China: Who's investing?

Private equity investment in China remains in the doldrums yet local investors claim to see green shoots. Where, when, and how they engage with the market is likely to differ from previous cycles

China's Labour Day festival in early May is expected to trigger a consumption boom – and provide a positive addendum to a first quarter in which GDP growth came in at 4.5%, exceeding the most optimistic predictions. China Tourism Academy estimated that 240m people would travel during the five-day holiday and spending would reach CNY 120bn (USD 17.3bn).

"People thought that there would be a second wave of COVID-19 in China but it appears to have ended quickly. From food and beverage to real estate to transportation, activity has heated up," said Yongbing He, CIO of local private equity firm CPE. "When people realised the pandemic was really over, there was a very clear turning point and the Chinese economy began to recover."

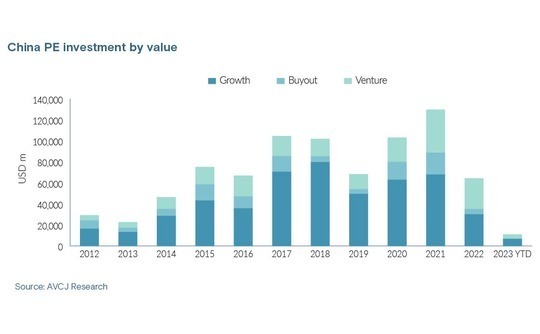

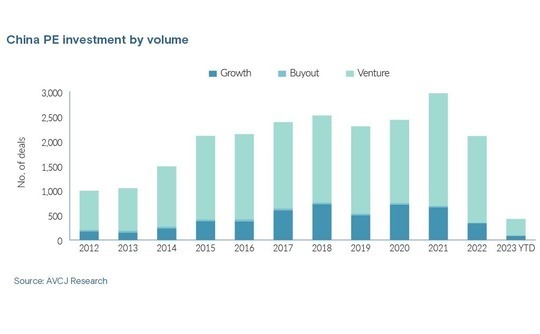

Private equity investment has yet to recover. The USD 8bn deployed in the first three months of 2023 was the lowest quarterly total since 2015, according to AVCJ Research. Having hit a record USD 130bn in 2021, deal flow slumped to USD 64bn in 2022, also a seven-year low. The growth capital share slipped below 50% for the first time in a decade, reflecting a general discomfort with the technology sector.

Even then, the 2022 total was inflated by a few very large deals. Eight transactions of USD 1bn or more amounted to USD 14bn, and half of that went into the two largest, both of which were driven by state-owned investors. Overall investment volume fell by 30% in 2022 and growth deals were down by half.

The valuation gap remains a sticking point. While venture capital investors note that founders have begun to adjust their pricing expectations downwards, private equity is still in limbo. More mature companies tend to be less cash-hungry than start-ups and the recent pick-up in the economy – and in public markets – has eroded their willingness to compromise.

Prevailing market conditions – including a risk-off mentality among GPs still mindful of the recent uncertainty – have made the pricing process almost impossible. One solution, according to Thomas Chou, co-head of the Asia private equity group at law firm Morrison Foerster, is to rely on convertible notes and warrants, which allow valuations to be deferred until the target's next priced equity round.

"Founders and their existing investors are starting to accept that down rounds and recaps may be the only means available to offer a valuable lifeline to bridge a company to a meaningful subsequent round of financing and ultimate liquidity event," said Chou.

"As deals have started to pick up on the back of this, the market is stabilising and we are slowly seeing a return to priced equity rounds, with convertible notes raised in the last 12-18 months finally converting into equity," said Chou.

Peak to trough

In most cases, valuations peaked in the first half of 2021. The subsequent downturn was driven by intensifying crackdowns on platform internet companies and property developers, a decision to ban commercial actors from the after-school tuition space, and a post-IPO investigation of ride-hailing player Didi Chuxing that struck fear into those pursuing US listings.

Any hope for a turnaround, and a rebound in public and private markets, was extinguished by COVID-19 lockdown measures, principally in Shanghai. Numerous private equity investment professionals and LPs got stuck in the city while on trips during Chinese New Year.

"Uncertainty as to what will happen next and whether there will be unexpected regulatory changes is the main reason for US dollar investors struggling with China. It's worse than China-US tensions, which aren't new. Some of former President Donald Trump's rhetoric was very anti-China, but it didn't stop people investing in China," said Niklas Amundsson, a partner at placement agent Monument Group.

Positive signs began to emerge at the end of last year. China's post-pandemic re-opening aside, there was no transformative announcement or definitive turning point around which the industry could rally. Rather, some investors – not all – pointed to a series of snippets that gave them more confidence.

