China fundraising: Zombie apocalypse?

A pullback by US investors is exacerbating difficult fundraising conditions in China. Most managers are either delaying their return to the market or pulling every lever to secure commitments

Denied access to traditional sources of capital amid a challenging global fundraising environment, Chinese GPs are facing an existential crisis. Absent the restoration of cordial US-China relations or a sharp uptick in returns, many managers must rebuild their LP bases or risk descending to zombie status – dragging out holding periods to maximise fees while nursing faint hopes of rejuvenation.

"It's hard to kill a GP because the cost structures are so flexible, it's just human capital. They will hunker down and try to ride out the market," said Edmond Ng, a managing partner at fund-of-funds Axiom Asia. "It should be a good time to make investments, so maybe in a few years, some of them can come back and raise more money. But track record is the big problem."

Ng wryly observed that track records, especially in China's early and growth-stage space, are so concentrated that much of the value can be traced to a handful of companies: the likes of social commerce player Pinduoduo, short video platform Kuaishou, and social networking giant ByteDance.

Monolith Management, possibly the only China GP to close a first-time fund in the past 18 months, can claim a piece of that story. Xi Cao, the firm's founder, made partner at Sequoia Capital China within two years, largely on the back of an investment history anchored by Kuaishou. He established Monolith in 2021, raised a USD 500m hedge fund, and in February closed a debut VC fund on USD 264m.

Cao relied on more than just Kuaishou. The GP commitment to the fund is around 20%, according to two sources familiar with the situation, and Monolith persuaded some hedge fund LPs to transfer a portion of their commitments to the VC vehicle. Endowments, family offices, and fund-of-funds also feature.

Monolith declined to comment. However, a source close to the process suggested that the firm's rawness might in fact be a blessing. "If you benchmarked China funds with 7-10-year records against the US, a few would be first quartile, most would be second quartile. It might be easier for a ‘blank slate' than an established GP because you aren't selling a track record that doesn't hold up," the source said.

Levels of discomfort

Above all, what Monolith managed to achieve was momentum. The fund launched last November with a target of USD 200m and reached a first close of USD 185m in January, by which point a degree of fear-of-missing-out had kicked in. It is difficult to make stardust stick to a fundraise when LPs are reluctant to commit to anything at all in China, let alone as an early investor.

"At the end of 2022, the base case was that the worst of COVID would be behind us by the second quarter of 2023 and by summer China would be normalising. It all happened much faster, there was a moment of euphoria, some numbers were looking better, but now it's all doom and gloom," said one fund-of-funds LP who was instructed that he could not speak publicly about China.

"It's not clear how strong the recovery will be, so the bar is super high for China right now. If you don't have to do anything – and there isn't much incentive to do anything – you just wait."

As one of a cluster of fund-of-funds with Asia-focused vehicles and mandates, this investor is bound to the region to some extent. LPs managing global programmes out of other markets are not. Several Canadian pension funds have, publicly or privately, confirmed that direct investments in China are on hold. Multiple US and European institutions have halted China fund commitments.

"We've effectively stopped putting capital to work in China. We think the risk-return trade-off in the near to medium term just isn't there," Michael Barzyk, global head of private equity at Allstate Investments, told the Mergermarket Private Equity Forum in New York in April. Greg Jania, global co-head of PE at APG Asset Management, added that some clients were having no China exposure written into their contracts.

Sentiment in the US has soured to the point that investor relations professionals and placement agents claim there is no point marketing there. One estimated that the US has accounted for 60% of the capital raised by China manages over the past decade; now it's 10%. Four in five endowments and foundations have put investments on hold; the rest are either still deploying in China or looking to sell fund positions.

Edward J. Grefenstette, president and CIO of The Dietrich Foundation, is less harsh in breaking down the market across all investor types. One-third are saying a hard no to more China, indefinitely; another third is not liquidating positions but planning to pause at least through 2023 for further study and may reengage with China thereafter; and another third is still open to the idea of investing in the country.

"They are probably pausing modestly but need to spend more time on the ground with managers to re-evaluate prospects. We are in that category. Having honest, face-to-face meetings with GPs and other trusted market participants is critical for us," Grefenstette said, adding that Dietrich's China exposure has dropped from 35% in 2020 to 26% today due to distributions, markdowns, and fewer new commitments.

One US pension fund expressed similar sentiments, highlighting plans to re-map the China market later in the year, with an emphasis on venture capital. Several others described their stance as not anti-China, but they noted the difficulty in getting investment committee approval for anything China-related.

