Portfolio: True North and Integrace

True North has spent five years transforming Integrace from a low-margin drug portfolio into a broader, better-performing platform with digital capabilities. The M&A story isn’t finished yet

“I’ve always felt that Ajay Piramal is more private equity than strategic in nature. He likes buying and selling companies, and he looks at assets in the same way as a PE firm,” said Kedar Rajadnye, now CEO of Integrace, an India-based drug developer owned by local GP True North. “He hired me because he’d bought a lot of companies and needed someone to integrate and manage them.”

Until then, Rajadnye had spent the bulk of his career at Hindustan Unilever, immersing himself in the world of fast-moving consumer goods (FMCG), from brand building to supply chains. This experience transferred easily into the pharmaceutical space and what became Piramal Healthcare. He ended up managing half the domestic formulations business that was sold to Abbott for USD 3.7bn in 2010.

Shortly before the divestment, Rajadnye embarked on a new course with a separate division, building a fledgling over-the-counter (OTC) business into a top-five player in India with brands in skincare, nutrition, and baby care. “When you start managing a business on your own, you look for opportunities to unlock value, and that’s how my conversations with True North began,” he said.

There was already a degree of familiarity. Rajadnye’s tenure at Piramal Healthcare overlapped with that of Praneet Singh, who became a partner at True North and now runs healthcare investor Ocimum Partners. His skillset was also a good fit for what True North wanted to do with Integrace, an orthopaedics and pain management business carved out from Glenmark Pharmaceutical in 2018.

“We could have gone down the traditional pharma route and brought in a business head from another pharma company, but we thought about it a bit differently. We didn’t want to do what other pharma companies were doing – we wanted to be differentiated in sales processes, systems, and the use of technology – and that required fresh thinking,” said Satish Chander, a partner at True North.

“Kedar had done OTC pharma, using his experience from FMCG. Having worked at places like Unilever, he understood the importance of trade, supply chains, good business practices, and building partnerships with distributors and stockists in the right way. He fitted the bill.”

Rajadnye joined Integrace in early 2019, ending a 14-year career at Piramal Group, and has since presided over the emergence of a standalone business that looks to solve problems that he claims are “ignored by most pharmaceutical companies.” These include sustainable practices, engagement of doctor-customers through digital channels, and scaling brands in seemingly niche areas.

True North paid INR 6.4bn (then USD 91.8m) for the original Glenmark asset, contributing capital from its fifth fund, which closed in 2015. There have been two bolt-on acquisitions, funded using cash from Integrace’s balance sheet and debt secured against its strong EBITDA: Glenmark’s India gynaecology business in 2020 and Zydus Healthcare’s women’s health drug portfolio in 2021.

Even though the investment is now in its fifth year, M&A will continue. Towards the end of 2021, Temasek Holdings pumped INR 5.4bn (USD 73m) into Integrace, acquiring primary and secondary shares. True North was able to return 25% of its principal. The new capital – which amounted to USD 38m – will support further acquisitions. Two are currently under consideration, Rajadnye said.

Transition agendas

The orthopaedic and pain management business became available because Glenmark was looking to rebalance its portfolio and reduce balance sheet debt. However, CEO Glenn Saldanha – whose father founded Glenmark and named it after his two sons – was reluctant to sell to private equity. True North effectively had to force its way into a process intended only for strategic buyers.

“We were doing some top-down work on domestic formulations, we heard about the transaction, and we liked the asset. We approached Glenn and presented our credentials on control deals, including what happened to the management teams and how the businesses progressed during our tenure,” said Chander. “He was convinced on the people side that we could do a good job.”

The first six months were all about transition. True North had acquired a profitable portfolio, led by brands such as Esoz, Bon K2, and Collasmart, that generated INR 1.56bn in revenue for the 12 months ended March 2018. However, as a former subsidiary of a larger company, the corporate infrastructure and personnel had to be built from scratch.

Rajadnye identified ensuring a seamless transfer of operations as one of three primary challenges. Integrace recruited an entire management team and established standalone functions across IT, sales, and human resources. Several of the points of differentiation highlighted by Chander came into play at this stage, requiring new systems, processes, and key performance indicators.

These foundations, in turn, allowed the company to deliver continuity of governance. “We are dealing in pharmaceutical products, we can’t drop the ball on governance just because we are going through a transition,” said Rajadnye. “This applies at the corporate level and the last-mile level. Any adverse effect in terms of quality standards can hurt you in the long term.”

Projects around sustainable business practices and digitalisation were complementary. Integrace claims its commitment to cleaner marketing practices is contrarian to the rest of the industry, and the company recruited younger medical representatives with “an open mindset” to execute it. This resulted in a more female and digitally savvy workforce with stronger engagement levels.

Digital tools, including gamified training solutions, were introduced to upskill representatives on scientific concepts – an initiative that dovetailed with efforts to build stronger ties with doctors through digitalisation. Specifically, Integrace sought to reimagine the representative-doctor relationship through a digital app called Vkonnect.

“Doctors live in cocoons, surrounded by patients and their needs, with few interfaces to understand what is happening outside. We thought we could add value by providing curated information because we understand their interests and the constraints of time and location,” said Rajadnye.

“We have a team that edits a lot of content into seven-minute videos. Most companies share an article and a case study, but no one has time to study a 40-page document. We provide information piece-by-piece. If a doctor is really interested in a topic, they can get into it.”

In addition to videos, Vkonnect offers a searchable library of medical journals and other resources, quizzes to test knowledge retention, artificial intelligence tools that enable doctors to customise case presentations, and community and content-sharing features. There are 28,000 users, 85% of whom return every month, and average time spent on the app is 17 minutes per week.