For example, the investigation into Ant Group ended with a less draconian punishment than many had envisaged; Premier Qiang Li made the strongest statement in recent memory supporting the private sector; and several foreign investors won approval for financial services investments, including a move by Warburg Pincus to acquire a stake in a domestic fund management house.

Fred Hu, founder, chairman, and CEO of Primavera Capital Group, added that policymakers realised they "went too far and too hard in the tech crackdown in 2020-2022." Now, the focus is on a course correction and a regulatory reset to boost investor confidence and rejuvenate entrepreneurship.

The Chinese government is described by some investors as being caught between two performance indicators: driving economic development and ensuring political stability. There is a general expectation that economic development will be prioritised over the next couple of years.

"It's like when you ride a bicycle and you lean too far to one side, you need to rebalance. And right now, in China, the weak side is the economic side, obviously," said one investor.

Of policy, geopolitics

Still, there were some takeaways from the disruption, including the importance of understanding regulations and establishing red lines. Forebright Capital, for example, now excludes sectors with ties to public welfare or a reliance on customer relationships, said H.W. Chen, a partner at the firm. CPE avoids policy-sensitive assets in areas such as finance, real estate, basic medical care, and media.

Investment strategies are also being influenced by China's deteriorating relationship with the US, with several managers seeing little chance of improvement in the medium term. Beijing's engagement with Moscow amid the ongoing Russia-Ukraine war hasn't helped matters.

Even though numerous high-profile Western officials, including US Treasury Secretary Janet Yellen, have warned of the damaging impact of decoupling from China, the phenomenon now seems to be apparent in trade volumes. China's exports to the US and Europe fell 17% and 7.1% year-on-year in the first quarter, but this was counterbalanced by significant growth in exports to Southeast Asia and Russia.

China-focused private equity investors play down the implications of decoupling. Trustar's Zhang observed that 70% of global trade is in intermediate goods – whereas 30 years ago it was 70% finished goods – and complex global supply chains are not easily disrupted by tariffs. A Chinese manufacturer could move only the latter stages of production to Vietnam and avoid all tariffs imposed by the US.

"While some attempt to revamp global supply chains and relocate the original specialisation, it significantly increases production costs. This creates a paradox as the goal to achieve supply chain security conflicts with the goal to contain inflation – to pursue supply chain security at any cost, one must accept inflation at any cost, and ordinary people end up bearing the burden," Zhang added.

Several pan-regional GPs have indicated the China allocation in their current funds will be lower than in previous vintages, but others demur. One investor noted that, while the pace of deployment in China has slowed, the overall allocation should not fall because the country has such strong fundamentals.

Time and again, investors point to the growth potential China has yet to realise: a GDP per capita of USD 12,000, still trailing developed markets by some distance; industrialisation and urbanisation that are ongoing and irreversible; a group of high-earners on USD 48,000-plus who represent 10% of the population, boast a collective GDP equal to that of Japan, and are only going to grow in number.

"As the second largest global economy, China will contribute to almost one-third of the global GDP growth in 2023, based on IMF estimates. China is looking to a clear post-COVID recovery this year and the market expects GDP growth of more than 5%," said Andrew Li, head of Greater China at Advent International. He also highlighted the moderation in valuations of late.

Mode of engagement

A "China for China" strategy is gaining popularity among certain players as a means of investing in the country while minimising the decoupling risk. In contrast to the "exporting to China" model whereby sales teams are deployed locally to market international products, it involves creating a China operation that has greater autonomy and develops products for local consumers.

Capvis, a Switzerland-headquartered buyout firm with total invested capital of more than EUR 3.5bn (USD 3.8bn), is active in China to the extent that it helps European portfolio companies expand there. For example, last year it facilitated Gotha Cosmetics' acquisition of iColor Group to accelerate growth with local brands in China and develop production facilities to address the broader Asian market.

"China for China is often the best way forward. Local competition is so intense you must be on the ground or you risk losing the market. It's important to give the China operation some independence, with its own R&D and engineers to roll out localised products," said Wolf Stein, co-head of Asia at Capvis.

"The exporting to China strategy will become more challenging: it will not work unless you have a super dominant market position and most international companies do not."

China's appeal relative to other markets is not limited to its size and growth prospects; the country is also at a different point in the economic cycle. The government is not risking recession by raising interest rates in a bid to curb inflation. Indeed, the central bank recently announced monetary easing measures.

"From an absolute risk point of view, each market has its own risks. While the West is worried about a potential economic recession, China has already started to recover and focus on growth and job creation," said Frank Tang, chairman and CEO of FountainVest Partners.

