Portfolio: Trustar Capital and Trustlink

Through Trustlink, Trustar Capital has successfully executed a buy-and-build strategy in China’s facility management space, using scale and standardisation to win contracts from multinationals

Driven by rising demand for electronics, energy storage systems, and electric vehicles, China's lithium-ion battery industry is growing at an eye-popping rate. Output reached 280-gigawatt hours in the first six months of 2022, up 150% year-on-year, and revenue exceeded CNY 480bn (USD 67bn).

For one of the domestic industry leaders, which has seen revenue grow 170% in each of the last two years, capacity is expanding faster than the infrastructure designed to support it. This is not just a matter of production lines.

The company needs an array of on-site services – from cleaning to security to energy efficiency solutions – to keep the manufacturing operation ticking over. Every month, rankings of facilities management (FM) providers across all its factories are published and the worst performers are terminated. Trustlink Group consistently makes the grade and has seen its order book grow sevenfold in the past year.

"Our client is like a child. He has grown so fast that the traditional big names in the FM domain, including those offering end-to-end services, were unable to keep up in terms of equipment support and were therefore eliminated," said Tim Li, a senior vice president of Trustlink.

Li was the founder of SkyFM, an FM business acquired by China-focused private equity firm Trustar Capital four years ago as the first asset in an industry roll-up effort. Six additional acquisitions completed from 2019 onwards helped create a business large enough to compete with global players.

Li admits that SkyFM wouldn't have been able to sign up the battery manufacturer as a stand-alone entity because the company relies solely on well-known FM providers that have sufficient scale.

SkyFM's annual revenue was around CNY 360m (USD 50.2m). Today, Trustlink generates CNY 2.8bn, fostering bigger ambitions among the entrepreneurs behind its constituent parts. Describing the esprit du corps that underpins their desire to shine on this larger stage and take market share from foreign rivals, several executives drew comparisons to The Avengers, Marvel's team of superheroes.

Li, who heads up sales, set an aggressive new business target of CNY 700m for 2022 but got there ahead of schedule. "I told him that, after our integration, he could create two SkyFMs each year just through new orders," said Wei Liu, who became Trustlink's CEO when ProIFM was acquired in 2020. "It took all of us over a decade to get where we were before the M&A. Now we're on the accelerated runway."

Origin story

The Trustlink story began in 2016 when Wesley Ye, a managing director at Trustar Capital, started researching the FM industry. He was driven by sound logic. China's property market would eventually move past its rapid construction phase and the focus would shift to effective management of existing real estate. This would lead to a surge in demand for FM providers.

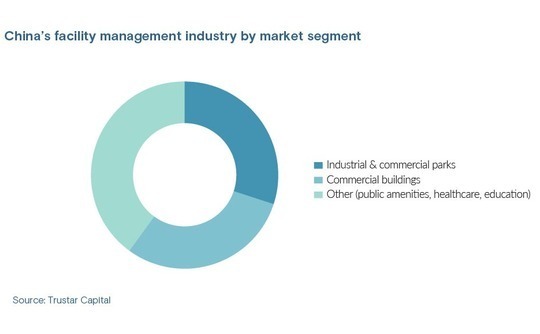

While the leading players enjoy a roughly one-third market share in most developed jurisdictions, China's top 10 were responsible for less than 10% of a revenue pool estimated to be worth USD 60bn a year. It appeared to be fertile territory for a buy-and-build strategy.

Ye met with approximately 100 start-ups since 2017. Each founder asked the same question: Why do you want to buy and build? Private equity-led consolidation is a familiar sight in buyout markets, but the founders weren't confident it would work in China.

Four years on, the numbers speak for themselves. Trustlink is one of the country's three largest independent FM providers, serving more than 2,700 corporate customers across 3,800 projects with a combined management area of 180m square metres. The company employs over 30,000 people based in 200 cities nationwide. Getting there hasn't necessarily been easy.

To some extent, Trustar assembled the different pieces of the business like a jigsaw puzzle. SkyFM brought expertise in factory security services; Anyuan Property, acquired in 2019, specialises in public amenities FM; while Dusservice, secured through a carve-out of the mainland China and Hong Kong operations of Germany-based Dussman Group in 2020, is known for working with hospital operators.

"The reason we decided to set up a new platform rather than integrate on top of an existing portfolio was that none of the acquired companies had comprehensive capabilities in terms of geography or sector coverage. The new platform combines their expertise and endorses these brands," said Ye.

Two more acquisitions came in 2021: Zhejiang Langjie which focuses on healthcare and public amenities, and D'Anchor Security, an event security specialist.

Most of the founders of these companies chose to stay with Trustlink post-acquisition – indeed, they were incentivised to do so through equity ownership plans. However, Ye is keen to distinguish between their roles in senior management and their roles as shareholders. He has no standard formula for dealing with founders; his priority is to put the right people in the right positions.

Value-added services

Integration kicked off in March 2021 and was completed in January this year. Asked to name his proudest achievement during this process, Liu points to the company's transformation into an organisation that can embrace opportunities related to environmental, social and governance (ESG) protocols, and the commercial landing of this strategy.

FM is notoriously difficult to define, with Ye noting that the industry has no official designation in China. TechSci Research, a market research firm, claims the industry was worth USD 122.7bn in 2021 and includes activities related to the maintenance of physical assets such as buildings and equipment, ancillary services like cleaning and security, and broader property management.

