China IPOs: Back to New York

With regulatory challenges receding, Chinese companies are once again targeting US listings. But the journey to New York – in terms of approvals, locations, and valuations – isn’t necessarily smooth

Finally, Chinese companies are finding their way back to US bourses. NASDAQ has seen five IPOs since the start of 2023 and new filings are stepping up in frequency and size. Industrial supplies platform ZKH Holdings, which has raised over USD 900m in private funding, is among the latest additions. It would generate liquidity for the likes of Eastern Bell Capital, Yunfeng Capital, and Tiger Global Management.

Hesai Technology, a developer of sensors used in autonomous driving, is the most notable of the five completed listings. Its USD 190m IPO – at a market capitalization of USD 2.4bn – is the largest by a Chinese company in the US since ride-hailing platform Didi was hit by regulatory headwinds in mid-2021. The offering is said to have been 20x oversubscribed.

"Hesai's listing is a positive signal not only for Chinese technology companies but also for US technology companies. It's not the best window for listing because interest rate hikes have impacted the value of all tech stocks. The positive market feedback for Hesai gives everyone confidence," said James Mi, founding partner of Lightspeed China Partners, the company's largest private backer.

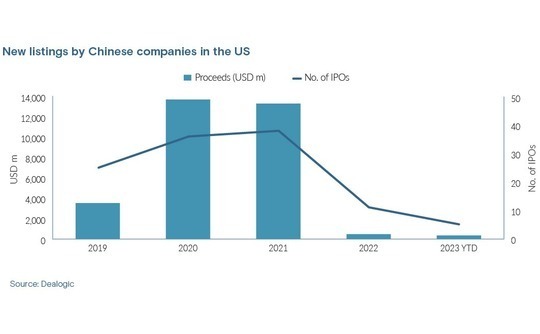

There are more than 250 Chinese companies listed in the US with a total market capitalization of USD 1.03trn, the US-China Economic & Security Review Commission found. They have emerged as the primary source of new foreign stocks – but activity was severely curtailed post-Didi. IPO proceeds fell to USD 471m in 2022 from USD 13.3bn in 2021 and USD 13.7bn in 2020, according to Dealogic.

"Since the beginning of the year, we have seen a number of smaller companies in China filing publicly with the SEC [Securities & Exchange Commission]. But behind them are many larger issuers waiting for market appetite in the US for tech and growth IPOs to recover, with many planning on a third quarter or fourth quarter launch," said Drew Bernstein, co-chairman of New York-based audit firm MarcumAsia.

"Assuming the overall IPO market improves, this could be a strong rebound for cross-border issuance, given the pent-up supply of companies looking to list."

Openminded authorities?

Hesai is an unusual poster child for a US IPO renaissance. First, it specialises in LiDAR technology, which was included in a list of restricted exports released at the end of last year. "It interests me how Hesai got approval from both US and Chinese regulators," said one PE investor, noting that China might prefer having tech companies list domestically and the US may feel uncomfortable with the export restrictions.

Second, Hesai filed to list on Shanghai's Star Market in 2020, was accepted in January 2021, and then withdrew two months later. Lightspeed's Mi said the decision was driven by a need to accelerate commercialisation. Hesai wanted to build a new factory to cope with rising demand from electric vehicle (EV) makers and companies cannot raise new private funding during an IPO approval process.

Mi believes sacrificing a generous Star Market valuation in the near term is offset by the long-term benefits of seizing an opportunity to scale. Hesai closed a new funding round soon after abandoning the local listing. By the time of the NASDAQ IPO, the company's orders for mass-production EVs as opposed to test-phase autonomous vehicles made it stand out from US-based LiDAR competitors, Mi said.

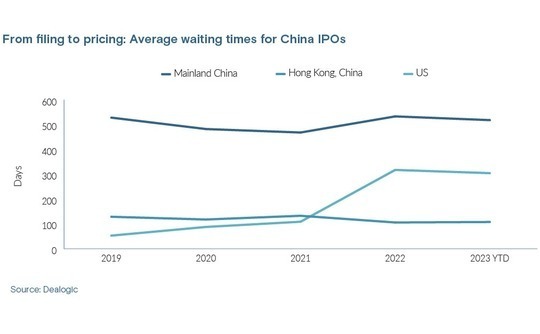

Hesai's decision seems reasonable given the lag period between filing for an IPO and pricing an offering on domestic bourses. The average waiting time for the Shanghai and Shenzhen A-share markets has been more than 600 days over the past five years. The Star Market is known for its accelerated assessment process but the waiting time has still risen from 161 days in 2019 to 359 days in 2023.

