GP profile: Yunqi Partners

It took seven years for Yunqi Partners' 2B investment thesis to be proven with the emergence of a swath of unicorns. The Chinese VC firm expects much more from the space – at rational valuations

Roadstar.ai's USD 128m Series A in 2018 was, at the time, the largest-ever fundraising round in China's autonomous driving industry. Yunqi Partners, which had seen the company's valuation grow more than tenfold since leading the angel round, seemingly had a potential unicorn in its portfolio.

Then everything went wrong. Two of Roadstar's co-founders dismissed the third, Guang Zhou, in January 2019. They accused him of various misbehaviours, from hiding code to falsifying production data. Zhou, in turn, sued Tong and Heng for defamation. The start-up went into liquidation amid internal acrimony.

"The valuation rocketed to USD 300m within a year of our investment, causing the young founders to develop inflated egos. There was infighting, but it was clear the engineering team favoured Zhou, the CTO, over the other co-founders. And we believed the company's technological prowess was its key value," said Yipin Ng, co-founder and managing partner at Yunqi.

The venture capital firm reached this conclusion after interviewing all 70 of Roadstar's staff. Michael Mao, Ng's fellow co-founder, took a collection of lawyers and Yunqi's entire post-investment team to work almost full-time at Roadstar and figure out what to do next.

Ultimately, Zhou and several key staff decamped to form Deeproute.ai, another autonomous driving start-up. Yunqi persuaded nearly all Roadstar's backers to transfer their allegiance, and then in 2021, Alibaba Group sealed the rejuvenation story by leading a USD 300m Series B round.

Deeproute is one of eight start-ups Yunqi has guided to unicorn status. The others are cloud-native database PingCap, home decoration software provider Kujiale, cross-border financial services player XTransfer, B2B trading platform Baibu, and smart robot developer Keenon Robotics. There have been 85 investments since the firm's inception in 2014 and eight exits, including two IPOs.

In recounting the Deeproute story, Ng doesn't seek to claim the credit. For him, it is a parable about partnership. Roadstar was initially Ng's deal, but Mao assumed responsibility during the tumultuous period and handed it back once Deeproute had emerged from the ashes.

"Michael said his local Chinese experience allowed him to address the matter more effectively," explained Ng, a Singaporean. "He volunteered to take the lead during the crisis and our entire team jumped in to help. I stepped back and focused on other deals. It was heartwarming to see the team stick together during a difficult period."

Meeting of minds

Ng and Mao each previously enjoyed lengthy stints with leading Chinese venture capital firms – Ng at GGV Capital and Mao at IDG Capital. They had known one another for over a decade prior to launching Yunqi and both sat on the board of Chamate, a Taiwan tea shop chain backed by GGV and IDG.

The comfortable status quo was disrupted by AAC Technologies, a manufacturer of miniaturised acoustic components, which offered to help Ng establish his own fund. AAC was a GGV portfolio company and the two had collaborated on several investments. These included Xiaomi and Heptagon, a producer of micro-optic systems used in iPhone's facial recognition solution.

With AAC willing to come in as an anchor investor, Ng resolved to launch what became Yunqi with a China-born-and-bred partner. Mao was a logical choice, and as it happened, he was getting restless. He had spent 15 years at IDG and seen several local investors spin out from global firms. Sensing this was the beginning of a golden period for China venture capital, Mao wanted to start something of his own.

"Michael and I felt China was about to see the emergence of enterprise-focused companies. The need for productivity improvements was driving this trend," said Ng.

From the outset, they divided the B2B landscape down the middle: Ng would lead investments in hard-tech and Mao would focus on industry applications and digitalisation. The idea was that creating dedicated teams within the firm would facilitate the development of domain expertise, resulting in better investment decisions and more constructive support for portfolio companies.

Nine years on, the delineation remains intact. Ng and Mao are each responsible for two sub-sectors: the former covers infrastructure software and hardware; the latter has applicational software-as-a-service (SaaS) and supply chains.

"In each sub-sector, we have bred unicorns from a very early stage: PingCap and Deeproute in infrastructure software, Keenon Robotics in hardware tech, Kujiale and Xtransfer in application SaaS and Baibu in supply chains," Mao explained.

Creating a culture

Yunqi has raised three US dollar-denominated funds to date, the most recent one closing on USD 300m in late 2021. It is currently in the market seeking the same amount for Fund IV. Total assets under management, which include several renminbi funds and some specialist vehicles, amount to approximately USD 1bn.

Inevitably, the strategy has evolved over time. The hardware domain was initially dominated by cell phone components and internet-of-things (IoT) devices, but now it embraces a wider remit that encompasses clean energy and areas like battery materials. Ng describes it as a response to macroeconomic shifts; opportunity sets change, but people rely on the same networks and expertise.

