Put a bow on it: India draws funds to GIFT City

India has created an onshore jurisdiction with offshore characteristics to lure country funds currently domiciled in Singapore and Mauritius. Does GIFT City have staying power?

ChrysCapital Partners has been using Mauritius as its fund domicile for nine vintages and counting. Compelling arguments can be made for moving onshore: greater investment flexibility, which can drive returns; and greater diversity in the LP base with the inclusion of local investors, which reassures global LPs yet eases a manager's reliance on them. But ChrysCapital refuses to rush.

Four years ago, when preparing to launch Fund VIII, advisors championed alternative investment funds (AIFs), the go-to local structure. ChrysCapital demurred, citing uncertainty over the taxation of management fees and carried interest. Last year, with Fund IX nearing, the same advisors had soured on AIFs but suggested something else: a Gujarat International Finance Tec-City (GIFT City) structure.

GIFT City is India's bid to bring the offshore infrastructure behind country-focused funds onshore. The international financial services centre (IFSC) replicates much of what is offered by Singapore and Mauritius in terms of taxation and other regulations but weaves in advantages tied to being treated as local capital. ChrysCapital, however, was unmoved. GIFT City will be considered for Fund X.

"We want to wait for one fund lifecycle and see how it plays out," said Kunal Shroff, ChrysCapital's managing partner. "It makes logical sense to move onshore, provided the government ensures there is clarity. What we've seen [with AIFs] is they keep tweaking the rules, and that gives us pause. We are mindful that if we moved from Mauritius to India, it wouldn't be easy to move back."

Numerous local private equity players have made the jump, with the likes of Kedaara Capital, Multiples Alternate Asset Management, and True North setting GIFT structures or looking into doing so, according to industry sources. VC firms are also arriving, including Blume Ventures, Fireside Ventures, and 3one4 Capital.

Nearly USD 11bn has been raised by approximately 60 funds registered in the jurisdiction, and those vehicles have put more than USD 500m to work, according to Kalpesh Jain, a managing director and CFO of Multiples. But ChrysCapital is not alone in holding back.

"GIFT City is a good structure for Indian GPs – especially new managers – that want to raise money offshore because Singapore and Mauritius can be prohibitively expensive. It is different for GPs already established in Singapore. LPs would question any move and there really isn't enough upside right now," said Pratibha Jain, group general counsel and head of corporate affairs at Everstone Group."

Concept to concrete

If demand for real estate is a valid yardstick, GIFT City is already a smash hit. An entire financial services ecosystem – fund managers, lawyers, accountants, fund administrators – has descended on a city that is still building the infrastructure required to meet its aspirations. Moreover, its status as essentially an offshore destination within India can be problematic when it comes to construction.

"There is inadequate availability of office space, and even once the space is acquired, getting it ready for use takes time. There could be issues around import-export regulations," said Nandini Pathak, a leader in the investment funds practice at Nishith Desai Associates.

Kalpesh Desai, a partner in the India M&A tax and private equity tax practice at KPMG, noted that anyone looking to open an office right now might have to be satisfied with a six-seat room or part of a co-working space. Pranav Pai, co-founder of 3one4, described his firm's GIFT City set-up as "not even close" to the firm's standard office. Neither expects this to be a long-term obstruction.

The concept was apparently seeded when Prime Minister Narendra Modi, then chief minister of his home state of Gujarat, visited Singapore and was impressed by the financial services infrastructure. It gave impetus to the question of why India was sitting back and allowing services to be provided from offshore rather than bringing all that economic activity – and all those jobs – back home.

The Gujarat government announced plans to build India's first greenfield smart city in 2007, allocating 886 acres of land near Gandhinagar, the state capital, for the project. It was divided into zones: a domestic tariff area where local companies could benefit from various tax incentives; and a special economic zone that houses India's first IFSC.

Initial regulations for fund management were issued in 2016. They roughly coincided with a redrawing of India's double taxation agreements with Mauritius and Singapore and the introduction of the general anti-avoidance rule (GAAR). Together, these cracked down on the use of jurisdictions for tax avoidance, forcing managers to establish substance if they wanted to access treaty benefits.

"From 2017, substance took centre stage. Questions are always asked about the commercial rationale of different structures, and it became harder to use Mauritius and Singapore only for tax benefits," said Tushar Sachade, a partner in the India tax and regulatory services practice at PwC.

"When they created the IFSC concept, which has non-resident status, the starting point was, ‘If people are investing out of Singapore, what benefits are they getting?' And they had no choice but to offer equal or better benefits, otherwise, people wouldn't go there."

The primary selling point of GIFT City is that it allows fund managers to operate within India without triggering permanent establishment and becoming liable for local tax. They get Singapore-style benefits – levies of 10%-15% on passive income streams such as interest, royalties, and dividends, and zero for capital gains in certain circumstances – at lower cost.