Troubles writ large

For country-focused mangers, geopolitical and performance concerns represent a troubling overlay to already difficult conditions. A US-based LP accustomed to deploying half its USD 200m annual budget with international managers may find that – because of the denominator effect and rising interest rates making bonds more attractive on a relative basis – it only has USD 100m and gives it all to US GPs.

"Whatever they have, the US market might satisfy them. At the same time, they only need build a portfolio that clears their obligations. If that's a 12% return, why shoot for 18%? In this context, bond yields are very important right now," said Axiom's Ng.

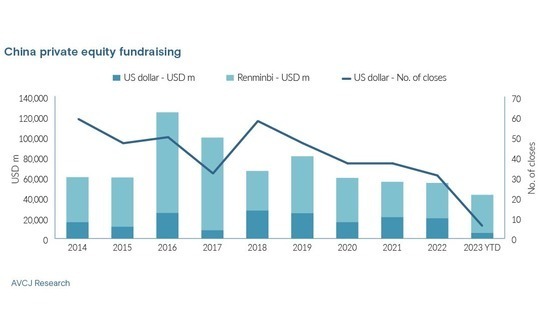

The challenges are already visible in China fundraising data. Approximately USD 19.8bn was committed to US dollar-denominated funds last year – a small drop on the 2021 figure – but HongShan (formerly Sequoia Capital China) and Qiming Venture Partners together accounted for nearly 60% of the total. As of mid-June 2023, USD 5.4bn had been collected across half a dozen closes.

Much the same applies to smaller managers. GenBridge Capital launched its second fund in early 2021, reached a first close of USD 300m within a few months, and then ran into trouble in 2022. It secured a one-year extension and did a final close on USD 400m in May. The fund is smaller than hoped for, but the amount is workable, said a source close to the situation.

Extensions are increasingly commonplace as GPs stay in the market for protracted periods. Sinovation Ventures closed its debut growth fund on USD 600m in February, short of the USD 1bn target after two years of effort. The firm reached a first close on its latest VC fund in April of last year, remains USD 200m short of the USD 500m target, but plans to extend, according to a separate source close to the situation.

Genesis Capital and GL Capital have both completed several closes and are more than two-thirds of the way to their respective targets, but they continue to push on despite passing the two-year mark, other sources said. Industry participants have mixed views as to whether a GP would be best served closing a fund short of target and focusing on deployment or staying open in search of additional commitments.

"If you are 70% to target and want to stay open for another 18 months, I would ask how many deals have been done already and are there any up rounds pending. I've seen investors rush to a final close because they've added eight solid assets since the first close, distributions are coming through, and there's the possibility of an early secondary," said Vincent Ng, a partner at placement agent Atlantic Pacific Capital.

Conversely, a manager might hold a fund open and continue seeding it in the hope of attracting new investors. LPs generally appreciate the opportunity to look before they buy, but Dietrich's Grefenstette warns that a manager who closes two early deals in the anticipation of raising USD 300m and ends up with half that amount will likely experience portfolio construction issues.

Moreover, while a decision to close below target might be predicated on a swift return to market with the next fund, that is a calculated risk. "A GP could raise a smaller amount than hoped for and then get into a situation where most of the capital is deployed," said the fund-of-funds LP. "What happens next?"

Searching for capital

Private equity firms not already in the market are slowing deployment and delaying the point of return. Some do not have that luxury; they have run out of capital and need more to stabilise their teams. "You have to be seen to be doing something," Atlantic Pacific's Ng argued, noting that it pays to be proactive with LPs rather than waiting for the feeding frenzy when conditions normalise.

That said, Atlantic Pacific is wary of taking on any China mandates. Several other placement agents expressed the same view. Asante Capital is open to China business, with Ricardo Felix, the firm's head of Asia, pointing to a recent improvement in sentiment and a positive experience working with local managers. Ten months ago, he would have hesitated even if approached by a top-tier GP.

And those managers are reaching out. "The quality of our China deal flow has never been higher. Firms that I've been reaching out to since I moved to Hong Kong are now sending me messages over LinkedIn, asking to talk," said Niklas Amundsson, a partner at Monument Group, another placement agent. "The good news is they want us; the bad news is they really need us."

Other investors and advisors claim the opportunity is being overhyped. From sovereign wealth funds to family offices, there is plenty of capital in the Middle East, but accessing it requires patience, persistence, and a willingness to accommodate different agendas. "I think the region is being falsely branded as a Klondike for fund managers," Ludvig Nilsson, founder of Jade Invest, told AVCJ in April.

