Portfolio: KKR and NVC China

KKR is targeting the short-video generation in the traditionally middle-aged world of home lighting fixtures with NVC China. But that hasn’t stopped the brick-and-mortar footprint from mushrooming

When KKR approached its first corporate carve-out in China in 2019, the parent company had hit the skids.

Hong Kong-listed NVC Lighting's founder, Changjiang Wu, had been convicted of embezzlement three years earlier and the money lost had to be written off. The company fell from a net profit of CNY 332m (then USD 51m) in 2017 to a net loss of CNY 302m in 2018.

The mainland household lamps and commercial lighting division never stopped being profitable, however. And KKR claims that the drama swirling around Wu, various shareholder disputes, and related legal entanglements during the prior few years posed no obstacle to operational work on the subsidiary thereafter.

KKR took a 70% stake in NVC China (NVCC) for about USD 670m via its third Asia fund, with NVC Lighting retaining the balance. The parent company's non-lighting-related assets in China were not part of the deal.

When the private equity firm's operations unit, Capstone, was brought in, the first impressions were of an old-fashioned business structure with minimal digital elements, mainly relying on offline wholesale distributors in various regions.

"Each business unit was like its own little kingdom with its own front office, middle and back office, its own warehousing and logistics – everything," said Yang Zhang, a director at Capstone.

"We transformed that into a channel front and integrated middle and back office and integrated supply chain to support the whole group. The efficiency has increased a lot."

Efficiency is a key differentiator in this segment. China's lamps and lighting space is highly competitive and fragmented, with no player said to have more than a 2-3% market share. The knowledge and intuition of veteran salespeople is king; data is not.

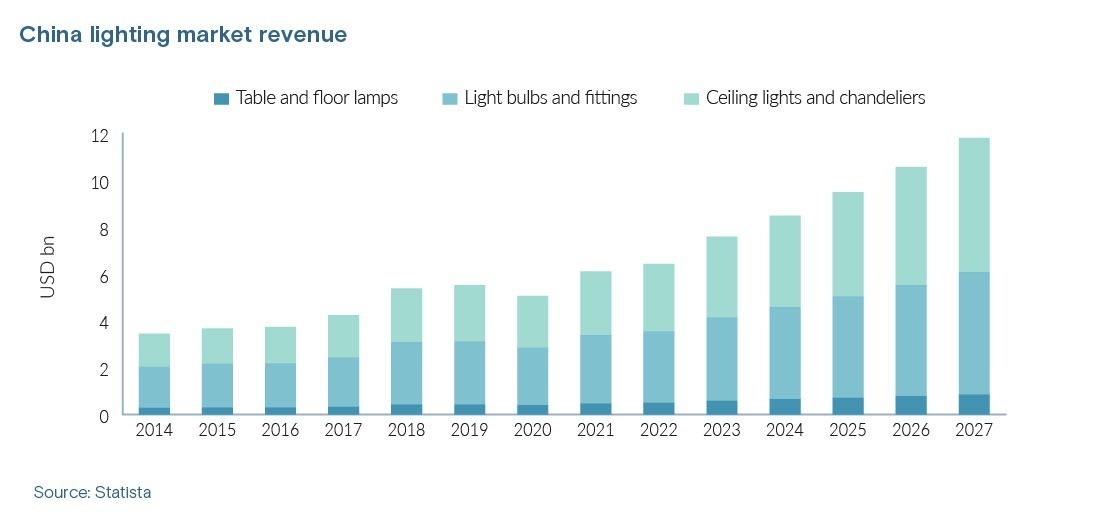

The opportunity to peel away from the pack was enhanced by the market backdrop. In the five years leading up to KKR's acquisition, annual revenue for China's combined lamps and lighting market grew 60% to about USD 5.5bn, according to Statista.

That figure is currently USD 7.6bn, with consideration of current exchange rates and market impacts related to the Ukraine war. It is projected to climb another 55% to USD 11.8bn by 2027.

Replenishing the ranks

The restructuring also included creating integrated teams in finance, human resources, and product development to replace larger, dispersed teams. This meant an approximately 20% reduction in overall headcount as well as KKR-appointed or KKR-advised hires for CEO, CFO, and the heads of HR, strategy, commercial projects, retail, and supply chain.

In all, more than 15 senior executives were replaced in the space of less than a year, with KKR claiming no cultural difficulties in the process. "We pushed ourselves to be thought partners with them – to help come up with strategies, to think about why we're doing this and how," said Shiyan Song, a principal at Capstone.

Liangqi Lin, who joined KKR as a senior advisor in November 2019, was named CEO of NVCC in July 2020. His previous roles include president of chemicals company AkzoNobel China and CEO of Philips Lighting Greater China.

"It has been a seamless process. By having aligned interests and putting themselves in the shoes of the management team, KKR has been able to focus on practical issues and approach them thoughtfully. This was particularly evident over the course of the pandemic, when the team exercised patience and adopted a long-term view on the situation," Lin said.

