2023 preview: Mass access to PE

More individuals will be able to invest in private equity as fund fractionalisation technology matures. But a global downturn, ever-malleable regulations, and blockchain gloom loom large

There's reason to believe that the current macroeconomic malaise could accelerate the introduction of mass-market individual investors into private equity in the near term.

From the GP side, a more difficult fundraising environment will stoke further interest in tapping an untapped investor base. On the LP side, it's slightly more uncertain. Public markets have become relatively less attractive to individual investors, but in an environment of greater general caution, they may have less appetite to experiment with the steeper risk-return profiles of private markets.

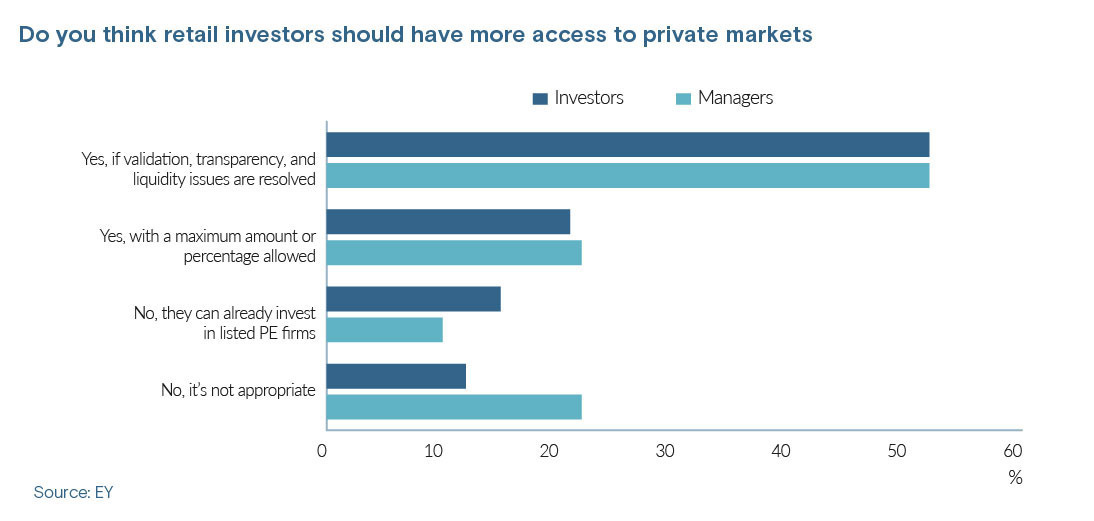

Still, there are signs that sentiment for the democratisation of private equity as a theme may hold. According to a recent survey by EY, 52% of fund managers and 52% of investors believe retail investors should have more access to private markets. Only 22% of managers and 12% of investors said it was inappropriate.

Marco Bizzozero, head of international at iCapital, points to data from his firm, Boston Consulting Group and Bank for International Settlements (BIS) that suggests the link between public markets and the economy is weakening. This includes the number of publicly listed companies shrinking by more than one-third globally, while the number of private equity-backed companies has increased 20x.

"We believe that in this environment with rising interest rates and inflation – or especially because of this environment – an allocation to private markets continues to be essential in contributing to potentially improve the quality of a portfolio and offers an opportunity to improve risk-adjusted return and diversify away from public equity markets," Bizzozero said.

Crypto fallout

The biggest short-term wildcard in this story is FTX, the cryptocurrency exchange whose spectacular implosion in recent weeks has bottomed out sentiment for all things blockchain, especially where it intersects with retail finance.

Blockchain-enabled platforms are the preferred tool for fractionalising private markets products for the mass market, and they are proliferating rapidly. For now, they court retail investors with menus listing the most recognised brand-name GPs. But in time, they will begin to differentiate themselves, with more niche, less proven managers. This appears set to happen in a delicate part of the cycle.

"These platforms are not outfitted to do much due diligence – they're more about onboarding and facilitation," said Vincent Ng, a partner at Atlantic-Pacific. "In a market of this level of volatility with rising interest rates, rising inflation, higher cost of capital, weaker exit environments, and a lot more cash flow sensitivity, the chances of a blow-up are higher than normal."

To some extent, such a blow-up is considered an inevitable growing pain in the PE democratisation process. But regulators, including BIS and the Basel Committee on Banking Supervision, are still making moves to stave it off. Monetary regimes in Singapore and Japan have already moved to formally distinguish crypto assets into two camps: cryptocurrencies and tokenized traditional securities. Thailand appears set to be next.

In the year to come, these developments will coincide with the increasing adoption of blockchain among intermediaries and GPs alike. For example, iCapital recently launched a distributed ledger R&D programme in partnership with the likes of Apollo Global Management, BlackRock, The Blackstone Group, BNY Mellon, The Carlyle Group, KKR, Morgan Stanley, State Street, UBS, and WestCap.

Meanwhile, new asset classes will adopt the concept. The fractionalisation of carbon credits and impact funds as well as singular real estate assets are expected to be among the next offerings, along with private debt. India's Innoven Capital, a joint venture between UOB and Temasek Holdings-owned Seviora Holdings, anticipated the trend earlier this month by using blockchain to offer a USD 50m venture debt fund with a minimum subscription of USD 20,000 for accredited investors.

Educational initiatives

All of this will have to come with a ramp-up in retail-level education. To date, most of this work has focused on the fundamentals of private equity, especially its illiquidity. Post FTX, that messaging will shift toward explaining that a fractionalisation platform's underlying value proposition has nothing to do with blockchain – it's about access to PE.

This is a line ADDX has been pushing since its inception in 2017. The Singapore-based company facilitated the Innoven fund with its smart contract technology and provided similar service for the likes of Partners Group and Hamilton Lane. It has raised USD 120m in private funding to date.

ADDX CEO Oi-Yee Choo is concerned that the proliferation of fractionalisation platforms – some less regulated than others – represents a reputational risk for the broader PE democratisation ecosystem. But she isn't necessarily expecting an FTX-style blow-up.

In this view, standardisation will be necessary for platforms to scale, and the industry will consolidate into a clutch of larger, more thoroughly compliant leaders in each region. As these platforms begin to onboard less proven managers, they will nudge them toward better governance practices. In theory, the duds will fade away.

"If the world remains as volatile as it is, we will see some of the smaller guys disappear. We're gratefully well-funded, but a lot of smaller players do rely on VC funding, and that's not going to be so forthcoming," Choo said. "Hopefully, they'll die out quietly as opposed to having a disaster."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.