India exits: Sustainable trend?

GPs saw abundant exits in India in 2021 and the flow continued last year even as other markets stumbled. Investors must assess the merits of various contributing cyclical and structural factors

Indian digital payments platform PhonePe raised USD 350m earlier this month at a pre-money valuation of USD 12bn. Two years ago, it was worth USD 5.5bn. Arguably the most striking aspect of the deal featured in the footnotes: PhonePe said it would not only fully separate from its parent and major shareholder, e-commerce giant Flipkart, but also redomicile from Singapore to India.

The move, which reportedly landed Flipkart owner Walmart with a INR 78bn (USD 957m) tax bill as shareholders sold their stakes in the Singapore entity and invested in the Indian entity, is not an isolated incident. Pranav Pai, a founding partner of 3one4 Capital, claims to know of at least three more unicorns planning to redomicile with a view to tapping India's capital markets.

"The first VCs were mainly foreign players with no India IPO experience. Whenever they were asked where a company should go public, they would say it must be the US or Singapore," Pai said.

"In 2021, that thinking changed. The Indian markets are strong, there are a lot of investors, including domestic mutual funds and global names, and good companies command a premium. We are seeing a wave of companies from across the technology sector redomiciling to India."

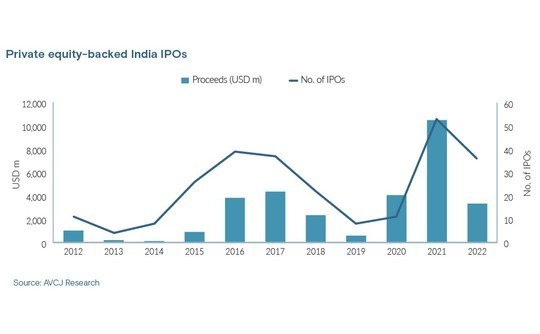

The change in sentiment reflects how regulators have made it easier for pre-profit companies to list on domestic exchanges, prompting a string of unicorn IPOs in 2021-2022. However, the more significant trend is the expansion of India's capital markets, spurred by greater investor participation. It has created more liquidity and helped drive private equity exits.

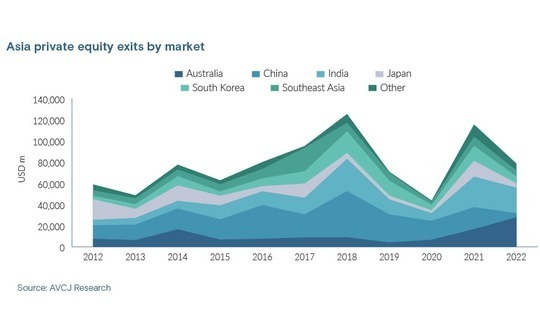

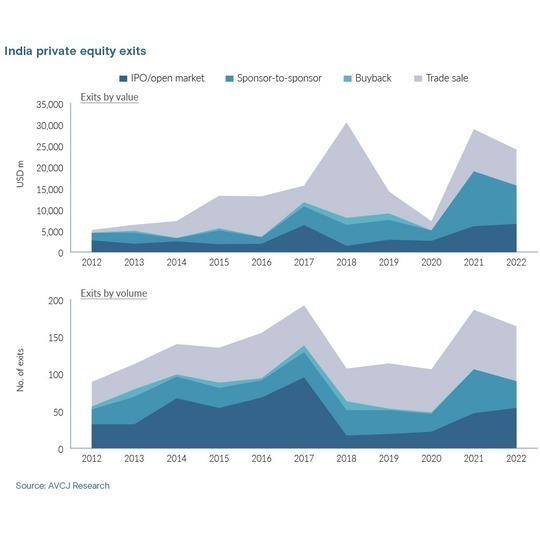

The public markets represent one route to realisation for investors, alongside sponsor-to-sponsor sales and trade sales. All three, to varying degrees, have been firing. Exit proceeds reached USD 28.9bn in 2021 and USD 24.1bn in 2022. The annual average for the prior eight years was USD 13.4bn – and one of these, 2018, was skewed by the USD 16bn sale of Flipkart to Walmart.

Every LP contacted by AVCJ reported an improvement in distributions and fund performance from their India portfolios. But some warned against reading too much into results from an 18-month period, citing the impact of vintage curves. A surge in exit activity came about eight years after the bloated and troubled 2006-2008 vintages. Now GPs are reaping what they sowed in 2012-2014.

"When you look at the investment numbers, India has been one of the most active markets in Asia for the past decade but exits have not been strong," said Praneet Garg, a managing director at fund-of-funds Asia Alternatives.

"Only a few years ago, LPs complained about the pile up of un-exited investments and relatively longer holding periods. That was an important forcing mechanism for exits in 2021 and 2022. Context is important: an 18-month period might not stack up well historically."

