AI: Asia awakens to ChatGPT

ChatGPT has sent shockwaves through the technology sector globally. Asia is no exception as investors look for ways to leverage the platform and China contemplates a standard of its own

Reactions to ChatGPT, an artificial intelligence-enabled chatbot known for its ability to engage in human-like conversation, speak to its reach. Schools are worrying about students cheating on assignments; technology companies are considering the transformative implications of language driven search and composition models; and government officials are voicing cybersecurity concerns.

Meanwhile, take-up has gone through the roof. Even though a prototype was only released in late November, the technology – said to be versatile enough to simulate chatrooms, play games, compose music and lyrics, and write code – had surpassed 100m users by January, according to UBS. It took short video platform TikTok nine months to achieve this landmark.

For PE and VC investors, ChatGPT's rise is emblematic of the broader potential of AI-generated content (AIGC). Specifically, it emphasises the power of GPT-3, the large language model (LLM) technology on which the chatbot is built. The latest in a series of GPT models developed by Microsoft-backed research lab OpenAI, GPT-3 is so far ahead of rivals that it has become a case of comply rather than compete.

"ChatGPT made many realise that GPT-3 was already an order of magnitude better than anything they have seen and that shifting their focus toward fine-tuned models and end-user access points makes more business sense. This is a worldwide phenomenon, including in Asia," said Jussi Salovaara, co-founder and Asia managing partner at venture capital firm Antler.

US start-ups were moving in this direction as early as 2020, when GPT-3 was released, according to Matt McIlwain, a managing director at Madrona Venture Group in Seattle. Early movers in the AI copywriting space included Copy.ai, OthersideAI, and Latitude. Each one raised seed funding in 2020 or 2021.

Jasper arguably became the first to raise capital at meaningful scale, closing a USD 125m Series A round at a USD 1.5bn valuation last year. The company created its platform using GPT-3 but quickly upgraded when OpenAI rolled out GPT-3.5 – the LLM behind ChatGPT – last year. Jasper was only founded in 2021 but it is expected to become the first AIGC player to reach USD 100m in annual recurring revenue (ARR).

In Asia, ChatGPT served as a wake-up call. Several Chinese start-ups have plugged into ChatGPT for demo tests as it is not officially available in the country. Laiye Technology, a private equity-backed robotic process automation (RPA) specialist, is one of them. The company is integrating GPT technology into overseas business units focused on conversational AI, intelligent document processing, and RPA.

"We feel a strong sense of urgency," said Guanchun Wang, Laiye's CEO and chairman. "ChatGPT may bring profound change to product design and user experience. The delivery cycle for a customer service chatbot could be shortened from two weeks to a matter of minutes. Some corporates might dispose of manual customer service departments if there is a high level of customer satisfaction with bot services."

Gradual evolution

The magic behind ChatGPT could hardly be described as a flash of inspiration. GPT stands for generative pre-trained transformer because it originated from Transformer, Google's neural network architecture for language understanding, which launched in 2017. The underlying technique, natural language processing (NLP), emerged in the 1940s and only achieved mass usage in AI in the 2010s.

OpenAI was established, initially as a non-profit, in 2015 and released GPT-1 three years later. The transition to GPT-3 drew little attention because at the algorithm level, there was no real innovation; it was more a case of learning at scale. However, this scale triggered a wave of emergent behaviour, an unplanned flurry of innovation driven by a proliferation of use-case scenarios.

"The power unleashed by this emergent behaviour was far beyond imagination of researchers. Even GPT's developers were surprised by the effect," said an assistant professor at a Chinese university who specialises in AI research.

However, ChatGPT's key advantage is still the depth and scale of the training model and its ability to memorise hundreds of rounds of conversations. In this way, GPT is responsible not only for validating the AI industry, but also for creating a new category within it called generative AI. For many investors, the future is about generating new content rather than purely relying on existing datasets.

The key battle here is between Microsoft and Alphabet. The former announced its third investment in OpenAI in January, committing an estimated USD 10bn at a valuation of USD 29bn. The latter recently poured nearly USD 400m into Anthropic, which was established by 11 former employers of OpenAI and is currently testing a chatbot known as Claude.