In a fund manager survey conducted by GIFT City, lower operating costs were identified as the key benefit, followed by proximity to the onshore market, favourable regulations, and tax benefits. GIFT City claims its set-up costs of USD 8,000-USD 12,000 are at least 66% lower than Singapore and on par with Mauritius. Annual ongoing costs of USD 7,000-USD 15,00O are 68%-75% lower.

Getting comfortable

More details of the GIFT City fund management regime, including an exemption from having an Indian tax identification number and filing domestic income tax returns, emerged as regulators sought to fill in the gaps in those early years. Yet take-up was relatively slow.

The sticking point was regulation. There was no single authority empowered to ensure GIFT City stayed competitive, prompting concerns that an arbitrary decision by one regulator could effectively crash the system. Moreover, the Securities & Exchange Board of India (SEBI) was applying Indian norms to international structures – for example, regulating the fund rather than the fund manager.

Decisive action was taken 12 months ago with the issuance of new fund management rules, which are said to better reflect the Singapore experience, and the appointment of the International Financial Services Centres Authority (IFSCA) as a unified regulator. It has the flexibility to formulate policy, with input from a board that includes SEBI, the Reserve Bank of India (RBI), and others.

"Having one regulator for every aspect of financial services – with individual regulators represented on the IFSCA committee – was a big change," said Jain of Multiples.

He also pointed to a swath of other reforms, such as no goods and services tax (GST) levied on management fees for 10 years over a 15-year block, allowing funds to borrow money; and simplifying co-investment by routing it through the main fund with a separate class of units. SEBI prohibits fund-level borrowing and has a standalone regime for co-investment.

These steps are said to have helped LPs get comfortable with GIFT City. Changes in fund domicile, especially where the new jurisdiction is outside the international mainstream, are viewed critically.

GIFT City removed the risk associated with accessing India via third-party jurisdictions, but there were questions about the long-term durability of the structure ranging from the level of government buy-in to whether regulators were business-friendly. Divya Thakur, a partner at Morgan Lewis, recalls dozens of meetings with investors, advisors, and clients about the viability of the structure.

"Those negotiations were tough – LPs were very apprehensive, especially global institutional players. Sponsors had to compromise on fund terms to make them comfortable," she said. "And even after that, there was still debate as to whether the regime was robust and could be sustained. Some LPs still raise that issue; they are looking closely at the tax implications, the legal and regulatory analysis."

Compromise solutions are said to involve some flexibility on restructuring or a willingness to return to the negotiating table if the GIFT City regime changes in a way that causes a material adverse impact on an LP's tax or legal position.

Structures of choice

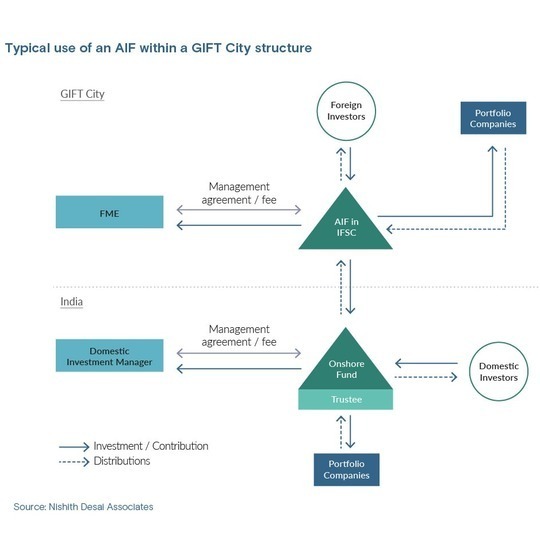

Most managers are using GIFT City as a direct replacement for Mauritius or Singapore or raising capital from international investors – outside of an AIF – for the first time. Either the GIFT feeds into the AIF or the two entities work in tandem and commit capital to companies directly. Multiples and 3one4 are both taking the latter approach, with no master-feeder structure.

"GIFT came at the right time for us. We were always an AIF and that came at a cost; some LPs weren't comfortable with it and so they couldn't work with us," said 3one4's Pai. "We've never believed in pooling, it's a hackneyed solution rather than a permanent solution."

The venture capital firm launched its fourth fund last year, seeking USD 200m, and a near 50-50 split is expected between foreign and domestic investors. 3one4 is a relatively young manager that has risen to prominence on the back of support from local LPs. Others are moving in the opposite direction, taking advantage of the GIFT-AIF structure to tap emerging pools of onshore capital.

"If Indian funds were 90% foreign capital, 10% domestic capital a decade ago, now it's more like 70-30 or even 60-40," said Vivek Mimani, a partner in the investment funds group at Khaitan & Co.

"People access local capital through a domestic pooling vehicle. Given that certain financial institutions can be no more than 10% of the fund corpus, if you don't pool domestic and offshore capital in the same structure, you might not be able to get the full benefit of domestic capital."

