FTX: Crypto dismisses another deathblow

An emerging technology giant has imploded. Regulations are set to tighten. Investors hit pause but remain confident about the long-term outlook. Business as usual in crypto

As promised, blockchain has sped up everything in financial services. The crypto world experiences reduced transaction friction, more timely audits, shorter lag between data collection and decision-making, and faster industry-hobbling meltdowns.

Bank runs used to take weeks to play out. The Lehman Brothers collapse took about a week. This month, FTX, a cryptocurrency exchange with a valuation topping USD 32bn after receiving some USD 2bn in private funding, was effectively reduced to ashes in less than 48 hours.

The episode, triggered by clues of insolvency in leaked balance sheet data, sent almost every listed token spiralling.

Businesses with substantial exposure to FTX have been crippled. The most recent and perhaps most significant of these is BlockFi, a US-based exchange that raised USD 1.4bn in funding at a valuation of USD 3bn last year. It filed for bankruptcy this week saying it owed more than 100,000 creditors.

Yet this is not as short and sharp as it may seem. It extends a string of blow-ups, starting with a rout from the native token of Korean crypto services player Terra in May that wiped out some USD 45bn in market capitalisation in less than a week. The next major domino was Singapore-based hedge fund Three Arrows Capital, which filed for bankruptcy in July with creditors including BlockFi.

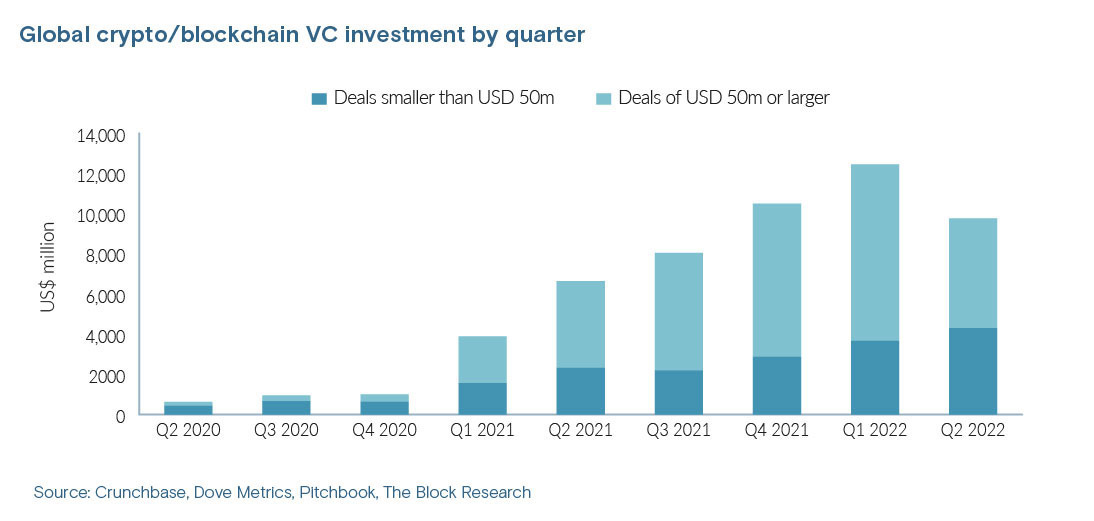

The cumulative effect for investors has been the snapping of an almost two-year surge in deployments. VC deployment in the crypto space reached USD 12.45bn in the first quarter of 2022, up 1,880% from the second quarter of 2020, according to data from Crunchbase, Dove Metrics, Pitchbook, and The Block, compiled by The Block.

Investment fell to USD 9.76bn in the second quarter of 2022 and, according to Pitchbook, dipped as low as USD 4.4bn in the third quarter. The retreat has set up predictions that the market could require up to 18 months to correct itself and breathless comparisons to the biggest macro shocks anyone can remember.

"What we are seeing now is a fallout of FTX is becoming much more like the 2008 financial crisis, where it's exposing poor credit practices and is exposing poor risk management," Coinbase CFO Alesia Haas told The Wall Street Journal.

Poor credit practices and risk management in this case appear to include the misappropriation of customer assets to an affiliated trading entity and for personal use, overleveraging during a period of excessive market euphoria, and a lack of bookkeeping, with more than USD 8bn in deposits unaccounted for.

Brand-name investors backed the company despite a lack of CFO and a proper board of directors; FTX had only a four-person "advisory board" that included some investors with no binding decision-making power. There was no chief compliance officer. In US bankruptcy proceedings, lawyers said FTX founder Sam Bankman-Fried ran the company as a "personal fiefdom."

Sequoia Capital, Temasek Holdings, and Ontario Teachers' Pension Plan are among the backers that have made their excuses in public statements, flagging the relatively fractional nature of their exposures and reminding stakeholders venture is a risk-on game. They respectively wrote down investments of USD 150m, USD 275m, and USD 75m to zero.