Another leading Chinese LiDAR company is now contemplating a US IPO. A source close to the company noted that the recent collapse of Silicon Valley Bank has created uncertainty and may influence the listing timeline, but regulation is no longer a major obstacle.

"The director of the international department of the CSRC [China Securities Regulatory Commission] has made it clear that there is support for US listings of technology companies, provided the competent authorities agree. As Lidar does not have a competent authority, the requirements for brokers and lawyers are being reduced," the source explained.

At the same time, investors with US dollar-denominated funds instinctively favour offshore IPOs. DCM first backed the business that ultimately became adult tuition platform QuantaSing Group – which recently went public on NASDAQ – in 2017. Hurst Lin, co-founder and a general partner at DCM China, said that by structuring the investment offshore, an implicit decision was made to list in the US.

"Over the course of seven years, the company grew very large. At any given time, you could change direction and decide to list in China but that involves a tender offer by the management to buy out the US dollar investors. In those situations, there are a lot of negotiations as to what the valuation should be and it is usually highly contentious," Lin added.

Much-needed clarity

On a broader level, the policy environment has influenced where companies are domiciled and their choice of listing venue. Technologies deemed sensitive at the national security level are more appropriate for domestic markets, with the US or Hong Kong favoured for consumer-facing businesses in areas like online education, e-commerce, and web3.

The availability of comparable listed companies is also a factor. For this reason, NASDAQ is seen as a logical home for autonomous driving and the Star Market for semiconductors. Artificial intelligence-enabled robotics appeals to domestic and international audiences, given its long-term tailwinds and tangible revenue. Qiming Venture Partners is looking to list several start-ups in Hong Kong.

Chinese regulators are said to be encouraging companies to leverage the specific strengths of different markets. The concession on audits is a further illustration of its open-mindedness.

The breakthrough came in the middle of 2022 when Chinese regulators agreed to give the PCAOB full access to local audits of US-listed Chinese companies. The PCAOB subsequently dispatched teams to conduct inspections. Non-compliance could lead to the delisting threat being reactivated. Hesai's prospectus notes that the US audit regulator must review and approve the listing each year.

"While it is no longer a headline concern for Chinese issuers at the moment, accounting firms must be able to continue to provide the PCAOB unfettered access to inspect Chinese companies' books and records, to keep this issue returning to the forefront of legal risk factors," said Thomas Chou, a partner and co-head of the Asia private equity group at law firm Morrison Foerster.

The Chinese cybersecurity review, announced after Didi pushed ahead with its IPO prior to the rollout of new data privacy legislation, also struck fear into companies. Kujiale, a 3D interior design platform, was two weeks away from listing when regulators launched an investigation into Didi, said sources close to the situation. The IPO was pulled despite winning approval from onshore authorities.

Similarly, a US-based corporate VC investor claims to have been approached about supporting a planned merger by autonomous driving player Pony.ai with a US-listed special purpose acquisition company (SPAC). Discussions were abruptly terminated in 2021.

However, following the introduction of cybersecurity review measures in February 2022, the process has proved clear and predictable. Filings are only required from platform operators carrying personal data pertaining to more than 1m users. Most companies receive a "no need for review" notice; a small portion undergoes a substantial review of four to six months; to date, no case has been rejected.

For example, Legend Capital-backed Atour Lifestyle Holdings operates 834 hotels and a loyalty programme with 32m members. It made an initial filing in April 2021, waited until the uncertainty had passed, and completed an IPO in November 2022. The prospectus simply states that the company applied for and completed a cybersecurity review.

A different approach was taken when Newlink Group spun out its charging pile business – a digital platform that helps EV drivers locate the best value charging piles – last year. The unit went public through a reverse merger with a NASDAQ-listed company and was renamed NaaS Technology. Prior to this, its data assets were transferred to a separate onshore company, AVCJ understands.

VIEs, again

The most recent regulatory development impacting Chinese companies pursuing US listings emerged in February when the CSRC introduced an overarching framework. It outlined a standardised process comprising a CSRC filing, approvals from relevant domestic regulatory authorities, and a security review.

Notably, the framework mentions the variable interest entity (VIE) structure, which has facilitated nearly all US IPOs involving Chinese technology companies by enabling foreign investors to get exposure to restricted sectors in China. VIEs have long existed in a regulatory grey area and the CSRC is essentially looking to assert some control – though companies with VIEs that are already listed won't be impacted.

Law firm Linklaters highlighted three issues that may hinder IPOs where there are VIE structures. The CSRC stipulates that foreign investors must not participate in the operation and management of companies; their individual and aggregate shareholdings are restricted to 10% and 30%, respectively; and they must avoid sectors in which foreign involvement is prohibited as opposed to restricted.

