Start-up banking: Filling an SVB-shaped hole

Silicon Valley Bank was arguably the only institution globally to comprehensively service the unique banking needs of start-ups. In its absence, a mix of players are rising to the challenge

When China's MetaApp, a gaming platform backed by several local VC firms, discovered on the morning of March 10 that Silicon Valley Bank (SVB) had collapsed, it still had USD 20m cash in its US-based account. Unable to transfer the money to Hong Kong or Singapore, the start-up soon realised that to be covered by federal deposit insurance protections, it had to transfer the money elsewhere in the US.

MetaApp turned to East West Bank (EWB), where founder Sen Hu had maintained a personal account in the US for several years. EWB opened a corporate account for MetaApp within 24 hours. The entire process, from withdrawing cash to depositing it in the new account, was done remotely from China.

Experiences of this kind appear to be widespread, albeit involving varying degrees of red tape. Start-ups with accounts at SVB have been able to get out, and by and large, they've decamped to systemically important banks. But the exodus has highlighted an inconvenient truth: start-ups don't get what they need from traditional diversified banks.

"I think SVB is a good enterprise that offers great service. In fact, after the fall of this kind of good product and service, money will rush to the mainstream banks. The service and efficiency with those large banks will get worse due to their volume advantage," Hu said.

"For personal accounts, we are used to using online banking. But for corporate banking, it feels like everything needs to be dealt with by a real person. You can't get anything done through online banking or their back-end system."

EWB has been one of the most welcoming banks for Asian start-ups in the wake of SVB. Its usual processing time for opening an account is about a week; as demonstrated by MetaApp, recently this has been contracted to a single day. Emma Wang, deputy general manager of EWB's Hong Kong branch said she has seen "tremendous" flow from both US and Hong Kong-based start-ups.

"Our platform is very similar to what SVB provided. Both our platforms are actually designed by the same vendor – it's just the surface is different. The core function is really to service start-ups for their cash management," Wang said, adding that SVB's specialisation in PE and VC was its key differentiator. "We are a very diversified balance sheet. Failure of one industry will not trigger a failure of the bank."

Best of both worlds?

The observation goes to the heart of the dilemma for start-ups seeking both stability and SVB-like support in a macro environment characterised by bank runs and evaporating funding channels.

The trends around these themes are naturally most prominent in SVB's home market. In February this year, only 9% of start-ups in the US had bank accounts at the major domestic banks, but by April, that number rocketed to 72%, according to San Francisco-based start-up accounting and tax advisory business Kruze Consulting.

JPMorgan has been the most popular destination by far. This is understandable in light of its acquisition last month of First Republic Bank (FRB), perhaps the second biggest of the start-up-friendly dominos in the SVB crisis. Bank of America, Morgan Stanley, and Wells Fargo are distant followers but saw substantial increases in percentage terms.

Kruze is pushing its clients in this direction and claims regional VCs are too. It recommends having at least one month of payroll in a so-called too-big-to-fail bank, as well as an "escape hatch" protocol for quickly redirecting other deposits and investments into the sturdiest account.

Fortunately, the newly unemployed bankers who focus on start-ups are also moving to Wall Street, although it has been an incomplete migration. Even in the instance of JPMorgan absorbing FRB, some of the latter's senior start-up bankers were not brought across as part of the deal.

"The start-up groups at JPMorgan are great but they hit capacity very quickly, so they started sending people to the branches. At the branches, the poor start-up founders were getting questions like, ‘Why do all these institutions own 20% of the company? We're not used to seeing that,'" said Scott Orn, COO at Kruze and formerly a partner at US venture debt mainstay Lighthouse Capital.

"We saw this boomerang effect where start-ups couldn't get their accounts open at too-big-to-fail banks. That's settled down now, but the start-ups are just not that important to JPMorgan. I think it's going to take time to hire more SVB of First Republic bankers."

HSBC on the rise

The most significant momentum on this front in Asia is happening at HSBC, which acquired SVB's London-based business for GBP 1 as part of a deal facilitated by the UK government and the Bank of England in the heat of the meltdown.

HSBC has also absorbed significant SVB talent outside of the UK. These efforts culminated earlier this month with the unveiling of an innovation banking unit that brings together the UK, US, Israel, and Hong Kong teams.

In Hong Kong, a start-up lending strategy and ecosystem support programme has been in place since 2019, with USD 1.8bn in debt funding earmarked for Greater Bay Area technology and healthcare start-ups. That pot has now been expanded to USD 3bn, with a wider Greater China remit that also touches sectors such as consumer, industrials, climate, and life sciences.