Not so transparent

No one in the sector is missing the irony – that the decentralised and disintermediated properties of blockchain were specifically designed to eliminate the murky dealings that characterised FTX. Now, the hype machine that has propelled the industry to date is cannibalising the technology it heretofore championed.

"You believe in blockchain, this whole super-transparency world where things can be tracked – but everyone just trusts this one guy or this one firm without really looking under the bonnet," said Michel Lee, executive president of Hong Kong digital assets financial services provider HashKey.

"Now, suddenly people are running these analyses, saying, ‘Oh yeah, we saw the coin moving back and forth between these two entities.' We always believe technology will solve the world's problems, but it doesn't. Blockchain is a better widget, but this is financial services, and it's ultimately about fear and greed."

HashKey is an interesting case-study for examining the aftermath of FTX. Established in 2015 as the digital assets arm of Chinese automotive parts supplier Wanxiang, it represents traditional industry's ongoing faith in crypto, but only where market rules have been clarified.

The Hong Kong-based company is currently launching its own exchange, HashKey Pro, after a two-year wait. The territory has been slow to establish crypto regulations, but HashKey didn't want to pull the trigger without a formal license. That license came this month with the fanfare of a local fintech conference and various post-pandemic investor outreach initiatives.

It's worth noting that FTX was founded in Hong Kong but moved to the Bahamas last year presumably to take advantage of greater regulatory latitude. Hong Kong has also lost trading platforms Bitmex and Crypto.com to the Seychelles and Singapore, respectively, in recent years. Regaining crypto credentials has become a regulatory priority.

Only days after the FTX collapse, local authorities doubled down on recent pledges to liberalise crypto trading rules for professional and retail investors alike. Previously only accredited investors with HKD 8m (USD 1m) in assets could participate.

Now, Hong Kong is being called the only major jurisdiction that has a proper licensing regime encompassing both security and utility tokens. Perhaps more importantly, it is the only major jurisdiction to introduce a requirement that exchanges have separately managed custodian entities.

This goes to the heart of FTX, Terra, Three Arrows, and the recent destruction of other large players such as Celsius Network and Voyager Digital. All were casualties of the trend of decentralised finance (defi) technologies getting mixed up in traditional centralised finance (cefi) business models.

Confidence returns?

Cefi is considered essential for introducing traditional currency investors to crypto because transaction fees are lower and users don't have to be technologically savvy enough to manage the practical security-related tools of crypto wheeling and dealing. The problem is defi entrepreneurs are tapping this opportunity, and regulators have yet to catch up.

Many markets, including Singapore, have indicated they are moving in the Hong Kong direction – and investors appear likely to respond. Lee said that HashKey Pro and other regulated exchanges are seeing an uptake in client enquiries and account openings in the wake of FTX. The short-termers are nervously waiting for the next domino, but their absence represents a welcome shakeout.

"Retail investment activity will remain pretty consistent until central banks begin to unwind their interest rate hike program, which we expect to start in earnest in spring 2023. We then expect to see a growing number increasing their exposure to crypto for the rest of the year," said Nigel Green, founder and CEO of deVere Group.

"Meanwhile, I think institutional investors, who have in recent years been piling into crypto, will continue to ramp up over the next 12 months. They appreciate that digital is the inevitable future of money and, as such, are using the current lower valuations as buying opportunities."

This confidence appears to be translating into fundraising activity as well. Most of the sector's funds over USD 500m in size were raised prior to Terra's collapse in May. But as recently as September, specialist investor Pantera Capital confirmed plans to raise USD 1.2b for its second fund with a strategy including equity and tokens.

Pantera can be seen as evidence that crosspollination in the crypto space will not necessarily lead to a chain reaction of companies falling from grace. One of the firm's investees, a cryptocurrency portfolio tracking app called Blockfolio, was acquired by FTX in 2020, resulting in FTX representing about 2% of Pantera's assets under management. HashKey invested in both Blockfolio and BlockFi.

There are also signs from the services sector that fundraising is gaining traction despite the bear market. Calvin Tan, a director at Singapore-based fintech fund administrator Ascent Fund Services, observes that although his firm has witnessed some anchor investors backing out of small funds, the larger, more institutional vehicles were ticking along with greater momentum.

"It's not as if the whole industry is collapsing. Our business continues to grow," Tan said, noting that fund strategies seeing traction include defi, hedge, venture, and crypto distress. "The number of funds that are launching supersedes the funds that haven't launched or are closing down."

Smaller fund managers relying on high net worth individuals and family offices have more explaining to do.

New Zealand's GD1, a generalist VC firm, launched its country's first web3 fund in May seeking USD 5m. Nawaz Ahmed, who heads the strategy, has been negotiating with a mix of individual investors, including some with no prior experience in crypto. A first close is still on schedule for later this year, but mustering the remainder is expected to require the entire first half of 2023.

"People who haven't invested in crypto before, most of their understanding of the space is from the media, and you don't see the best high-quality companies doing interesting things in the media. So, we show them those use-cases, walking them through our companies and the overall market, and tell them how this is probably a good time to be deploying capital," Ahmed said.

