GP profile: LeapFrog Investments

LeapFrog Investments is broadly recognised as a pioneer of impact investing globally as well as an architect of the industry’s legitimising standards and controls. Asia has always been core

In 2008, Bill Clinton helped Andrew Kuper launch what would become an asset class-defining impact investment firm. In the meantime, LeapFrog Investments has exceeded its original fundraising and population outreach promises by more than 10x. So, last September, Clinton called Kuper back.

"The reason he called me back was because we originally said we were going to raise USD 100m for this thing that doesn't exist called impact investing, and we were going to reach 25m low-income people," Kuper said.

"Sincerely, my mother, my wife, and Clinton believed in it, but not that many people beyond that. I came back and said, we've raised more than USD 2bn and reached 250m low-income people and 342m people in total. I can't talk about [financial] returns, but we've raised three funds and a separate account [with Prudential Financial], so you can make your own inferences."

The occasion was a relaunch of the Clinton Global Initiative in New York, where Kuper announced LeapFrog's latest plans to support 25m micro, small and medium-sized companies (MSMEs) – which will in turn support 100m jobs – by 2030. "We're structured to do it, and we're going to do it," he said.

Kuper describes himself as a farm boy from South Africa and a former non-government organisation (NGO) worker in India. His formation was more centred around philosophy and ethics than asset management – and certainly not hobnobbing with former US presidents.

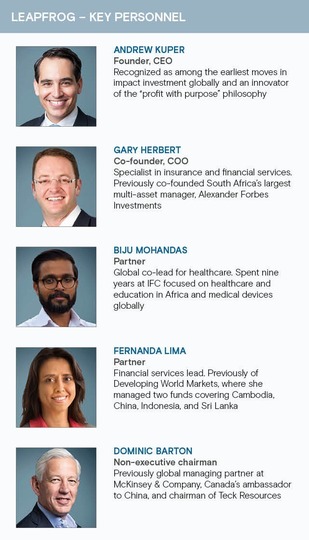

Still, when he decided to establish LeapFrog in the wake of the global financial crisis, he recognised an on-stage endorsement from Clinton would be worth countless miles criss-crossing the globe pitching an untested concept. His co-founding partner was Gary Herbert, founder of Alexander Forbes Investments, South Africa's largest multi-asset manager, who continues to act as COO.

Kuper was inspired by the invention of the smart phone, quitting his job after the release of the iPhone in January 2007 and incorporating LeapFrog three weeks later. The plan was to be the first truly commercial impact investor by tapping new markets the smart phone would open in developing economies. "Basically, 4bn people were about to join the grid," Kuper said.

Profit with purpose

The most distinctive aspect of the venture was the idea that the balance between commercial and social returns was more about synergies than trade-offs. Outsized private equity returns would be required to achieve the necessary momentum. Every LeapFrog business card includes the phrase "profit with purpose," a term largely attributed to the firm.

"When I was looking to leave my previous firm after 10 years, I scanned the market. I had co-invested with many impact investors and knew the industry quite well from within. And it was very clear that LeapFrog was quite innovative in how it was tackling impact and very authentic," said Fernanda Lima, a partner and head of financial services at LeapFrog, who joined the firm in 2018.

"They also had found a formula to scale, and scale is very important. How can you provide impact and value creation if you don't have scale to fund a team that can provide support for portfolio companies? LeapFrog does that in a systematic way with things like a consumer insights team and a talent accelerator team because it has scale. That's how I made my decision."

Lima became involved in impact investing in 2008 with US-based Developing World Markets (DWM), where she made her first investments in developing Asia and managed two funds through a 10-year cycle. This experience led to some incidental connections with LeapFrog personnel during various due diligence processes. She describes the firm's ownership as distributed and incentives as egalitarian.

"A lot of us came from mainstream industries. We're not doing this for the money," Lima said. "Other impact private equity investors have different cultures in how to disseminate economics. This is not a company where we feel we have one CEO or one founder who dictates. We are building this together."

Financial services have historically been the core focus; Lima describes it as a philosophy of springboards (credit) and safety nets (insurance). At the time of inception, springboards in the form of microfinance were well trod turf for emerging markets investors such as development finance institutions (DFIs). The safety nets were trickier, less proven, and more reliant on the advent of smart phones.

A debut fund closed on USD 135m in 2010, beating a target of USD 100m with support from J.P. Morgan, Accion, Omidyar Network, Soros Economic Development Fund, Calvert, reinsurance companies Flagstone Re and SCOR, and various DFIs, including International Finance Corporation (IFC). It has been described as the first impact fund focused 100% on insurance.

At the time, J.P. Morgan, the Global Impact Investing Network (GIIN), and the Rockefeller Foundation had recently conducted one of the first scoping studies on impact investing, concluding it was a USD 4bn industry globally. Last October, GIIN revised that figure to USD 1.1trn. IFC has estimated it could be as large as USD 26trn.

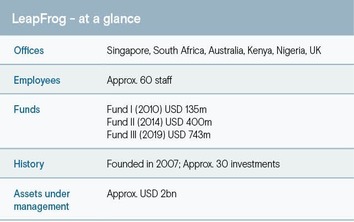

LeapFrog's growth reflects this backdrop. Fund II closed on USD 400m I 2014, and Fund III rallied USD 743m in 2019 for an increasingly healthcare-focused mandate. The separate account with Prudential, which began as a USD 350m programme in 2016, has since upsized to USD 500m. Fund IV has been launched with a target of USD 1bn.

Last year, Temasek Holdings invested USD 500m for a minority stake in the GP and unspecified future fund commitments. The Singapore government-controlled institution is not involved in operations or investment decisions, although it has a seat on the board and is counted as an essentially indefinite partner.