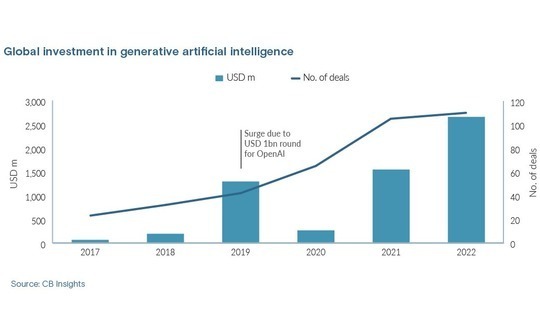

Global investment in generative AI hit a record USD 2.6bn in 2022, according to CB Insights, up from USD 1.5bn in 2021 and USD 271m in 2020. It topped USD 1bn in 2019 but Microsoft's first commitment to OpenAI accounted for the bulk of that.

Meanwhile, the broader AI industry is slowing. The State of AI Report 2022, which is compiled by two VCs from Air Street Capital and Plural, found that USD 47.5bn was put to work last year, down from USD 111.4bn in 2021. The same trend was apparent in Asia. Investment dropped 39% year-on-year to USD 5.4bn in 2022, according to AVCJ Research. Deals in China, the largest market, slumped by 65%.

The China angle

Amid the furore around ChatGPT, China is expected to see a generative AI bump. Investors are competing fiercely to participate in a round currently being raised by local LLM start-up Minimax, one Beijing-based manager said. This is unusual given the constrained investment environment and it stands in stark contrast to the level of interest when Yunqi Partners backed Minimax 18 months ago.

"When we invested, we didn't even know the term AIGC. But I thought it was a very promising direction, whether you plugged the content-generating capability into existing websites or into the metaverse. The business model makes a lot of sense," said Yipin Ng, co-founder and a managing partner at Yunqi.

Chinese platform internet company Kunlun Tech has also launched an LLM. Unlike its predecessor, GPT-3 is not fully opensource, so Kunlun created its own version based on Chinese language material. The company is building a version of ChatGPT as well. About CNY200 m (USD 29.5m) has been invested in the project since it was conceived in October 2020.

Han Fang, CEO of Kunlun Tech, said there is no point trying to match ChatGPT in terms of scale. Rather, Kunlun Tech's LLM is opensource and the plan is to monetise the technology by focusing on use-case scenarios. Microsoft has the exclusive right to GPT-3. For a fee, external users can access an application programming interface (API) that plugs into their platforms.

With China's LLMs unable to match ChatGPT, which is already available in multiple languages, the competitive environment seems tepid. Yet the absence of ChatGPT from China, which is variously interpreted a consequence of US-China tensions and Beijing's restrictions on the use of local data overseas, means there is an opportunity to create a domestic foundation model.

Baidu, Alibaba Group, and ByteDance are already working on this, said a cloud business executive at a leading internet company. Baidu recently announced plans to launch a ChatGPT-style bot in March.

One non-profit, the Beijing Academy of Artificial Intelligence, is also developing a product. Several start-up founders said they would prefer a LLM from a neutral third party to aligning with one of the internet giants. There is no guarantee Baidu's LLM will be accessible to groups in the Alibaba ecosystem.

Several industry participants advocate awarding a mandate to a cloud service provider. "The foundation model is asset-heavy and requires a lot of computing power and a lot of capital. It is very similar to a cloud service provider. ChatGPT was trained on Microsoft's Azure platform and Alphabet already has powerful foundation models," said the cloud business executive.

Application scenarios

Much like in the US, PE and VC investors aren't especially interested in backing a foundation model. Applications that co-exist with this model – and require less capital while offering a greater chance of success – are a more attractive proposition. The emphasis is on identifying new use-case scenarios and establishing what is required to support business flow.

Pepper Content, a content production outsourcing provider that counts Lightspeed India Partners as an investor, is a case in point. The India-based company has integrated the GPT model, but Dev Khare, a partner at Lightspeed, sees this as the means to an end. The key consideration is how Pepper's content teams interact with large enterprise customers.

"Generative AI is not the main thing for the company. To succeed at the application level, you can't just write a thin layer on top of OpenAI, because everybody else can do it and copy it. What you must add are enterprise-ready features: you have to productise the workflow," said Khare.

The view is echoed by Wei Zhou, founder and managing partner at China Creation Ventures (CCV). The firm has made several AI-related investments, including the likes of Shukun, a medical imaging start-up, and Perfect Corp, which develops AI and augmented reality (AR) solutions aimed at improving the consumer experience of brands. Neither is working on the underlying AI.

"Their technology is not unique, but each has a deep understanding of a certain industry and great commercial use cases, whether it's healthcare or beauty," said Wei Zhou, founder and managing partner at China Creation Ventures.