Vkonnect is not directly linked to Integrace brands and there are no plans to introduce customised marketing, but the company has tracked a positive correlation between downloads and prescriptions written for its drugs. This feeds the notion of reciprocity – that being seen as a preferred source of information effectively buys a representative more face time with a doctor.

“We are the most downloaded app by professionals in the orthopaedic and gynaecology spaces today. And we’re like a typical IT company in that we track how much time people spend on the app, what they are doing, how we can add more value,” Rajadnye said. “We only have content for two therapeutic areas, so the app could be the precursor to moving into other spaces.”

Buying and building

Another post-transition initiative was building internal capabilities for evaluating and executing acquisitions. “Both deals were led by the company – due diligence, negotiations, contracts, everything. True North is not doing them and passing them on,” Chander explained.

At the same time, he emphasised that M&A has been considered and coherent for fear of creating “a mishmash of different therapeutic areas.” Expansion, whether organic or inorganic, hinges on two key considerations: the target area must help maintain an overall growth rate faster than that of the industry, and it must offer some synergies with existing coverage.

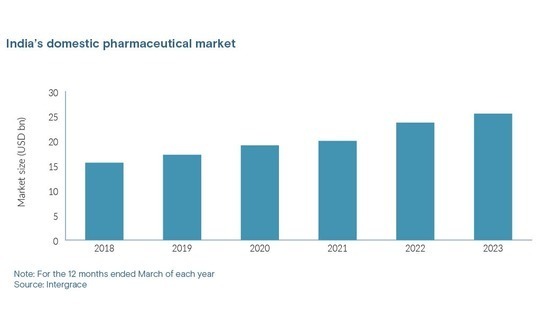

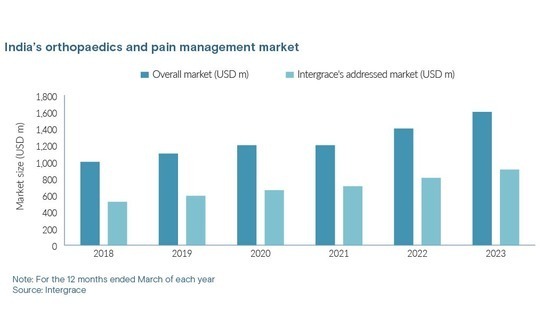

India’s domestic pharmaceutical market was worth USD 25.5bn in the 12 months ended March 2023, having posted compound annual growth (CAGR) of 10% since 2018. The orthopaedics and pain management segment hit USD 1.6bn last year, with CAGR of 11% and Integrace’s addressable market was estimated at USD 907m, with a CAGR of 12%.

The formulations industry breaks down into three broad categories: chronic, where prescription duration exceeds six months; semi-chronic (15 days to six months); and acute (less than 15 days). True North believed the chronic space, though most profitable, had become too competitive, leading to unsustainable marketing practices. Glenmark’s portfolio appealed because it was semi-chronic.

Yet orthopaedics, gynaecology, dermatology, paediatrics, and gastroenterology occupy a sweet spot at the upper end of semi-chronic, creating the potential for high value per prescription. This formed the rationale for the subsequent acquisitions from Glenmark and Zydus. Gynaecology now accounts for about 30% of overall revenue.

Brand-building skills honed during Rajadnye’s FMCG days were brought to bear in recalibrating the portfolio to focus on drugs that could achieve scale. The business acquired from Glenmark included four brands with annual revenue of more than INR 200m. Six have now crossed this threshold, with two in the INR 500m-plus category, a third above INR 400m, and two more above INR 300m.

This has been accompanied by a shift in focus. Esoz and Bon, both key brands under Glenmark, remain in the top six, but Integrace identified greater growth potential in other areas. Stiloz, which is used to treat pain in the legs due to insufficient blood flow, now outstrips all other brands in terms of market dominance with a 45% share. Its rise was in part predicated on doctor education.

“Typically, a patient with pulmonary artery disease (PAD) has trouble walking and a doctor refers them to a consulting physician. What we’ve done is explain to orthopaedic professionals how to treat this. It is a blue ocean for them because they are expanding their patient flow,” said Rajadnye. “In 45% of cases, PAD leads to coronary artery disease. If we detect it early, we can prevent it.”

Other leading brands – each of which has a market share of at least 20% – include Lizolid, an antibiotic that tackles serious bacterial infections such as MRSA, and Dubinor, a treatment for neuropathic pain. Stiloz and Mifegest, a drug acquired from Zydus that is used for medical termination of pregnancies, are the two with annual sales exceeding INR 500m.

A question of time

Integrace has grown substantially across most metrics. The company’s annual turnover has risen from INR 2.3bn to INR 4.3bn, according to healthcare analytics provider IQVIA, while headcount has doubled to reach 720. The Glenmark orthopaedics and pain management business was growing at 3%-4% a year; Integrace increased it to 17%-18%. Gross margins exceed 25%.

Rajadnye describes the journey as eventful. He is encouraged by how quickly the industry accepted Vkonnect, noting that COVID-19 was probably helpful. It took longer to overcome internal scepticism from sales teams that questioned the emphasis on digitalisation and providing a broader set of services to doctors. Management spent upwards of six months gradually winning them over.

For True North, time is not the burden some might assume. Trade sale and IPO exit routes are both open, but for now, the priority is putting Temasek’s capital to work through a couple more acquisitions. Chander observed that five years is True North’s median holding period: some portfolio companies have been exited much earlier; others have been held for more than a decade.

“If a business is accreting well, there is no reason for us to call it short. Contractually, we can accommodate longer investment horizons than some private equity firms because our LPs know we like to take control of assets and do buy-and-build, which often means bringing in new management and making investments to grow new business lines,” he said.

“And in this case, we’ve taken out one-quarter of our investment. That gives us more leeway on the timeline and additional opportunities to realise value.”

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.