Nevertheless, the Middle East, North Asia, and Southeast Asia are regularly cited as attractive targets for China fund commitments. Targeting constituencies that might be less negative on the country is a key theme, which takes in everything from overseas Chinese money to Asia-based institutional investors like sovereign wealth funds and insurance companies.

There is also increased focus on non-traditional forms of capital – typically family offices and corporates – that aren't necessarily restrained by the denominator effect or by conservative institutional investment committees. Chris Lerner, formerly of Eaton Partners and MSA Capital and now CEO of asset manager Asia Heritage, noted that approaches to these investors must be underpinned by strategic rationale.

"It comes down to thinking about what value you can bring to different kinds of investors," he said. "Can you offer insights to a group that might become an equity partner in your holding company, an LP in your fund, or someone who uses you as a channel for co-investment and learning? What can you offer besides 2/20 because 2/20 with no DPI [distributions to paid-in] isn't attractive anymore."

Atlantic Pacific embraced this philosophy when working with a manager on a recent co-investment pitch for a technology deal. They specifically targeted family offices and corporates in Southeast Asia that have exposure to natural resources that form a key part of the company's supply chain. These groups were invited to invest alongside the fund to build familiarity ahead of a possible commitment to the fund.

Co-investment is one of several incentives offered to prospective LPs alongside stakes in the GP and access to secondaries. There are two principal paths for secondaries: an incoming investor is invited to make a stapled commitment in conjunction with the purchase of interests in older funds; or an existing investor is encouraged to re-up using part of the proceeds generated through a secondary transaction.

Neither path is easy to navigate, according to one secondaries advisor. First, incoming investors are typically asking for USD 5 of secondary for every USD 1 of primary commitment, compared to 1:2.5 in the US. Second, Chinese GPs look to cram as many assets as possible into continuation funds, diluting the impact of standout portfolio companies and thereby eroding the price investors are willing to pay.

Jason Sambanju, a partner and CEO at secondaries specialist Foundation Private Equity, believes the bid-ask spread is narrowing as GPs accept that discounts must be steeper than 20%. This doesn't necessarily translate into more deal flow: rationalisation of pricing expectations on the LP side can be more haphazard and then there's no guarantee a secondaries investor can syndicate a deal once it is agreed.

Ultimately, though, the new fundraising reality is forcing the issue. "Every established US dollar manager must think about whether their US LPs will come back for the next fund," said Sambanju. "The pin dropped in 2022, so it's new. If it is going to generate more deal flow, it won't happen until later this year or sometime next year, or even 2025. But I think we will see more continuation funds."

Day of reckoning

For managers still struggling to make a breakthrough on fundraising, there are more fundamental pivots. Numerous China GPs have sought to rebrand themselves as pan-Asian – despite reservations among LPs about their ability to deploy beyond China – while others are turning to renminbi funds as a means of keeping the fees rolling in and their franchises intact.

However, this is merely delaying what Asia Heritage's Lerner regards as an essential period of introspection for China managers – and an inevitable moment of reckoning if they are to reclaim the affections of international investors based on performance.

"You need to look at your team, your focus, how you've run your business, what you've done well and what you've done not so well and make improvements. Then you must have an intellectually honest conversation about the market and the state of your portfolio," he said. "If you just come out with the same pitch and target geographies you think are less penetrated or more open to China, it won't work."

There are examples of bounce-backs in Asia – Advantage Partners in Japan and Pacific Equity Partners in Australia – where managers have experienced difficulties at the portfolio level, taken stock, endured a difficult fundraise, but ultimately emerged stronger. In each case, introspection led to tweaks in strategy, best practice, and sector coverage, and the GPs didn't rush back to market as these changes took hold.

China's private equity hierarchy has evolved over the last 20 years, with certain managers fading and others coming the fore, but no one can identify a bounce-back. Industry participants offer explanations ranging from the relative youth of most firms to a pervading cult of personality whereby the power and economics rest with an individual who is reluctant to submit to internal cross-examination.

Fundraising in China will continue to favour a select number of firms who float above the carnage below as their peers compete for a smaller pool of international capital. To some extent, it's not personal and it doesn't have to be protracted. Dietrich's Grefenstette sees the current struggles as a function of the macro rather than the micro and he is willing to wait for a government-led return to pragmatism.

But there will also be questions about the sustainability of existing investment strategies in a comparatively lower growth environment and the viability of exit routes that historically have relied heavily on US capital markets. GPs always claim differentiation; now they will be asked to prove it.

"Some zombie GPs will emerge and then consolidation will follow. There will be those who really take it on the nose and those who will very successful," said Monument's Amundsson. "China's been a bit of a beta market to date. We are about to find out who adds value the way they say in the pitchbook."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.