None of the China-focused managers interviewed by AVCJ has plans to develop expertise in other markets. Several have ventured into new geographies to make acquisitions, but investment theses are infused with some kind of China relevance. Two GPs that have established offices in Southeast Asia said their primary motivation was to work with Chinese entrepreneurs who are expanding into the region.

Others have returned to China after exploring Southeast Asia and India. The challenges they encountered are well-known: companies that are too small for relatively large China funds; fragmented markets that lack homogeneity; complex legal and regulatory environments. Joe Ngai, Greater China chairman at McKinsey & Company, spoke for many when he observed that "the next China is China."

"China holds several advantages over other markets, primarily due to its status as the largest single market in the world, offering a more unified landscape in terms of currency, monetary policy, legal and administrative systems, language, and customers," said Rongjing Zhao, a partner at Morrison Foerster.

"Additionally, China's ‘talent dividend' or ‘engineer dividend' is another strong comparative from a highly-integrated industrial ecosystem, supported by a targeted higher education system for engineering, which has produced a large pool of skilled labour."

Target areas

Healthcare specialist CBC Group started out as a predominantly China-focused investor and then grew into a pan-Asian platform. However, the firm is now accelerating its pace of investment in China, deploying around USD 1.5bn over the past 12 months across PE, credit, and infrastructure strategies.

"This is the best time to go overweight China – a market with the lowest valuations and the highest growth potential globally. But we are investing in a different way, focusing on companies with good liquidity. We must adapt to different stages in the market," said Fu Wei, founder and CEO of CBC.

"I don't think the capital markets will be good during the next two years. Innovative pharmaceutical companies will not receive unlimited financing, so they cannot afford to make mistakes."

Not for the first time, an emerging trend being championed is the gravitation towards control investments. Over the past decade, the buyout share of overall China deal flow has fluctuated between 5% and 20%, averaging out at 13%. GPs reference three primary buyout types.

First, multinationals divesting assets as part of China exit strategies. He of CPE said that his firm is in dialogue with US technology companies regarding such deals. Second, special situations opportunities have emerged from the difficulties of the past two years, typically involving businesses with high debt loads or where major shareholders need liquidity.

Third, Chinese companies listed in the US are looking for partners to support take-private transactions. The buyout share hit 20% in 2015 following a swath of similar deals. Forebright is still active in the space, completing privatisations of digital power transmission equipment manufacturer Jinpan Electric and IT outsourcing service provider iSoftStone. Both relisted domestically at higher valuations.

Even though growth capital activity has dropped off significantly, the likes of Trustar and FountainVest expect to continue investing in the space to build ecosystems around their buyout portfolios. Chou of Morrison Foerster added that growth deals are still getting done, albeit at more prudent valuations and at a much more selective pace than before the pandemic.

CPE, meanwhile, believes control and majority transactions in China exhibit the same growth-driven characteristics. This is because leverage buyouts (LBOs) are still rare in the local market and Chinese companies follow different cash flow management practices to their US peers.

"China is a developing country and many companies are in a fast growth period, which means they tend to reinvest every penny they earn into development, to create second or third growth curves. They rarely prioritise cash for dividends, which makes it difficult to do traditional LBO-type investments," said CPE's He.

As for sectors, technology, new energy, and consumer are frequently tagged favourites. To some, reports of the death of consumer technology are greatly exaggerated. The latest artificial intelligence business models characterised by OpenAI's ChatGPT are viewed as game-changers, with several investors suggesting they represent an opportunity to reshape internet companies.

New energy, including renewables, resonates with investors because it is aligned with China's overall development direction and policy support is likely. Deep-tech and semiconductors are presented in the same context – often with a buyout angle as well as a growth agenda given regulators are generally keen on consolidation as a means of delivering efficiencies and industry upgrades.

Still bullish?

Not all investors will act on opportunities with the same level of aggression. Some are struggling to raise capital and cannot pursue even the most compelling of deals; others have broader remits and may find more attractive risk-reward elsewhere; and still more might be haunted by the difficulties of the past two years, and either still working through existing China portfolios or reluctant to build new ones.

China-focused managers don't necessarily have this flexibility: they are inextricably tied to the country and have mandates to deploy capital there. Enduring bullishness is understandable, but Primavera's Hu makes his case in a broader economic context that is relevant to all investors.

"I believe global investors will, sooner or later, regain comfort about investing in China," he said. "China is not about to go away and its importance in driving global growth and value creation continues to rise. In the medium to long term, China and the US will be two of the world's largest and most consequential private equity markets."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.