Moreover, there is a strong culture of collaboration between the sub-sector teams. Investment professionals from infrastructure software and hardware have worked together on robotics deals, for example, because they touch on all three areas. Similarly, industrial SaaS opportunities are explored from the perspective of software and supply chains.

"Each industry has its own logic and cycle of development, its own regulatory framework, and even its own level of IT," said Mao. "For logistics, a shipping terminal or a mine may have only just installed Wi-Fi, yet in financial services, institutions are often already using big data and AI [artificial intelligence]. You need to understand each industry and develop very different technology offerings."

There are seven primary investment professionals at vice president level or above. Yunqi makes a point of recruiting industry experts who have minimal investment experience and having them grow within the firm, which contributes to team stability.

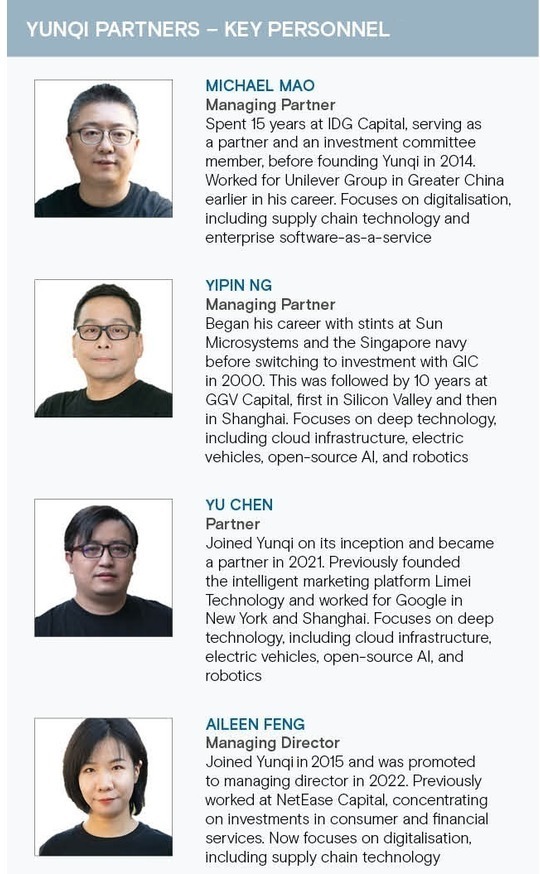

Yu Chen was an engineer at Google and co-founder of an intelligent marketing platform before joining Yunqi when it was formed. Promoted to partner in 2021, he mainly focuses on infrastructure software. Midi Zheng was recruited to cover hardware after eight years at Foxconn, while Aileen Feng and Hock Han, previously of NetEase Capital and IBM respectively, focus on supply chains and application SaaS.

Mao adds that Yunqi's recruitment process is underpinned by a preference for those who embrace the same key value proposition – money should be earned through the application of sound principles and not by any means. As such, the firm won't touch deals where there is a whiff of short-term speculation.

"Some VC firms promote a lone-wolf culture and encourage internal competition. That may be effective, but that's not our style," said Mao. "Nowadays, people often talk about involution, but this phenomenon exists because investors take a short-term approach. For example, when AI is hot, everyone puts what they were doing to one side and looks at AI, which leads to rough internal competition."

Echoing these sentiments, Ng adds that Yunqi shows respect to junior team members and encourages them to take centre stage. "There are firms where, if you do a good deal, your boss takes all the credit. We are very sensitive to that. If it's your deal, you sit on the board, don't bother me," he said.

This spirit of inclusivity is nurtured by daily communal lunches in the firm's well-maintained kitchen. Issues of all kinds are discussed in a friendly and equal manner. The founders have also sought to structure compensation in a way that prioritises development and stability. They studied the approaches of numerous global firms and set aside a portion of carried interest for long-term incentive plans.

A blessing of unicorns

Yunqi didn't really attract broader industry attention until its seventh year when several portfolio companies achieved unicorn status almost at the same time. These started out as early-stage bets on overlooked industry segments.

The firm led a first round for Keenon with Green Pine Capital Partners in 2016 and then introduced the company's restaurant service robots to other investors. Most of them passed on it.

"We were convinced that Keenon had significant growth potential and that the long-term trend of labour being replaced by robots was inevitable. However, at that time, US dollar funds were not focused on hardware technology and renminbi funds favoured pre-IPO projects with greater certainty," said Ng.

Keenon also benefited from Yunqi's insights into the smart phone industry supply chain. The rise of large-scale manufacturing dramatically reduced the cost of sensors and chips while improving their performance. Keenon benefited from this trend, putting algorithms and computing platforms into its robots. Now a dominant player in service robots, it raised a USD 200m round led by Softbank Vision Fund 2 in 2021.