"I sat down with [Temasek CEO] Dilhan Pillay [Sandrasegara], and he said, ‘Are you looking for a 10-year relationship or a 100-year partnership?'" Kuper said. "The long-term thinking, depth of relationship, clarity upfront, and commitment to these markets over time is just incredible."

The healthcare angle

The team now numbers around 60, with Dominic Barton among the most recent additions as non-executive chairman. Barton was global managing partner at McKinsey & Company from 2009 to 2018, chairman of Teck Resources and a non-executive director at Singtel Group. He also served as Canada's ambassador to China.

More than 30 companies have been backed across Africa and Asia to date. Investees have an average annual revenue growth rate of 27%, with total revenue topping USD 3.6bn. The loss rate is 3.3%, versus an industry average of 17.9%.

In financial services, the portfolio has disbursed some USD 19.2bn in loans, including USD 2.8bn to MSMEs, and tallied USD 670m in insurance claims paid out. The healthcare strategy, sprung organically from an interest in insurance, has enabled 22.8m pharmaceutical deliveries, 900,000 tele-consultations, and 2.2m diagnostics tests.

Biju Mohandas, a partner and co-head of healthcare at LeapFrog, joined the firm in 2021 after nine years covering the sector for IFC including a stint as global head of medical devices. His lightbulb moment in impact came as a field doctor for the Indian army in remote Himalayan regions.

"The places I was deployed were poor with no infrastructure, but even in those circumstances, people had access to cigarettes and alcohol," he said. "Pepsi had figured out a way to get there. Why can't healthcare be provided in the same fashion?"

Mohandas expects healthcare to grow from about 30% of total investment activity to 40% in the foreseeable future. This will come with a shift from models that merely treat the sick toward technologies that prevent illness and enable preventative wellness.

"Hardware and software costs are only going in one direction, downwards. Fast-forward five years and most human beings – maybe all in 10 years – should be able to look at their health not just as a result of what they have done but a result of things like your basic genomic information, your basic microbiome information, your glucose reactions," Mohandas said.

"You and your healthcare provider will have access to all this information. There will literally be a digital twin that informs clinical decisions as well as your own behavioural decisions. Our view is that is the future of health, and we want to continue to invest in companies that are pushing the boundaries in that regard."

Access is a key word in the LeapFrog thesis, not only in terms of remote consumers and data but also in reducing end-user costs, improving the quality and speed of services, and the ability to influence large-scale shifts in behaviour and awareness.

This approach has translated into a preference for asset-light models, where a large number of business units can be set up at low cost, shortening break-even timelines, and setting up a virtuous cycle of public outreach.

Standout examples include Indian diagnostics platform Redcliffe Labs, which provides on-demand one-hour home collection and same-day tests for common non-communicable conditions such as cancer and heart disease. The company, which leverages 38 labs and some 900 app-connected collections centres, is said to have tripled its revenue run rate since LeapFrog led a USD 61m round last May.

Data and direction

The data collected from businesses of this kind, representing 342m end-users across the portfolio, are increasingly viewed as one of LeapFrog's most important assets – at least in the firm's 10 core Asian and African markets.

"As far as I know, there's no other private equity firm on earth that has that kind of knowledge and data on emerging consumers. It's a narrow set – healthcare and financial services across those 10 countries – but normally you would have to be Facebook or Unilever to have that," Kuper said.

"That is increasingly a superpower as we learn what emerging consumers are looking for and how to address them. It makes you magnetic to potential portfolio companies and co-investors. It's why Sequoia, Sofina, or Accel come to us to invest, because we understand that space better than anybody."

The data component and the fact that it is rooted in healthcare and financial services has also improved LeapFrog's ability to measure impact outcomes at a more granular and meaningful level. While DFIs may have more data points, their coverage areas are so much wider that their broader impact measurement parameters arguably deliver less incisive insights.

It's a reminder that as LeapFrog developed as a firm, it also had to develop a legitimate impact industry around it. The challenge led to Kuper contributing foundational work to the development of GIIN, its impact measurement and management system Iris, the World Economic Forum's Mainstreaming Impact Investing group, and the Operating Principles for Impact Management.

"I've always wanted to have a level of rigor about this. When people say they're doing good and it's self-reported, and it sounds noble and nice, it always made me feel deeply uncomfortable," Kuper said. "Now you've got the metrics, the industry body, the money coming in, the principles you have to meet, and the benchmarking. That's been my journey for the past 15 years. It's a very exciting moment."

For some investors, however, the excitement of the impact industry coming of age has been tempered by rising uncertainty risk factors in the macro.

LeapFrog's markets are, by nature, vulnerable to systemic shocks. For example, the firm has exposure to the economic crisis and political upheaval in Sri Lanka through insurer SoftLogic Life. So far, the response game plan has been straight from the pandemic playbook – remain close partners and make sure companies have enough runway to come out the other side.

But how will institutional investors re-evaluate the global south in an environment of high inflation, rising interest rates, reduced stimulus, war, geopolitical tensions, decoupling, deglobalisation, and pressures on household budgets?

"You've got to find growth, otherwise you're going backwards. Where do you go? To markets that are still growing but may have relatively low inflation," Kuper said, flagging Indonesia, India, and Vietnam as relatively strong performers, even in the current climate.

"Does that mean they don't have fragilities in the economy? No, but what are we worried about? Are we worried about the economy going into recession? That's already happening in certain markets. You have to recalibrate the actual risk versus perceived risk, and I think these global growth markets continue to be exactly that."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.