"Objectively speaking, the new rules will bring uncertainty into listing under VIE structures. The CSRC must contact the competent regulators to verify whether a VIE structure is legal and compliant.

"Since foreign investment is regulated by the Ministry of Commerce, and each industry has its own licensing authority, it would be difficult for the CSRC to coordinate all other departments to give a final opinion," said Zaiguang Lu, a partner at Han Kun Law Offices, adding that the CSRC may choose to hold joint meetings with other regulators and make decisions on a case-by-case basis.

Clarity on the matter – and on what is regarded as too sensitive for foreign participation – is not expected until late May or June when the first decisions come through. Industry participants are encouraged by the CSRC's move to establish a formal communication channel for issuers prior to filing as opposed to the previous "black box" regime.

MarcumAsia's Bernstein describes the developments as a "strong net positive" because they remove regulatory uncertainty. This view is endorsed by DCM's Lin who observes that an IPO by GigaCloud Technology, a DCM-backed B2B furniture retailer, was delayed for a year by multiple rounds of SEC questioning, much of it relating to VIEs. The company abandoned the structure and listed last August.

In addition, the CSRC framework treats direct overseas listings (by joint-stock companies established in mainland China) and indirect overseas listings (by domestic companies through overseas incorporated entities) as one and the same from a regulatory perspective. China-based companies are defined very broadly to prevent offshore players from slipping through the net.

To qualify, companies must generate more than half their operating income or net profit from mainland China or have over half their total or net assets in the mainland; and their main business must take place in China, their major operating sites must be in China or a majority of their senior executives must be Chinese or reside in China.

Chinese fast-fashion e-commerce platform Shein shifted its location of incorporation to Singapore last year and most if not all its income comes from overseas markets. However, the company's core supply chain operation is in Guangzhou, so CSRC approval would be required to pursue a US IPO.

Of locations, valuations

This has not stopped some companies from re-thinking where and how they operate – mindful that even though the US capital markets channel has reopened, US-China tensions remain. The potential policy implications were recently highlighted by Mark Warner, chair of the US Senate Intelligence Committee, pledging to introduce a bill allowing the US to ban Chinese technology like ByteDance-owned TikTok.

"This is not only about IPO, but also about long-term development, especially in terms of market access given the current political pressure," said one VC investor. "It's hard for Chinese companies to enter the US and India markets. One is the largest market, the other is the fastest growing market."

Asia Innovations Group, a VC-backed company that completed a SPAC merger last year makes for an illustrative example. It replicates Chinese consumer internet business models in overseas markets and moved to Singapore ahead of its listing.

According to a partner at a Chinese VC firm with a portfolio comprising many companies that generate the majority of their revenue overseas, a key objective for 2022 was making these businesses global

"First, we do the data isolation, which involves separating domestic market data from overseas market data. We also have to separate the operating business, so the China entity becomes an outsourced manufacturing partner or a subsidiary," the investor explained.

"A global supply chain layout incorporating Israel, Germany or Japan is always nice. If any restrictions are imposed on exports of products manufactured in China, our supply chains in Europe or the Middle East can immediately step in and work with customers."

Affine, a developer of open-source collaborative software founded by Chinese entrepreneurs, claims 70% of its users are based overseas. In conjunction with a recent fundraise, the company said it would move its base to Singapore.

One way or another, it appears that the upturn in US IPOs by Chinese – or China-related – companies will continue. For some, though, valuation could be a stumbling block. According to DCM's Lim, the QuantaSing offering went ahead after management and late-stage investors reconciled themselves to the fact that a USD 1bn market capitalisation wasn't achievable. It went out at approximately USD 700m.

"All investors want liquidity. But late-stage investors ask, ‘What is the price of that liquidity if I have to take a discount to what I paid in the last round?'" he added.

"They are professional money managers with track records they want to maintain. What does an IPO at a discount to the last round mean for their careers? A lot of them got carried away in the last bubble and now they don't want to be called a fool. I hear that argument all the time."

These concerns are already filtering through to pre-IPO funding rounds. Some start-ups are issuing additional shares to late-stage investors as a means of compensating them for downward valuation adjustments. Others are being forced to raise capital with pay-to-play clauses, whereby existing investors that opt out are penalised by heavy dilution of conversion of preferred shares to ordinary shares.

"While global institutional appetite for Chinese public equities may be recovering, valuation challenges will remain as one of several hurdles to get these companies listed," said Morrison Foerster's Chou.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.