When PingCap was founded in 2015, no one bought into its ambition to challenge Oracle by building the world's best database software. Matrix Partners China provided seed funding, but the Series A round proved tough, with dozens of investors rejecting a company that had no product or users and insisted on an open-source model that didn't generate revenue directly.

"Most investors didn't understand us at the time – after all, we were a long way from commercialisation. Yunqi's support was like sending charcoal in snowy weather," said Dylan Cui, co-founder of PingCap, incorporating a relevant Chinese idiom.

The deal was referred to Yunqi and Chen began studying Pingcap's design documents and codes. He was soon convinced by the quality of the project and Yunqi led the Series A. It re-upped in every subsequent round through a USD270m Series D in 2020. In 2021, the company raised additional funding at a USD 3bn valuation, according to a source close to the situation.

PingCap now serves 3,000 enterprise customers across 20 countries and regions. Yunqi's backed the company having reasoned that any software developer capable of thriving in the cutthroat Chinese market would be strong enough to emerge as a global leader.

"China's internet environment is complex, the userbase is large, and the likes of Baidu, Alibaba, Tencent, ByteDance, and Meituan are demanding customers, constantly pushing against the far reaches of technology and doing so before their international peers. A software developer in this environment may see problems before others, and have the chance to invent solutions before others," said Ng.

With XTransfer, Yunqi went into the seed round alongside Gaorong Capital and then stuck around for the Series A and Series B, which were more challenging.

Mao met the company's founder and CEO, Guobiao Deng, when he was working at Alibaba Group. Yunqi was interested in the payments space but refused to support the peer-to-peer lending space because Mao thought it created little real value for the economy. The firm screened start-ups providing tools for small and medium-sized enterprise (SME) exporters instead, and Mao approached Deng for advice.

"We mainly discussed the industry landscape," Deng said, recalling that Mao offered a start-up working on payments collection for Amazon as a case study. "We concluded that most start-ups were operating in a small corner of a very large platform and didn't have the potential to become giants."

Deng later pitched Mao an idea for an online platform that helps Chinese SMEs set up offshore accounts and manage inbound remittances. Mao liked it and the Yunqi due diligence apparatus was deployed. Deng notes that Mao interviewed not only all five partners but their family members as well to gauge support for the project. Potential customers were quizzed on the technology and potential use cases.

When the P2P bubble burst, many investors abandoned China's financial technology space, even though XTransfer enjoyed policy support. The company became a unicorn on raising a USD 138m Series D round in 2021. It has over 2,000 staff and Deng is currently recruiting in Hong Kong. An IPO is not top of mind, with Deng noting that XTransfer has been profitable since the second half of last year.

Out of adversity

Kujaile is another example of a company that defied market turbulence. The start-up provides simple tools for aspiring interior decorators to create designs and render them in a 3D preview format. Mao led an initial round at IDG in 2013 and put Yunqi into the cap table a year later. Then in 2015, 40% was wiped off the value of Shanghai's stock market, severely curtailing private consumption for a period.

Mao advised focusing on 2B services as a means of shoring up revenue, so Kujiale started targeting professional designers instead of homeowners. The company broke even in 2016 and became cash flow-positive in 2017. Heeding Mao's advice once again, Kujiale switched to cloud-based servers. It now has more than 100,000 of them and claims to offer services at 12.5% of the cost of Alibaba Cloud.

According to Victor Huang, Kujiale's co-founder and chairman, the business grew 20% despite a tough 2022. The company became a unicorn on closing a extended Series D round in 2019 and hasn't needed to raise any more external capital since then.

Yunqi's seven-year journey to wider recognition is not coincidental. Ng estimates that it takes at least that amount of time for a strong 2B company to achieve meaningful scale. However, the end of this period coincided with an explosion of interest in 2B services and SaaS in particular. Consumer internet investors flocked into the space – and then abruptly left in 2022 when conditions became difficult.

"When everyone rushed in, it proved our thesis was sound. On the other hand, valuations were pushed up and so overall returns went down," Mao observed. "Last year, we saw investors pull back and turn to other opportunities like Southeast Asia or web3. But we felt good and maintained our investment pace."

For Ng, it conjured up an additional lesson from Roadstar: that valuation corrections can ultimately benefit entrepreneurs. Yunqi has witnessed a gradual return to rationality as founders accept that 2021 pricing was an aberration and focus on fundamentals, making it easier for investors to engage them.

"Previously, founders would say, ‘Zoom is trading at 100x P/S [price-to-sales], why am I only at 30x?' Now they are willing to accept 8x or 10x, which is better for long-term growth," Ng said.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.