It cites CBRE Group, Jones Lang LaSalle, ISS, Sodexo, and Colliers as the major players in China, but some of these companies might ordinarily win a mandate from a corporate client and then subcontract certain services to other players.

Local operators tend to refer to FM as encompassing all non-core outsourcing service needs of customers. They divide them into "soft services" such as security and cleaning, and "hard services" like mechanical and electrical maintenance. Liu notes that single-service outsourcing is slowly migrating towards packaged services, which results in greater customer stickiness and higher margins.

Providing a clean, green, and healthy environment for those who use buildings can be integral to the FM offering. For corporate customers, energy costs are an increasingly heavy burden, so they welcome efficiency-related solutions. FM providers, meanwhile, are motivated by the margins. For security or cleaning in a commercial complex, the return is less than 5%; energy saving is a totally different story.

"Energy saving is usually a long-term contract business, for example, you might win a five-year or eight-year contract that helps the shopping mall save CNY 10m on its electricity bills. We receive service fees that equate to a proportion of those savings. In this way, through ESG, we turned a business area that previously didn't enjoy high margins into one that is very profitable," said Li.

Trustlink's goal is to become the ESG benchmark for FM, but selling energy-saving services to existing clients is not straightforward. It decided to focus on key accounts that have an ESG agenda, expanding their points of contact from facility or administration departments to sustainable development departments. New solutions were added to the menu such as photovoltaics and energy storage.

However, initial excitement around the initiative gradually cooled as a six-month trial delivered zero sales. Not only did clients lack confidence in Trustlink's green energy services, team members doubted their ability to offer quality services outside of their traditional areas of expertise.

Ye and Liu devised a plan to address these issues. They continued screening and communicating with potential targets, while simultaneously absorbing feedback from existing customers, and ultimately decided to find a small entry point into this broad opportunity set.

In 2022, Trustlink acquired Tekene, a provider of centralised energy efficiency control systems for air-conditioning units. The company's solution was highly focused and easy to implement, delivering large electricity cost savings through small adjustments to hardware and the installation of software.

Several clients put in orders not long after the acquisition, and Liu estimates orders amounting to CNY 100m have been received from existing customers in the past three months alone.

"Tekene has core technology but lacks a sales network, which is exactly what Trustlink can offer. When we plug in and cross-sell an energy-saving service, we can roll it out to each one of our 3,800 projects. That's the power of the network we've built," said Ye.

He expects Trustlink's energy-saving service to grow at an annual rate of 50-100% in the coming years, compared to 20-25% for the traditional FM business. Gross profit margins can exceed 50%. The company will use M&A and third-party collaborations to offer more energy-saving initiatives.

Fit for purpose

Bringing the six FM sub-brands together, and then creating an energy-saving business that cuts across all of them, didn't happen naturally. Maintaining a high level of service quality and efficiency was a post-M&A priority. Trustar despatched two operating partners to Trustlink to ensure the high-growth start-up spirit didn't obstruct the introduction of standardised corporate procedures.

Trustlink is now organised under regional management units rather than sub-brands. As Liu puts it, "If you want to approach customers, you must manage regionally." Sub-brands deliver industry solutions, with clients choosing FM providers based on domain expertise. Working across three regions and 10 districts in China, each strand of Trustlink serves as an endorsement of the others.

"For example, a hospital in Beijing might use a small local provider and receive the best level of service based on this provider's local experience. If they use Trustlink, we can deliver best-practice services in mainland China and Hong Kong, relying in part on our experience working with hospitals in Hong Kong, and every region and district will meet this standard," said Ye. "It's hard for smaller players to compete."

The company's primary target areas are automotive, biopharmaceuticals, semiconductors, and the new energy vehicle (NEV) supply chain.

It is already the single largest domestic FM provider to one of Germany's largest carmakers, having started out with cleaning services and moved into security services on the back of the Dusservice brand. Tekene's energy-saving solutions may come next. And when the company added a factory in Suzhou, Jiangsu province, to its existing presence in Shenyang, Liaoning, Trustlink followed.

Crucially, signing up this carmaker as a customer brought Trustlink to the attention of the battery manufacturer referenced earlier. And it was a similar expansion story, moving from basic FM services to energy-saving solutions. Battery makers need humidity levels to remain below 4%. Using Tekene's technology, the dehumidification effect generated by one electrical degree rose by one-fifth.

As part of its standard value creation offering to portfolio companies, Trustar rolled out digitalisation and workflow streamlining initiatives. The private equity firm follows a set playbook but customises solutions to meet the needs of each company. It claims to have cut Trustlink's materials costs by 10%.

In addition, operating partners identified 112 process node problems and formulated 96 optimization plans with a 76% success rate. For example, multiple departments used to get involved in developing new services. Trustar recommended the operations department take the lead, which means customer feedback is quickly digested into actionable insights emanating from a single source.

In 2018, when Ye first met Li, he promised to take him on an exciting journey that could potentially become case study material at business schools. Looking at Trustlink's track record of implementation to date, he believes the company remains on the right course.

"We have been very disciplined in the past four years while the industry has experienced a lot of noise from different types of buyers and sellers with different purposes," Ye added. "We have always adhered to two key principles: acquisition prices must fall within our valuation spectrum, and we must focus on business development with a view to creating value for the industry."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.