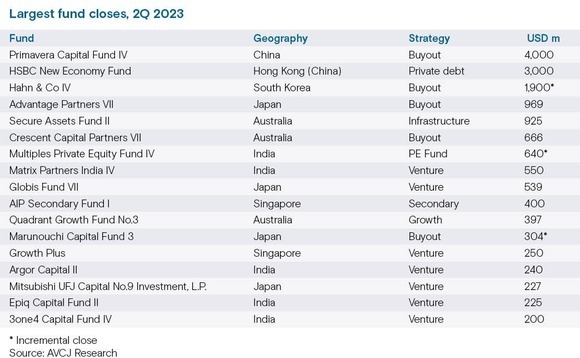

Beware false dawns in China fundraising. Of the USD 5.2bn raised for US dollar-denominated vehicles in the second quarter of 2023, three-quarters is attributed to Primavera Capital Group – which closed its fourth country fund on USD 4bn in May but accumulated the bulk of the corpus prior to the outbreak of war in Ukraine.

Primavera is one of nine Chinese representatives in the 25 largest partial or final closes between April and June, but the other eight are renminbi funds. Other US dollar managers collected more than in the paltry USD 500m registered in the first quarter, but not much more, and certainly less than in each of the 20 quarters before that.

Even renminbi fundraising dropped off or, to put it more accurately, corrected. The launch of two mega government guidance funds in the first quarter was an aberration as commitments to local currency funds fell from USD 33.8bn to USD 4.6bn, which is more in line with recent trends.

Asia-wide fundraising hit USD 21.7bn in the second quarter, the lowest three-month total in nearly two years. Excluding renminbi funds, LPs committed USD 17.1bn, up from the 14-year low of USD 4.8bn in the first three months but trailing the USD 22.8bn average for the prior eight quarters.

In Australia, there were final closes for Crescent Capital Partners on Fund VII (AUD 1bn, USD 670m) and Quadrant Private Equity on its debut growth equity vehicle (AUD 600m). India's venture capital space was also busy, with Matrix Partners India raising USD 550m for its fourth fund, Matrix spinout Epiq Capital getting USD 225m for its second, and 3one4 Capital collecting USD 200m for its fourth.

Meanwhile, Advantage Partners and Globis Capital Partners both made their mark on entering their seventh vintages in Japan. The former raised JPY 130bn (USD 969m), up from JPY 85bn in the previous cycle, while the latter secured JPY 72.7bn for the country's largest-ever early-stage fund.

Advantage spent about eight months in the market, emphasising there is still demand for the right manager in the right market with the right track record.

Other middle-market fundraising efforts remain works in progress, but there appears to be momentum. Hahn & Company took seven months to reach a first close of USD 1.9bn on its fourth Korea fund against an overall target of USD 3.25bn, while Multiples Alternative Asset Management remains on course to hit USD 1bn following a USD 640m first close on its fourth India vehicle.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.