"We are in constant dialogue, and this frequency tends to increase ahead of important milestones or decisions, which could include organisational changes or the setting of incentives plans. It is important that the teams are aligned ahead of those moments."

He added that the introduction of a more professional management culture has led to more independent and data-driven decision-making, as well as stronger governance and compliance measures. This has in turn improved motivation, efficiency, brand equity, and competitiveness.

"In general, we have become more customer-centric and look to be more values-driven going forward," Lin said.

The comments touch on various initiatives to tighten up environmental, social, and governance (ESG) standards and practices as well. This has included programmes around carbon footprint monitoring, diversity and inclusion, and employee engagement considered relatively uncommon locally.

Other environmental and social efforts involved the development of lights that use 26% less energy than conventional products and CNY 1bn worth of lighting product donations to cities struggling with the impacts of the pandemic.

There was also an upgrade of the employee dormitory, including the construction of a new recreation field. "NVCC is now a role model for KKR's China portfolio companies in terms of ESG," said Tong Chen, a Capstone director.

Cost and quality

Meanwhile, costs have been reduced by bringing much of the manufacturing in-house. At the time of investment, 25%-30% of products were manufactured by NVCC itself. That figure has now climbed to nearly 50% for the company's core products, which is also said to have resulted in improved quality.

The quality factor is arguably of greater importance in light of a shift toward B2C, with the retail business having increased from 55% to 70% of overall sales during KKR's holding period. The commercial projects business (outfitting commercial buildings with lighting systems) represents the balance.

The transition was an outcome of the online strategy; more than 90% of e-commerce business is B2C. KKR's input in this area included differentiating between online and in-store audiences. The younger digital natives want more portable lighting versus strictly home decoration products.

In addition, there was a diversification of the channel strategy, with a traditional focus on mainstream outlets such as Tmall and JD.com giving way to more emerging vendors like Douyin and Pinduoduo. Social commerce is seen as fast-growing in lower-tier cities – an important target market – as well as a means of staying abreast of evolving purchasing habits.

"Not only did we have to design products to target younger customers, we had to direct marketing resources to them too," Song said. "We had to ask, ‘How can we reach them? What kinds of platforms and content do they like? What will attract them to our brand so we can sell them what we designed for them?'"

Online sales have grown 65% during KKR's holding period, climbing to about 50% of the overall business. Importantly, this has ramped up the accumulation of data about the performance of stockkeeping units (SKUs).

Previously, SKUs were considered underperforming if they didn't hit a certain threshold in terms of raw sales numbers, at which point they would be retired. But more sophisticated data around marketing efficiency and return-on-investment have helped NVCC optimise the SKUs it keeps on the shelf. This is said to have reduced overstocking by 30% within a year.

The online strategy has arguably also proven the most effective area for leveraging connections with KKR's broader portfolio, commercial lighting contracts with chain brick-and-mortar businesses notwithstanding.

"The cross-portfolio synergies are not limited to private equity – they're integrated across strategies," Chen said.

"For example, our tech growth strategy helped bring in more innovative D2C and digital-native experience and how to operate at new digital channels like ByteDance's Douyin. There's a lot of value-add in that because it's tricky to create appealing content and attract traffic on Douyin. You need to design the content specifically for that."

KKR has been an investor in ByteDance since at least 2018, when it joined a USD 3bn round. Douyin, the mainland China equivalent of the short-form video app known globally as TikTok, is its key asset.

Selling solutions

The focus on youth markets and lifestyles is notable in the home décor category. Indeed, in addition to further digitalisation of middle and back-office operations and bringing manufacturing in-house, there are plans to rethink the traditional approach to homewares with a "home lighting environment solutions" gambit. Clunky chandeliers are out; portable LEDs and ambient rope lighting are in.

"It's a new business model. When a customer comes into the store, you don't sell individual products to them – you sell a solution or a lighting renovation plan," Zhang explained. "In this model, the customers care less about what the products are. It's about delivering the effect and the final solution. We want to bring that to lighting."

This approach to product positioning helps reinforce the importance of physical showrooms. Under KKR, NVCC has increased its number of brick-and-mortar locations by 20x across some 300 cities.

The company now covers 100% of tier-one cities and 95% of tier-twos. Most of the growth has been in lower-tier cities, however, where smaller, hardware-oriented outlets stand in for the flagship store experience.

It's worth noting also that all of this expansion has been done during the pandemic. The acquisition was agreed in mid-2019 but didn't close until a month before the first outbreak of COVID-19. KKR declined to provide detail on financial performance.

"During COVID-19, we kept profit stable, with marginal growth in sales revenue, at a time when other companies were adversely affected. Every quarter, we conduct competitive benchmarking to see where we are, and have generally outperformed," Zhang added.

"Previously, NVC China was a leader in commercial lighting, and now it is a leader in online sales – we look to be on the leading edge in every channel that we operate in."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.