Past the peak

It is worth noting that India's public markets weakened over the course of last year and the first weeks of 2023 have been challenging. The SENSEX and NIFTY 50 indices each rose 20%-plus in 2021 and then posted gains of around 4% in 2022. They are both down slightly for 2023 to date.

Still, the fact that they held up for much of 2022 when many other markets were crumbling – enabling investors in unicorns like Zomato and Nykaa to make partial exits once post-IPO lockup periods expired – is testament to robust domestic demand. This comes not only from regulatory reforms that allow institutional players to invest more freely but also from the retail segment.

"Part of the reason India is only 2-3% off its peak while more mature markets have been hammered is asset management companies that manage money for small investors," said Nitish Poddar, national head of private equity at KPMG India. "The flow has been robust and it's going to continue. It is claimed Indian markets are overpriced, but money is still pouring in."

The structural shift, characterized by individual investors moving their savings from real estate and gold into financial products such as systematic investment plans (SIPs), has helped ease India's reliance on foreign capital. Yogesh Singh, a partner at Trilegal, observed that the markets remained relatively stable in the third quarter of 2022 despite a significant pullback by global equities funds.

It does not mean, however, that every IPO is welcomed. Numerous prospectuses have been withdrawn in recent weeks while scrutiny of technology sector applicants has intensified in response to weak performance by listed unicorns. In some cases, it has come immediately after the IPO, driven by overly ambitious pricing, and in others more recently, following post-lockup sell-downs.

"Businesses that are weaker or more speculative in nature will find it harder, especially given the general scepticism of certain business models in India."

Amid this more discerning market dynamic, there is a reluctance to move too early. For example, Bikaji Foods completed an oversubscribed IPO with a market capitalisation of INR 74.9b. The company had been profitable for years but Mukund Krishnaswami, a founding partner at Lighthouse Funds, one of the investors, said it couldn't have listed earlier because it wasn't big enough.

"If the company had gone public two or three years ago, the market cap would have been less than USD 400m-USD 500m, and at that level, liquidity from domestic and foreign sources is more limited," he said. "The closer you get to USD 1 billion, the market of potential investors becomes deeper."

Poddar of KPMG concurs that USD 500m is a reasonable starting point, but closer to USD 1bn is better. 3one4 had a sub-USD 200m offering last October with data provider Tracxn Technologies, and the stock is up 30%. According to Pai, the company is unique, profitable, and the IPO played well with international clients from a reputational perspective. A secondary listing in the US is planned.

The VC firm has four unicorns in its portfolio, which are expected to list at close to their current valuations of USD 1.5bn-USD 2bn. However, those IPOs are likely to be delayed until the companies are profitable. 3one4 also advises any investee looking to go public to under-price its offerings to ensure some post-IPO momentum and avoid sharp drops experienced by the likes of Paytm.

Big beasts

Adams Street Partners is a fund-of-funds with positions in India venture capital funds but limited exposure to the country's listed unicorns. Distributions have been strong in the past 12-18 months, according to Sunil Mishra, a partner at the firm, but public market exits have come from non-technology companies. Post-IPO trading has generally been strong.

Of the USD 6.6bn generated through public market exits in 2022, USD 5.1bn came from block trades and sell-downs. Key contributors included KKR's INR 91.9bn full exit from hospital operator Max Healthcare, The Blackstone Group's INR 40.4bn partial exit from automotive systems and components maker Sona Comstar, and Bain Capital's INR 14.9bn partial exit from Axis Bank.

KKR's exit represented the end of a complex journey that involved taking a 49% interest in Radiant Life Care, a smaller hospital operator with aggressive expansion plans, and merging it with Max, which was already listed. The private equity firm ended up with a 51.9% stake in one of India's largest hospital chains. This was pared to 27.5% through several block trades ahead of the final exit.

To Ashwath Rau, a partner at law firm AZB & Partners, the deal was significant in that it demonstrated GPs are comfortable with majority positions in listed companies. KKR later assumed the sponsor role at J.B. Chemicals & Pharmaceuticals, while The Carlyle Group did the same with SeQuent Scientific. The former trades at a 63% premium to the purchase price; the latter trades at a small discount.

"Hitherto, private equity wasn't willing to do majority deals in Indian public companies because they were worried about liability and governance, and rules being too stringent and impacting value accretion," Rau said. "That has gone. There is more confidence in governance frameworks and a lot of the bad practices have been eliminated."

Despite increased public market activity, this channel was not responsible for the bulk of exit proceeds in 2021 and 2022. Sponsor-to-sponsor transactions occupied top spot, with USD 12.9bn and USD 9bn. Trade sales contributed USD 9.9bn and USD 8.5bn. The aggregate sponsor-to-sponsor total is equal to that of the previous seven years combined, underlining a region-wide phenomenon.

Lighthouse raised USD 230m for its third fund and is targeting USD 425m for its fourth. ChrysCapital Partners, which recently closed its ninth fund on USD 1.4bn and has completed 76 exits since inception, made the same observation.