"If start-ups are going to scale and commercialise, they need people to take risk. That's what venture is for, but at some point, banks have a responsibility," said Thomas Elliot, HSBC's head of client coverage for Hong Kong commercial banking.

"If you look at how banks traditionally take risk and lend, we would say we need to see three years' audited financial statements with nice profits and cash flows, and ‘Please can we have your building so we can take a mortgage?' If you're a start-up in advertising technology or a disruptive fintech, you don't have any of that. It's a real philosophical evolution in terms of how banks think about this kind of stuff."

HSBC's venture debt strategy goes as early as Series A. Annual revenue of USD 4m is typically the starting point, although pre-revenue companies with extended commercialisation dynamics such as biotech developers are considered on a selective basis. Cheques range from USD 1m to USD 50m. Structures are flexible and can include equity kickers.

One of the standout deals to date came last March with a USD 8m green term loan to Hong Kong's Ampd Energy, a Series A-stage energy storage company. HSBC acted as the sole lender, security agent, and account bank. It claims to put as much diligence and analysis into transactions in this vein as it would with a large corporate acquisition financing deal.

Elliot describes the offering as unique in Asia, and that's hard to dispute. In India, the region's most developed venture debt market, for example, most banks have at least some kind of start-up lending programme. However, there's a fair amount of turnover in the relevant teams and little activity in terms of early-stage risk.

DBS has been among the more aggressive banks in dollar terms, having set up a USD 500m mostly India-focused venture debt programme called EvolutionX alongside Temasek Holdings. EvolutionX will put warrants into deals but tilts conservatively toward quite mature companies. As a result, only three deals – all in India – have been agreed since launch in late 2021.

Ankur Bansal, co-founder of longstanding Indian venture debt firm BlackSoil, confirms that HSBC is among the more prolific and aggressive banks locally in terms of start-up engagement. But this does not necessarily translate into taking on substantial risk in underwriting.

"There's been a lot of progress – it's not like people shudder at the thought of working with banks," Bansal said, referring to the general trend of banks embracing start-ups in India.

"But when it comes to the lending part of it, covenant structures will be much heavier, there will be the requirement of flowing all the cash through their bank, and they will require a lot more visibility and documentation. That's the balance one has to make to raise relatively cheap debt."

Remember the downside

There is also a sense that traditional banks are only able to get regulators comfortable with their explorations into early-stage tech risk by baking protective instruments into deals. And for the start-ups, these can be overly cumbersome.

At the cheapest lending rates, the devil will be in details such as material adverse change (MAC) clauses, abandonment clauses, and minimum runway requirements. HSBC declined to comment on regulatory matters and noted that deal terms regarding downside protections of this kind were weighed on a case-by-case basis.

"SVB bankers were great relationship people, but it's easier to be a great relationship person when you can say yes a lot. I'm not sure those bankers are going to have the same autonomy and arrows in their quiver at other banks," said one industry participant.

"It's very easy to structure a loan where the bank is not really taking any risk and the start-up doesn't really get any benefit from it. Every few years Wells Fargo tries a venture lending business, but they can never really do it because they can't take the risk."

Standard Chartered is in the initial stages of setting up a venture debt fund – it wants to eventually offer a full spectrum of start-up services – but the bank is taking its time. For now, outreach has been the priority, especially in terms of ecosystem-building exercises such as fintech challenges and incubation. The centrepiece of the strategy is its Singapore-based investment unit SC Ventures.

SC Ventures funnels emerging fintechs into the parent bank but its greater vision is to be a platform for innovation and community building. Only some portfolio companies have Standard Chartered accounts, but all cross-pollinate with the bank in areas like accounting services and cash management. This includes start-ups getting advice on transferring excess equity funding cash into interest-generating deposits.

"Most start-ups are so busy running their own businesses, they sometimes neglect that aspect of cash management," said Gautam Jain, a member at SC Ventures who previously served as Standard Chartered's global head of digitisation, client access, and transaction banking.

"Treasury management as a service for start-ups is something that's very valuable – I know of at least a couple of fintech companies that are developing it. We're looking to see if there's an opportunity for them to come together with our ecosystem to create a value proposition."

Need for speed

The essential understanding here is that start-ups have trouble accessing relevant non-lending financial services from traditional banks for the same reasons they need those services in the first place.

Start-ups do not have normal account balances. They can suddenly raise millions of dollars at the prototype stage and then spend it all within two years. They have a complex web of fiduciaries, with some board members representing investors with their own underlying investors.