There are also instances of managers eschewing the AIF structure – and domestic LPs – and making all investments from funds domiciled in GIFT City. To some extent, this might be tied to a residual discomfort with SEBI and the onshore funds regime.

Desai of KPMG observes that SEBI is getting stricter on AIF approvals in the name of investor protection. Thakur of Morgan Lewis adds that SEBI is becoming more prescriptive in its approach to regulation, citing recent excuse and exclusion rules that exempt LPs from certain fund portfolio investments. Most GPs regard these as negotiated terms, but SEBI made them an automatic right.

In the background, uncertainty over the tax treatment of carried interest rumbles on. Traditionally, carried interest has been considered both a capital gain and income arising from securities, which made it exempt from income tax and GST, respectively. However, two years ago, a tax tribunal ruled that carried interest earned by ICICI Venture constituted a service fee and was liable for GST.

The dispute echoes those that have played out in other markets, and India's position seems likely to be decided by the courts. Several industry participants claim to have discussed workarounds with advisors – such as moving the manager's interest in a fund offshore – but no one is acting on them.

Teething problems

This is playing out in a separate lane to GIFT City and the contrast with the jurisdiction's business-friendly approach is stark. But the situation does highlight the risks attached to relatively unproven structures and processes. According to KPMG's Desai, several managers in GIFT City have received notices from IFSCA because they were following procedures deemed improper.

"There is always a challenge when it comes to testing whether you are operating in the way you should be operating," he said. "There are some basic conditions for operating as a fund manager in GIFT City, but unlike Singapore, we have not established any bright-line tests. We need them so that fund managers understand what they need to do."

Nevertheless, interest in GIFT City continues to rise unabated, emerging as a topic of conversation with all Desai's local private equity clients. Khaitan's Mimani observes that, of every 10 funds he worked on, eight would be in Mauritius and two in Singapore. Now, five or six are in GIFT City. Sometimes a Mauritius structure is established purely so "they have it ready, in case anyone asks."

Much as there are concerns about the availability of office space, there is also a dearth of talent. Most managers setting up in GIFT City will need to have two permanent staff on-site, an investment professional to serve as principal officer and a compliance and risk manager. These individuals must be properly qualified and have at least five years of relevant industry experience.

It remains to be seen whether there are issues around relocation. Jain of Multiples suggests the "main challenge could be getting enough talent and the right type of talent." GIFT City is 90 minutes to Mumbai by plane and six hours by road. Moreover, Gujarat is an alcohol-free state and mainly vegetarian. IFSC residents will be able to get a drink at top-tier hotels and the so-called GIFT Club.

To some, it's a moot point because GIFT City is inexorably achieving critical mass. For example, an innovation sandbox committee has been formed to consider what other legal frameworks could be introduced and it is suggested a stock exchange will be launched, allowing companies to tap global investors from India rather than through American Depository Receipt offerings on NASDAQ.

Critical mass also helps assuage whatever political risk still looms over a project sometimes touted as a prime ministerial pet project that might be swiftly side-lined it there is a change in administration at next year's general election. "It's become too big to fail," said Tejas Desai, a partner at EY. "A new government may introduce competing domiciles, but it cannot ignore GIFT City."

The long game

Pathak of Nishith Desai cites political risk as one reason why managers might stick with Singapore or Mauritius, but the primary motivating factor is habit. For private equity firms that have spent years building substance in a jurisdiction, GIFT City might not be attractive enough to justify a move.

Indeed, global managers that operate across multiple markets have shown little interest in GIFT City. Even mid-market players that are not solely focused on India increasingly opt for Singapore as a platform jurisdiction. Everstone, for example, is active across India and Southeast Asia and has been based in Singapore for 13 years. Most of the senior leadership team lives there.

"I don't see GIFT as an emerging alternative to Singapore. For regional allocators of capital, GIFT just isn't at that level," said Vivaik Sharma, a partner at Cyril Amarchand Mangaldas. "Acceptance of GIFT has increased over the past two years, but it will not replace all vehicles for all kinds of managers."

A combination of ongoing policy support and robust investor appetite for India might accelerate the rise of GIFT City. Pai of 3one4 sees USD 200m as a realistic target for a GIFT City-AIF structure right now, but he predicts USD 1bn-plus funds will be commonplace in five years. The cost argument of moving functions onshore will also become more compelling as local infrastructure develops.

However, arguments are made for an even longer horizon characterised by stability in structures and regulation. Thakur of Morgan Lewis suggests that investors will only get truly comfortable once they see a generation of funds go through a full lifecycle and can track and understand inflows and outflows of money. It is not a unique view.

"We need to walk on the same path for 5-10 years," said Richie Sancheti, a fund formation lawyer and founder of Richie Sancheti Associates. "Only then can people be comfortable that India won't succumb to those emerging market risks of tweaking the law, changing tax positions, and trying to see where it can maximise revenue. That would topple the apple cart if it happened in GIFT City."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.