There is third layer that effectively sits in between foundation models and applications, described by OpenAI CEO Sam Altman in a December interview with US-based VC firm Greylock as a significant opportunity. It involves taking existing models and building customised versions for specific industry verticals such as healthcare or finance. The data can be shared with others to create a flywheel effect.

A broad vision

For all the new opportunities created by ChatGPT, it could destabilise certain incumbent players. Amit Anand, founding partner of Southeast Asia and India-focused Jungle Ventures, believes one of the most profound changes will be to the internet interface where LLMs could supplant traditional text-based website searches. This represents a direct challenge to Google.

The New York Times reported last month that Google CEO Sundar Pichai issued a code red alert regarding the ChatGPT threat and moved to accelerate the company's own AI product pipeline. A few days ago, Pichai unveiled Bard, an experimental conversational AI service. He also flagged Google's longstanding commitment to AI, including through the Transformer project.

OpenAI has already launched WebGPT, a version of GPT-3 that can search the web, provide information, and cite sources. Combining ChatGPT and WebGPT is a logical next step.

But the company's vision for natural language models is far-reaching. It includes harnessing the power of GPT-3 in programming, to that point that copycat versions of entire apps could be created in response to a single instruction. This could have severe implications for the low-code and no-code space occupied by players such as China-based app-building platform Huoban.com, which has several VC backers.

Chatbot developers - potentially ranging from China's Xiaoduo to India's Gupshup – could also be impacted. Daisy Cai, a China-based partner at B Capital Group, expects to see a new wave of start-ups emerge based on AI technology represented by ChatGPT.

"Existing chatbot manufacturers still have a 1-2-year window to switch to the ChatGPT technical base and realise the development of new products," she said. "If the product switch is smooth and existing customer resources are properly leveraged, we believe that existing chatbot companies still have great opportunities to expand market capacity and share."

One impediment to the ChatGPT revolution is cost. Apps offering search and chatbot functionality, or even those controlling non-player characters (NPC) in games, must pay for access to the foundation model. The price is only a few cents, but that is for every search query, bot response, and NPC expression. OpenAI has pay-as-you-use and flat-rate subscription models for different products.

"Each search only generates a tiny amount of revenue for a search engine, but if it is paying LLMs every time, it becomes very expensive. In contrast, when you're writing content, what is produced is far more valuable. The fee ratio is lower and more manageable," said Lightspeed's Khare.

This essentially narrows the current economically viable use-cases for GPT, which means ChatGPT does not pose a threat to all AI companies. "The best applications today solve for efficiencies on customer engagement, or on sales and marketing efficiencies," observed Jungle's Anand.

Follow the chips

While the profit-generating capacity of ChatGPT has yet to be determined, manufacturers of chips used in training models are already benefiting. Citigroup recently estimated that ChatGPT could translate into USD 3bn-USD 11bn of additional revenue for Nvidia over the next 12 months.

"Given the computationally intensive nature of AI, we feel the near-term winners will be cloud infrastructure companies such as Microsoft Azure and AWS and chip manufacturers like Arm and Nvidia), not the start-ups building on these platforms," said Andy Hwang, a general partner at Southeast Asia-focused Wavemaker Partners.

"This is akin to the California gold rush during the 19th century where the real people that struck it rich were the purveyors of picks and shovels, not the miners themselves."

For China, restrictions on shipments of semiconductor chips and related equipment from the US present an interesting twist – and an added opportunity for domestic substitution plays.

Dou Shen, head of Baidu's AI cloud group, told participants in the company's third-quarter earnings call that much of its AI business does not rely on highly advanced chips. Business units with exposure have sufficient supplies to cover their near-term needs and then the in-house developed Kunlun chip is a long-term solution.

"By using our Kunlun chips in LLMs, the efficiency to perform text and image recognition tasks on our AI platform has been improved by 40% and the total cost has been reduced by 20% to 30%," said Shen.

Even as China's international chip embargo intensifies, with the Netherlands and Japan recently agreeing to impose export bans, one local LLM developer maintains that domestic products can meet his needs. Cambricon Technology, which listed in Shanghai in 2020, and Horizon Robotics, which has received substantial PE backing, are both identified as competent suppliers of AI chips.

"When Chinese people first started mining bitcoin, they used household computers. The transition to professional devices was only gradual," the developer said. "In a country where people mine bitcoin at home in the absence of better tools, I don't think the chip sanctions will restrict progress on AI."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.