Furthermore, since the competitive advantage of start-ups is speed rather than scale, any friction in their financial infrastructure could alter their ability to survive and thrive. It is therefore crucial they find banking partners that can execute quickly.

Traditional non-tech small to medium-sized enterprises (SMEs) would also prefer faster banking services, but it's less mission-critical. Still, start-up demand for digital banking can be inferred from the SME set, which has demonstrated a clear preference for banks with more digital capabilities.

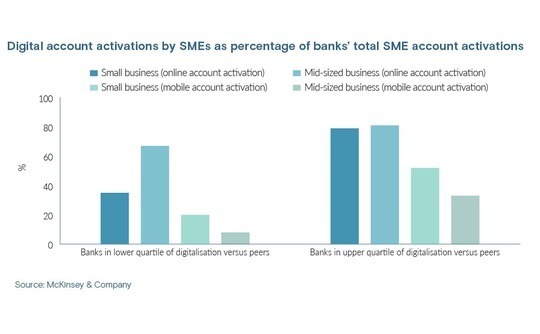

Among banks with the most developed digital services, 79% of the accounts they activated with small businesses were done so online, versus only 35% for banks with the least developed digital capabilities, according to McKinsey & Company. For medium-sized businesses, these figures were 81% and 67%. The discrepancy is even wider for SMEs activating accounts via mobile.

"When you're doing something frontier tech or disruptive, they [banks] don't really know how to account for it in the books. Sometimes your own accountant doesn't understand it, and that can create huge challenges later," said Manu Rikhye, a partner at India's Merak Ventures.

"These are things founders need help setting up so they can have their house in order for more sophisticated investors later. I couldn't do that as an angel but as a fund I can because we are institutional and have resources – people who do this on a day-to-day basis."

Rikhye helped spin out Merak from angel network GrowX Ventures last year and has raised about half the targeted corpus of a debut USD 100m fund. Merak invests in companies at the prototype, pre-revenue stage. Part of the service is connecting investees with corporate secretarial experts to organise their accounts.

In later stages, start-ups with big expansion plans are warier of spending their equity on anything so routine. But as VC funding has decelerated, basic operational expenses such as payroll have come to the fore in start-ups' financial services wish lists.

"Especially in this market, since last year, working capital loans are what most growth-stage start-ups are looking at, unless they've hit profitability or are on a path to profitability," said Yoshiharu Okubo, a vice president at East Ventures.

Digital dynamics

East has several portfolio companies in alternative lending that help other start-ups with working capital, most notably Indonesia's Koinworks, which raised a USD 108m Series C last year. Although best known for peer-to-peer lending, Koinworks has recently expanded into neobanking services including money transfers and expense report management.

Okubo advises start-ups to diversify their accounts both in terms of traditional banks and their fintech interfaces, noting there are risks in start-ups concentrating too much in one camp or the other. That sentiment appears to be amplifying in the aftermath of SVB.

Many neobanks magnify their ability to claim central bank deposit coverage by virtually syndicating it out to other banks through instruments called insured cash sweeps or demand deposit marketplace programmes. There's nothing wrong with this per se. But if the technical legal risk of a neobank using a traditional custodian bank partner is close to zero, practical operational risk matters in edge cases.

"Theoretically, if a traditional bank is the underlying custodian, there's little or no risk. However, in a scenario where such arrangements matter – likely an extreme case – it is impossible to know whether basic frameworks hold and will be executed as expected," said John Kim, a managing partner at US-Singapore VC firm Amasia.

"For example, although a custodian bank would legally be required to help its fintech partner's customers, in a crisis situation, they may not prioritize such obligations relative to clients who have a direct relationship with the bank. We saw during the SVB collapse that the difference of hours or even minutes could cost billions of dollars."

It's a matter of some speculation how feasible it is in the foreseeable future to combine digital interfaces, VC savvy, and traditional banking security into a single package with comprehensive start-up services spanning accounting basics to complex venture debt products.

Despite its spectacular downfall, SVB came closer to this ideal than any other organisation, and it remains to be seen whether the formula can be repeated in Asia. Regulation and culture could be the key inhibitors. Over a period of decades, SVB was able to gradually train regulators in a single jurisdiction to accept its unconventional loan portfolio. That's difficult magic to reconjure.

"I think Asia needs it. There's an opportunity for someone to do it really well. I hear HSBC mentioned a lot nowadays, but it's missing from a bank perspective," said Karthi Sepulohniam, head of Asia Pacific at Partners For Growth, one of the first venture debt players in the region.

"SVB went beyond loans. They provided founders support, networking, access to new markets. We've partnered with them to do events in the past. But no one does that. So yes, there's a gap in the market."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.