"Some of them are a lot more sceptical, but they're willing to learn more and they're definitely open to the idea. They're not just ‘no' based on what they know about the current market."

Tangential plays

Part of getting prospective LPs over the line has been a matter of shifting strategies toward infrastructural aspects of blockchain, the so-called picks and shovels of the industry. About 34% of sector investment has been in the infrastructure category since December 2021, compared to 25% during the boom months of 2021, according to Dove Metrics.

But picks and shovels can be valued at a premium while taking longer to build out and realise. They also tend to be technical in nature, requiring a high level of expertise. As such, blockchain investment strategy pivots have also tended to simply eschew pure financial applications in favour of web3 models, especially around gaming, media, and marketing via non-fungible tokens (NFTs).

Winston Ma, a managing partner at metaverse-focused CloudTree Ventures and a professor at New York University's School of Law, said he expects regulations globally to tilt, at least somewhat, toward mainland China's philosophy – embracing blockchain as an underlying technology while hardening rules around crypto as a financial tool.

Still, there is an increasing recognition that the financial aspects of blockchain cannot be fully separated from metaverse businesses such as play-to-earn games and NFT marketplaces. As a result, the current drop in crypto sentiment is not expected to result in sweeping China-style bans on financial applications, but compliance will be a higher hurdle.

"Once you get into tokens and NFTs, then all of a sudden you have a lot more reporting obligations with your LPs and a lot more compliance issues. Even before FTX, you had to be careful with that kind of exposure. Now, even more so," Ma said.

The prevailing expectation is that the coming wave of regulation will be part of a boom, especially in models that emphasize blockchain's strengths as a financial instrument. Indeed, it will be necessary to exploit the decentralised transaction verification aspects of blockchain to bring more transparency to private companies in the sector.

The first measures will likely target the pitfalls of cefi, including requiring the use of proof-of-reserve technologies. Recognising that defi models can also be fraudulent, subsequent rules may address smart contract audits and checks on the tendency for projects to have only one or two key persons.

Like many investors, Jerome Wong, co-founder of Hong Kong venture studio Everest Ventures Group, sees crypto trading and less overtly financial web3 domains as inextricable concepts. Everest advised local NFT and gaming studio Animoca Brands on a USD 359m capital raise earlier this year at a valuation of USD 5bn and helped the company incubate its virtual real estate project, Sandbox.

Metaverse businesses of this kind will be directly impacted by regulations targeting cryptocurrency exchanges due to their embedded economies, and as with the exchanges, the weaker players will be shaken out. As for blockchain applications that are sufficiently non-financial to avoid such regulation, investment interest is limited.

"Permissioned blockchains can provide value to industries, but it's not as disruptive as AI or some other technologies. It can save costs, increase transparency, and give stakeholders a more cohesive environment, but it won't raise the efficiency frontier of the [target] industry," Wong said.

"We're still going to focus on permission-less blockchain initiatives. Let's leave all these enabler solutions to IBM and those big companies. That's more B2B. The true nature of web3 is disintermediation, decentralisation, financial inclusion and creating a trust-less environment that is free from central power structures."

Looking forward

The question remains whether the current crypto crisis is truly a pivotal moment. Much has been made of FTX being one of the largest players in its space. But that space has arguably achieved critical mass to the point where most investors are talking about "when" not "if" crypto will recover.

There have been several similar busts in the history of blockchain, including the hack of bitcoin exchange MtGox in 2014, the initial coin offering (ICO) craze of 2017, the hack of Japan's Coincheck in 2018, and the "defi summer" of 2020. As with 2022's string of disasters from Terra to FTX, each event reduced overall crypto market capitalisation by 70% to 80%. Then it clawed back.

The difference this time could be that more retail investors are involved, which suggests a deeper wound in terms of loss of public confidence. There is also the fact that this crash has coincided with a broader traditional macro downturn, exacerbating pressure on the crypto industry as an emerging technology play to continue attracting risk capital.

Singapore's Openspace Ventures, a generalist fund that launched a crypto unit called Ocular earlier this year, is emblematic of the business-as-usual mentality. Ocular closed its debut fund in October on USD 25m, shy of a USD 30m target, and has deployed about 25% of the capital to date. It is an investor in Pantera.

LPs have been kept abreast of the situation and the strategy, which in step with much of the industry, has involved a slower pace of deployment and-greater focus on due diligence around governance. The field of potential investees is narrower, but the people involved are more seasoned and higher quality.

"Whatever early technology emerges, the price generally does get ahead of reality at the beginning, but that capital is needed for the talent migration to truly happen – and that did happen in blockchain and crypto," said Ocular lead Amy Zhao.

"We've seen a lot of talented people move from traditional industries to web3, and they're staying post-FTX. They understand the promise of the technology and the inherent volatility, and they have high conviction."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.