"We have seen a lot of sponsor-to-sponsor exits in the past year. The global and pan-regional funds are getting much larger and refocusing from China to India. They want to increase their exposure to India through deals of USD 200m-USD 500m, which feeds well into the exit cycle of firms like ours," said Sanjay Kukreja, a managing partner at ChrysCapital.

In the past 10 years, KKR's pan-Asian funds have increased in size from USD 6bn to USD 15bn. Over the same period, ChrysCapital, the largest active Indian manager, has risen from USD 600m to USD 1.4bn. Adam Street's Mishra observed that pan-regional managers previously might have allocated 5%-15% to India; now it is more likely to be 10%-30%.

Strategic angles

The notion that investors, spooked by macro and regulatory uncertainty in China, are deploying more capital in India is widely circulated yet the overall impact is hard to quantify. India's growth story had made it a rising priority for most pan-regional GPs before the upheaval in China. Sponsor-to-sponsor deals were certainly already a reasonably well-established theme.

"These companies have been cleaned up by mid-market firms," said Garg of Asia Alternatives. "In some cases, there are three private equity investors with 20% stakes and a pan-regional comes in and buys 100%. They prefer doing that to dealing directly with promoters because they don't have to manage the transition from family ownership."

Such deals are also prevalent in the technology sector, driven by early-stage investors wanting to lock in gains and by entrepreneurs seeking stability. One mid-market Indian GP recalls talking to a promoter with an investor base comprising entirely VCs and angel investors. Having decided to delay going public by two years, he wanted late-stage private equity to take up 20% of the cap table.

Diversifying Asian exposure away from China also crops up in a trade sale context – although this may provide added incentive for those already attracted by India's favourable policies for local manufacturing. Several GPs claim that global strategics are taking India more seriously than before.

Lighthouse Funds is invested in Shaily Engineering, a plastic injection moulding business that serves multinational consumer and healthcare brands and increasingly toy manufacturers. Some of their newer customers were heavily reliant on sourcing from China, and when they considered other Asian locations, found that only India could offer the requisite scale and consistency of manufacturing and labour. Other companies are looking to sell into India.

"There are US-based companies with large Indian operations that have never done much with them. In the last 12 months, they have started talking not just about how to distribute products in India but about the prospect of acquiring companies with capabilities or products that complement their own and folding them into the portfolio to develop products specifically for the Indian market," said Krishnaswami.

While international players may feature more prominently in private equity auction processes, M&A was a domestic-driven story in 2022. According to Mergermarket, AVCJ's sister title, M&A activity – which is not restricted to transactions involving private equity – rose 69% year-on-year to USD 182bn, even as deal flow in the likes of China, Australia, Japan, and South Korea tumbled.

Headline transactions led by HDFC, Reliance Industries, Adani Enterprises, and Bharti Airtel underpinned a strong showing in sectors like financial services, telecom, and construction. At the same time, there has been a string of smaller technology-oriented acquisitions that reflect corporate India's desire to buy businesses in emerging areas rather than build them.

"Ten years ago, these deals wouldn't have happened because they were growing nicely and had different priorities," said ChrysCapital's Kukreja. "Now some have recognised growth isn't so easy to achieve, they have developed corporate M&A functions, and they are sitting on cash – so they can do M&A, return it to investors, or do buybacks. They are becoming more like global companies."

Of distributions, allocations

For private equity investors considering the implications of these trends, there are two key questions. First, can the recent stream of exits be sustained? Second, will improved distributions translate into larger allocations to Indian managers?

The public market exit channel is cyclical and already showing signs of weakness, but 3one4's Pai argues that structural changes in the market suggest liquidity will be more consistent in the long term. "Few of our LPs think it is a short-term phenomenon. India has changed and this has created new opportunities," he said. "Will all IPOs be successful? No, each one is unique."

Meanwhile, investors expect the surge in financial and strategic capital entering India to continue provided the country's growth trajectory, attractive demographics, and recent macroeconomic and political stability remain unchecked. KPMG's Poddar suggests that private equity investment alone currently represents "the tip of the iceberg" and is destined to rise 5-10x in the mid to long term.

As for fundraising, India tracks broader Asia trends. Outperforming VCs will be oversubscribed and established mid-market private equity players that have delivered returns will win support from investors that want India exposure with less risk, said Garg of Asia Alternatives. Those who do not meet these criteria will struggle.

Even though performance has improved in recent years, prompting LPs that previously had no exposure to India or accessed the market purely through pan-regional funds to begin monitoring country managers, the impact will not be immediate.

"There is also more open-mindedness towards India from LPs, but global institutional investors tend to be deliberate and long-term," said Mishra of Adams Street. "The fundraising fortunes of Indian mid-cap managers are only marginally different. But if the current trend continues, perhaps it will pick up in the next two years."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.